Mexico Metal Cutting Tools Market Size, Share, Trends and Forecast by Tool Type, Product Type, Application, and Region, 2026-2034

Mexico Metal Cutting Tools Market Overview:

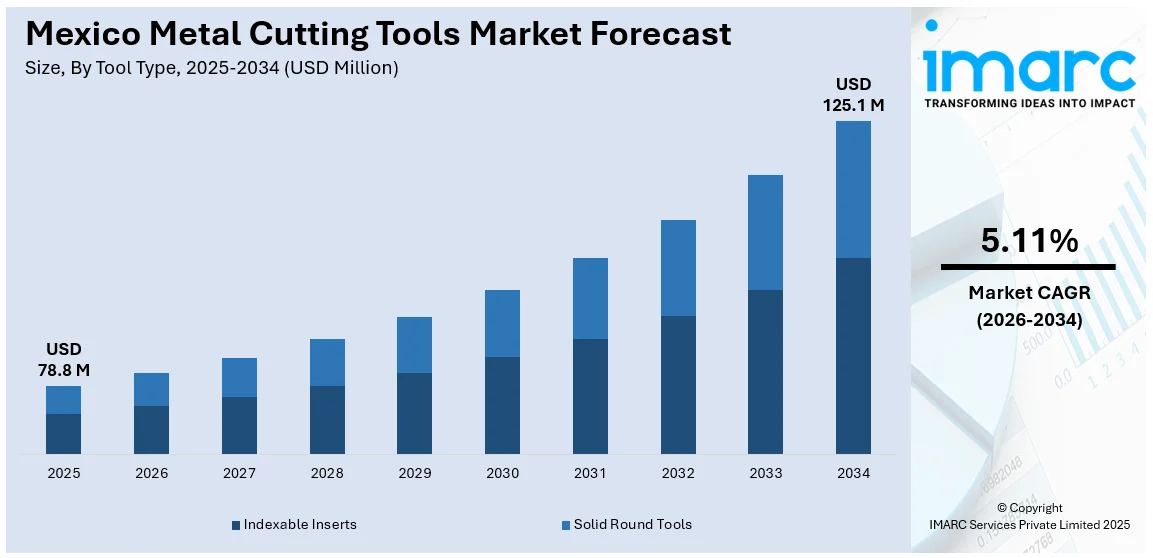

The Mexico metal cutting tools market size reached USD 78.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 125.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.11% during 2026-2034. The market is driven by technological innovations in automation, growing demand from precision-based industries such as automotive and aerospace, and the implementation of Industry 4.0 solutions. These drive manufacturing productivity and product quality, thus further expanding the Mexico metal cutting tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 78.8 Million |

| Market Forecast in 2034 | USD 125.1 Million |

| Market Growth Rate 2026-2034 | 5.11% |

Mexico Metal Cutting Tools Market Trends:

Technological Advancements in Metal Cutting Tools

The Mexico metal cutting tools market is witnessing strong growth owing to ongoing technological innovations. Technologies like the creation of high-performance cutting tool materials and coatings have improved tool durability and performance. Such developments allow manufacturers to increase precision and efficiency in machining operations, especially for industries such as the automotive and aerospace industries. The use of automation and digitalization in production also adds to the need for advanced metal cutting tools, as they can be easily integrated into CNC machines and robotic arms. This inclination indicates the sector's desire to implement innovative technologies to address the changing needs of contemporary manufacturing. Industry 4.0-based smart manufacturing practices are revolutionizing the Mexico metal cutting tools market growth. For instance, FABTECH Mexico 2025, held in May 2025 in Monterrey, showcased more than 350 machines and over 450 exhibitors across a 27,000 square meter exhibition space. Attracting 12,970 industry professionals, the event highlighted the latest advancements in metal forming, welding, automation, software, and metal cutting tools. It served as a key platform for networking, technology demonstrations, and exploring innovative solutions driving growth and efficiency in the metalworking sector across Mexico and Latin America.

To get more information on this market Request Sample

Adoption of Smart Manufacturing Practices

The incorporation of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, into production processes increases the productivity and accuracy of metal cutting functions. These technologies promote real-time monitoring, predictive maintenance, and the optimization of machining parameters, resulting in lower downtime and enhanced tool life. The transformation toward smart factories is the industry's response to increasing productivity and competitiveness. As manufacturers in Mexico adopt these technologies, the market for high-tech metal cutting tools that are compatible with smart manufacturing methodologies will increase further, driving market growth. For instance, in September 2024, ANCA revealed a strategic alliance with Tetralytix to integrate its CIM3D tool verification software with the Toolyzer simulation platform. This collaboration streamlines virtual cutting tool design by accelerating development, lowering costs, and minimizing manual tasks. The integrated solution enables performance analysis before physical prototyping, fostering innovation and enhancing efficiency. This partnership underscores ANCA’s commitment to advancing digital manufacturing and marks a significant step toward transforming precision cutting tool development through sophisticated simulation and modeling technologies.

