Mexico Microgrid Market Size, Share, Trends and Forecast by Energy Source, Application, and Region, 2025-2033

Mexico Microgrid Market Overview:

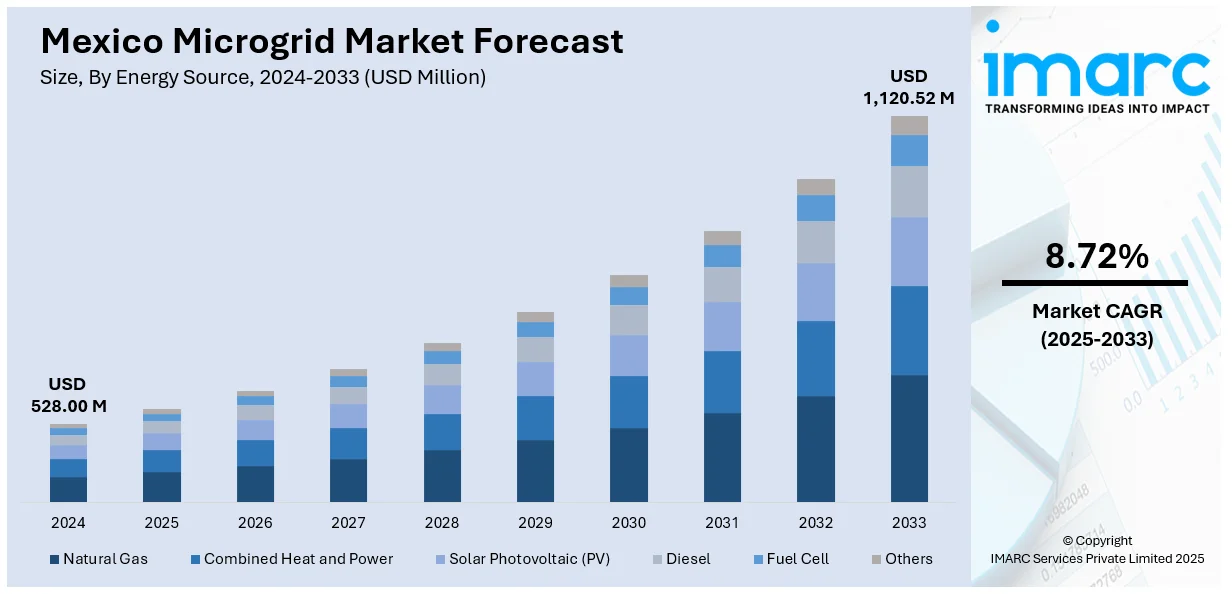

The Mexico microgrid market size reached USD 528.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,120.52 Million by 2033, exhibiting a growth rate (CAGR) of 8.72% during 2025-2033. The market is growing due to rising demand for energy resilience, renewable energy integration, and cost savings. Industrial and commercial sectors prioritize microgrids for uninterrupted power, while declining technology costs and sustainability goals accelerate deployment. Additionally, government incentives, unreliable grid infrastructure, and extreme weather events across the country are further expanding the Mexico microgrid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 528.00 Million |

| Market Forecast in 2033 | USD 1,120.52 Million |

| Market Growth Rate 2025-2033 | 8.72% |

Mexico Microgrid Market Trends:

Rising Adoption of Renewable Energy Integration in Microgrids

The market is experiencing a significant shift toward renewable energy integration, driven by the country’s abundant solar and wind resources. In 2024, just 25% of Mexico’s electricity was previously generated from low-carbon sources, lagging the global average of 41%. Solar energy made up 8% of the country’s top clean-energy source. Twenty years of growth in power demand (+56%) has not been matched by an increase in clean energy generation, leading to higher emissions. With a goal of achieving 33% renewable energy by 2030, Mexico's solar industry plays a vital role in bridging the gap towards meeting global energy objectives. Businesses and utilities are increasingly adopting hybrid microgrid solutions that combine solar PV, wind, and battery storage to reduce reliance on fossil fuels and enhance energy resilience. Government incentives, such as the Energy Transition Law and net metering policies, are accelerating this trend by making renewable-powered microgrids more economically viable. Additionally, remote and industrial sectors are leveraging these systems to mitigate energy costs and ensure uninterrupted power supply. As technology costs decline and energy storage solutions improve, renewable-based microgrids are becoming a preferred choice for commercial, agricultural, and residential applications. This trend is expected to grow as Mexico strengthens its commitment to sustainability and energy independence, positioning microgrids as a key component of the nation’s decentralized energy future.

