Mexico Medical Robots Market Size, Share, Trends and Forecast by Product, Application, End user, and Region, 2026-2034

Mexico Medical Robots Market Summary:

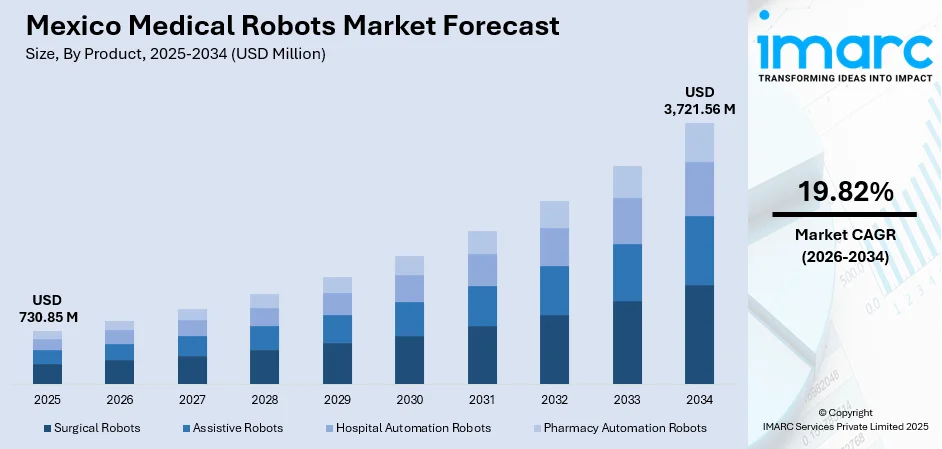

The Mexico medical robots market size was valued at USD 730.85 Million in 2025 and is projected to reach USD 3,721.56 Million by 2034, growing at a compound annual growth rate of 19.82% from 2026-2034.

The market is driven by the growing adoption of artificial intelligence-powered surgical robots that enhance precision and improve patient outcomes, the rising demand for minimally invasive surgeries offering faster recovery and fewer complications, and the expansion of telemedicine combined with robotic systems enabling remote consultations and surgeries. These factors collectively improve healthcare access while encouraging hospitals to invest in advanced robotic technologies, thereby strengthening the Mexico medical robots market share.

Key Takeaways and Insights:

- By Product: Surgical robots dominate the market with a share of 48% in 2025, driven by adoption in orthopedic, neurological, and laparoscopic surgeries, offering superior precision and growing healthcare provider preference for robotic-assisted procedures.

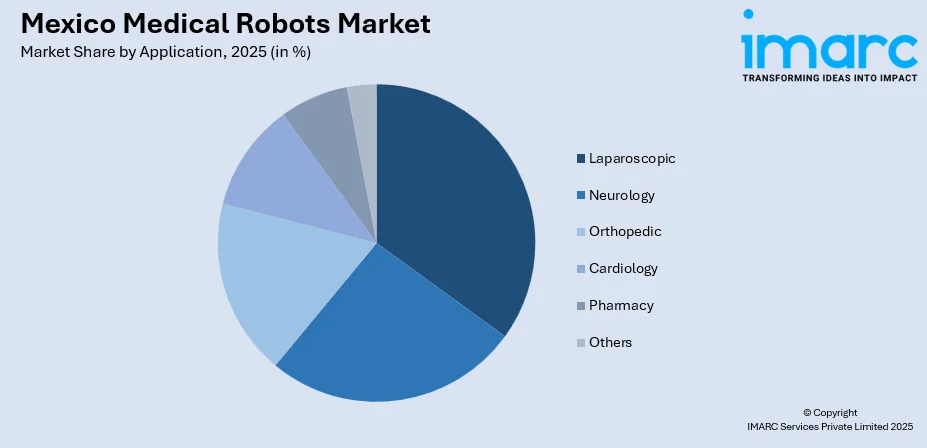

- By Application: Laparoscopic leads the market with a share of 32% in 2025, owing to rising demand for minimally invasive surgeries that reduce discomfort, shorten hospital stays, accelerate recovery, and improve outcomes across multiple medical specialties.

