Mexico Mobile Health Market Size, Share, Trends and Forecast by Component, Service, Participant, and Region, 2025-2033

Mexico Mobile Health Market Overview:

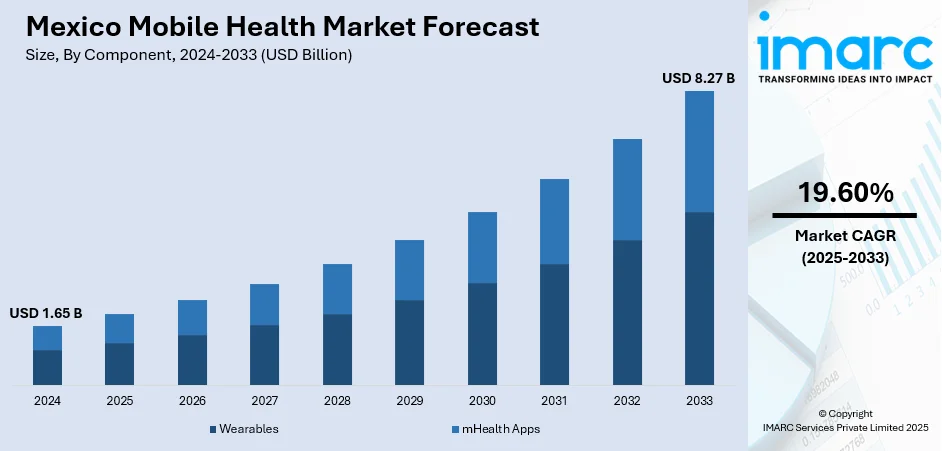

The Mexico mobile health market size reached USD 1.65 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.27 Billion by 2033, exhibiting a growth rate (CAGR) of 19.60% during 2025-2033. The market is driven by rising smartphone penetration and improved internet connectivity, enabling broader access to telemedicine and mobile health apps, particularly in underserved regions. Increased adoption of wearable health technology, supported by employer and insurer incentives, is fostering proactive health management among consumers. Additionally, government digital health initiatives and private-sector partnerships are accelerating innovation, further augmenting the Mexico mobile health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.65 Billion |

| Market Forecast in 2033 | USD 8.27 Billion |

| Market Growth Rate 2025-2033 | 19.60% |

Mexico Mobile Health Market Trends:

Rapid Adoption of Telemedicine Services

The market is experiencing significant growth due to the rapid adoption of telemedicine services. With increasing smartphone penetration and improved internet connectivity, more consumers are turning to mobile health apps for remote consultations. In 2023, 81.4% of Mexicans aged six and above use the internet, with 97.2 million users owning smartphones, making mobile connectivity a matter of national necessity. The widespread use of smartphones, with 97% of users accessing online services via mobile phones, enables the development of mobile health solutions. The COVID-19 pandemic accelerated this trend as patients sought safer means to connect with healthcare providers aside from face-to-face consultations. Telemedicine providers can integrate various features, including AI-based symptom checkers, virtual physician consultations, and e-prescribing, enabling patients to receive medical care more conveniently, particularly in rural communities where medical facilities are scarce. Apart from government initiatives, public and private healthcare providers are collaborating with technology firms to develop digital health-related programs and drive the industry forward at a consistent pace. Consequently, telemedicine will continue to expand over the next five years and beyond, primarily in response to the healthcare utopia, convenience, and affordable healthcare solution needs of consumers.

