Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Mexico Medical Tourism Market Overview:

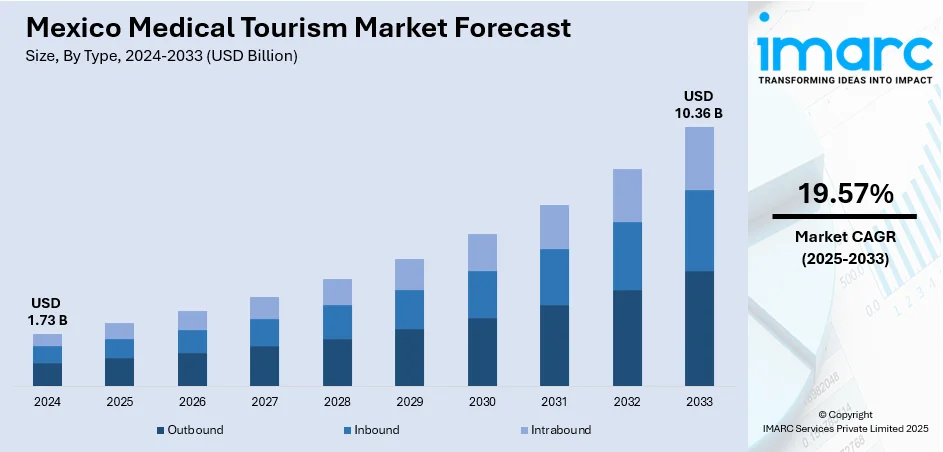

The Mexico medical tourism market size reached USD 1.73 Billion in 2024. Looking forward, the market is projected to reach USD 10.36 Billion by 2033, exhibiting a growth rate (CAGR) of 19.57% during 2025-2033. The market is driven by proximity to the U.S., which enables affordable and high-volume cross-border access to dental, surgical, and aesthetic care. Strong specialization in bariatric and cosmetic procedures, supported by internationally trained professionals, attracts global patients. Government promotion and hospital investments are further augmenting the Mexico medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.73 Billion |

| Market Forecast in 2033 | USD 10.36 Billion |

| Market Growth Rate 2025-2033 | 19.57% |

Mexico Medical Tourism Market Trends:

Proximity to the United States and Cross-Border Infrastructure

Mexico’s primary competitive edge in medical tourism lies in its proximity to the United States and the well-developed healthcare infrastructure in border cities such as Tijuana, Ciudad Juárez, and Mexicali. These locations are easily accessible for U.S. residents, especially from California, Texas, and Arizona, seeking affordable treatments without long travel. Cross-border clinics cater to short-stay patients with fast-track medical visa programs, secure transport, and English-speaking staff. Many facilities have established partnerships with U.S. health insurers or medical concierge services that streamline appointments, pre-approvals, and payments. Patients cross the border for procedures ranging from dental care and cosmetic surgery to bariatric and orthopedic surgeries, often receiving same-day or next-day consultations. Additionally, mobile clinics and international patient wings in hospitals are tailored to American expectations regarding privacy, quality, and post-op follow-ups. The U.S.-Mexico cross-border dynamic creates a high-volume, low-barrier healthcare exchange that continues to drive inbound demand. This geographic and logistical advantage has made Mexico one of the top destinations globally for affordable and accessible private medical care, directly contributing to Mexico medical tourism market growth and strengthening its role as a North American healthcare hub.

To get more information on this market, Request Sample

Strong Reputation in Dentistry, Bariatrics, and Aesthetics

Mexico has earned global recognition in high-demand specialties such as dental surgery, weight loss procedures, and aesthetic medicine. Clinics in Guadalajara, Cancun, and Monterrey attract medical tourists from the U.S., Canada, and Central America for procedures like dental implants, veneers, liposuction, tummy tucks, and gastric bypass surgeries. Dentists and surgeons often receive international training and certifications, and many practices are equipped with advanced imaging, 3D scanning, and minimally invasive surgical tools. Treatment costs are often 50–70% lower than in the U.S., and bundled packages include airport pick-up, hotel stays, translation, and postoperative care—making the process seamless and cost-effective. These centers also benefit from transparent online pricing and English-language digital marketing, which increase trust and ease of access for international patients. Mexico’s strong reputation in cosmetic and dental care is further enhanced by medical tourism agencies and third-party accreditation services that ensure standards and safety protocols are met. This specialty-focused reputation plays a significant role in reinforcing patient loyalty and generating word-of-mouth referrals, fueling continued growth in these elective healthcare segments.

Public Sector Support and Growing Private Healthcare Investment

Mexico’s federal and regional governments are increasingly recognizing the economic impact of medical tourism and supporting the sector through policy alignment and infrastructure funding. Initiatives led by SECTUR (the Ministry of Tourism) and ProMéxico have promoted the country’s top healthcare clusters, encouraging investment in hospital expansion and certifications. Key cities like Puebla, Querétaro, and León are emerging as second-tier medical hubs, diversifying the geographic reach of the sector beyond traditional border areas. Simultaneously, private hospital groups such as Hospital Ángeles and Star Médica are expanding services for international patients, including bilingual staff, international billing, and partnerships with global insurers. Public health campaigns and investment incentives have led to increased JCI accreditation among private hospitals, raising confidence among medical travelers. Telemedicine and remote diagnostics are also being integrated into pre- and post-treatment care, allowing Mexico to extend its healthcare services beyond its borders. This convergence of public sector advocacy and private sector capability is creating a stable ecosystem for sustainable growth in medical tourism, ensuring consistent service quality and broader regional participation in international health travel.

Mexico Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

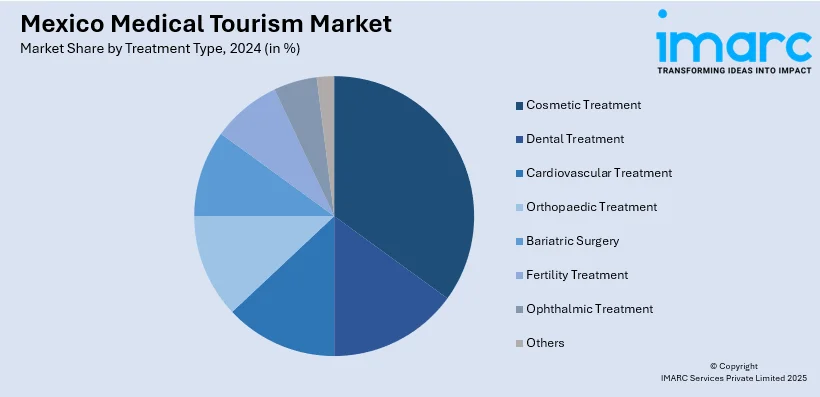

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico medical tourism market on the basis of type?

- What is the breakup of the Mexico medical tourism market on the basis of treatment type?

- What is the breakup of the Mexico medical tourism market on the basis of region?

- What are the various stages in the value chain of the Mexico medical tourism market?

- What are the key driving factors and challenges in the Mexico medical tourism market?

- What is the structure of the Mexico medical tourism market and who are the key players?

- What is the degree of competition in the Mexico medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)