Mexico Machine Components Market Size, Share, Trends and Forecast by Component Type, Material, End Use Industry, and Region, 2025-2033

Mexico Machine Components Market Overview:

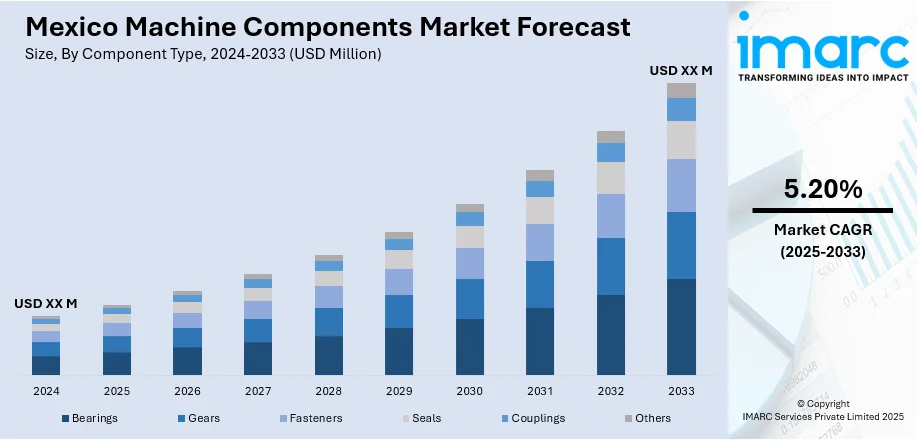

The Mexico machine components market size is projected to exhibit a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by increased adoption of industrial automation and Industry 4.0 technologies, boosting demand for advanced, precise components. Nearshoring trends and foreign direct investment are fueling the growth of manufacturing facilities, which require high-quality machine parts. Additionally, government infrastructure projects and policies encouraging local manufacturing are expanding the need for durable machinery components thus supporting the Mexico machine components market share. Together, these factors create a dynamic market focused on modernization, supply chain resilience, and industrial growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Machine Components Market Trends:

Industrial Automation and Industry 4.0 Adoption

Mexico's manufacturing industry is fast embracing industrial automation and Industry 4.0 technologies, including robotics, Internet of Things (IoT), and artificial intelligence (AI). This is due to the necessity of increasing productivity, enhancing product quality, and lowering operational expenditures. Modern manufacturing systems demand highly accurate machine parts that can integrate with smart factory systems. The increased focus on predictive maintenance and real-time monitoring increases the demand for components that can sustain these advanced processes even further. As industries modernize, the demand for components that facilitate digital control, connectivity, and automation grows even higher. This is driving suppliers to be more innovative and create machine parts that meet these advancing technological demands, thereby repositioning Mexico's machine components industry into a more technologically advanced and competitive industry.

To get more information on this market, Request Sample

Foreign Direct Investment (FDI) and Nearshoring Trends

Foreign investment and nearshoring are key drivers of Mexico’s machine components market. The United States contributed $16.51 billion of Mexico's record $36.87 billion in foreign direct investment (FDI) in 2024, primarily in manufacturing industries like electronics, automotive, and industrial production. This surge is fueled by global companies relocating operations closer to the U.S. to enhance supply chain resilience and reduce lead times. The expansion of manufacturing plants across Mexico, especially in automotive, aerospace, and electronics, increases demand for sophisticated machine components needed to build and maintain advanced machinery. Nearshoring also strengthens local supply chains and fosters collaboration between international firms and Mexican manufacturers. This synergy encourages innovation and drives growth as manufacturers work to meet global quality and precision standards, solidifying Mexico’s status as a vital manufacturing hub in North America.

