Mexico Motorcycle Tires Market Size, Share, Trends and Forecast by Tire Type, Tire Structure, Tire Category, Tire Size, Sales Channel, Location, and Region, 2026-2034

Mexico Motorcycle Tires Market Summary:

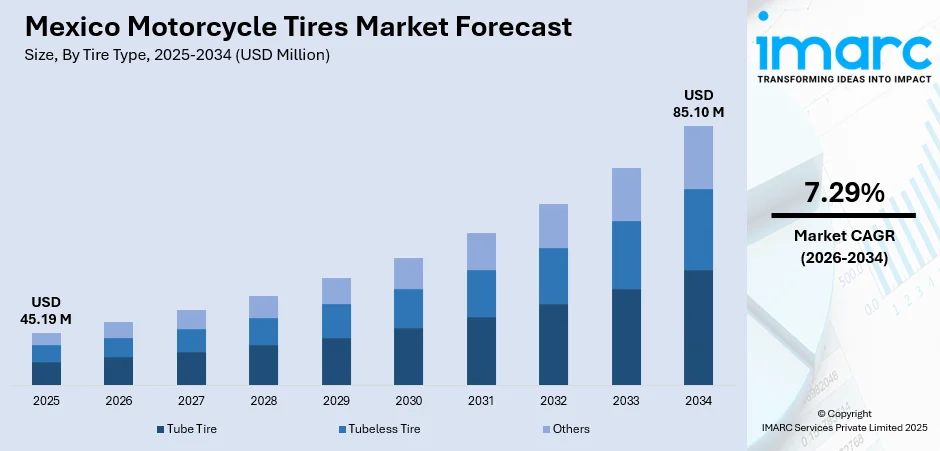

The Mexico motorcycle tires market size was valued at USD 45.19 Million in 2025 and is projected to reach USD 85.10 Million by 2034, growing at a compound annual growth rate of 7.29% from 2026-2034.

The Mexico motorcycle tires market is experiencing robust growth driven by rising urbanization, increasing motorcycle adoption for daily commuting services, and expanding demand for high-performance tires. The proliferation of e-commerce platforms and food delivery services has substantially increased motorcycle usage, consequently boosting tires demand. Additionally, growing consumer preference for tubeless and radial tires offering enhanced safety, better fuel efficiency, and superior handling characteristics is reshaping the Mexico motorcycle tires market share.

Key Takeaways and Insights:

- By Tire Type: Tubeless tire dominates the market with a share of 73% in 2025, driven by superior puncture resistance, enhanced safety features, and growing consumer preference for low-maintenance tire solutions across urban commuting applications.

- By Tire Structure: Radial tire leads the market with a share of 58% in 2025, attributed to their superior handling characteristics, improved fuel efficiency, and extended tread life compared to bias-ply alternatives.

- By Tire Category: Street tires represent the largest segment with a market share of 45% in 2025, reflecting the predominance of motorcycle usage for daily transportation and commercial delivery services.

- By Tire Size: The 12”-15” holds the largest share at 42% in 2025, corresponding to the widespread popularity of standard and commuter motorcycles in the Mexican market.

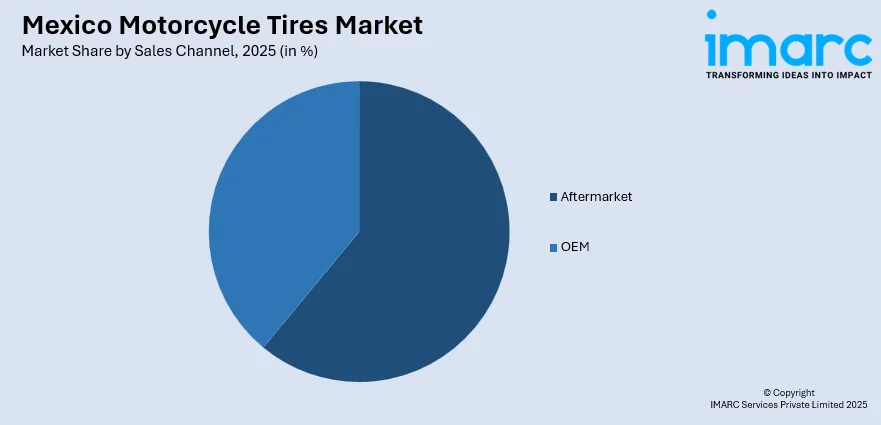

- By Sales Channel: Aftermarket leads the market with 61% of market share in 2025, driven by the large installed base of motorcycles requiring periodic tire replacements and growing consumer awareness of tire safety.

