Mexico Medical Disposables Market Size, Share, Trends and Forecast by Product, Raw Material, End Use, and Region, 2026-2034

Mexico Medical Disposables Market Summary:

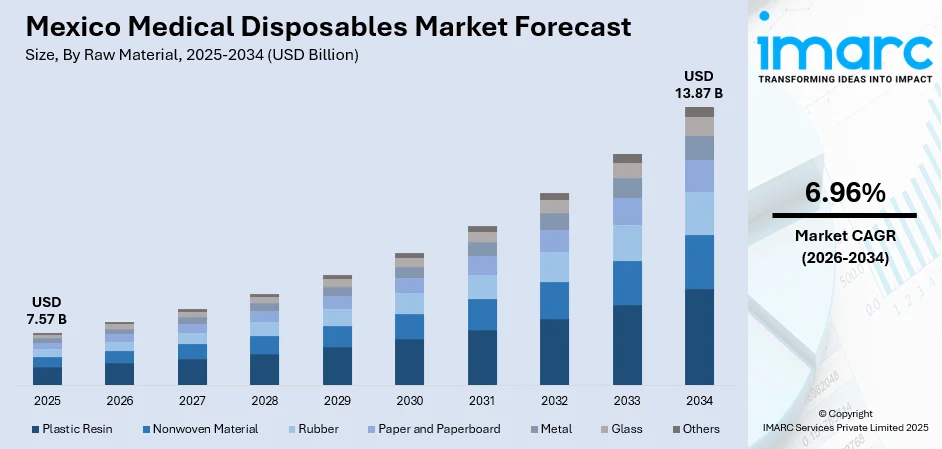

The Mexico medical disposables market size was valued at USD 7.57 Billion in 2025 and is projected to reach USD 13.87 Billion by 2034, growing at a compound annual growth rate of 6.96% from 2026-2034.

The market is driven by heightened public health campaigns promoting preventive care and hygiene standards, rising demand for homecare solutions among the growing elderly population, and increased focus on infection control across healthcare facilities. Government initiatives to expand community clinics and primary healthcare accessibility in underserved areas are compelling demand for cost-effective, hygienic, and high-performance disposable products. As the healthcare landscape shifts towards improved accessibility and safety protocols, these dynamics together contribute to the expansion of the Mexico medical disposables market share.

Key Takeaways and Insights:

- By Product: Disposable Gloves dominates the market with a share of 18% in 2025, driven by their essential role in infection prevention protocols, widespread adoption across hospitals and clinics, and increasing emphasis on procedural safety standards throughout Mexico's healthcare system.

- By Raw Material: Plastic resin leads the market with a share of 38% in 2025, owing to its cost-effectiveness, versatility in manufacturing diverse disposable products, lightweight properties, and superior barrier protection capabilities making it the preferred material choice.

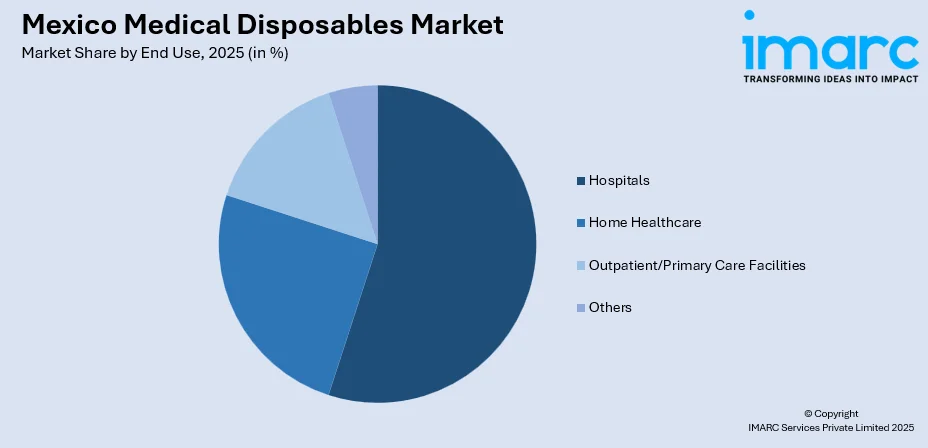

- By End Use: Hospitals represent the largest segment with a market share of 55% in 2025, driven by high patient volumes, stringent infection control requirements, extensive surgical procedures, and comprehensive healthcare service delivery demanding consistent supplies of disposable medical products.

- Key Players: The Mexico medical disposables market is moderately to highly competitive, with multinational and regional manufacturers vying across diverse product categories and price segments. Rivalry drives innovation, cost optimization, and expanded distribution, enhancing product quality and accessibility for healthcare providers nationwide.

