Mexico Metal Sheets Market Size, Share, Trends and Forecast by Material Type, Thickness, Application, and Region, 2025-2033

Mexico Metal Sheets Market Overview:

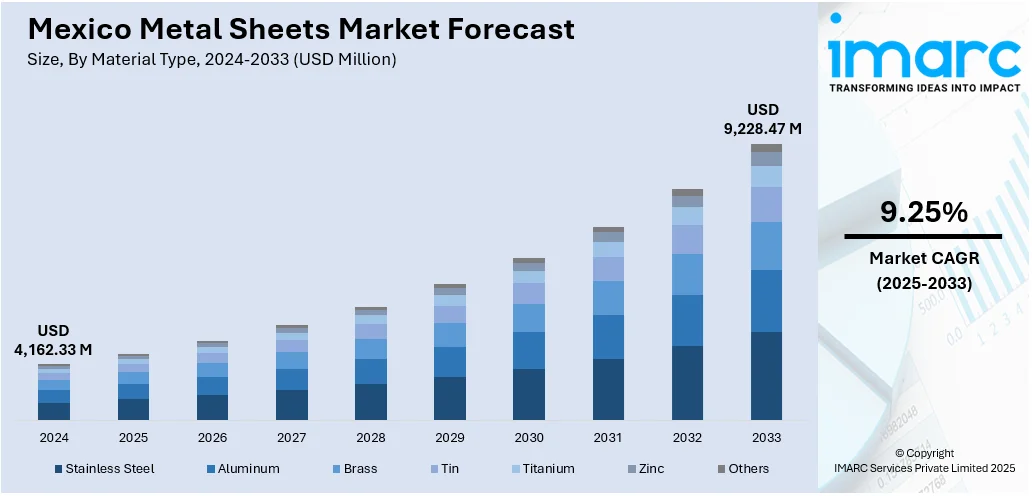

The Mexico metal sheets market size reached USD 4,162.33 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,228.47 Million by 2033, exhibiting a growth rate (CAGR) of 9.25% during 2025-2033. The market is experiencing strong growth fueled by infrastructure development, industrial upgrade, and a move toward lightweight, sustainable materials. Technology advances in manufacturing and growing demand in the automotive, construction, and commercial industries are augmenting the use of high-performance sheet metals. Smart city and sustainable building trends also add impetus to market growth. These emerging factors are driving increasing demand and diversified usage, eventually bolstering the competitive environment and boosting Mexico metal sheets market share in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,162.33 Million |

| Market Forecast in 2033 | USD 9,228.47 Million |

| Market Growth Rate 2025-2033 | 9.25% |

Mexico Metal Sheets Market Trends:

Growing Demand from Urban and Infrastructure Projects

Mexico is experiencing massive public and private investments in large urban development and infrastructure projects, propelling demand for metal sheets. Growth of industrial parks, highways, urban areas, and public transport infrastructure is creating steady demand for sheet metal in structural buildings, roofing systems, and façade components. Also, smart city projects and commercial real estate projects are driving growth. Good tensile strength, formability, and durability render metal sheets a suitable material for civil construction elements. Government schemes to promote infrastructure development and residential projects will boost the use of stainless steel, aluminum, and zinc sheets to grow progressively in urban regions. According to the sources, in August 2024, Ternium revealed it would finish a 2.6 million-ton steel slab mill in Mexico by mid-2026. The expansion is likely to boost the Mexico Metal Sheets market position even with enhanced project expenses of USD 3.5 billion. Moreover, these trends are redefining builders' and contractors' procurement and material choice patterns. This building-focused momentum is an overarching impetus for Mexico metal sheets market growth, part of a larger trend toward more durable and affordable building materials.

To get more information on this market, Request Sample

Technological Integration in Industrial Manufacturing

The Mexican metal fabrication industry is highly technologically oriented, as there is more automation and precision machining. New manufacturing plants are adding laser cutting, CNC bending, and robotic welding methods, which demand the use of consistent, high-quality sheet metals. This innovation is not only enhancing product performance but also minimizing production waste and lead time. Consequently, the need for sheets of standardized thicknesses and specialized finishes is accelerating in automotive, appliance, and electronics manufacturing. In addition, tailored alloy compositions and intelligent coatings are being embraced to fulfill specialized industrial needs such as corrosion resistance and light weight optimization. This trend indicates increasing advancement in local manufacturing capabilities. The implementation of intelligent production methods and quality control systems is driving Mexico metal sheets market trends, especially in the advanced industrial machinery and components sector. As per the reports, in May 2024, Cadrex grew its Monterrey, Mexico sheet metal fabrication plant by adding three new injection molding presses, increasing capabilities to keep pace with boosting demand and to serve the Mexico Metal Sheets market.

