Mexico Metal Recycling Market Size, Share, Trends and Forecast by Metal, Sector, and Region, 2025-2033

Mexico Metal Recycling Market Overview:

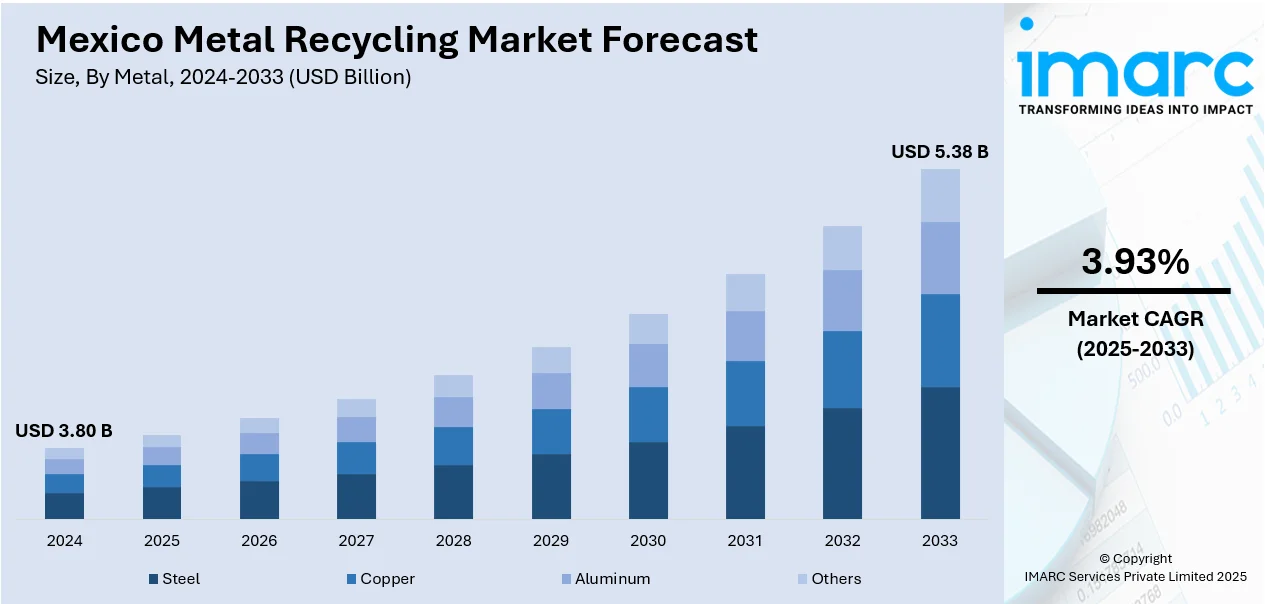

The Mexico metal recycling market size reached USD 3.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.38 Billion by 2033, exhibiting a growth rate (CAGR) of 3.93% during 2025-2033. The market is fueled by increasing industrialization and urban development, which generate substantial volumes of scrap metal and heighten the demand for recycled materials. Additionally, government regulations promoting sustainable waste management practices and environmental conservation are encouraging investments in metal recycling infrastructure. Apart from this, the growing emphasis on circular economy models among manufacturers and the rising cost-effectiveness of recycling compared to primary metal production are expanding the Mexico metal recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.80 Billion |

| Market Forecast in 2033 | USD 5.38 Billion |

| Market Growth Rate 2025-2033 | 3.93% |

Mexico Metal Recycling Market Trends:

Expansion of Industrialization and Urban Development

Mexico's ongoing industrial growth and rapid urbanization are significantly influencing the metal recycling market. According to industry reports, in 2023, the country's urban population share remained at approximately 81.58 percent. As the urban population expands and infrastructure projects multiply, the volume of metal waste generated from construction, demolition, and manufacturing activities is rising steadily. This increased availability of scrap metal, such as aluminum, steel, and copper, is feeding into recycling streams and supporting the development of a more robust secondary metal economy. Industrial zones across the country are also witnessing a rise in production efficiency demands, pushing companies to integrate recycling as a cost-effective method for raw material procurement. Urban development further contributes to the replacement of aging infrastructure and appliances, increasing the supply of recyclable metals. The trend is particularly evident in metropolitan areas like Mexico City, Monterrey, and Guadalajara, where modernization and industrial activity are most concentrated. These dynamics collectively reinforce a consistent, long-term demand for organized metal recycling operations, which is supporting the Mexico metal recycling market growth.