- By End User: Hospitals represent the largest segment with a market share of 64% in 2025, driven by strong capital investment capacity, advanced surgical infrastructure, high patient volumes, and established systems for integrating robotic medical technologies.

- Key Players: The Mexico medical robots market exhibits a moderately consolidated competitive landscape, with multinational medical technology corporations competing alongside specialized robotics manufacturers across various product segments, focusing on technological innovation, strategic partnerships, and expanding distribution networks throughout the country.

To get more information on this market Request Sample

The Mexico medical robots market is experiencing robust expansion driven by the increasing adoption of robotic-assisted surgical systems across major healthcare facilities. The rising prevalence of chronic diseases requiring surgical interventions, coupled with the growing geriatric population demanding advanced medical care, is propelling market growth. Healthcare institutions are increasingly investing in robotic technologies to enhance surgical precision, reduce operative complications, and improve patient outcomes. Additionally, government initiatives promoting healthcare infrastructure modernization, favorable reimbursement policies, and the presence of skilled medical professionals trained in robotic surgery are creating a conducive environment for market development. In October 2025, ISSSTE invested over MXN 158 Million to deploy six Da Vinci Xi surgical robots across specialized hospitals, expanding robotic surgery access and supporting advanced cancer procedures for millions of beneficiaries nationwide. Moreover, the integration of artificial intelligence and machine learning capabilities into medical robots is further revolutionizing diagnostic accuracy and treatment protocols.

Mexico Medical Robots Market Trends:

Integration of Artificial Intelligence in Robotic Surgery

The incorporation of artificial intelligence (AI) algorithms into medical robotic systems is transforming surgical capabilities across Mexico. Advanced machine learning models enable robotic platforms to analyze complex medical imaging data, predict surgical outcomes, and assist surgeons in real-time decision-making during procedures. As per sources, in July 2025, an AI-trained surgical robot autonomously performed gallbladder procedures with 100% accuracy in controlled models, demonstrating real-time decision-making, anatomical adaptation, and self-correction without human assistance. This technological convergence is enhancing procedural accuracy, reducing operative times, and minimizing the risk of complications. Healthcare providers are increasingly adopting AI-powered robotic systems that can learn from vast surgical datasets, enabling personalized treatment approaches tailored to individual patient anatomies and conditions.

Expansion of Telemedicine-Enabled Robotic Procedures

The convergence of telemedicine platforms with robotic surgical systems is revolutionizing healthcare delivery across geographically dispersed regions in Mexico. Telepresence robots and remote-controlled surgical systems are enabling specialist physicians to conduct consultations, monitor patients, and perform complex procedures from distant locations. According to sources, in 2025, IMSS-Bienestar launched the National Telemedicine Program, enabling over 25,000 teleconsultations across Chiapas, Nayarit, and Sinaloa, expanding specialized care to rural Mexican communities. This trend is particularly significant for rural and underserved communities where access to specialized medical expertise remains limited, thereby democratizing access to advanced surgical care and reducing healthcare disparities across the nation.

Advancement in Minimally Invasive Surgical Technologies

The growing preference for minimally invasive surgical procedures is driving significant innovations in medical robotic technologies. In June 2025, Hospital Angeles Health System in Mexico performed an average of two thousand robotic surgeries annually, marking a decade of minimally invasive procedures with enhanced precision and faster recovery. Furthermore, modern robotic platforms feature enhanced dexterity, smaller instrument profiles, and improved visualization capabilities that enable surgeons to perform intricate procedures through minute incisions. These technological advancements are translating into substantial patient benefits including reduced postoperative pain, shorter hospitalization periods, faster recovery trajectories, and minimal scarring. Healthcare facilities are increasingly prioritizing robotic systems that offer superior minimally invasive capabilities across multiple surgical specialties.

