Mexico Mobile Money Market Size, Share, Trends and Forecast by Technology, Business Model, Transaction Type, and Region, 2025-2033

Mexico Mobile Money Market Overview:

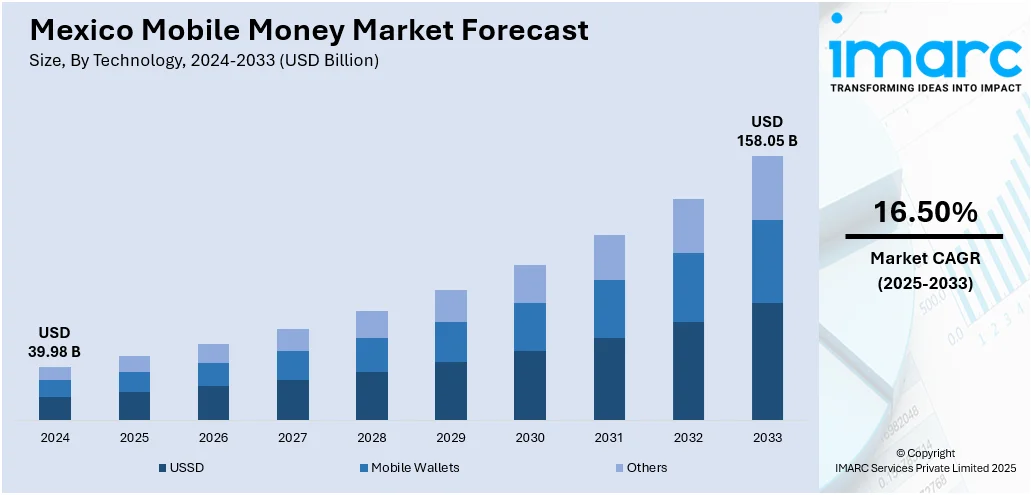

The Mexico mobile money market size reached USD 39.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 158.05 Billion by 2033, exhibiting a growth rate (CAGR) of 16.50% during 2025-2033. The market is being driven by a burgeoning fintech ecosystem, expanding financial inclusion, increasing smartphone penetration, and a high reliance on remittances, with companies like Nubank, Mercado Pago, and Revolut expanding services amidst evolving regulatory frameworks and a substantial unbanked population.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 39.98 Billion |

| Market Forecast in 2033 | USD 158.05 Billion |

| Market Growth Rate 2025-2033 | 16.50% |

Mexico Mobile Money Market Trends:

Rapid Expansion of Real-Time Payment Rails via SPEI, CoDi, and DiMo

Mexico's Interbank Electronic Payment System (SPEI) has become a critical enabler of the nation's mobile money revolution, processing 3.823 billion transactions in 2023, an increase from 2.787 billion in 2022. To further enhance real-time payments, Banco de México launched Cobro Digital (CoDi) in 2019 and Dinero Móvil (DiMo) in 2023. By the end of 2023, CoDi averaged 12,111 daily transactions and was offered by 38 SPEI participants. Meanwhile, DiMo reached 5.28 million users across 16 authorized providers, with more on the way. Major banks and fintechs have integrated these systems into their mobile apps, while non-bank institutions saw a 44% rise in SPEI transactions in 2023. Government and merchant incentives, like QR-based bill payments, continue to expand digital finance, reducing reliance on cash and paving the way for future mobile money services.

To get more information on this market, Request Sample

Proliferation of Fintech-Led Mobile Wallets and Omnichannel Super-Apps

Mobile money adoption in Mexico is witnessing rapid growth, underpinned by a robust and evolving fintech ecosystem that seamlessly integrates payment services with credit, savings, and rewards. Central to this transformation is the SPEI, which currently processes over 3 million transactions per day and is utilized by approximately 60% of the Mexican population. Complementing SPEI is CoDi, the national QR code-based mobile payments platform, which has acquired 14 million users since its inception in September 2019. These digital payment solutions are distinguished by value-added features such as consumer credit offerings, bill-splitting options, and loyalty programs, all of which enhance user engagement and retention. Furthermore, fintech companies are reducing service delivery costs in underserved areas, facilitating the cross-selling of financial services, and strengthening customer loyalty through gamified incentives. Collectively, these efforts are advancing financial inclusion and positioning mobile money as a mainstream solution for everyday transactions across Mexico.

