Mexico Mobile Advertising Market Size, Share, Trends and Forecast by Segment, and Region, 2025-2033

Mexico Mobile Advertising Market Overview:

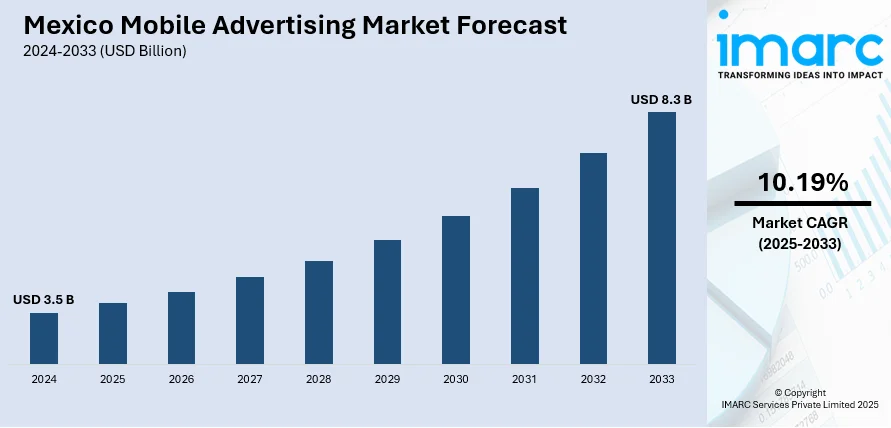

The Mexico mobile advertising market size reached USD 3.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.19% during 2025-2033. The market is expanding due to rising smartphone penetration, increased internet accessibility, and growing digital ad spending. The popularity of social media, video streaming, and mobile gaming fuels the demand for targeted ads. Additionally, programmatic advertising and AI-driven optimization enhance ad efficiency, while brands prioritize engagement through rewarded and in-game ad formats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Market Growth Rate 2025-2033 | 10.19% |

Mexico Mobile Advertising Market Trends:

Rapid Growth of Programmatic Advertising in Mexico

The significant shift toward programmatic advertising, driven by increased smartphone penetration and improved digital infrastructure is favoring the Mexico mobile advertising market growth. 94% of internet users in Mexico are connected to the web through smart devices at home. In 2023, 81.2% of the population used the Internet, up 9.7 percentage points since 2020, which points to progress in the digital inclusion of the population. The data highlights significant opportunities for mobile advertisers as digital engagement grows across rural and urban centers. Programmatic ad spending in Mexico is projected to grow, as brands leverage data-driven targeting to reach consumers more efficiently. With programmatic platforms enabling real-time bidding (RTB) and AI-powered audience segmentation, advertisers can deliver personalized ads on a scale. This trend is further fueled by the rise of connected TV (CTV) and over-the-top (OTT) platforms, which integrate programmatic mobile ads into video content. Additionally, local businesses and global brands are adopting demand-side platforms (DSPs) to optimize ad spending, thereby reducing wasted impressions. As privacy regulations transform, programmatic solutions that prioritize first-party data and contextual targeting will gain traction, creating a positive Mexico mobile advertising market outlook.

Increasing Adoption of In-Game and Rewarded Mobile Ads

In-game advertising and rewarded ads are emerging as key trends in Mexico’s mobile advertising market, particularly due to the country’s growing mobile gaming industry. With numerous internet users engaging in mobile gaming, brands are capitalizing on this captive audience through non-intrusive ad formats such as playable ads and rewarded videos. These formats offer value-exchange incentives, such as in-game currency or premium content, leading to higher engagement rates compared to traditional banner ads. The growth of hyper-casual games, popular among Mexican users, provides ample opportunities for advertisers to integrate seamless ad placements. Furthermore, advancements in ad tech allow for precise targeting based on user behavior, enhancing campaign performance. As mobile gaming continues to expand, especially among younger demographics, advertisers are increasing investments in in-game ads, making it one of the fastest-growing segments in Mexico’s mobile advertising ecosystem. Therefore, this is further expanding the Mexico mobile advertising market share. The gaming market in Mexico registered a value of USD 2.56 Billion in 2023, with a penetration of 78.4%, marking the highest score in Latin America. Around 69% of adults in Mexico participate in mobile gaming, with top apps such as Free Fire and Roblox leading the rankings. With 60% of gamers falling within the 20–39 age bracket, Mexico presents significant opportunities for mobile advertising within a swiftly growing digital landscape.

Mexico Mobile Advertising Market Segmentation:

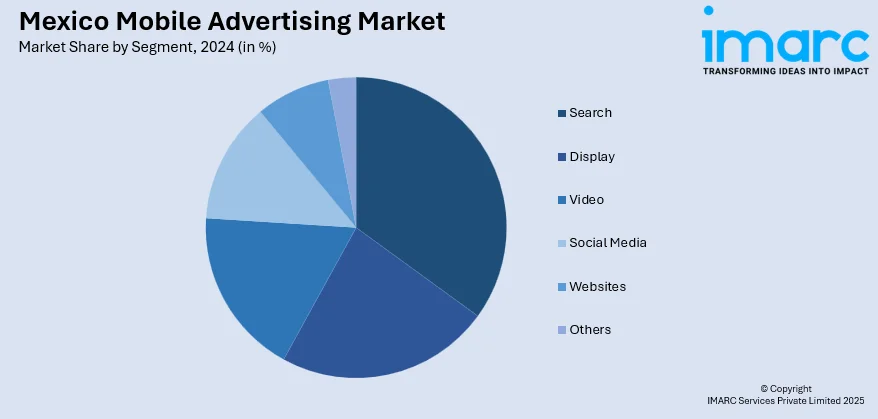

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on segment.

Segment Insights:

- Search

- Display

- Video

- Social Media

- Websites

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes search, display, video, social media, websites, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile Advertising Market News:

- September 10, 2024: Amagi launched into the Mexican market with Miriam Rios attached to lead its growth, joining the growing CTV and mobile video ad industries in Mexico. It enables broadcasters to find monetization opportunities through its cloud-based advertising technology with over 5000 global channel deliveries and support of over 800 content brands. This initiative further solidifies Mexico's status as a growing center for mobile-driven media consumption and targeted advertising.

Mexico Mobile Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Search, Display, Video, Social Media, Websites, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile advertising market on the basis of segment?

- What is the breakup of the Mexico mobile advertising market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile advertising market?

- What are the key driving factors and challenges in the Mexico mobile advertising market?

- What is the structure of the Mexico mobile advertising market and who are the key players?

- What is the degree of competition in the Mexico mobile advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)