Mexico Mental Health Market Size, Share, Trends and Forecast by Disorder, Service, Age Group, and Region, 2025-2033

Mexico Mental Health Market Overview:

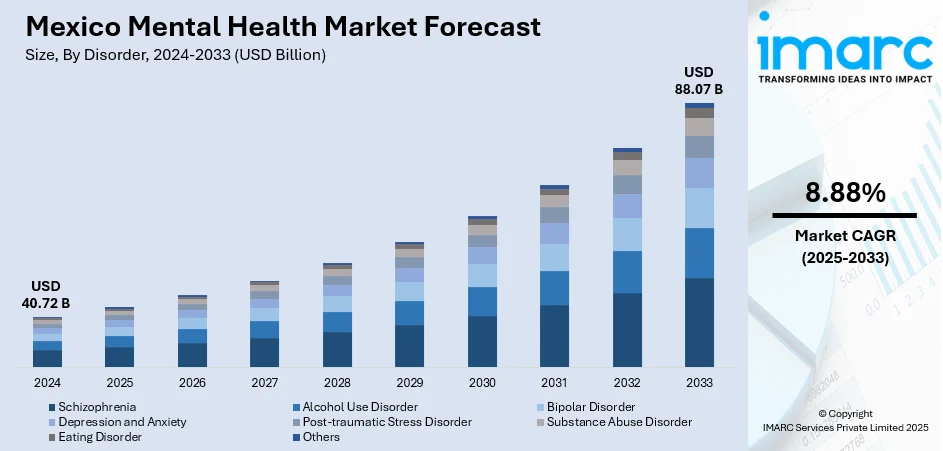

The Mexico mental health market size reached USD 40.72 Billion in 2024. The market is projected to reach USD 88.07 Billion by 2033, exhibiting a growth rate (CAGR) of 8.88% during 2025-2033. The market is driven by government-backed mental health reforms, emphasizing integration within primary healthcare and community-level interventions. Expanding use of telepsychiatry and digital therapeutics is improving access, particularly for underserved populations. Additionally, increased corporate investments in employee mental health initiatives and evolving workplace standards are strengthening service demand, further augmenting the Mexico mental health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.72 Billion |

| Market Forecast in 2033 | USD 88.07 Billion |

| Market Growth Rate 2025-2033 | 8.88% |

Mexico Mental Health Market Trends:

Government Strategies and Integration into Public Healthcare

The Mexican government has been steadily incorporating mental health services into the broader national healthcare framework to improve access and reduce systemic disparities. Under programs such as the Programa de Acción Específico de Salud Mental, the Ministry of Health has emphasized prevention, early detection, and community-based interventions. These efforts are supported by partnerships between public institutions, international organizations, and non-profits to build awareness campaigns and address stigma. Expansion of psychiatric services within general hospitals, alongside specialized clinics for mental healthcare, is helping bridge longstanding service gaps. Furthermore, recent healthcare reforms have focused on integrating mental health into primary care, allowing general practitioners to assess and refer patients more efficiently. Emphasis is also being placed on expanding services in underserved and rural regions, with mobile mental health units and telepsychiatry initiatives gaining traction. Increased funding for mental health, including targeted investments in addiction treatment and suicide prevention programs, reflects sustained government commitment to improving national well-being. These institutional developments are foundational for supporting Mexico mental health market growth, fostering an increasingly inclusive and responsive mental healthcare system.

To get more information on this market, Request Sample

Rising Role of Telepsychiatry and Digital Therapeutics

Digital mental health solutions are emerging as a transformative force within Mexico’s healthcare ecosystem, driven by increasing internet penetration and smartphone usage. Telepsychiatry platforms are helping bridge the accessibility gap, particularly for populations in remote or underserved areas lacking specialized providers. These platforms offer video consultations, digital cognitive behavioral therapy (CBT), and AI-driven symptom tracking, allowing patients to receive timely care while minimizing travel and waiting times. Mexican startups, in collaboration with healthcare professionals, are developing culturally adapted digital solutions in Spanish, catering to both urban and rural populations. Employers and private insurance providers are also integrating digital mental health offerings into employee benefits packages, addressing stress, anxiety, and burnout. Public institutions, including the Mexican Social Security Institute (IMSS), have increasingly supported virtual consultations as part of broader healthcare modernization initiatives. Furthermore, global health organizations have been active in piloting telehealth projects focused on mental health interventions across Mexico’s healthcare network. The convergence of technology, growing digital literacy, and expanding provider networks is reshaping how mental health care is delivered, making virtual support a permanent feature of the national landscape.