To get more information on this market, Request Sample

Growth of Wearable Health Technology

The rising popularity of wearable health technology is significantly supporting the Mexico mobile health market growth. Devices such as smartwatches, fitness bands, and connected glucose monitors are gaining traction among chronic disease patients and health-conscious consumers. These wearables track vital metrics such as heart rate, blood pressure, and physical activity, enabling users to monitor their health in real time. As of 2024, 23.2% of the population in Mexico owns an Apple Watch, which is helping drive the increasing popularity of smartwatches in the country. With an online recommendation purchase rate of 66%, wearable technology, such as the Apple Watch, plays a crucial role in health tracking and fitness. The increasing use of smartwatches, accompanied by a rise in mobile health solutions, indicates a growing demand for connected health services in Mexico. Insurance companies and employers are also promoting wearable adoption by offering incentives for healthy behaviors, such as discounted premiums or wellness programs. Furthermore, integration with mobile health apps allows users to share data with healthcare providers, improving preventive care and chronic disease management. With increasing awareness of personal health and advancements in IoT technology, the wearable health tech market in Mexico is projected to expand significantly, supported by partnerships between local and international tech firms. This trend aligns with the global shift toward proactive, data-driven healthcare solutions.

Mexico Mobile Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, service, and participant.

Component Insights:

- Wearables

- Blood Pressure Monitors

- Blood Glucometers

- Pulse Oximeters

- Neurological Monitors

- Others

- mHealth Apps

- Medical Apps

- Fitness Apps

The report has provided a detailed breakup and analysis of the market based on the component. This includes wearables (blood pressure monitors, blood glucometers, pulse oximeters, neurological monitors, and others) and mhealth apps (medical apps and fitness apps).

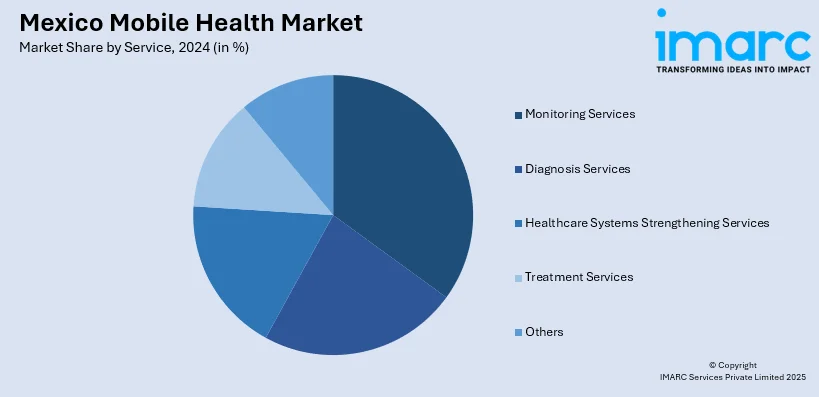

Service Insights:

- Monitoring Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Treatment Services

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes monitoring services, diagnosis services, healthcare systems strengthening services, treatment services, and others.

Participant Insights:

- mHealth Application Companies

- Pharmaceuticals Companies

- Hospitals

- Health Insurance Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the participant. This includes mhealth application companies, pharmaceuticals companies, hospitals, health insurance companies, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile Health Market News:

- April 04, 2025: 19Labs launched a revolutionary telemedicine program in Yucatán, Mexico, using GALE clinics to connect ten remote communities with quality healthcare services. Funded by USTDA, the program utilizes mobile health technology, including Zoom and EchoNous, to facilitate virtual consultations and advanced diagnostics, with a greater emphasis on managing chronic care. With plans to expand its coverage, it looks to bridge healthcare gaps and enhance health outcomes among underserved populations in the region.

Mexico Mobile Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Services Covered | Monitoring Services, Diagnosis Services, Healthcare Systems Strengthening Services, Treatment Services, Others |

| Participants Covered | mHealth Application Companies, Pharmaceuticals Companies, Hospitals, Health Insurance Companies, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile health market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile health market on the basis of component?

- What is the breakup of the Mexico mobile health market on the basis of service?

- What is the breakup of the Mexico mobile health market on the basis of participant?

- What is the breakup of the Mexico mobile health market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile health market?

- What are the key driving factors and challenges in the Mexico mobile health market?

- What is the structure of the Mexico mobile health market and who are the key players?

- What is the degree of competition in the Mexico mobile health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)