Mexico Masterbatch Market Size, Share, Trends and Forecast by Type, Polymer Type, Application, and Region, 2026-2034

Mexico Masterbatch Market Summary:

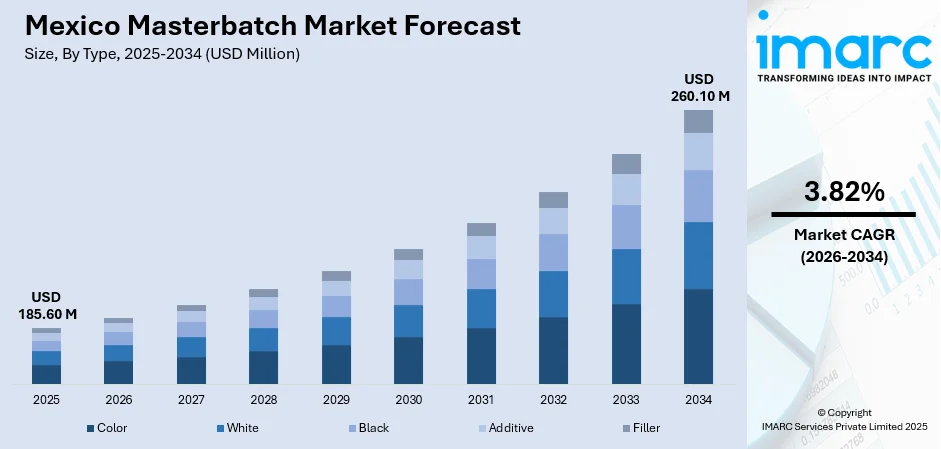

The Mexico masterbatch market size was valued at USD 185.60 Million in 2025 and is projected to reach USD 260.10 Million by 2034, growing at a compound annual growth rate of 3.82% from 2026-2034.

The Mexico masterbatch market is experiencing sustained expansion driven by the country's strategic position as a manufacturing hub for North America, particularly benefiting from nearshoring trends. Increasing demand from packaging, automotive, and consumer goods sectors is propelling market growth, while manufacturers are investing in advanced colorant and additive technologies. The country's robust automotive production, which reached record levels in recent years, alongside expanding e-commerce and food packaging requirements, continues to strengthen the Mexico masterbatch market share.

Key Takeaways and Insights:

-

By Type: Color masterbatch dominates the market with a share of 54% in 2025, driven by increasing demand for visually appealing packaging and automotive components requiring precise color matching and aesthetic appeal.

-

By Polymer Type: PP leads the market with a share of 38% in 2025, owing to its excellent mechanical properties, cost-effectiveness, and widespread use in packaging films and automotive interiors.

-

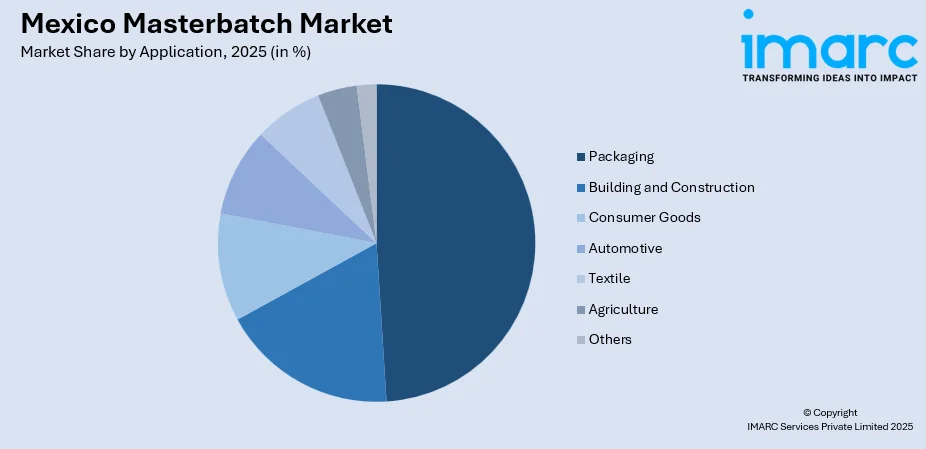

By Application: Packaging represents the largest segment with a market share of 49% in 2025, fueled by expanding e-commerce activities, growing food and beverage industry, and increasing demand for flexible packaging solutions.