To get more information on this market, Request Sample

Rising Demand from Key End-Use Industries

The growing demand for recycled metals from end-use industries such as automotive, construction, consumer electronics, and packaging is driving expansion in the sector. As companies prioritize cost control and seek more sustainable inputs, recycled metals are increasingly preferred due to their lower environmental impact and competitive pricing compared to virgin materials. In the automotive sector, original equipment manufacturers (OEMs) are integrating recycled aluminum and steel into vehicle frames and parts to meet regulatory emission targets and sustainability commitments. Similarly, the consumer electronics and packaging sectors also benefit from recycled materials, contributing to the circular use of metals like copper and aluminum. For instance, industry reports indicate that Hisense, a leading electronics manufacturer in Mexico, now produces approximately 9.5 million televisions annually. This surge in production reflects a broader trend of increasing consumer adoption of electronic devices, driven by routine product upgrades and technological advancements. As a result, the volume of end-of-life electronic products is growing, creating a steady supply of recyclable metal components. This cross-sectoral demand is fostering continuous innovation in recycling technologies and improving the economic viability of processing facilities. Consequently, the recycling market is becoming an integral part of the supply chain for diverse manufacturing activities across the country.

Mexico Metal Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on metal and sector.

Metal Insights:

- Steel

- Copper

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the metal. This includes steel, copper, aluminum, and others.

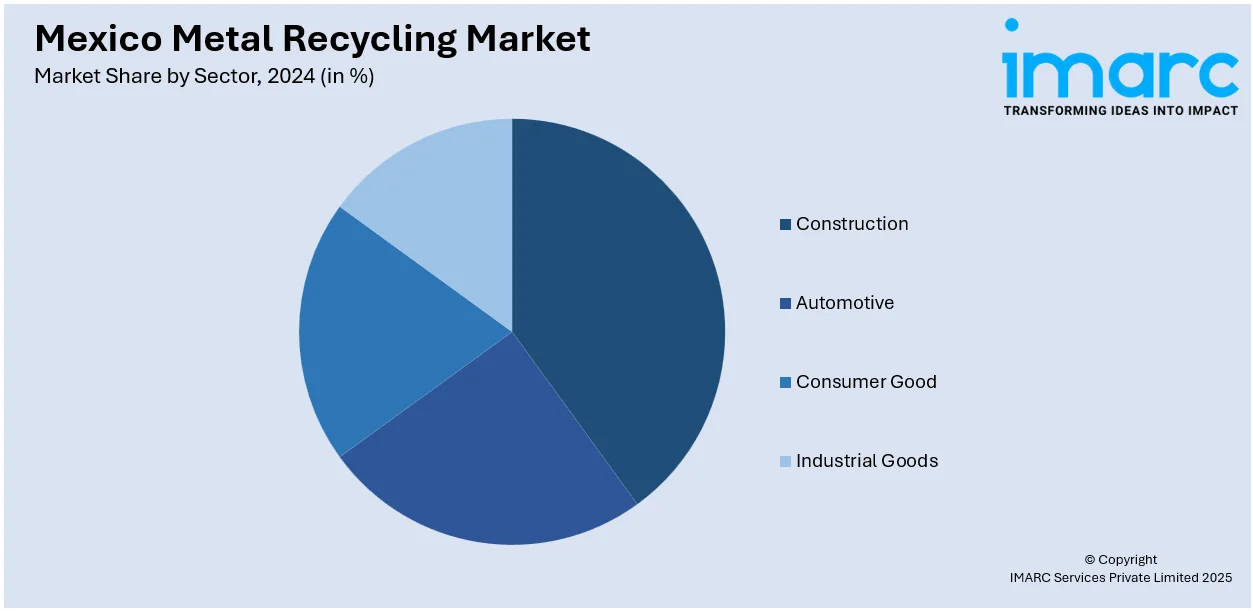

Sector Insights:

- Construction

- Automotive

- Consumer Good

- Industrial Goods

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes construction, automotive, consumer good, and industrial goods.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metals Covered | Steel, Copper, Aluminum, Others |

| Sectors Covered | Construction, Automotive, Consumer Good, Industrial Goods |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal recycling market on the basis of metal?

- What is the breakup of the Mexico metal recycling market on the basis of sector?

- What is the breakup of the Mexico metal recycling market on the basis of region?

- What are the various stages in the value chain of the Mexico metal recycling market?

- What are the key driving factors and challenges in the Mexico metal recycling market?

- What is the structure of the Mexico metal recycling market and who are the key players?

- What is the degree of competition in the Mexico metal recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)