Market Outlook 2026-2034:

The Mexico medical robots market revenue is projected to experience substantial expansion throughout the forecast period, supported by increasing healthcare expenditure and technological advancement initiatives. Rising demand for precision-guided surgical procedures, coupled with expanding applications across neurology, orthopedics, and cardiology specialties, is anticipated to drive sustained revenue growth. Strategic investments by healthcare institutions in robotic infrastructure and favorable government policies supporting medical technology adoption are expected to further strengthen market expansion prospects. The market generated a revenue of USD 730.85 Million in 2025 and is projected to reach a revenue of USD 3,721.56 Million by 2034, growing at a compound annual growth rate of 19.82% from 2026-2034.

Mexico Medical Robots Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Surgical Robots | 48% |

| Application | Laparoscopic | 32% |

| End User | Hospitals | 64% |

Product Insights:

- Surgical Robots

- Assistive Robots

- Hospital Automation Robots

- Pharmacy Automation Robots

Surgical robots dominate with a market share of 48% of the total Mexico medical robots market in 2025.

Surgical robots constitute the dominant product category within the Mexico medical robots market, accounting for the largest revenue contribution. These sophisticated systems enable surgeons to perform complex procedures with enhanced precision, improved visualization, and superior instrument articulation compared to conventional surgical approaches. According to sources, in October 2025, Hospital Ángeles Acoxpa in Mexico launched the Hugo RAS robotic-assisted surgery system by Medtronic, enabling certified specialists to perform minimally invasive procedures across multiple specialties. Moreover, the segment encompasses various specialized platforms designed for orthopedic joint replacements, neurological interventions, urological procedures, and general surgical applications.

The growing preference for robotic-assisted surgeries among both healthcare providers and patients is driving sustained demand for surgical robot platforms. Healthcare institutions are prioritizing investments in advanced surgical robots to differentiate their service offerings, attract specialized surgical talent, and improve clinical outcomes. Continuous technological innovations including enhanced haptic feedback systems, augmented reality visualization, and integrated artificial intelligence capabilities are further expanding surgical robot adoption across multiple medical specialties.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Neurology

- Orthopedic

- Cardiology

- Laparoscopic

- Pharmacy

- Others

Laparoscopic leads with a share of 32% of the total Mexico medical robots market in 2025.

Laparoscopic represents the leading segment in the Mexico medical robots market, reflecting the widespread adoption of minimally invasive surgical techniques across healthcare facilities. Robotic-assisted laparoscopic procedures offer superior instrument maneuverability, three-dimensional visualization, and tremor filtration capabilities that enhance surgical precision in confined anatomical spaces. In September 2025, ISSSTE announced that six hospitals across Mexico will perform at least 150 Da Vinci robotic surgeries this year, focusing on cancer and complex urological and gynecological procedures. Moreover, common applications include cholecystectomy, hernia repair, bariatric surgery, and various gynecological interventions.

The segment's dominance is attributed to the substantial patient benefits associated with robotic laparoscopic procedures, including reduced postoperative pain, shorter hospital stays, and faster return to normal activities. Healthcare providers are increasingly transitioning from conventional laparoscopic approaches to robotic-assisted techniques to improve surgical outcomes and patient satisfaction. Ongoing advancements in robotic platform capabilities and instrument miniaturization are expanding the range of procedures amenable to robotic laparoscopic intervention.

End User Insights:

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Others

Hospitals exhibit a clear dominance with a 64% share of the total Mexico medical robots market in 2025.

Hospitals represent the predominant end-user segment in the Mexico medical robots market, driven by their comprehensive surgical infrastructure and substantial capital investment capabilities. Furthermore, major public and private hospital networks are leading adopters of medical robotic systems, integrating these technologies across multiple surgical departments to enhance procedural capabilities. Hospital settings provide the necessary operational environment, including specialized surgical suites, trained support staff, and maintenance infrastructure required for optimal robotic system utilization.