-

Key Players: The Mexico masterbatch market exhibits a partially consolidated competitive structure, with multinational corporations competing alongside regional manufacturers across various product segments and applications.

To get more information on this market Request Sample

The Mexico masterbatch market demonstrates strong fundamentals underpinned by the country's expanding manufacturing ecosystem and favorable trade position within North America. The market benefits significantly from nearshoring trends, creating new demand for plastic additives and colorants across multiple industries. The automotive sector serves as a particularly robust growth driver, with Mexico's vehicle production reaching 4.2 Million Units in 2024, surpassing previous records and establishing the country as a global automotive manufacturing powerhouse. This industrial expansion, combined with stringent quality requirements from international brands and increasing emphasis on product aesthetics, is accelerating adoption of high-performance masterbatch solutions. The market also benefits from Mexico's position as a key recipient of US polymer exports, securing competitive raw material pricing.

Mexico Masterbatch Market Trends:

Growing Adoption of Sustainable and Recycled Masterbatch Solutions

Environmental consciousness is reshaping the Mexico masterbatch market as manufacturers increasingly develop bio-based and recyclable formulations. State-level single-use plastic bans in Mexico City, Durango, Quintana Roo, and other regions are driving innovation in sustainable alternatives. In May 2024, the new REPLASBLAK universal circular black masterbatches with certified sustainable material were introduced by Cabot Corporation. With this introduction, Cabot has unveiled two new products that will be marketed as the first universal circular black masterbatches with International Sustainability & Carbon Certification (ISCC PLUS) certified content in the industry. Cabot will be able to continue providing the excellent performance, quality, and dependability that the plastics industry demands at scale for certified circular solutions thanks to the new REPLASBLAK universal circular black masterbatches, which are powered by EVOLVE Sustainable Solutions.

Expansion of Electric Vehicle Manufacturing Driving Specialty Masterbatch Demand

The rapid growth of electric vehicle production in Mexico is creating new opportunities for specialty masterbatch applications. Sales of electric and plug-in hybrid vehicles in Mexico increased by 84% in 2024, reaching 69,713 units according to the data provided by Electro Movilidad Asociación. This accelerating transition toward vehicle electrification is driving robust demand for lightweight high-performance plastic components requiring specialized additive masterbatches with enhanced UV resistance, improved thermal stability, and superior flame retardancy properties that are essential for EV battery enclosures and interior applications.

Nearshoring Accelerating Local Production Capacity Investments

Geopolitical shifts and supply chain realignment are positioning Mexico as a preferred manufacturing destination, stimulating masterbatch demand across multiple sectors. Major automotive investments exemplify this trend, with leading global automakers establishing electromobility hubs and expanding production facilities throughout the country. These capacity expansions create sustained demand for color, additive, and functional masterbatches as tier-one suppliers modernize production capabilities to serve growing manufacturing operations. The strategic location advantage and favorable trade agreements continue attracting foreign direct investment, reinforcing long-term market growth prospects.

Market Outlook 2026-2034:

The Mexico masterbatch market outlook remains positive through the forecast period, supported by continued industrial expansion and evolving end-user requirements. Technological advancements in color consistency, UV stabilization, and functional additives are expected to drive premiumization across diverse applications. The construction sector's sustained annual growth provides additional demand impetus for masterbatches used in pipes, insulation, roofing, and building materials, while infrastructure development projects across residential and commercial segments strengthen market prospects. The market generated a revenue of USD 185.60 Million in 2025 and is projected to reach a revenue of USD 260.10 Million by 2034, growing at a compound annual growth rate of 3.82% from 2026-2034.

Mexico Masterbatch Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Color |

54% |

|

Polymer Type |

PP |

38% |

|

Application |

Packaging |

49% |

Type Insights:

- Color

- White

- Black

- Additive

- Filler

The color masterbatch dominates with a 54% share of the total Mexico masterbatch market in 2025.

Color masterbatch holds the commanding market position owing to extensive demand across packaging, consumer goods, and automotive sectors requiring precise color matching and aesthetic differentiation. The segment benefits from expanding e-commerce activities driving branded packaging requirements, with Mexico's online retail sales experiencing significant growth. Manufacturers are investing in advanced colorant technologies offering improved dispersion characteristics, thermal stability, and compatibility with recycled resins to address evolving sustainability requirements and meet increasingly stringent quality standards across end-user applications.

