Mexico Meal Replacements Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Mexico Meal Replacements Market Summary:

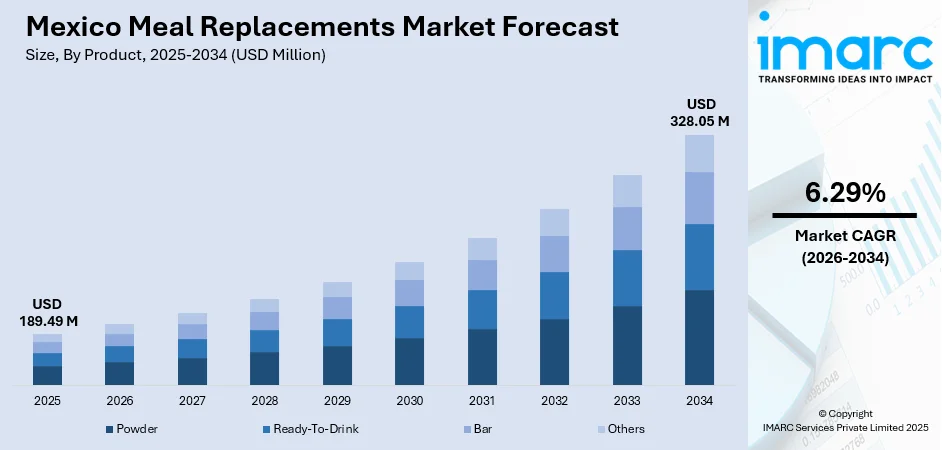

The Mexico meal replacements market size was valued at USD 189.49 Million in 2025 and is projected to reach USD 328.05 Million by 2034, growing at a compound annual growth rate of 6.29% from 2026-2034.

The Mexico meal replacements market is experiencing expansion driven by increasing health consciousness among Mexican consumers seeking convenient nutritional solutions amid busy urban lifestyles. Rising prevalence of obesity and diabetes across the country has prompted widespread adoption of portion-controlled, nutrient-dense meal alternatives that support weight management goals. Enhanced retail availability through supermarkets, pharmacies, and convenience stores has improved product accessibility nationwide. Growing disposable incomes and expanding fitness culture further accelerate Mexico meal replacements market share.

Key Takeaways and Insights:

- By Product: Powder dominates the market with a share of 45% in 2025, owing to its cost-effectiveness, versatility in preparation, and extended shelf life. Growing consumer preference for customizable nutritional options and enhanced portability are fueling segment expansion.

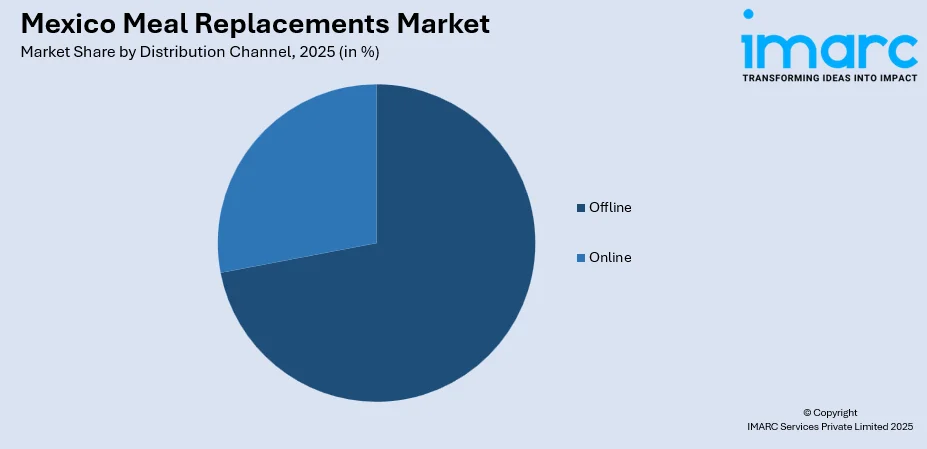

- By Distribution Channel: Offline leads the market with a share of 72% in 2025. This dominance is driven by strong consumer trust in physical retail purchases, widespread supermarket and pharmacy networks, and the ability to examine product labels and seek in-store nutritional guidance.

- Key Players: Key players drive the Mexico meal replacements market by expanding product portfolios, improving taste profiles and nutritional formulations, and strengthening nationwide distribution. Their investments in marketing, affordability initiatives, and partnerships with healthcare providers boost awareness and accelerate adoption.

To get more information on this market Request Sample

The Mexico meal replacements market is witnessing transformative growth as consumers increasingly prioritize health and wellness amid escalating lifestyle-related health challenges. The country's expanding middle class and urbanization trends have created substantial demand for convenient nutrition solutions that align with time-constrained modern lifestyles. The proliferation of fitness centers and gym memberships across major metropolitan areas has generated a considerable consumer base for meal replacement products among fitness enthusiasts seeking optimized nutrition. Government initiatives promoting healthier dietary choices, including front-of-package warning labels on high-calorie products, have shifted consumer preferences toward balanced nutritional alternatives. Rising awareness regarding obesity prevention and diabetes management continues driving adoption of portion-controlled meal solutions. Major manufacturers are responding with innovative formulations featuring plant-based proteins, reduced sugar content, and functional ingredients that address specific dietary requirements across diverse demographic segments throughout the country.