- By Location: Rear tires dominate with a 55% market share in 2025, as rear tires experience faster wear due to power transmission and load-bearing requirements.

- Key Players: The Mexico motorcycle tires market exhibits moderate competitive intensity with both global tire manufacturers and regional players competing across various price segments. International brands are expanding retail presence while domestic distributors strengthen aftermarket networks to capture growing replacement demand.

To get more information on this market Request Sample

The Mexico motorcycle tires market is witnessing transformative growth, underpinned by the country's position as one of the largest motorcycle markets globally with substantial annual unit sales. The expanding e-commerce and food delivery ecosystem has fundamentally altered motorcycle usage patterns, with a significant majority of new motorcycles deployed for commercial delivery purposes. This commercial intensity accelerates tire wear and replacement cycles, substantially benefiting the aftermarket segment. Delivery riders accumulating high daily mileage require frequent tire replacements, creating predictable recurring demand throughout the year. Urban congestion further drives motorcycle adoption as riders seek efficient transportation alternatives. Growing consumer awareness of tire safety and performance characteristics encourages quality-focused purchasing decisions. This strategic retail expansion demonstrates growing demand for premium motorcycle tires and signals manufacturers' confidence in the Mexican market's long-term growth trajectory and sustained development potential.

Mexico Motorcycle Tires Market Trends:

Growing Demand for Performance Tires Among Urban Riders

Mexico's rapid urbanization has intensified motorcycle use in major metropolitan areas, driving demand for high-performance tires capable of withstanding frequent braking, rapid acceleration, and varying road surfaces. Urban riders increasingly prioritize grip, responsiveness, and stability for stop-and-go traffic conditions. Tire manufacturers are responding with advanced compound formulations and optimized tread patterns for agility and cornering capability. Enhanced wet-weather performance and heat dissipation technologies address diverse urban riding challenges throughout seasonal variations.

Sustainability-Driven Innovation in Tire Materials

Environmental consciousness is increasingly influencing product innovation across the motorcycle tire industry. Manufacturers are incorporating bio-based rubbers, silica compounds, and recycled materials to reduce carbon footprints while maintaining performance standards. These sustainable materials offer additional benefits including lower rolling resistance and improved fuel economy. Growing regulatory emphasis on environmental responsibility encourages continued research into eco-friendly tire technologies. Consumer demand for greener products further accelerates adoption of sustainable manufacturing practices across the industry.

Expansion of Adventure and Off-Road Touring Segment

The growing popularity of adventure and dual-sport motorcycles in Mexico is driving interest in terrain-specific tires designed for durability across diverse conditions. Grupo Salinas invested over MX$500 Million (US$27.6 Million) in launching Ensamblika Guadalajara, a new motorcycle assembly plant in Mexico, Ensamblika Guadalajara, located in El Salto, Jalisco. Recreational riding culture is expanding beyond urban centers, creating demand for tires that balance on-road comfort with off-road capability. This trend reflects changing consumer lifestyles prioritizing outdoor exploration and motorcycle tourism.

Market Outlook 2026-2034:

The Mexico motorcycle tires market outlook remains highly favorable through the forecast period, supported by sustained motorcycle sales growth, expanding aftermarket infrastructure, and increasing premium tire penetration. The proliferation of delivery services and commuting applications continues driving replacement tire demand across all categories. Growing consumer preference for advanced tubeless and radial technologies reflects evolving quality expectations among Mexican riders. Manufacturing investments by international tire companies enhance local production capabilities while strengthening supply chain resilience. The expanding network of specialized tire retailers and service centers improves product accessibility across metropolitan and secondary markets. Electric motorcycle adoption represents an emerging opportunity for specialized tire development catering to unique performance requirements. Rising disposable incomes among middle-class consumers support premiumization trends, encouraging purchases of higher-quality tires offering enhanced safety, durability, and performance characteristics throughout extended product lifecycles. The market generated a revenue of USD 45.19 Million in 2025 and is projected to reach a revenue of USD 85.10 Million by 2034, growing at a compound annual growth rate of 7.29% from 2026-2034.