The automotive sector represents a significant demand driver for color masterbatch, with plastic components increasingly replacing metal parts for weight reduction and design flexibility. Ampacet Corporation expanded its ELTech portfolio, introducing high-performance color masterbatches utilizing polybutylene terephthalate carrier resin specifically designed for optical fiber cable applications. This product innovation demonstrates the segment's evolution toward specialized, high-value color solutions catering to technical applications beyond traditional commodity uses.

Polymer Type Insights:

- PP

- LDPE/LLDPE

- HDPE

- PVC

- PUR

- PET

- PS

- Others

The PP leads with a 38% share of the Mexico masterbatch market in 2025.

PP masterbatch commands market leadership due to the polymer's excellent mechanical strength, chemical resistance, and cost-effectiveness across diverse applications. Mexico's strong reliance on imported plastics, particularly from the United States under favorable trade agreements, ensures steady PP compound supply for domestic manufacturers. The carrier polymer's exceptional versatility makes it ideal for packaging films, automotive components, and consumer goods requiring balanced performance characteristics, while its compatibility with various additive systems enables customized formulations for specific end-user requirements.

The automotive sector's increasing adoption of lightweight PP components drives sustained masterbatch demand, with PP-based compounds offering superior impact resistance for bumpers, dashboards, and interior trim applications. Innovation in metallocene PP and glass fiber-reinforced compounds is expanding application possibilities in demanding technical environments requiring enhanced durability. Taghleef Industries strengthened its Latin American position through strategic acquisitions, significantly increasing BOPP production capacity with manufacturing facilities strategically located in Colombia and Altamira, Mexico to serve regional packaging market requirements.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Building and Construction

- Consumer Goods

- Automotive

- Textile

- Agriculture

- Others

The packaging exhibits clear dominance with a 49% share of the total Mexico masterbatch market in 2025.

Packaging represents the primary demand driver for masterbatch in Mexico, supported by the country's expanding food processing industry and robust e-commerce growth. Mexico's processed food sales have experienced significant year-on-year growth, with dairy, snacks, and ready-to-eat meals posting substantial volume gains. The Mexico plastic packaging market continues expanding rapidly, creating substantial opportunities for color, additive, and functional masterbatch solutions across rigid and flexible packaging formats serving diverse consumer and industrial applications throughout the country.

The segment benefits from continuous innovation in barrier films, recyclable mono-material structures, and UV-protective packaging for extended shelf-life applications. UFlex announced significant investment of Rs. 750 Crore toward new film and recycling complexes in Mexico during 2025, reflecting continued commitment to Mexico's flexible packaging infrastructure development. Consumer preference for convenience packaging and stringent food safety requirements are accelerating adoption of advanced masterbatch formulations incorporating antimicrobial and oxygen barrier properties essential for maintaining product quality throughout distribution channels.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico serves as the primary manufacturing corridor, benefiting from proximity to US markets and concentration of automotive and packaging production facilities in states including Nuevo León, Coahuila, and Chihuahua. The region attracts significant foreign direct investment in manufacturing operations, with MAHLE inaugurating Plant 3 in Ramos Arizpe, Coahuila in January 2024 through substantial capital investment, demonstrating continued confidence in the region's industrial capabilities.

Central Mexico, anchored by the greater Mexico City metropolitan area and industrial corridors in Querétaro and Guanajuato, represents a significant demand center for masterbatch products. Ampacet Corporation operates a color masterbatch facility in Querétaro, in the northwest of Mexico City, serving the rigid and flexible packaging markets with local production capabilities.

Southern Mexico exhibits emerging growth potential driven by expanding agricultural applications and regional construction activities. The region's developing infrastructure and government investment programs are creating incremental demand for masterbatch used in agricultural films, irrigation systems, and building materials applications.

Market Dynamics:

Growth Drivers:

Why is the Mexico Masterbatch Market Growing?

Expanding Automotive Manufacturing and Lightweighting Initiatives

The automotive sector's robust expansion is propelling masterbatch demand as manufacturers increasingly substitute metal components with high-performance plastics for weight reduction and fuel efficiency improvement. Mexico's automotive industry broke historic records thus, achieving both production and export record-breaking results. The Mexican Automotive Industry Association projects the country is on track to become the world's fifth-largest vehicle producer by the end of 2025. This growth trajectory creates sustained demand for color, additive, and functional masterbatches used in interior and exterior automotive components. The transition toward electric vehicles further amplifies requirements for specialized masterbatches offering enhanced thermal management, UV resistance, and flame retardancy properties essential for EV-specific applications.