The segment's leadership position reflects hospitals' strategic imperative to maintain technological competitiveness and attract patients seeking advanced surgical care. Healthcare administrators are recognizing the long-term value proposition of robotic surgery investments, including improved clinical outcomes, enhanced institutional reputation, and potential for reduced complications. Collaborative partnerships between hospitals and robotic system manufacturers are facilitating technology adoption through favorable financing arrangements, comprehensive training programs, and ongoing technical support services.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for medical robots, characterized by its proximity to advanced healthcare technologies from the United States and well-established medical tourism infrastructure. Major cities including Monterrey and Tijuana house sophisticated healthcare facilities equipped with cutting-edge robotic surgical systems. The region benefits from substantial foreign direct investment in healthcare infrastructure and strong cross-border medical collaborations that facilitate technology transfer and knowledge exchange.

Central Mexico, encompassing Mexico City and surrounding metropolitan areas, dominates the national medical robots market owing to its concentration of premier tertiary care hospitals and specialized surgical centers. The region benefits from superior healthcare infrastructure, highest population density, and presence of leading medical research institutions driving robotic technology adoption. Major public and private healthcare systems in the capital region continuously invest in advanced robotic platforms to address substantial patient volumes and maintain competitive positioning.

Southern Mexico presents emerging opportunities for medical robot deployment, with growing healthcare infrastructure development initiatives addressing regional healthcare disparities. States including Oaxaca, Chiapas, and Yucatan are witnessing gradual adoption of robotic technologies in major urban hospitals. Government programs focusing on healthcare modernization and telemedicine expansion are facilitating robotic system implementation to improve surgical care accessibility across underserved communities in the southern region.

Others across Mexico, including western coastal states and central highlands, are witnessing progressive medical robot adoption driven by expanding private healthcare networks and medical tourism facilities. Cities including Guadalajara and Puebla are emerging as secondary hubs for robotic surgical services. Regional healthcare authorities are increasingly collaborating with technology providers to establish robotic surgery training programs and expand advanced surgical capabilities beyond traditional metropolitan centers.

Market Dynamics:

Growth Drivers:

Why is the Mexico Medical Robots Market Growing?

Rising demand for Minimally Invasive Surgical Procedures

The escalating preference for minimally invasive surgical approaches represents a fundamental driver propelling the Mexico medical robots market forward. Patients increasingly seek surgical options that minimize tissue trauma, reduce postoperative discomfort, and enable rapid recovery to normal activities. Medical robots excel in delivering these benefits through enhanced precision, superior visualization capabilities, and refined instrument control that facilitate complex procedures through minimal incisions. Healthcare providers are responding to this patient demand by investing in robotic surgical platforms that expand their minimally invasive procedure offerings across multiple specialties including urology, gynecology, general surgery, and thoracic surgery. As per sources, in February 2025, Hospital Ángeles Puebla’s NaPro Clinic performed 200 gynecological surgeries using the Da Vinci Robot, attracting patients from 17 countries and demonstrating minimally invasive surgical precision.

Technological Advancements in Robotic Platforms

Continuous technological innovation in medical robotic systems is significantly driving market expansion across Mexico. Modern robotic platforms incorporate sophisticated features including artificial intelligence-assisted surgical planning, advanced haptic feedback mechanisms, enhanced three-dimensional visualization systems, and improved instrument articulation capabilities. These technological advancements enable surgeons to perform increasingly complex procedures with greater precision and confidence while reducing operative times and potential complications. The integration of machine learning algorithms that analyze surgical performance data and provide real-time guidance is further enhancing the value proposition of robotic surgical systems, encouraging broader adoption across healthcare institutions.

