Mexico Metallurgical Equipment Market Size, Share, Trends and Forecast by Type, Equipment, Application, and Region, 2025-2033

Mexico Metallurgical Equipment Market Overview:

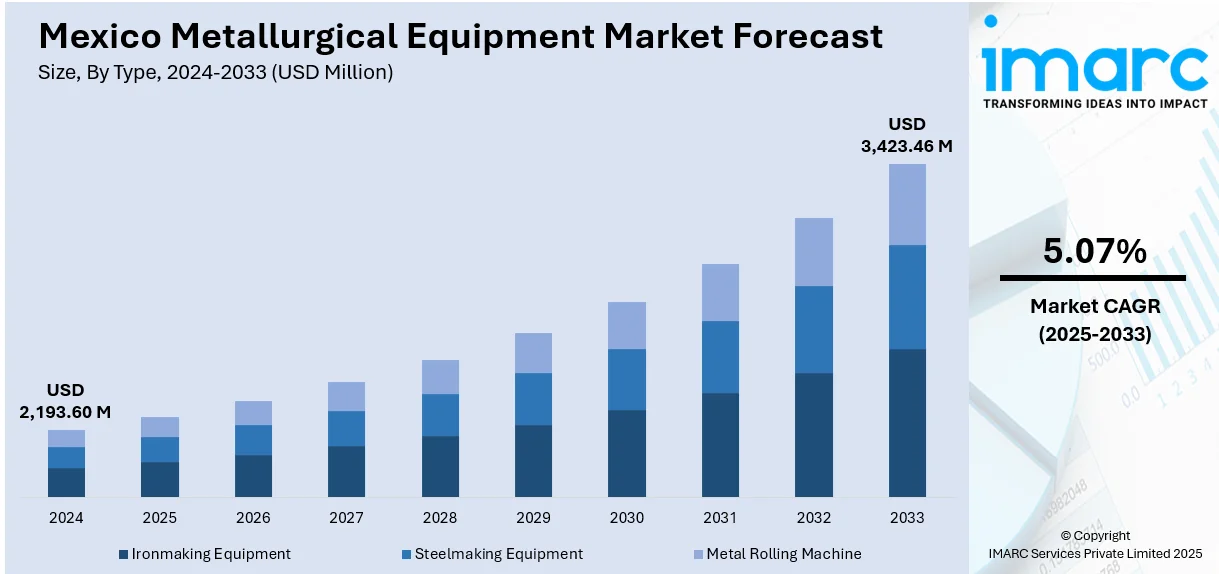

The Mexico metallurgical equipment market size reached USD 2,193.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,423.46 Million by 2033, exhibiting a growth rate (CAGR) of 5.07% during 2025-2033. The market is driven by the country's expanding mining and metal production sectors, supported by favorable government policies and foreign investment in resource extraction. Moreover, the rising demand for advanced metallurgical equipment to improve operational efficiency, reduce environmental impact, and comply with international quality standards is accelerating market growth. Additionally, the modernization of aging infrastructure and the adoption of automation and digital technologies are augmenting the Mexico metallurgy equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,193.60 Million |

| Market Forecast in 2033 | USD 3,423.46 Million |

| Market Growth Rate 2025-2033 | 5.07% |

Mexico Metallurgical Equipment Market Trends:

Expansion of the Automotive and Manufacturing Sectors

The growth of the automotive and general manufacturing industries in Mexico is significantly influencing the demand for advanced metallurgical equipment. As a leading global hub for vehicle assembly and components production, Mexico hosts major operations. These facilities require large volumes of precision-engineered metal components, which is driving the demand for cutting-edge metallurgical machinery that can process, form, and treat metals to exacting standards. Moreover, with increasing local content requirements and the regionalization of supply chains under agreements like the USMCA, manufacturers are expanding domestic metalworking and metallurgical capacities to reduce dependency on imports. This growth has led to increased investments in high-efficiency furnaces, rolling mills, heat treatment systems, and alloy production technologies. According to an industry report, the country's automotive sector experienced notable growth in 2024 with the rapid uptake of electric and plug-in hybrid vehicles (EVs and PHEVs), recording total sales of 69,713 units. This marks a substantial 83.8% rise over the previous year. This shift towards electric vehicles is stimulating the demand for specialized equipment to produce lightweight alloys, battery-grade metals, and high-strength steels. As OEMs and tier-1 suppliers continue to scale up operations, the need for durable, efficient, and automated metallurgical equipment is expected to rise accordingly. This, in turn, is expected to contribute to Mexico metallurgy equipment market growth.