Mexico Meal Replacements Market Trends:

Growing Adoption of Plant-Based and Clean-Label Formulations

Mexican consumers are increasingly gravitating toward plant-based meal replacement products that align with sustainability concerns and dietary preferences. Manufacturers are introducing formulations featuring pea protein, soy protein, and natural ingredients with transparent labeling to meet evolving consumer expectations. The clean-label movement continues gaining momentum as health-conscious consumers scrutinize ingredient lists and demand products free from artificial additives. This shift reflects broader wellness trends prioritizing wholesome, minimally processed nutritional solutions across the country.

Integration of Functional Ingredients for Targeted Health Benefits

The meal replacements sector is evolving beyond basic nutrition toward functional formulations addressing specific health concerns prevalent among Mexican consumers. Manufacturers are incorporating probiotics, fiber blends, vitamins, and minerals to support digestive health, immune function, and metabolic wellness. In October 2024, ProBiotix Health announced an exclusive distribution agreement with Mexico-based Raff to commercialize cardiometabolic probiotic strains. This trend reflects growing consumer sophistication and demand for products delivering measurable health outcomes beyond simple caloric management.

Personalized Nutrition and Weight Management Solutions

Personalized nutrition is emerging as a significant trend in Mexico's meal replacements market, with manufacturers developing products tailored to individual dietary requirements and health objectives. The rising use of weight management medications has created demand for complementary nutritional solutions supporting muscle preservation during weight loss. Companies are leveraging digital platforms and fitness applications to provide customized meal replacement recommendations based on consumer profiles. This personalization trend is reshaping product development strategies and enabling brands to establish deeper consumer engagement.

Market Outlook 2026-2034:

The Mexico meal replacements market outlook remains positive, supported by increasing health awareness, rising fitness culture, and expanding retail infrastructure throughout the country. The market generated a revenue of USD 189.49 Million in 2025 and is projected to reach a revenue of USD 328.05 Million by 2034, growing at a compound annual growth rate of 6.29% from 2026-2034. Continued urbanization and busy lifestyles will sustain demand for convenient nutritional solutions across demographic segments.

Mexico Meal Replacements Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Powder | 45% |

| Distribution Channel | Offline | 72% |

Product Insights:

- Powder

- Ready-To-Drink

- Bar

- Others

Powder dominates with a market share of 45% of the total Mexico meal replacements market in 2025.

Powder meal replacements maintain dominant position in Mexico due to their exceptional cost-effectiveness and preparation versatility that appeals to budget-conscious consumers seeking affordable nutritional solutions. The format offers extended shelf life without refrigeration requirements, making it ideal for storage and distribution across diverse retail environments including supermarkets, pharmacies, and specialty health stores. Powder products also provide significant advantages in transportation efficiency and inventory management for retailers operating throughout the country.

Mexican consumers particularly favor powder formulations for their ability to blend with various liquids and incorporate additional ingredients such as fruits, nuts, and supplements according to individual taste preferences. The product format enables manufacturers to develop diverse flavor profiles including traditional Mexican preferences and international varieties that cater to evolving consumer palates. Fitness enthusiasts and weight management seekers represent core consumer segments driving powder consumption, valuing the precise nutritional control and portion management these products provide. Enhanced protein content and functional ingredient integration continue strengthening powder product appeal across demographic groups nationwide.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Others

- Online

Offline leads with a share of 72% of the total Mexico meal replacements market in 2025.

Offline distribution channels maintain commanding market presence in Mexico, driven by consumer preference for physical product examination and in-store nutritional guidance before purchase. In 2023, Mexico had 25 supermarkets accounting for 6,768 stores, providing extensive retail coverage that ensures widespread product accessibility across urban and suburban markets. Pharmacies, specialty health stores, and convenience outlets offer dedicated shelf space for meal replacement products, enabling consumers to compare brands and seek professional recommendations from knowledgeable store personnel regarding nutritional content and appropriate product selection.

Traditional retail networks benefit significantly from impulse purchases, promotional offers, and established brand visibility that influence consumer buying decisions in physical store environments. Mexican consumers demonstrate strong preference for examining product packaging, verifying nutritional labels, and assessing product quality firsthand before committing to purchase. The tactile shopping experience and immediate product availability reinforce consumer confidence in offline channels. Additionally, pharmacies benefit from healthcare-related trust associations that reduce purchasing hesitation, while supermarkets leverage strategic product placement and bundled promotions to drive consistent sales volumes across diverse consumer demographics nationwide.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for meal replacements, benefiting from proximity to the United States market, higher disposable incomes, and well-developed retail infrastructure. The region's industrial workforce and fitness-conscious population drive consistent demand for convenient nutritional solutions supporting active lifestyles.