Increased Demand for Light and Eco-Friendly Materials

Sustainability is now driving material selection in most industries in Mexico, and as a result, there is an heightened focus on lightweight as well as recyclable sheet metals like aluminum and zinc. These products provide benefits like reduced carbon footprint, simplified transport, and effective lifecycle performance, which are appealing to industries such as transportation, construction, and consumer electronics. Manufacturers are also addressing emissions regulations and green building certifications by moving towards environment-friendly metal sheets. Additionally, product development is leading to the creation of thinner, high-strength sheets with uncompromised structural integrity while minimizing overall material consumption. As sustainability and energy efficiency become essential to procurement, corporations are finding themselves more and more in line with environmental standards when it comes to sourcing. This alignment points toward a clear shift in Mexico metal sheets market trends, where emphasis is shifting toward balancing performance with ecological accountability in public and private sector uses.

Mexico Metal Sheets Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, thickness, and application.

Material Type Insights:

- Stainless Steel

- Aluminum

- Brass

- Tin

- Titanium

- Zinc

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stainless steel, aluminum, brass, tin, titanium, zinc, and others.

Thickness Insights:

- < 1 mm

- 1-6 mm

- > 6mm

A detailed breakup and analysis of the market based on the thickness have also been provided in the report. This includes < 1 mm, 1–6 mm, and > 6 mm.

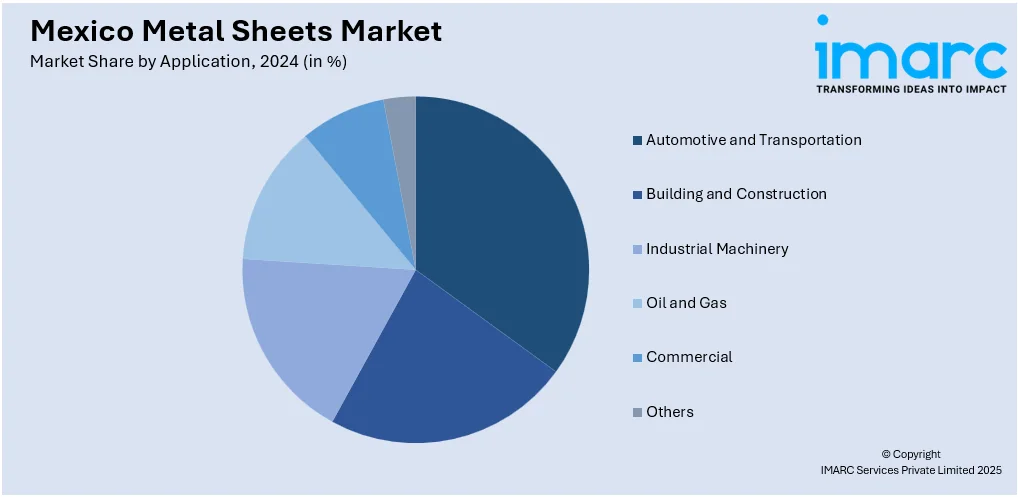

Application Insights:

- Automotive and Transportation

- Building and Construction

- Industrial Machinery

- Oil and Gas

- Commercial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, building and construction, industrial machinery, oil and gas, commercial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Sheets Market News:

- In May 2024, Canada's Giampaolo Group company Venture Steel Inc. expanded metals processing capacity in its Ramos Arizpe plant in northern Mexico. The modernization will serve to address increasing manufacturing demand and will have the effect of boosting scrap volumes for the nearby Triple M Metal recycling plant.

Mexico Metal Sheets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Aluminum, Brass, Tin, Titanium, Zinc, Others |

| Thicknesses Covered | < 1 mm, 1–6 mm, > 6 mm |

| Applications Covered | Automotive and Transportation, Building and Construction, Industrial Machinery, Oil and Gas, Commercial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal sheets market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal sheets market on the basis of material type?

- What is the breakup of the Mexico metal sheets market on the basis of thickness?

- What is the breakup of the Mexico metal sheets market on the basis of application?

- What is the breakup of the Mexico metal sheets market on the basis of region?

- What are the various stages in the value chain of the Mexico metal sheets market?

- What are the key driving factors and challenges in the Mexico metal sheets?

- What is the structure of the Mexico metal sheets market and who are the key players?

- What is the degree of competition in the Mexico metal sheets market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal sheets market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal sheets market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal sheets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)