Mexico Luxury Perfume Market Size, Share, Trends and Forecast by Price, Distribution Channel, End User, and Region, 2025-2033

Mexico Luxury Perfume Market Overview:

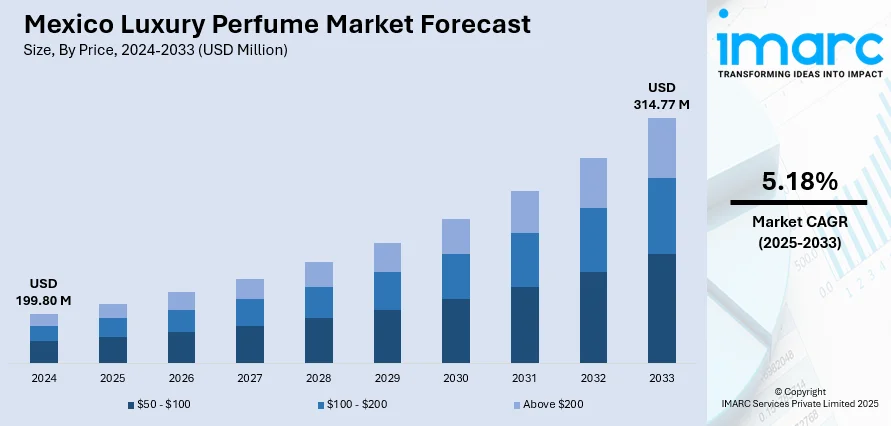

The Mexico luxury perfume market size reached USD 199.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 314.77 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The Mexico luxury perfume market is driven by rising disposable incomes, increasing brand consciousness among younger consumers, and a strong cultural inclination toward fragrance as a form of self-expression and gift-giving, further fueled by the availability of brand variants that blend national identity with luxury appeal.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 199.80 Million |

| Market Forecast in 2033 | USD 314.77 Million |

| Market Growth Rate 2025-2033 | 5.18% |

Mexico Luxury Perfume Market Trends:

Rising Affluence and Changing Consumer Preferences

One of the most important drivers of the luxury perfume market in Mexico is increasing prosperity among the middle and upper-middle classes. As the economy in Mexico strengthens, there is an expanding pool of consumers who have greater disposable incomes. These consumers are investing more in higher-quality, premium products, including luxury perfumes. Specifically, millennials and Gen Z consumers, being more aspirational buyers, look for luxury brands to fit their lifestyle and status. Such buyers are prepared to spend money on perfumes that not only provide high quality but also indicate their personality and sophistication. More exposure to worldwide fashion trends through social media and travel has redirected the choice toward niche, upscale perfume brands. These customers want unique and bespoke fragrances that reflect their own tastes, away from mass-market aromas. Luxury perfume houses are exploiting this by producing limited-edition fragrances, bespoke perfumes, and alliances with celebrity influencers, and building an aura of exclusivity. This is a potent combination of wealth, brand awareness, and the need for bespoke luxury that is propelling the market in Mexico.

Cultural Significance and Gift-Giving Traditions

Another factor driving the Mexican market for luxury fragrances is cultural significance attached to gift-giving, especially across holiday seasons like Christmas, birthday celebrations, and special occasions such as Día de los Muertos. Cultural life in Mexico involves gift-giving as one method of registering love and honor. Perfume, as such, is used as an excellent gift because fragrance appeals on emotional and intimate terms and is read as thought and care. High-end perfumes are often linked by Mexicans with luxury and sophistication, and thus are a gift-giver's favorite for special occasions. At such times, consumers tend to turn to perfumes from established luxury brands to express their feelings in a significant manner. This tendency fuels the market for high-end perfumes since gift givers are ready to pay extra for these products in order to make a good impression on their loved ones. Such perceptions are well grasped by fragrance companies, who often create themed marketing campaigns designed to coincide with these cultural phenomena, emphasizing that their products would make ideal presents. The attraction of beauty and personal care, particularly among celebrity circles, through Mexican media helps reinforce the prestige perception of these perfumes as must-have luxury presents.

Mexico Luxury Perfume Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on price, distribution channel, and end user.

Price Insights:

- $50 - $100

- $100 - $200

- Above $200

The report has provided a detailed breakup and analysis of the market based on the price. This includes $50 - $100, $100 - $200, and above $200.

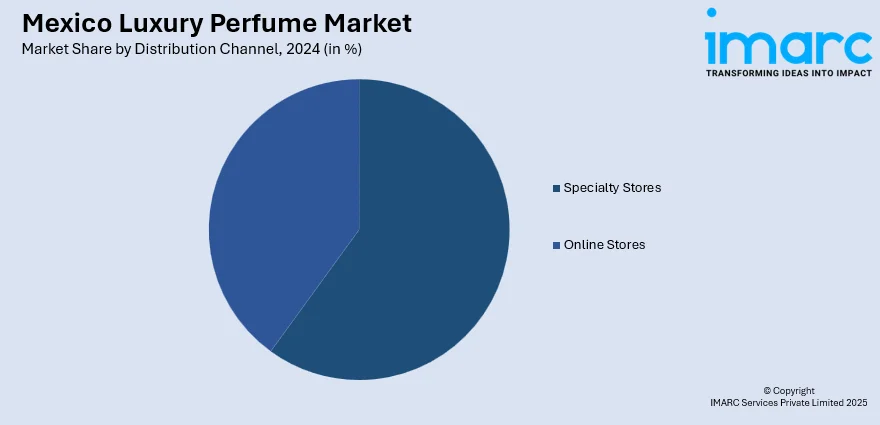

Distribution Channel Insights:

- Specialty Stores

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores and online stores.

End User Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes male, female, and unisex.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Perfume Market News:

- September 2024: Maison Solís launched an agave-inspired fragrance line in Mexico, blending olfactory art with tequila heritage. The scents — Blanco, Reposado, and Añejo — reflect various stages of tequila and pay tribute to the company’s founder’s Chicano roots and expertise in luxury spirits.

- July 2024: Le Labo introduced "Coriandre 39", available exclusively at local Le Labo labs year-round. This scent captures the essence of Mexico City with notes of spicy lime, aldehydic cilantro leaves, crisp watery accords, green florals, and a musky base, evoking experiences like forest bathing in Chapultepec and sipping mezcal in La Condesa.

Mexico Luxury Perfume Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prices Covered | $50 - $100, $100 - $200, Above $200 |

| Distribution Channels Covered | Specialty Stores, Online Stores |

| End Users Covered | Male, Female, Unisex |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury perfume market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury perfume market on the basis of price?

- What is the breakup of the Mexico luxury perfume market on the basis of distribution channel?

- What is the breakup of the Mexico luxury perfume market on the basis of end user?

- What is the breakup of the Mexico luxury perfume market on the basis of region?

- What are the various stages in the value chain of the Mexico luxury perfume market?

- What are the key driving factors and challenges in the Mexico luxury perfume market?

- What is the structure of the Mexico luxury perfume market and who are the key players?

- What is the degree of competition in the Mexico luxury perfume market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury perfume market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury perfume market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury perfume industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)