Mexico Mayonnaise Market Size, Share, Trends and Forecast by Type, Distribution Channel, End Use, and Region, 2025-2033

Mexico Mayonnaise Market Overview:

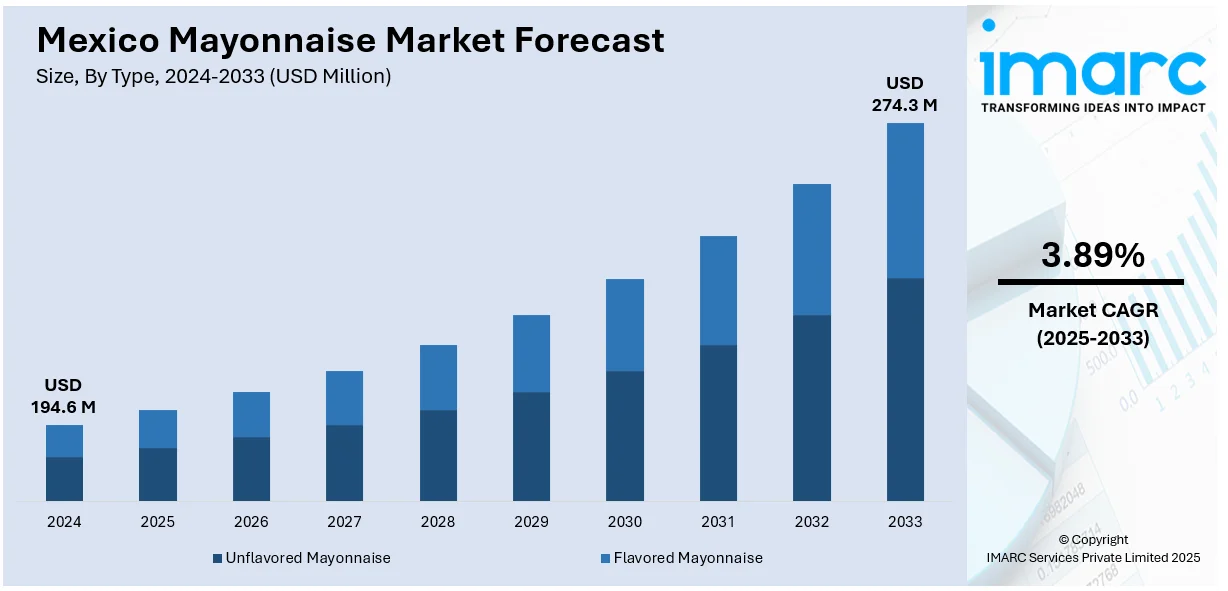

The Mexico mayonnaise market size reached USD 194.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 274.3 Million by 2033, exhibiting a growth rate (CAGR) of 3.89% during 2025-2033. The market is driven by mounting consumer desire for flavorful and health-oriented options, growing retail and e-commerce distribution, and shifting culinary trends, with innovation and convenience most prominently featured among the factors driving increased total product demand and consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 194.6 Million |

| Market Forecast in 2033 | USD 274.3 Million |

| Market Growth Rate 2025-2033 | 3.89% |

Mexico Mayonnaise Market Trends:

Rising Demand for Flavored and Premium Variants

Consumer trends in Mexico are slowly moving toward gourmet and flavored mayonnaise products. Regular unflavored mayonnaise remains dominant, but the interest in global cuisine and fusion food is promoting experimentation in flavor categories. Flavors like chipotle, lime, garlic, and jalapeño-flavored mayonnaise are picking up momentum, especially with younger consumers and urban families. For instance, in August 2024, Hellmann's launched Chili Lime Mayonnaise Dressing, blending its classic mayonnaise with Tajín Clásico seasoning. Its new variation brings a zesty, slightly spicy taste and is available through national retail channels. Moreover, this diversification is complemented by shifting food consumption, such as rising consumption of mayonnaise as a dip, spread, or an ingredient in quick and prepared meals at home. With shifting taste buds, companies are meeting the demand with extended portfolios that suit local tastes yet follow international flavor directions. Mexico mayonnaise market outlook indicates sustained growth, fueled by premiumization and innovation of products. With shoppers happy to try new things and pay extra for greater taste complexity, the market is increasingly segmented and competitive, backing overall volume and value growth across retail shelves.

Expansion of Retail and Online Distribution Channels

Availability of mayonnaise through all types of modern trade channels and e-commerce platforms is playing a big role in expanding the market. Supermarkets and hypermarkets are still the strongest distribution channels with a broad selection of brands and pack sizes. Convenience stores and specialty food shops are also increasingly becoming significant in urban and semi-urban centers. One notable trend is the growing contribution of e-commerce and grocery delivery channels to sales, especially in the post-pandemic era. Consumers are looking more and more for convenience, and online retail offers more access to various types of mayonnaise, such as niche and imported ones. This multichannel availability is making mayonnaise more visible and accessible to Mexico's diverse consumer base. Mexico mayonnaise market share is experiencing positive momentum, supported by growing shelf space, promotions, and subscription-based delivery models. With enhanced last-mile logistics and online engagement, mayonnaise is turning from a pantry room staple into a product that is characterized by lifestyle decisions and food experimentation.

