Mexico Medical Wearables Market Size, Share, Trends and Forecast by Product, Device Type, End User, and Region, 2025-2033

Mexico Medical Wearables Market Overview:

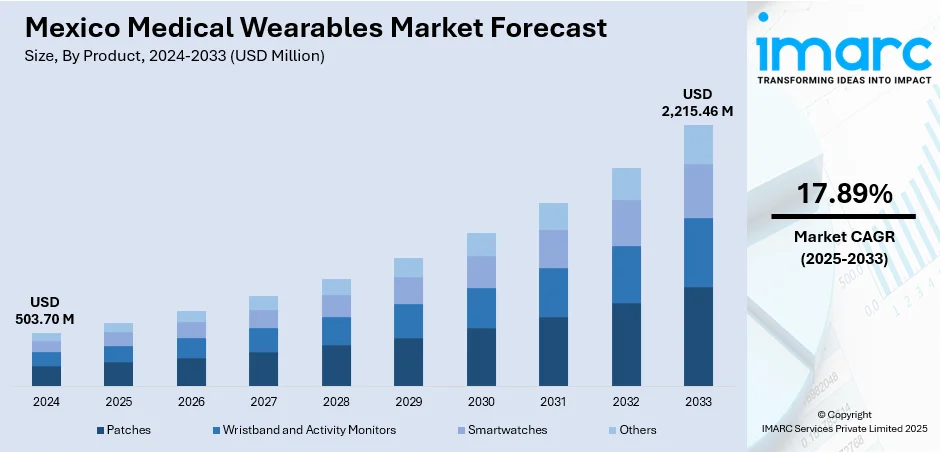

The Mexico medical wearables market size reached USD 503.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,215.46 Million by 2033, exhibiting a growth rate (CAGR) of 17.89% during 2025-2033. The market is seeing robust growth spurred by innovation in telemedicine, greater emphasis on geriatric care, and growing consumer demand for preventive wellness. The technologies are facilitating real-time health tracking, improving elderly care systems, and equipping individuals with the ability to proactively manage their health. Wearables' inclusion in clinical and consumer environments represents a country-wide movement toward data-driven, accessible healthcare. These advancements are helping to drive the ongoing growth of Mexico medical wearables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 503.70 Million |

| Market Forecast in 2033 | USD 2,215.46 Million |

| Market Growth Rate 2025-2033 | 17.89% |

Mexico Medical Wearables Market Trends:

Growth of Telemedicine Fueling Wearable Device Adoption

Mexico's telemedicine infrastructure is moving forward progressively, supporting the seamless adoption of medical wearables throughout the healthcare network. With increased accessibility of virtual consultations, particularly in underserved rural areas, wearables like pulse oximeters, ECG monitors, and blood pressure monitors are helping to fill the care gap. These products send patient information in real time, enabling healthcare professionals to make swift decisions with reduced need for in-person visits. The government's encouragement of digital transformation in healthcare, in addition to increasing mobile connectivity, is underpinning the use of wearables in mainstream care. Doctors intensely are turning to data-driven monitoring solutions in order to better manage chronic conditions and be ready in case of emergencies. This trend is part of Mexico's overall initiative to broaden equitable healthcare access using digital innovation. For instance, in August 2024, Mexico rolled out a program to incorporate SMEs into high-tech medical device supply chains, providing an indirect spur to its medical wearables market by enhancing local precision manufacturing competences. Moreover, the use of telemedicine-enabled technologies is a key driver of Mexico medical wearables market growth, particularly because telecare becomes a key part of national health plans.

To get more information on this market, Request Sample

Geriatric Health Monitoring Posing Demand for Smart Wearables

The geriatric population in Mexico is one primary demographic driving the increased demand for medical wearables that target elderly care. Wearable devices with the capacity to monitor heart rate, sleep, blood glucose, and fall detection are becoming critical to ensuring the health of independently living older adults or those in long-term care. The potential of these devices to notify caregivers or medical staff in real-time promotes patient safety alongside proactive health intervention. Moreover, healthcare facilities and nursing homes are integrating wearable technologies into care plans to enhance outcomes and optimize resource utilization. This age-driven trend is also in accordance with the nation's continued moves to modernize geriatric care services and enhance the quality of life for its geriatric population. As more individuals depend on digital devices for ongoing health monitoring, the wearable device market is poised to grow. These healthcare and demographic trends are heavily driving Mexico medical wearables growth, especially in geriatric care. According to the sources, in August 2024, Mexico rolled out a program to incorporate SMEs into high-tech medical device supply chains, providing an indirect spur to its medical wearables market by enhancing local precision manufacturing competences