Growing Corporate Focus on Employee Mental Wellness

Corporate investments in mental health has become increasingly visible in Mexico, driven by heightened awareness of mental well-being as a key productivity factor. Large employers across sectors, including manufacturing, finance, and technology, are adopting structured mental health initiatives within workplace wellness programs. These programs often include confidential counseling services, resilience workshops, stress management training, and direct partnerships with mental health professionals. The expansion of employee assistance programs (EAPs) across multinational corporations operating in Mexico reflects a commitment to improving workforce engagement and retention. Additionally, labor reforms emphasizing occupational health now increasingly include mental wellness provisions, encouraging organizations to incorporate psychological safety into workplace standards. Insurance providers are broadening coverage for mental health consultations and therapy, making these services more financially accessible for employees. Non-governmental organizations and advocacy groups are partnering with private sector firms to promote mental health literacy, further integrating these initiatives into corporate culture. These combined efforts reflect a shift in workplace priorities, embedding mental wellness into organizational strategies, and contributing to sustained demand for comprehensive mental health services across the country.

Mexico Mental Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on disorder, service, and age group.

Disorder Insights:

- Schizophrenia

- Alcohol Use Disorder

- Bipolar Disorder

- Depression and Anxiety

- Post-traumatic Stress Disorder

- Substance Abuse Disorder

- Eating Disorder

- Others

The report has provided a detailed breakup and analysis of the market based on the disorder. This includes schizophrenia, alcohol use disorder, bipolar disorder, depression and anxiety, post-traumatic stress disorder, substance abuse disorder, eating disorder, and others.

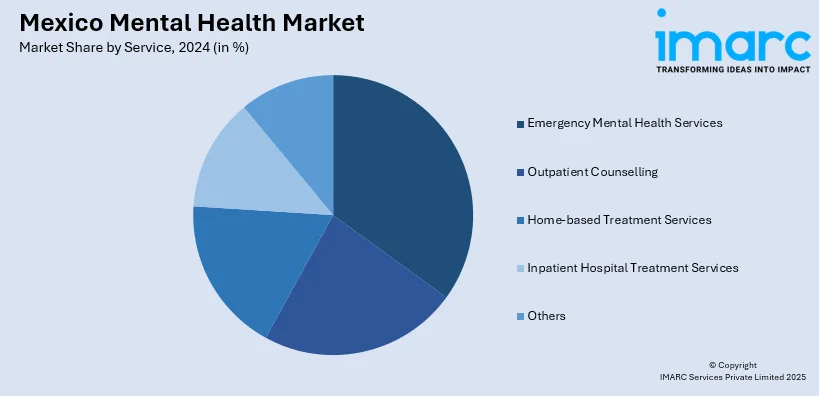

Service Insights:

- Emergency Mental Health Services

- Outpatient Counselling

- Home-based Treatment Services

- Inpatient Hospital Treatment Services

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes emergency mental health services, outpatient counselling, home-based treatment services, inpatient hospital treatment services, and others.

Age Group Insights:

- Pediatric

- Adult

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the age group. This includes pediatric, adult, and geriatric.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mental Health Market News:

- On May 28, 2025, Mexico-based Medsi AI secured approval for its platform as the first Class II Software as a Medical Device (SaMD) for preventive healthcare by COFEPRIS, transforming smartphones into diagnostic tools measuring over 20 vital signs via a 70-second facial scan. With USD 3 Million in Seed 1 funding led by Sanfer Farma, Medsi AI targets Mexico’s USD 46 Billion primary care and screening market, focusing on early detection of chronic diseases like diabetes and hypertension. This aligns with Mexico’s broader healthcare transformation and increasing reliance on AI-driven preventive care solutions.

Mexico Mental Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Disorders Covered | Schizophrenia, Alcohol Use Disorder, Bipolar Disorder, Depression and Anxiety, Post-Traumatic Stress Disorder, Substance Abuse Disorder, Eating Disorder, Others |

| Services Covered | Emergency Mental Health Services, Outpatient Counselling, Home-Based Treatment Services, Inpatient Hospital Treatment Services, Others |

| Age Groups Covered | Pediatric, Adult, Geriatric |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mental health market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mental health market on the basis of disorder?

- What is the breakup of the Mexico mental health market on the basis of service?

- What is the breakup of the Mexico mental health market on the basis of age group?

- What is the breakup of the Mexico mental health market on the basis of region?

- What are the various stages in the value chain of the Mexico mental health market?

- What are the key driving factors and challenges in the Mexico mental health market?

- What is the structure of the Mexico mental health market and who are the key players?

- What is the degree of competition in the Mexico mental health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mental health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mental health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mental health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)