Government Initiatives and Infrastructure Development

Government policies aimed at the development of infrastructure are significantly influencing the machine components business in Mexico. Plans to upgrade transport networks, industrial corridors, and interregional connectivity are fueling demand for heavy machinery and equipment used in construction. Heavy dependence on robust and accurate machine components ensures operating efficiency and equipment dependability in these industries. In addition, policies advocating local manufacturing and import reduction stimulate local supply of machine components. These policies assist in building up Mexico's manufacturing sector and provide an encouraging environment for machine parts suppliers. By investing in infrastructure and local industry development, the government is indirectly supporting Mexico machine components market growth by different sectors, making it a more independent and competitive manufacturing environment.

Mexico Machine Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, material, and end use industry.

Component Type Insights:

- Bearings

- Gears

- Fasteners

- Seals

- Couplings

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes bearings, gears, fasteners, seals, couplings, and others.

Material Insights:

- Metals

- Plastics

- Composites

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals, plastics, and composites.

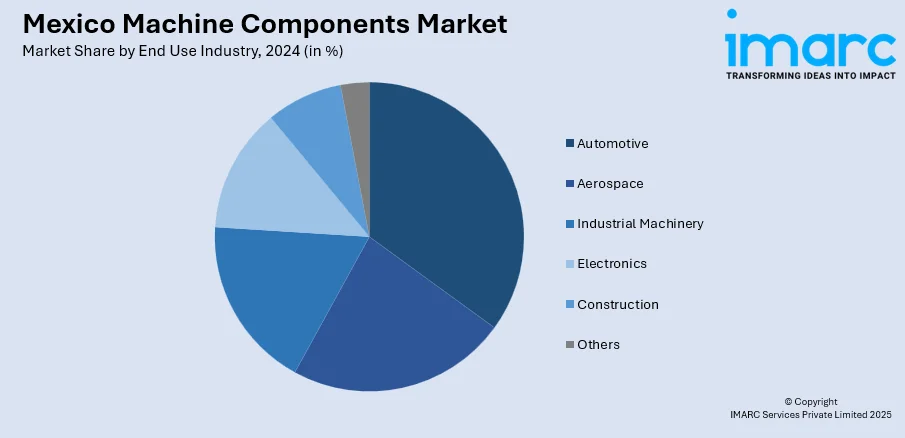

End Use Industry Insights:

- Automotive

- Aerospace

- Industrial Machinery

- Electronics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, industrial machinery, electronics, construction, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Machine Components Market News:

- In May 2025, Tata AutoComp Systems Ltd and Katcon Global formed a manufacturing partnership in Mexico to produce advanced lightweight composite components for North America. Building on a decade-long collaboration in India, the alliance focuses on durable, weight-reducing materials for vehicles and machinery. Tata brings patented technology, while Katcon offers manufacturing expertise. This local venture aims to meet stricter efficiency standards, shorten supply chains, and support the industry’s shift toward energy-efficient platforms.

- In April 2025, Komaspec opened a new 20,000 sq. ft. manufacturing facility in Juarez, Mexico, to meet growing demand for custom metal parts in North America. Equipped with advanced technology like laser cutting and sheet metal bending, the factory offers fast, high-precision production with reduced lead times. Integrated with Komacut.com’s digital platform, customers can get instant quotes and seamless ordering. This expansion enhances manufacturing efficiency and speeds delivery to the US, Canada, and Latin America.

Mexico Machine Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Bearings, Gears, Fasteners, Seals, Couplings, Others |

| Materials Covered | Metals, Plastics, Composites |

| End Use Industries Covered | Automotive, Aerospace, Industrial Machinery, Electronics, Construction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico machine components market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico machine components market on the basis of component type?

- What is the breakup of the Mexico machine components market on the basis of material?

- What is the breakup of the Mexico machine components market on the basis of end use industry?

- What is the breakup of the Mexico machine components market on the basis of region?

- What are the various stages in the value chain of the Mexico machine components market?

- What are the key driving factors and challenges in the Mexico machine components market?

- What is the structure of the Mexico machine components market and who are the key players?

- What is the degree of competition in the Mexico machine components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico machine components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico machine components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico machine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)