Influence of Health and Clean Label Preferences

Health-aware customers are driving the way that mayonnaise is packaged and sold in Mexico. Although classic full-fat mayonnaise remains a strong seller, there is a clear increase in sales for light, low-fat, eggless, and organic versions. For example, in March 2023, Kraft Heinz and NotCo launched NotMayo a plant-based mayonnaise that contains chickpea flour for a silky feel. The product comes in black bold packaging with magenta and white branding under the NotCo brand. Furthermore, these changes mirror greater eating trends toward clean label foods and lower calorie consumption. Consumers are checking labels more carefully for ingredients, nutritional value, and country of origin. Therefore, companies are recasting recipes to satisfy demands for healthier versions without sacrificing taste or texture. Plant-based oils, natural preservatives, and allergen-free statements are more frequently being added. Along with consumer education on portion control and balanced eating, the development of smaller, trial-sized SKUs is driving growth. Mexico mayonnaise market growth is being driven by this segment and opening opportunities for product innovation and differentiation. As wellness trends keep shaping food categories, mayonnaise manufacturers are evolving to stay relevant and attractive across health-conscious consumer segments.

Mexico Mayonnaise Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, distribution channel, and end use.

Type Insights:

- Unflavored Mayonnaise

- Flavored Mayonnaise

The report has provided a detailed breakup and analysis of the market based on the type. This includes unflavored mayonnaise and flavored mayonnaise.

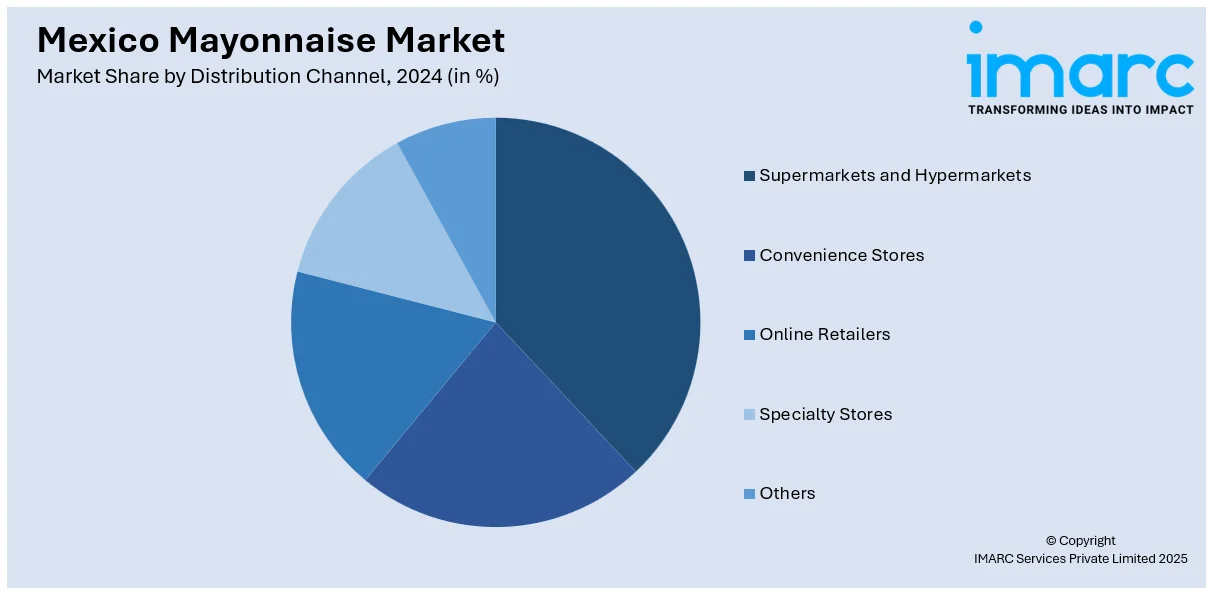

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online retailers, specialty stores, and others.

End Use Insights:

- Institutional

- Retail

The report has provided a detailed breakup and analysis of the market based on the end use. This includes institutional and retail.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mayonnaise Market News:

- In May 2024, Hellmann's renamed its Vegan Mayo to Plant Based Mayo to more effectively appeal to flexitarian consumers. The new recipe contains sunflower oil and xanthan gum, with less rapeseed oil. The certified vegan product comes in 400ml jars and 430ml and 750ml squeezy bottles across the country.

Mexico Mayonnaise Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Unflavored Mayonnaise, Flavored Mayonnaise |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others |

| End Uses Covered | Institutional, Retail |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mayonnaise market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mayonnaise market on the basis of type?

- What is the breakup of the Mexico mayonnaise market on the basis of distribution channel?

- What is the breakup of the Mexico mayonnaise market on the basis of end use?

- What is the breakup of the Mexico mayonnaise market on the basis of region?

- What are the various stages in the value chain of the Mexico mayonnaise market?

- What are the key driving factors and challenges in the Mexico mayonnaise?

- What is the structure of the Mexico mayonnaise market and who are the key players?

- What is the degree of competition in the Mexico mayonnaise market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mayonnaise market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mayonnaise market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mayonnaise industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)