To get more information on this market Request Sample

The Mexico medical disposables market is witnessing robust growth, driven by rising demand for hygienic, single-use products across healthcare settings. Government initiatives enhancing primary care accessibility in both rural and urban areas are expanding usage, while the growing geriatric population and preference for home-based care further boost adoption. As per sources, in November 2024, Mexico launched a new consolidated procurement model for medicines and medical supplies for 2025–2026, covering 4,454 product codes across 26 public health institutions. Moreover, increased awareness of healthcare-associated infections is prompting hospitals and clinics to prioritize infection control through disposable solutions. Strong regulatory frameworks emphasizing patient safety and procedural compliance are reinforcing their critical role. Collectively, these factors are establishing medical disposables as an indispensable component of Mexico’s healthcare infrastructure, supporting safer, more efficient, and patient-centered care delivery nationwide.

Mexico Medical Disposables Market Trends:

Expansion of Telemedicine-Integrated Home Healthcare Solutions

The integration of telemedicine platforms with home healthcare services is significantly influencing the medical disposables market in Mexico. As healthcare providers increasingly adopt remote patient monitoring and virtual consultation models, there is a corresponding rise in demand for disposable diagnostic tools and self-care products that patients can use independently at home. In November 2025, IMSS-Bienestar launched the National Telemedicine Program to connect 450 medical units and conduct over 25,000 teleconsultations in its first year, enhancing rural healthcare access. This trend is particularly pronounced among patients managing chronic conditions who require regular health assessments. The convenience of receiving professional medical guidance remotely while utilizing disposable testing supplies and wound care products at home is transforming patient care paradigms and creating new consumption patterns for single-use medical items.

Sustainable and Eco-Friendly Disposable Product Development

Environmental consciousness is increasingly shaping product development strategies within the medical disposables sector. Manufacturers are responding to growing sustainability concerns by investing in biodegradable materials and eco-friendly production processes that reduce environmental impact without compromising product efficacy or safety. Healthcare facilities are also showing greater interest in disposable products that offer easier recycling pathways and reduced carbon footprints. This trend reflects broader societal shifts toward environmental responsibility and is influencing procurement decisions across hospitals, clinics, and healthcare systems seeking to balance operational efficiency with ecological stewardship in their disposable product selections. For example, in August 2025, Baxter Healthcare Mexico partnered with Médica Sur Hospital to recycle hospital plastic bags into new products, advancing circular economy practices and reducing environmental impact.

Nearshore Manufacturing and Supply Chain Optimization

Mexico is emerging as a strategic hub for medical disposables manufacturing as healthcare companies seek to optimize their supply chains through nearshoring initiatives. The country's geographic proximity to major North American markets, combined with competitive manufacturing costs and improving infrastructure, is attracting significant investment in production facilities. In January 2025, Medline Industries announced a $250 million investment to build a new medical supplies facility in Nuevo Laredo, Tamaulipas, expanding its manufacturing footprint in Mexico and enhancing domestic production capabilities. Moreover, this trend is enhancing domestic manufacturing capabilities while reducing dependency on distant suppliers. The establishment of advanced manufacturing plants equipped with automation technologies and clean room facilities is positioning Mexico as a key player in the regional medical disposables supply chain ecosystem.

Market Outlook 2026-2034:

The Mexico medical disposables market is set for significant revenue growth, driven by healthcare infrastructure expansion and evolving patient care needs. Investments in hospital modernization, primary care network development, and rising adoption of disposable products across healthcare settings are key contributors. Manufacturers are diversifying offerings to meet clinical and regulatory demands, while government programs enhancing care accessibility and quality further boost demand. Increased private sector involvement in healthcare delivery creates additional opportunities, positioning medical disposables as a critical component of Mexico’s healthcare ecosystem. The market generated a revenue of USD 7.57 Billion in 2025 and is projected to reach a revenue of USD 13.87 Billion by 2034, growing at a compound annual growth rate of 6.96%from 2026-2034.

Mexico Medical Disposables Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Disposable Gloves | 18% |

| Raw Material | Plastic Resin | 38% |

| End Use | Hospitals | 55% |

Product Insights:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Hand Sanitizers

- Gel

- Form

- Liquid

- Others

- Others

The disposable gloves dominate with a market share of 18% of the total Mexico medical disposables market in 2025.

Disposable gloves represent the leading product segment within the Mexico medical disposables market, commanding the largest share among all product categories. Their widespread utilization across hospitals, clinics, laboratories, and homecare settings underscores their fundamental importance in maintaining hygiene standards and protecting both healthcare workers and patients from potential contamination during medical procedures.

The segment's dominance is attributed to mandatory usage protocols in surgical and examination settings, growing awareness regarding infection transmission prevention, and expanding applications beyond traditional healthcare environments. Material innovations in latex-free and hypoallergenic glove options are further broadening adoption among healthcare facilities seeking to accommodate diverse user requirements while maintaining procedural safety standards.