Preventive Wellness Trends Supporting Consumer-Level Adoption

Mexico is experiencing increased health-aware behavior that supports consumer-level adoption of medical wearables for preventive wellness. Fitness trackers and smartwatches with medical-grade functionality are utilized to track physical activity, sleep, stress, and vital signs. This culture of self-monitoring is being complemented by rising public awareness programs on lifestyle diseases and the advantage of early detection. Populations in urban areas are adopting wearable health technologies, in specific, to remain proactive about their health. In addition, combining wearables with mobile health apps improves user experience and encourages frequent use of health information. This trend is part of a larger movement towards digital health management, in which consumers take responsibility for their own well-being. The combination of personal health objectives and technology tools is reinforcing the base for long-term uptake. These are significant contributions to Mexico medical wearables market trends, particularly in the preventive healthcare category.

Mexico Medical Wearables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, device type, and end user.

Product Insights:

- Patches

- Wristband and Activity Monitors

- Smartwatches

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes patches, wristband and activity monitors, smartwatches, and others.

Device Type Insights:

- Diagnostic and Monitoring Medical Devices

- Vital Signs Monitoring Devices

- ECG /Holter Heart Rate Monitors

- Pulse Oximeters

- Blood Pressure Monitors

- Multiparameter Trackers

- Glucose Monitoring Devices

- Sleep Apnea Monitors

- Fetal Monitoring Devices

- Neurological Monitoring Devices

- Vital Signs Monitoring Devices

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes diagnostic and monitoring medical devices, vital signs monitoring devices (ECG /holter heart rate monitors, pulse oximeters, blood pressure monitors, and multiparameter trackers), glucose monitoring devices, sleep apnea monitors, fetal monitoring devices, and neurological monitoring devices.

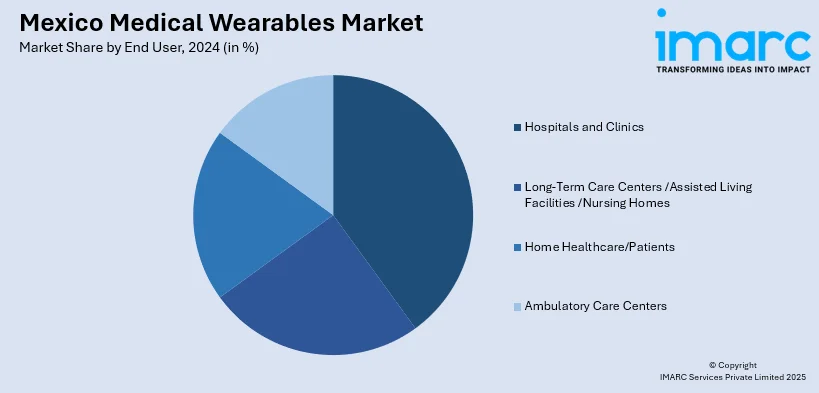

End User Insights:

- Hospitals and Clinics

- Long-Term Care Centers /Assisted Living Facilities /Nursing Homes

- Home Healthcare/Patients

- Ambulatory Care Centers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, long-term care centers /assisted living facilities /nursing homes, home healthcare/patients, and ambulatory care centers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Medical Wearables Market News:

- In January 2025, VIV Health released the VIV Ring at CES, introducing the world's first AI-powered smart ring with generative sleep aid sound technology. Having biometric monitoring and AI-powered audio, the wearable finished production during December 2024 and will start commercial sales in February 2025.

Mexico Medical Wearables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Patches, Wristband and Activity Monitors, Smartwatches, Others |

| Device Types Covered |

|

| End Users Covered | Hospitals and Clinics, Long-Term Care Centers /Assisted Living Facilities /Nursing Homes, Home Healthcare/Patients, Ambulatory Care Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico medical wearables market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico medical wearables market on the basis of product?

- What is the breakup of the Mexico medical wearables market on the basis of device type?

- What is the breakup of the Mexico medical wearables market on the basis of end user?

- What is the breakup of the Mexico medical wearables market on the basis of region?

- What are the various stages in the value chain of the Mexico medical wearables market?

- What are the key driving factors and challenges in the Mexico medical wearables?

- What is the structure of the Mexico medical wearables market and who are the key players?

- What is the degree of competition in the Mexico medical wearables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico medical wearables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico medical wearables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico medical wearables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)