Growing Healthcare Infrastructure Investment

Substantial investments in healthcare infrastructure modernization across Mexico are creating favorable conditions for medical robot adoption. In December 2025, the State of Mexico inaugurated the country’s first free public hospital robotic surgery unit at “Lic. Adolfo López Mateos” Medical Center, completing 20 successful minimally invasive procedures. Furthermore, government initiatives aimed at strengthening public healthcare capabilities, combined with private sector expansion of hospital networks and specialty surgical centers, are driving demand for advanced medical technologies. Healthcare institutions are prioritizing capital expenditure on cutting-edge surgical equipment to enhance service quality, attract skilled medical professionals, and differentiate their offerings in an increasingly competitive healthcare landscape. This infrastructure development trend encompasses not only robotic system procurement but also investment in supporting technologies, training facilities, and maintenance capabilities essential for sustainable robotic surgery programs.

Market Restraints:

What Challenges the Mexico Medical Robots Market is Facing?

High Capital Investment Requirements

The substantial capital investment required for medical robot acquisition represents a significant barrier to market expansion. Robotic surgical systems entail considerable upfront costs encompassing equipment procurement, facility modifications, and comprehensive training programs. These financial requirements pose particular challenges for smaller healthcare facilities and institutions with constrained capital budgets, limiting market penetration beyond major hospital networks.

Shortage of Trained Medical Professionals

The limited availability of surgeons and support staff adequately trained in robotic surgical techniques constrains market growth potential. Achieving proficiency in robotic surgery requires extensive training, supervised practice, and ongoing skill development that many healthcare institutions struggle to provide. This skills gap restricts the utilization of existing robotic systems and creates hesitancy among facilities considering robotic program establishment.

Operational and Maintenance Complexity

The operational complexity and ongoing maintenance requirements associated with medical robotic systems present challenges for healthcare facilities. Robotic platforms require specialized technical support, regular calibration, and prompt access to replacement components to maintain optimal functionality. Ensuring consistent system availability while managing maintenance costs and technical dependencies adds operational burden that some institutions may struggle to accommodate effectively.

Competitive Landscape:

The Mexico medical robots market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational medical technology corporations alongside emerging specialized robotics manufacturers. Market participants compete primarily through technological innovation, product differentiation, and comprehensive service offerings encompassing training and maintenance support. Strategic partnerships between international robotics companies and local healthcare distributors facilitate market access and customer support capabilities. Companies are focusing on expanding product portfolios to address diverse surgical specialties while developing financing solutions that improve affordability for healthcare institutions. The competitive environment encourages continuous technological advancement and service quality improvement, ultimately benefiting healthcare providers and patients through enhanced surgical capabilities and support services.

Recent Developments:

- In March 2025, Grupo Hospitalario Dalinde San Ángel Inn introduced the Versius surgical robot in Mexico, developed by CMR Surgical. The system enhances minimally invasive procedures, offering improved precision, shorter recovery times, and broader access to robotic surgery, marking a significant step in advancing patient care and surgical innovation nationwide.

Mexico Medical Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Surgical Robots, Assistive Robots, Hospital Automation Robots, Pharmacy Automation Robots |

| Applications Covered | Neurology, Orthopedic, Cardiology, Laparoscopic, Pharmacy, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Rehabilitation Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico medical robots market size was valued at USD 730.85 Million in 2025.

The Mexico medical robots market is expected to grow at a compound annual growth rate of 19.82% from 2026-2034 to reach USD 3,721.56 Million by 2034.

Surgical robots held the largest share in the market, supported by broad adoption across various surgical specialties, improved precision, and growing healthcare provider preference for robotic-assisted procedures, boosting efficiency, patient outcomes, and the overall expansion of robotic surgery in the country.

Key factors driving the Mexico medical robots market include rising demand for minimally invasive surgeries, technological advancements in robotic platforms, growing healthcare infrastructure investment, and increasing adoption of AI-powered surgical systems.

Major challenges include high capital costs, limited availability of trained professionals, complex operation and maintenance needs, inadequate reimbursement structures, and uneven geographic access to advanced robotic technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)