Rising Demand for Energy Resilience in Industrial and Commercial Sectors

The increasing investment by commercial and industrial sectors in microgrids to enhance energy reliability and reduce operational disruptions is supporting the Mexico microgrid market growth. Mexico’s industrial and commercial sectors are increasingly investing in microgrids to enhance energy reliability and reduce operational disruptions caused by grid instability. Frequent power outages, aging infrastructure, and extreme weather events have heightened the need for resilient energy solutions, particularly in manufacturing, mining, and data center operations. Mexico experienced serious power outages in 20 of its 32 states due to intense heat in 2024, with the country's electricity demand peaking at 44.9 GW against a generation capacity of 45.0 GW. This episode highlights the imperative need for increasing grid resilience, with experts calling for increased private investments in renewable energy and storage technology. Moreover, with water levels in the Cutzamala system dipping below 31%, the significance of microgrids is growing as a decentralized solution to Mexico's energy and water stress problems. Microgrids offer these sectors a decentralized power supply, enabling continuous operations through grid outages while optimizing energy costs. Furthermore, companies are adopting microgrids to meet sustainability goals and comply with stricter environmental regulations. Advanced control systems and smart grid technologies are further driving adoption by improving efficiency and load management. As businesses prioritize operational continuity and cost savings, the demand for industrial and commercial microgrids in Mexico is projected to rise, supported by private investments and government initiatives promoting energy modernization.

Mexico Microgrid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on energy source and application.

Energy Source Insights:

- Natural Gas

- Combined Heat and Power

- Solar Photovoltaic (PV)

- Diesel

- Fuel Cell

- Others

The report has provided a detailed breakup and analysis of the market based on the energy source. This includes natural gas, combined heat and power, solar photovoltaic (PV), diesel, fuel cell, and others.

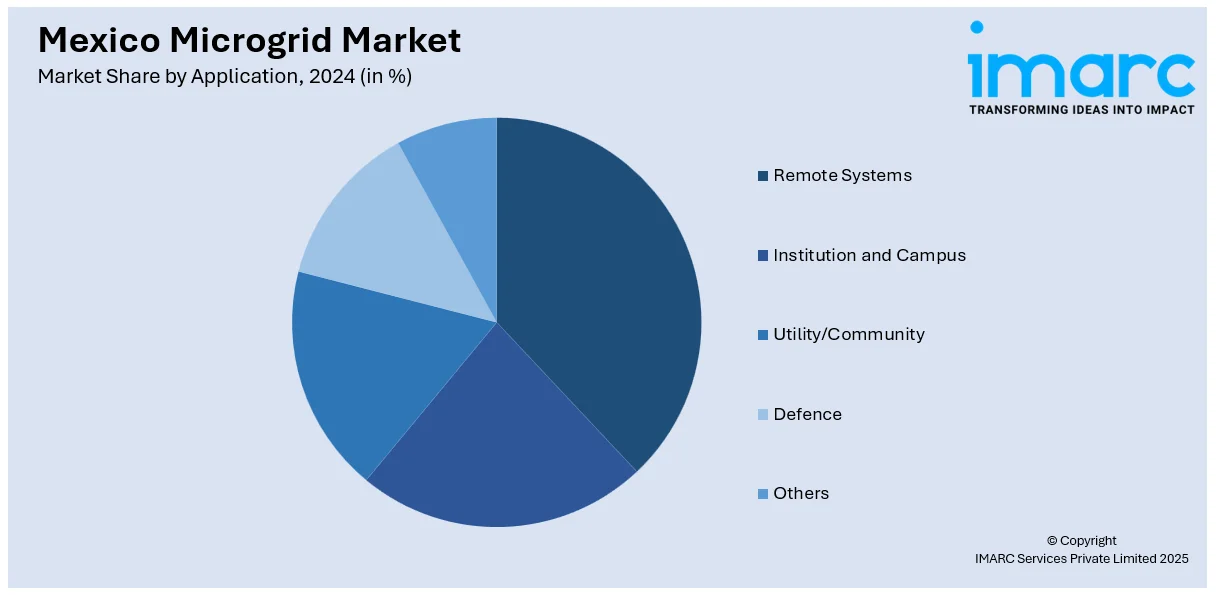

Application Insights:

- Remote Systems

- Institution and Campus

- Utility/Community

- Defence

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes remote systems, institution and campus, utility/community, defence, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Microgrid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Energy Sources Covered | Natural Gas, Combined Heat and Power, Solar Photovoltaic (PV), Diesel, Fuel Cell, Others |

| Applications Covered | Remote Systems, Institution and Campus, Utility/Community, Defence, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico microgrid market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico microgrid market on the basis of energy source?

- What is the breakup of the Mexico microgrid market on the basis of application?

- What is the breakup of the Mexico microgrid market on the basis of region?

- What are the various stages in the value chain of the Mexico microgrid market?

- What are the key driving factors and challenges in the Mexico microgrid market?

- What is the structure of the Mexico microgrid market and who are the key players?

- What is the degree of competition in the Mexico microgrid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico microgrid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico microgrid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico microgrid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)