Mexico Mobile Money Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology, business model, and transaction type.

Technology Insights:

- USSD

- Mobile Wallets

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes USSD, mobile wallets, and others.

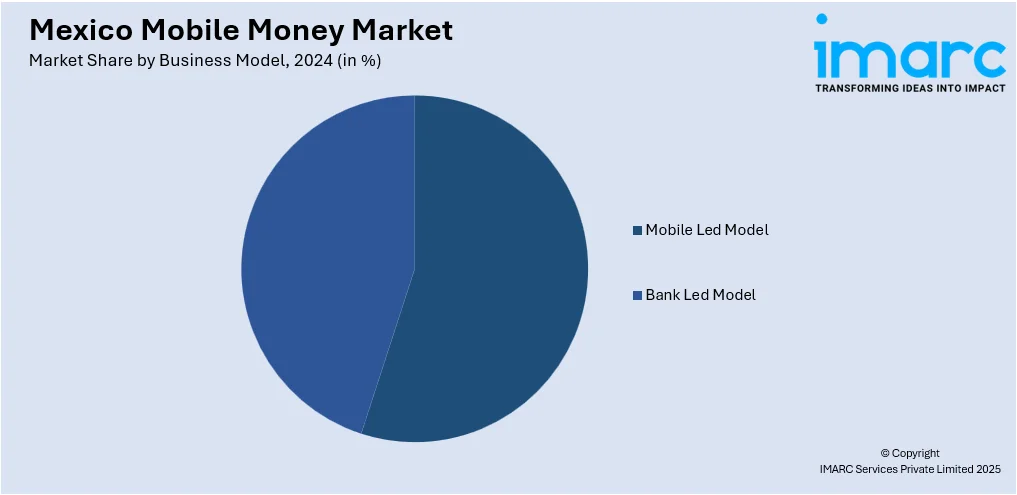

Business Model Insights:

- Mobile Led Model

- Bank Led Model

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes mobile led model and bank led model.

Transaction Type Insights:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

The report has provided a detailed breakup and analysis of the market based on the transaction type. This includes peer to peer, bill payments, airtime top-ups, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile Money Market News:

- February 2025: Openbank, Santander's fully digital bank, launched across Mexico, introducing a mobile-first banking experience. Its flagship product, the Débito Open account, offers a 10% yield with no fees or minimum balance, accessible via app or web in just five minutes. Customers benefit from free SPEI transfers, cash withdrawals at Santander ATMs, and enhanced card security features.

- September 2023: Western Union, in collaboration with Elektra and Banco Azteca, introduced a mobile money solution in Mexico, enabling users to receive U.S. remittances via a WhatsApp chatbot. By linking their Banco Azteca account, customers can initiate transactions through the chatbot, facilitating direct deposits and digital receipts.

Mexico Mobile Money Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | USSD, Mobile Wallets, Others |

| Business Models Covered | Mobile Led Model, Bank Led Model |

| Transaction Types Covered | Peer to Peer, Bill Payments, Airtime Top-ups, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile money market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile money market on the basis of technology?

- What is the breakup of the Mexico mobile money market on the basis of business model?

- What is the breakup of the Mexico mobile money market on the basis of transaction type?

- What is the breakup of the Mexico mobile money market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile money market?

- What are the key driving factors and challenges in the Mexico mobile money market?

- What is the structure of the Mexico mobile money market and who are the key players?

- What is the degree of competition in the Mexico mobile money market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile money market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile money market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile money industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)