Mexico Mobile Gaming Market Size, Share, Trends and Forecast by Type, Device Type, Platform, Business Model, and Region, 2025-2033

Mexico Mobile Gaming Market Overview:

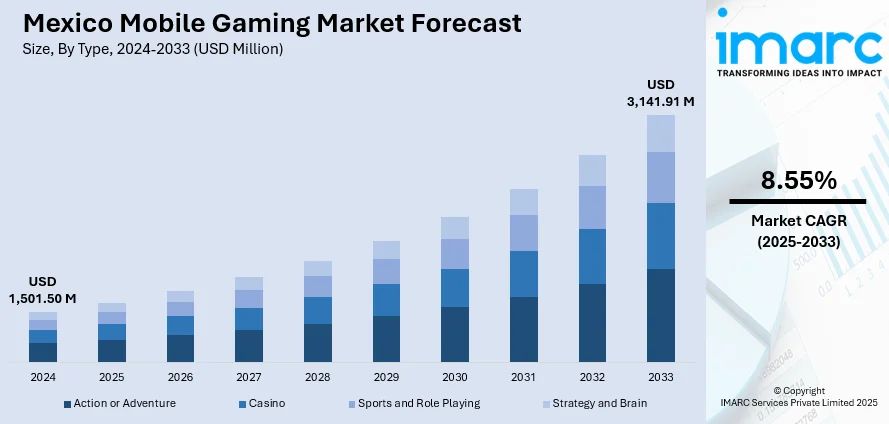

The Mexico mobile gaming market size reached USD 1,501.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,141.91 Million by 2033, exhibiting a growth rate (CAGR) of 8.55% during 2025-2033. The market share in Mexico is expanding rapidly because of the rising smartphone adoption, improved network infrastructure, innovative monetization models, and culturally relevant localized content, all of which are making mobile games more accessible, engaging, and commercially viable across diverse user segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,501.50 Million |

| Market Forecast in 2033 | USD 3,141.91 Million |

| Market Growth Rate 2025-2033 | 8.55% |

Mexico Mobile Gaming Market Trends:

Rising Smartphone Penetration and Affordable Data Plans

Mexico is experiencing an increase in smartphone uptake among different income groups, fueled by the accessibility of low-cost devices and improvements in mobile network infrastructure. This broad availability is making mobile gaming a favored source of entertainment, particularly among younger age groups. Telecom companies are significantly contributing to the growth of 4G and 5G services, offering competitively priced data plans that enhance online gaming accessibility for the average users. For instance, in 2024, America Movil announced plans to prioritize 5G expansion across Latin America in 2025, with a $7 billion budget allocated for the rollout. The company aimed to increase 5G coverage in key markets like Mexico, Brazil, and Colombia. As reliable internet and modern devices become increasingly available, mobile gaming is becoming a staple in daily life, deeply embedded in Mexico’s digital culture. This development is further bolstered by Mexico's growing middle class, which is progressively investing in digital entertainment. Smartphone features keep advancing, allowing for more fluid gameplay and enhanced graphics, bridging the divide between mobile and console gaming experiences. Technological and telecommunications developments offer a robust base for the Mexico mobile gaming market growth, reinforcing its status as a key center for digital entertainment.

Monetization Innovation and Localized Content

The mobile gaming market in Mexico is rapidly growing due to creative monetization approaches and content that is more localized and culturally pertinent. Developers are evolving beyond merely translating games and are incorporating regional themes, local humor, and recognizable aesthetics that strongly connect with players in Mexico, greatly enhancing user engagement and retention. From a business perspective, freemium models, advertising-supported gaming, and in-app purchases are reducing the entry barrier, enabling users to play at no cost while providing useful enhancements and premium experiences for those who pay. This adaptability is vital in a market where direct credit card usage might be restricted and alternative payment options such as prepaid cards, mobile carrier billing, and digital wallets are creating new revenue streams. In a significant step strengthening this trend, Google revealed in 2024that it would broaden support for real-money gaming applications on the Play Store in Mexico beginning in June. This encompassed a wider variety of game types beyond those previously regulated and presented new service fee structures designed for local markets. This policy changes legitimized and facilitated real-money gaming in a structured, legal setting, enabling developers to broaden revenue sources and craft more engaging, reward-driven gameplay experiences. Supported by culturally customized content and flexible payment solutions, the mobile gaming sector in Mexico is evolving into a mainstream, profitable, and scalable form of entertainment. This shift reflects a positive Mexico mobile gaming outlook, driven by growing smartphone penetration, youth engagement, and increasing in-game spending.