Strategic Relocation of Manufacturing Operations Boosting Market Demand

Geopolitical realignment and supply chain diversification strategies are positioning Mexico as a preferred manufacturing destination for companies seeking proximity to North American markets. According to the International Monetary Fund's Coordinated Direct Investment Survey, the United States is Mexico's largest source of foreign direct investment (FDI), with a stock of USD 283.8 Billion in 2023. Each new manufacturing facility establishes dedicated supply streams for plastic materials and additives, fueling demand for masterbatch across packaging, automotive, and consumer goods applications. The USMCA trade agreement strengthens Mexico's role as a manufacturing hub, facilitating duty-free flow of key polymers and reinforcing competitive positioning. This structural shift toward regional production is creating sustained long-term demand growth for masterbatch products.

Growing Demand from Packaging and E-commerce Sectors

The expanding packaging industry serves as a primary demand driver for masterbatch products, supported by growing e-commerce activities and evolving consumer preferences for convenience packaging. Online retail penetration in Mexico is accelerating demand for lightweight, protective packaging solutions requiring advanced colorant and additive formulations. The food and beverage sector's continuous growth, with Mexico's processed food sales climbing year-on-year in 2024, creates incremental demand for masterbatch used in barrier packaging, aseptic containers, and shelf-life extending applications. This convergence of e-commerce expansion and food industry growth establishes a robust foundation for sustained masterbatch market development.

Market Restraints:

What Challenges the Mexico Masterbatch Market is Facing?

Raw Material Price Volatility and Supply Chain Dependencies

Fluctuations in raw material prices, including polymers, titanium dioxide, and calcium carbonate, create margin pressures for masterbatch manufacturers. Mexico's heavy reliance on imported feedstocks exposes the market to global price volatility, while significant portions of resin consumed remain imported. Currency volatility further complicates raw material procurement and pricing strategies for domestic producers.

Stringent Environmental Regulations on Plastic Usage

Increasing regulatory pressures on single-use plastics and environmental compliance requirements pose challenges for conventional masterbatch applications. State-level plastic bans implemented in Mexico City, Durango, Quintana Roo, and other regions necessitate reformulation investments. These regulations require manufacturers to develop sustainable alternatives while maintaining product performance and cost competitiveness across diverse application segments.

Competition from Alternative Packaging Materials

Growing adoption of paper-based and biodegradable packaging alternatives creates substitution pressure in certain application segments. Paper packaging is projected to post the fastest growth in Mexico's packaging market through the forecast period. This trend may limit masterbatch demand growth in applications where sustainability considerations and environmental preferences override plastic's inherent performance advantages.

Competitive Landscape:

The Mexico masterbatch market exhibits a partially consolidated competitive structure characterized by the presence of multinational corporations alongside regional manufacturers serving diverse end-user requirements. Major international players leverage global technology portfolios and manufacturing scale to serve premium segments requiring advanced color matching and specialty additives. Local production capabilities are becoming increasingly important to serve Mexican customers with reduced lead times. Competition intensifies across price-sensitive commodity segments while innovation in sustainable formulations and specialty applications creates differentiation opportunities. Strategic partnerships between technology providers and regional distributors enhance market coverage and customer service capabilities.

Mexico Masterbatch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Color, White, Black, Additive, Filler |

| Polymer Types Covered | PP, LDPE/LLDPE, HDPE, PVC, PUR, PET, PS, Others |

| Applications Covered | Packaging, Building and Construction, Consumer Goods, Automotive, Textile, Agriculture, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico masterbatch market size was valued at USD 185.60 Million in 2025.

The Mexico masterbatch market is expected to grow at a compound annual growth rate of 3.82% from 2026-2034 to reach USD 260.10 Million by 2034.

Color masterbatch dominated the market with a 54% share in 2025, driven by extensive demand across packaging, automotive, and consumer goods sectors requiring precise color matching, aesthetic differentiation, and brand consistency.

Key factors driving the Mexico masterbatch market include expanding automotive manufacturing with record vehicle production, nearshoring trends accelerating foreign direct investment, growing packaging demand from e-commerce and food processing sectors, and increasing adoption of specialty additives.

Major challenges include raw material price volatility and supply chain dependencies on imported feedstocks, stringent environmental regulations on single-use plastics requiring reformulation investments, and competition from alternative paper-based and biodegradable packaging materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)