Raw Material Insights:

- Plastic Resin

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metal

- Glass

- Others

The plastic resin leads with a share of 38% of the total Mexico medical disposables market in 2025.

Plastic resin maintains its position as the leading raw material segment, forming the foundation for manufacturing a diverse array of medical disposable products. In October 2025, LyondellBasell expanded its medical-grade polymer portfolio in North America, supplying resins for syringes, IV bottles, and diagnostic disposables used in Mexican healthcare facilities. Its versatility enables production of items ranging from syringes and containers to packaging materials and protective equipment. The material's inherent properties including durability, transparency, and barrier protection make it indispensable in medical device manufacturing.

The segment benefits from established manufacturing infrastructure, cost advantages over alternative materials, and continuous technological advancements in polymer science. Healthcare-grade plastic resins meeting stringent regulatory requirements for biocompatibility and sterility continue to drive preference among manufacturers seeking reliable, scalable raw material solutions for disposable medical product production.

End Use Insights:

Access the Comprehensive Market Breakdown Request Sample

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

The hospitals exhibits a clear dominance with a 55% share of the total Mexico medical disposables market in 2025.

Hospitals constitute the dominant end-use segment for medical disposables in Mexico, reflecting their central role in the healthcare delivery system. These facilities require comprehensive inventories of disposable products spanning surgical supplies, diagnostic materials, patient care items, and infection control equipment. High patient throughput and diverse procedural requirements generate consistent demand across all disposable product categories.

The segment's leadership position is reinforced by ongoing hospital infrastructure investments, increasing surgical procedure volumes, and stringent regulatory compliance requirements mandating single-use products in numerous clinical applications. According to reports, in July 2025, Mexico announced plans to inaugurate 31 new hospitals and 12 healthcare centers between October 2024 and December 2025, enhancing healthcare access and infrastructure nationwide. Further, both public and private hospital systems continue expanding their procurement of disposable medical supplies as they prioritize patient safety and operational efficiency.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a key market for medical disposables, supported by advanced healthcare infrastructure, proximity to international supply chains, and a strong industrial base. Numerous medical device manufacturing facilities and well-established hospital networks in urban and industrial areas drive consistent demand, while economic growth in border states continues to stimulate healthcare spending and disposable product consumption.

Central Mexico, including the capital region, shows substantial medical disposables demand due to densely populated areas and extensive healthcare networks. Major public and private hospitals, research institutions, and medical schools collectively generate high consumption of disposable products across clinical applications, training, and patient care, reinforcing the region’s position as a core market for medical disposables.

Southern Mexico offers growing opportunities as government initiatives enhance healthcare access in underserved areas. Expansion of community health centers and primary care facilities is creating new channels for affordable disposable products. Investments in infrastructure development and service quality improvements are expected to accelerate market growth in this emerging region, supporting broader adoption of medical disposables.

Other regions across Mexico contribute to overall market growth through diverse healthcare delivery models serving rural populations, tourist destinations, and specialized care centers. Gradual improvements in accessibility, mobile health services, telemedicine, and public health programs, combined with increasing awareness of hygiene and preventive care, are driving steady adoption of disposable medical products across these varied geographic areas.

Market Dynamics:

Growth Drivers:

Why is the Mexico Medical Disposables Market Growing?

Expansion of Primary Healthcare Infrastructure and Community Clinics

Mexico's strategic commitment to expanding primary healthcare accessibility is generating sustained demand for medical disposables across diverse geographic regions. Government initiatives to establish community health centers in underserved rural and urban areas are creating new consumption channels for essential disposable products including examination gloves, syringes, wound care materials, and diagnostic supplies. As per sources, in February 2025, Mexico’s Consolidated Purchase of Medicines and Medical Supplies 2025–2026 successfully awarded 95.7% of 4.982 billion units, with hospital and clinic supply beginning in March. These decentralized healthcare facilities rely heavily on single-use products to maintain hygiene standards without requiring extensive sterilization infrastructure. Preventive care programs focusing on vaccination campaigns, maternal health services, and chronic disease management further amplify demand for disposable medical supplies. The emphasis on bringing quality healthcare closer to communities is fundamentally transforming consumption patterns and establishing long-term growth trajectories for the medical disposables market.

Rising Geriatric Population and Home Healthcare Preferences

Demographic shifts characterized by an aging population are substantially influencing medical disposables demand in Mexico. The growing elderly population requiring management of chronic conditions such as diabetes, cardiovascular diseases, and respiratory ailments is driving increased utilization of disposable products in home care settings. Families and professional caregivers increasingly rely on incontinence products, wound dressings, diagnostic strips, and protective equipment to deliver quality care outside traditional hospital environments. In May 2025, Mexico launched the “Health House to House” program, deploying 19,300 healthcare workers to provide in‑home medical care to over 8 million seniors and people with disabilities. This trend aligns with broader healthcare system objectives of reducing hospitalization while maintaining care standards. The convenience, affordability, and hygiene benefits of disposable products make them essential components of home-based care protocols, creating sustained demand growth tied directly to demographic evolution and changing care delivery preferences.