Mexico Mobile Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, device type, platform, and business model.

Type Insights:

- Action or Adventure

- Casino

- Sports and Role Playing

- Strategy and Brain

The report has provided a detailed breakup and analysis of the market based on the type. This includes action or adventure, casino, sports and role playing, and strategy and brain.

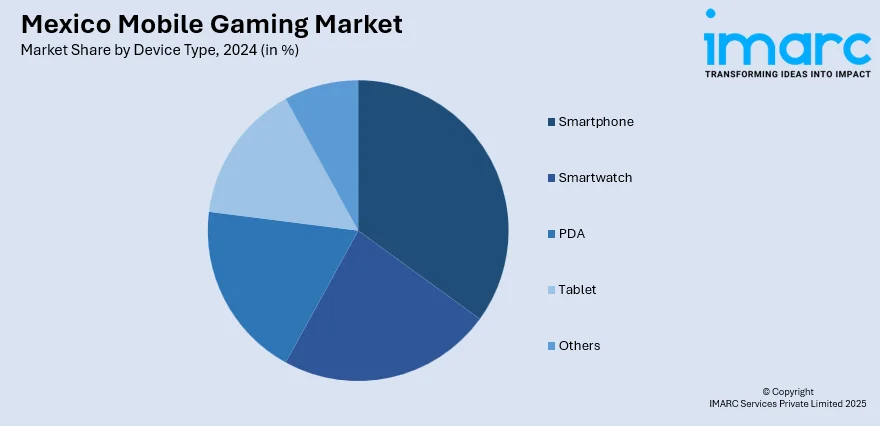

Device Type Insights:

- Smartphone

- Smartwatch

- PDA

- Tablet

- Others

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes smartphone, smartwatch, PDA, tablet, and others.

Platform Insights:

- Android

- iOS

- Others

The report has provided a detailed breakup and analysis of the market based on the platform. This includes Android, iOS, and others.

Business Model Insights:

- Freemium

- Paid

- Free

- Paymium

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes freemium, paid, free, and paymium.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile Gaming Market News:

- In March 2025, Mobile Streams PLC announced a reverse takeover deal to acquire Mexican gaming company Estadio Gana for £62.8 million. The deal involves issuing Mobile Streams shares to gain full ownership. This move aims to expand their iGaming and media presence in Mexico and Latin America.

- In June 2024, Codere Online partnered with AI platform Blip to enhance mobile and online gaming in Mexico. The collaboration introduces a chatbot for personalized support and promotions through popular messaging apps. This move strengthens Codere’s innovation in its top revenue market.

Mexico Mobile Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Action or Adventure, Casino, Sports and Role Playing, Strategy and Brain |

| Device Types Covered | Smartphone, Smartwatch, PDA, Tablet, Others |

| Platforms Covered | Android, iOS, Others |

| Business Models Covered | Freemium, Paid, Free, Paymium |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile gaming market on the basis of type?

- What is the breakup of the Mexico mobile gaming market on the basis of device type?

- What is the breakup of the Mexico mobile gaming market on the basis of platform?

- What is the breakup of the Mexico mobile gaming market on the basis of business model?

- What is the breakup of the Mexico mobile gaming market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile gaming market?

- What are the key driving factors and challenges in the Mexico mobile gaming?

- What is the structure of the Mexico mobile gaming market and who are the key players?

- What is the degree of competition in the Mexico mobile gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile gaming market from 2025-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)