Central Mexico dominates regional consumption, anchored by Mexico City, Guadalajara, and Monterrey metropolitan areas where concentrated urban populations and advanced retail networks facilitate product accessibility. Higher disposable incomes and sophisticated consumer awareness regarding nutritional products characterize this economically dynamic region.

Southern Mexico demonstrates emerging market potential as retail infrastructure expands and health awareness increases among regional populations. Government nutrition programs and healthcare initiatives are gradually elevating consumer understanding of balanced dietary practices and convenient nutritional alternatives throughout the developing southern regions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Meal Replacements Market Growing?

Rising Prevalence of Obesity and Lifestyle-Related Health Conditions

Mexico faces substantial public health challenges related to obesity and diabetes, driving significant demand for weight management nutritional solutions. The country ranks among nations with highest obesity prevalence according to national health surveys. This health burden has prompted widespread consumer adoption of meal replacement products as practical dietary interventions supporting weight management objectives. Healthcare professionals increasingly recommend portion-controlled nutritional alternatives to patients seeking sustainable weight reduction strategies, enhancing product credibility and driving mainstream acceptance across diverse demographic segments throughout the nation.

Accelerating Urbanization and Time-Constrained Modern Lifestyles

Rapid urbanization across Mexico has fundamentally transformed dietary patterns as working professionals and students seek convenient nutritional solutions compatible with demanding schedules. Metropolitan areas including Mexico City, Guadalajara, and Monterrey concentrate large populations requiring portable, ready-to-consume meal alternatives that eliminate traditional meal preparation time requirements. The expansion of dual-income households has further intensified demand for efficient nutrition delivery systems. Meal replacement products directly address these evolving lifestyle needs by providing complete, balanced nutrition in convenient formats suitable for consumption at workplaces, educational institutions, and transit environments throughout urban Mexico.

Expanding Fitness Culture and Health Consciousness Among Consumers

Mexico's fitness industry has experienced exceptional growth with gym memberships and fitness center participation increasing substantially in recent years. This expanding fitness culture generates consistent demand for protein-enriched meal replacement products supporting muscle recovery, athletic performance, and body composition objectives. Social media influence and fitness content proliferation have elevated nutritional awareness among younger demographics, driving adoption of meal replacement products as integral components of health-focused lifestyles. The convergence of fitness trends and nutritional supplementation continues positioning meal replacements as essential products for health-conscious Mexican consumers pursuing wellness goals.

Market Restraints:

What Challenges the Mexico Meal Replacements Market is Facing?

Price Sensitivity and Affordability Constraints

Meal replacement products often carry premium pricing that limits accessibility among price-sensitive Mexican consumers, particularly in lower-income segments. Economic pressures and competing household expenditure priorities can reduce discretionary spending on specialized nutritional products despite recognized health benefits.

Consumer Preference for Traditional Whole Foods

Strong cultural attachment to traditional Mexican cuisine and home-cooked meals presents competitive challenges for meal replacement product adoption. Many consumers perceive processed nutritional products as inferior alternatives to fresh, whole food preparations, limiting market penetration among traditionalist demographic segments.

Limited Consumer Awareness in Rural Markets

Rural and semi-urban populations demonstrate lower awareness regarding meal replacement product benefits and appropriate usage protocols. Limited retail distribution, inadequate marketing penetration, and reduced healthcare professional engagement constrain market development potential in these underserved geographic areas.

Competitive Landscape:

The Mexico meal replacements market exhibits a moderately concentrated competitive landscape featuring established multinational corporations alongside regional players competing across product segments and distribution channels. Leading companies leverage extensive research capabilities, manufacturing infrastructure, and distribution networks to maintain market positioning. Strategic initiatives focus on product innovation, flavor diversification, nutritional enhancement, and marketing campaigns targeting specific consumer demographics. Players emphasize partnerships with healthcare professionals, fitness centers, and retail chains to strengthen brand credibility and expand market reach. Competitive differentiation increasingly centers on clean-label formulations, plant-based alternatives, and functional ingredients addressing targeted health concerns prevalent among Mexican consumers.

Mexico Meal Replacements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Powder, Ready-To-Drink, Bar, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico meal replacements market size was valued at USD 189.49 Million in 2025.

The Mexico meal replacements market is expected to grow at a compound annual growth rate of 6.29% from 2026-2034 to reach USD 328.05 Million by 2034.

Powder dominated the market with a share of 45%, owing to its cost-effectiveness, versatility in preparation, extended shelf life, and growing consumer preference for customizable nutritional solutions.

Key factors driving the Mexico meal replacements market include rising prevalence of obesity and diabetes, accelerating urbanization and time-constrained lifestyles, expanding fitness culture, increasing health consciousness, and growing retail infrastructure accessibility.

Major challenges include price sensitivity among consumers, strong cultural preference for traditional whole foods, limited awareness in rural markets, competition from fresh food alternatives, and affordability constraints affecting lower-income demographic segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)