Mexico Luxury Hotel Market Size, Share, Trends and Forecast by Type, Room Type, Category, and Region, 2025-2033

Mexico Luxury Hotel Market Overview:

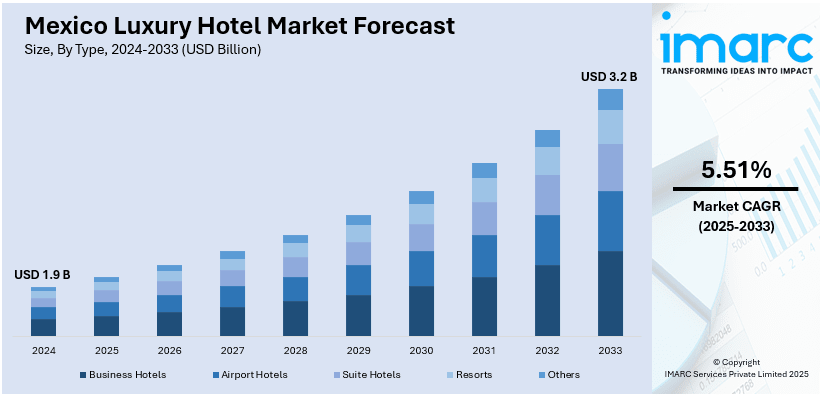

The Mexico luxury hotel market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. The market is expanding, driven by rising international tourism, demand for boutique and eco-conscious stays, and strong investment from global brands. Developments in urban centers and coastal regions reflect growing interest in high-end, culturally immersive, and design-focused hospitality experiences across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Market Growth Rate 2025-2033 | 5.51% |

Mexico Luxury Hotel Market Trends:

Resort Developments Boost Coastal Appeal

Mexico’s coastal luxury market has continued to attract high-end travelers and global hospitality brands due to its scenic locations, warm climate, and rising demand for immersive experiences. The Riviera Maya, in particular, has become a preferred site for ultra-premium resort investments. Global brands are focusing on low-density, eco-conscious developments that preserve natural surroundings while offering exclusive experiences. In October 2024, Mandarin Oriental announced a new luxury beachfront resort and branded residences in Riviera Maya, scheduled to open in 2028. The project is set within the Kanai master plan, integrating refined architecture with environmental care only 9% of the land is used for construction, preserving the mangrove reserve. Design firms like Migdal Arquitectos and Esrawe Studio contributed to the aesthetic, blending Mayan influence with modern minimalism. This development also involves art curation by Bosco Sodi, reinforcing a cultural link within the resort’s identity. Such projects highlight how Riviera Maya is evolving into a destination that offers not just luxury but meaning and sustainability. The announcement added weight to Mexico’s position in long-term global luxury tourism planning. It drew attention to environmentally sensitive growth along its coastlines, where demand for serenity, exclusivity, and natural integration remains strong among affluent travelers.

Urban Luxury Gains New Momentum

Mexico’s luxury hospitality segment is gaining renewed attention, driven by increasing demand for boutique stays that blend design, culture, and location. Urban travelers are now looking beyond traditional large-chain hotels, favoring unique properties that offer curated experiences, personalized service, and an aesthetic that connects with the city’s local character. In October 2024, the Alexander Hotel opened in the Torre Virreyes skyscraper, introducing 26 exclusive suites with a sleek, modern design. Developed by Grupo Arquitectura in collaboration with Ambia Studio, the hotel embraced high-end materials like calcite blue marble, leather, and ebony wood to shape its interiors. Mexican art and design elements were subtly incorporated, adding local warmth and cultural relevance. Features such as the intimate Caviar Bar and suites overlooking the city’s financial district created a distinct identity within the competitive urban hospitality space. This launch marked a shift in Mexico city’s hotel market away from volume-based operations and toward premium, experience-driven concepts. The Alexander Hotel reinforced the city’s position as a hub for creative luxury, catering to design-conscious travelers and strengthening the capital’s presence in the global boutique hotel landscape. Its success is expected to inspire similar high-end developments in other key urban neighborhoods.

Mexico Luxury Hotel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, room type, and category.

Type Insights:

- Business Hotels

- Airport Hotels

- Suite Hotels

- Resorts

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes business hotels, airport hotels, suite hotels, resorts, and others.

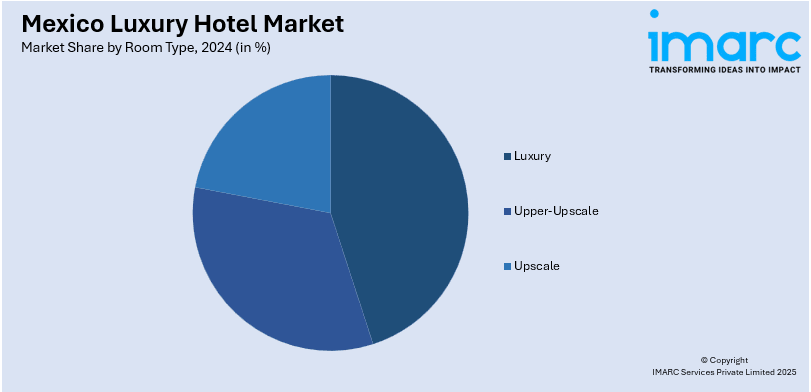

Room Type Insights:

- Luxury

- Upper-Upscale

- Upscale

A detailed breakup and analysis of the market based on the room type have also been provided in the report. This includes luxury, upper-upscale, and upscale.

Category Insights:

- Chain

- Independent

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes chain and independent.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Hotel Market News:

- January 2025: Los Cabos experienced a surge in luxury hotel developments, including Four Seasons, Hilton, Park Hyatt, and Grand Velas openings. These additions strengthened Mexico’s upscale tourism appeal, highlighting a shift toward culturally immersive, high-end stays and boosting the region’s international hospitality profile.

- October 2024: Marriott International opened Almare, a Luxury Collection Resort, in Isla Mujeres, marking its 500th property in the Caribbean and Latin America. As Marriott’s first luxury all-inclusive in Mexico, it strengthened the country’s upscale hospitality sector and reinforced demand for premium adult-only experiences.

Mexico Luxury Hotel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Business Hotels, Airport Hotels, Suite Hotels, Resorts, Others |

| Room Types Covered | Luxury, Upper-Upscale, Upscale |

| Categories Covered | Chain, Independent |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury hotel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury hotel market on the basis of type?

- What is the breakup of the Mexico luxury hotel market on the basis of room type?

- What is the breakup of the Mexico luxury hotel market on the basis of category?

- What are the various stages in the value chain of the Mexico luxury hotel market?

- What are the key driving factors and challenges in the Mexico luxury hotel market?

- What is the structure of the Mexico luxury hotel market and who are the key players?

- What is the degree of competition in the Mexico luxury hotel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury hotel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury hotel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury hotel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)