To get more information on this market, Request Sample

Increasing Focus on Sustainability and Circular Metallurgy

Environmental responsibility and sustainable production practices are gaining prominence in Mexico's metallurgical sector, influencing equipment design and procurement choices. Mexico has set ambitious climate objectives, targeting a reduction in greenhouse gas emissions by over 35% by 2030 and striving to achieve carbon neutrality in the longer term. As global and domestic pressure mounts to reduce carbon emissions and industrial waste, metallurgical operators are increasingly seeking equipment that enables cleaner, more efficient processes. This includes electric melting furnaces that emit fewer pollutants, waste heat recovery systems to improve energy utilization, and dust collection units that comply with air quality regulations. Apart from this, the growing adoption of circular economy principles, such as metal recycling, scrap recovery, and byproduct valorization, is also driving demand for specialized sorting, melting, and purification equipment. Moreover, Mexico's increasing participation in international sustainability frameworks, along with ESG expectations from global investors and end customers, is accelerating this transition. Additionally, mining and smelting companies are pursuing certifications that require proof of low-impact metallurgical processing, further pushing innovation in green equipment design. As a result, sustainability is no longer a compliance obligation alone but a strategic factor influencing capital investment and operational planning in the metallurgical equipment landscape.

Mexico Metallurgical Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, equipment, and application.

Type Insights:

- Ironmaking Equipment

- Steelmaking Equipment

- Metal Rolling Machine

The report has provided a detailed breakup and analysis of the market based on the type. This includes ironmaking equipment, steelmaking equipment, and metal rolling machine.

Equipment Insights:

- Milling Machines

- Broaching Machines

- Grinding Machines

- Drilling Machines

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes milling machines, broaching machines, grinding machines, and drilling machines.

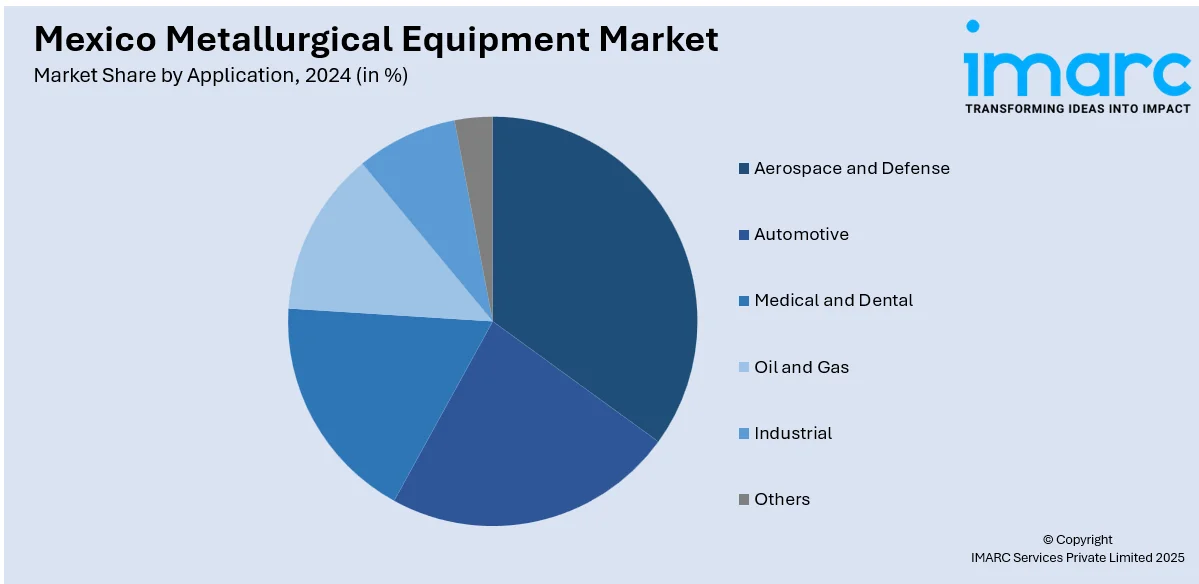

Application Insights:

- Aerospace and Defense

- Automotive

- Medical and Dental

- Oil and Gas

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes aerospace and defense, automotive, medical and dental, oil and gas, industrial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metallurgical Equipment Market News:

- On November 4, 2024, Godrej & Boyce announced the successful manufacture and dispatch of over 20 critical process equipment units, including high-pressure reactors and large columns, to two refineries in Mexico. These units feature specialized Chrome Moly Vanadium Steel construction, offering exceptional strength, durability, and resistance to corrosion, heat, and wear, essential for demanding refinery operations. This accomplishment underscores the company's commitment to expanding its global footprint and showcases the excellence of Indian manufacturing on the international stage.

Mexico Metallurgical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ironmaking Equipment, Steelmaking Equipment, Metal Rolling Machine |

| Equipments Covered | Milling Machines, Broaching Machines, Grinding Machines, Drilling Machines |

| Applications Covered | Aerospace and Defense, Automotive, Medical and Dental, Oil and Gas, Industrial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metallurgical equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metallurgical equipment market on the basis of type?

- What is the breakup of the Mexico metallurgical equipment market on the basis of equipment?

- What is the breakup of the Mexico metallurgical equipment market on the basis of application?

- What is the breakup of the Mexico metallurgical equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico metallurgical equipment market?

- What are the key driving factors and challenges in the Mexico metallurgical equipment market?

- What is the structure of the Mexico metallurgical equipment market and who are the key players?

- What is the degree of competition in the Mexico metallurgical equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metallurgical equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metallurgical equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metallurgical equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)