Stringent Infection Control Protocols and Regulatory Compliance

Heightened emphasis on infection prevention within healthcare settings is propelling increased adoption of single-use medical disposables throughout Mexico's healthcare system. Hospitals, clinics, and diagnostic laboratories are implementing comprehensive infection control protocols that mandate utilization of disposable products to minimize cross-contamination risks during medical procedures. Regulatory frameworks requiring compliance with patient safety standards are reinforcing procurement of certified disposable supplies including surgical gloves, face masks, gowns, and sterilization materials. In October 2025, Mexico updated NOM‑045, mandating strict infection‑control and surveillance standards across hospitals and clinics, reinforcing the use of certified disposable gloves, masks, gowns, and sterilization materials. Moreover, healthcare-associated infection awareness has elevated the priority given to procedural safety, compelling facilities to transition from reusable to disposable alternatives in numerous applications. Training programs for healthcare professionals further emphasize standardized use of disposable equipment, embedding their utilization into clinical practice and generating consistent demand growth.

Market Restraints:

What Challenges the Mexico Medical Disposables Market is Facing?

Environmental Concerns and Waste Management Challenges

Growing environmental awareness regarding medical waste disposal presents challenges for the disposables market. The accumulation of single-use plastic products in healthcare waste streams is attracting regulatory scrutiny and prompting calls for sustainable alternatives. Healthcare facilities face increasing pressure to balance infection control requirements with environmental responsibility, creating complex procurement decisions. Waste management infrastructure limitations in certain regions further complicate proper disposal of used medical disposables.

Price Sensitivity in Resource-Constrained Healthcare Settings

Budget constraints affecting public healthcare facilities and smaller private clinics create pricing pressures within the medical disposables market. Resource-limited settings often face difficult choices between product quality and affordability, potentially limiting adoption of premium disposable products. Economic fluctuations and healthcare budget allocations directly influence procurement volumes, creating demand volatility. Price competition among suppliers can also affect product quality and innovation investments.

Supply Chain Vulnerabilities and Raw Material Dependencies

Dependence on imported raw materials and finished products exposes the market to supply chain disruptions and currency fluctuations. Logistics challenges affecting timely delivery to remote healthcare facilities can impact product availability and service continuity. Manufacturing capacity constraints during periods of elevated demand may create temporary shortages of essential disposable products. These vulnerabilities underscore the importance of supply chain diversification and domestic manufacturing development.

Competitive Landscape:

The Mexico medical disposables market exhibits a moderately fragmented competitive structure characterized by the presence of multinational corporations, regional manufacturers, and specialized distributors competing across diverse product segments and price points. Market participants differentiate themselves through product quality, portfolio breadth, distribution network strength, and customer service capabilities. Competition intensifies around major procurement contracts with public healthcare systems and private hospital networks. Manufacturers are increasingly investing in domestic production facilities to enhance supply chain reliability and cost competitiveness. Strategic partnerships between international brands and local distributors facilitate market access and customer reach. Innovation in product development, particularly regarding material sustainability and enhanced functionality, is emerging as a key competitive differentiator as market participants seek to address evolving customer requirements and regulatory expectations.

Recent Developments:

- In September 2025, DEBx Medical, in collaboration with Biotechlives SAPI, formally launched DEBRICHEM® in Mexico following approval by COFEPRIS. This CE-marked Class IIb advanced wound care product offers hospitals and clinics a high-standard disposable solution, enhancing patient care quality and reinforcing infection control protocols within medical settings.

Mexico Medical Disposables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Raw Materials Covered | Plastic Resin, Nonwoven Material, Rubber, Paper and Paperboard, Metal, Glass, Others |

| End Uses Covered | Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico medical disposables market size was valued at USD 7.57 Billion in 2025.

The Mexico medical disposables market is expected to grow at a compound annual growth rate of 6.96% from 2026-2034 to reach USD 13.87 Billion by 2034.

Disposable gloves held the largest share, driven by their essential role in infection control, widespread usage across hospitals, clinics, and laboratories, and growing awareness of hygiene and safety standards in healthcare settings nationwide.

Key factors driving the Mexico medical disposables market include expansion of public health programs and community clinics, increased demand from homecare and geriatric services, emphasis on infection prevention and procedural safety, healthcare infrastructure development, and growing adoption of telemedicine-integrated care solutions

Major challenges include environmental concerns regarding medical waste disposal, price sensitivity in resource-constrained healthcare settings, supply chain vulnerabilities and raw material dependencies, regulatory compliance requirements, and competition from reusable medical device alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)