Mexico Metal Cutting Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on tool type, product type, and application.

Tool Type Insights:

- Indexable Inserts

- Solid Round Tools

The report has provided a detailed breakup and analysis of the market based on the tool type. This includes indexable inserts and solid round tools.

Product Type Insights:

- Lathe

- Drilling Machine

- Milling Machine

- Grinding Machine

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lathe, drilling machine, milling machine, grinding machine, and others.

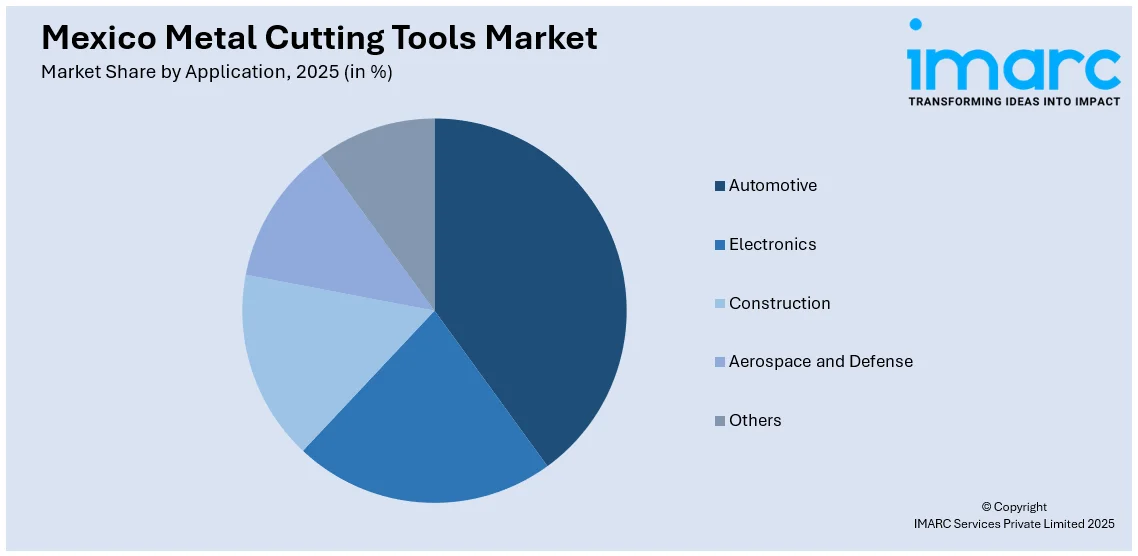

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electronics

- Construction

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, electronics, construction, aerospace and defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Cutting Tools Market News:

- In April 2025, Komaspec, a Canadian contract manufacturer, expanded to Mexico with a new 20,000 sq ft factory in Cd. Juárez to produce custom metal parts. The facility offers advanced sheet metal fabrication services, including laser cutting and bending, through Komacut’s digital platform. This expansion reduces lead times for North American customers, enhances efficiency, and supports on-demand ordering with transparent pricing, reinforcing Komaspec’s commitment to scalable, high-quality manufacturing across the US, Canada, and Latin America.

- In September 2024, Sumitomo Electric’s subsidiary, A.L.M.T. Corp., acquired Esteves Group, a leading precision diamond tool manufacturer. Esteves produces diamond tools for wire drawing and extrusion with facilities across six countries. This acquisition strengthens A.L.M.T.’s global presence, combining technologies, sales networks, and service capabilities, supporting infrastructure and industrial development with high-precision, sustainable metal cutting tool solutions.

Mexico Metal Cutting Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tool Types Covered | Indexable Inserts Tools, Solid Round Tools |

| Product Types Covered | Lathe, Drilling Machine, Milling Machine, Grinding Machine, Others |

| Applications Covered | Automotive, Electronics, Construction, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal cutting tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal cutting tools market on the basis of tool type?

- What is the breakup of the Mexico metal cutting tools market on the basis of product type?

- What is the breakup of the Mexico metal cutting tools market on the basis of application?

- What is the breakup of the Mexico metal cutting tools market on the basis of region?

- What are the various stages in the value chain of the Mexico metal cutting tools market?

- What are the key driving factors and challenges in the Mexico metal cutting tools market?

- What is the structure of the Mexico metal cutting tools market and who are the key players?

- What is the degree of competition in the Mexico metal cutting tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal cutting tools market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal cutting tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal cutting tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)