Mexico Motorcycle Tires Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Tire Type | Tubeless Tire | 73% |

| Tire Structure | Radial | 58% |

| Tire Category | Street Tires | 45% |

| Tire Size | 12”-15” | 42% |

| Sales Channel | Aftermarket | 61% |

| Location | Rear | 55% |

Tire Type Insights:

- Tube Tire

- Tubeless Tire

- Others

The tubeless tire dominates the Mexico motorcycle tires market with a 73% share in 2025.

Tubeless tires have achieved market dominance due to their superior safety characteristics and operational advantages over traditional tube-type alternatives. These tires resist sudden air loss during punctures, maintaining controllability and reducing accident risk. The elimination of inner tubes reduces maintenance complexity while improving fuel efficiency through lower rolling resistance. Urban riders particularly value the convenience of tubeless technology for navigating debris-prone city streets without catastrophic tire failures.

The premium motorcycle segment demonstrates particularly strong tubeless tire penetration, as manufacturers increasingly equip new models with tubeless-compatible wheels. Tubeless tire adoption has accelerated in Mexico's major metropolitan areas where commuter motorcycle usage has intensified significantly. Global regulatory trends favoring tubeless technology for enhanced road safety are influencing Mexican market standards. The growing availability of tubeless tire repair kits and services through expanding aftermarket networks further supports consumer adoption throughout the country.

Tire Structure Insights:

- Radial

- Bias

- Others

The radial tire leads the Mexico motorcycle tires market with a 58% share in 2025.

Radial tires have established market leadership through their fundamental design advantages that deliver superior performance characteristics. The perpendicular cord ply arrangement provides enhanced flexibility, resulting in improved grip, handling, and ride comfort particularly at higher speeds. These structural benefits translate to better fuel efficiency through reduced rolling resistance, representing significant cost savings over the tire's lifecycle. Mexican consumers increasingly recognize the value proposition of radial tires despite their higher initial cost compared to bias-ply alternatives.

The premium and sport motorcycle segments demonstrate particularly strong radial tire demand as performance-oriented riders prioritize superior handling characteristics and cornering stability. Radial tire penetration continues expanding across mid-range motorcycle categories as technology costs decrease, and consumer awareness about performance benefits grows. Manufacturing investments in Mexico support increased local availability and competitive pricing for radial tire products, while expanding service center expertise in radial tire installation and maintenance further encourages adoption across diverse rider segments.

Tire Category Insights:

- Street Tires

- Dual Sports or Adv Tires

- Touring Tires

- Sports/Performance Tires

- Sports Touring Tires

- Off-Roads Tires

- Racing Tires/Slicks

The street tires hold the largest share at 45% of the Mexico motorcycle tires market in 2025.

Street tires dominate market share reflecting the predominant use of motorcycles for transportation and commercial delivery services across Mexico. These tires are engineered for optimal performance on paved road surfaces, prioritizing grip in both dry and wet conditions while maximizing tread life for cost-effective commuting applications. The explosive growth in food delivery logistics has intensified demand for reliable street tires capable of sustaining high daily mileage.

Urban infrastructure improvements in major Mexican cities are enhancing road surfaces, creating favorable conditions for street tire performance optimization. Tire manufacturers offer diverse street tire portfolios spanning economy to premium segments, addressing varied consumer budget constraints. In 2024, Mexican motorcycle sales reached a record of 1.6 million units according to AMFIM data, with the majority deployed for transportation purposes requiring street-oriented tire specifications. The expanding network of tire retailers and service centers in metropolitan areas facilitates convenient street tire replacement, supporting consistent aftermarket demand throughout the year.

Tire Size Insights:

- Less than 12”

- 12”-15”

- 15”-17”

- More Than 17”

The 12”-15” represent the largest market with 42% of the Mexico motorcycle tires market in 2025.

The 12”-15” segment corresponds directly to the popularity of standard and commuter motorcycles that constitute the largest share of Mexico's motorcycle fleet. Entry-level and mid-range motorcycles from dominant manufacturers predominantly utilize tire sizes within this range, creating substantial replacement demand. These tire sizes offer an optimal balance of handling agility for urban navigation and stability for highway commuting at moderate speeds. The price accessibility of this tire size segment aligns with budget-conscious consumer preferences prevalent in the Mexican market.

Local manufacturing and import dynamics favor the 12”-15” segment through established supply chains and competitive pricing structures. Domestic motorcycle manufacturers predominantly produce commuter models equipped with tire sizes in this range, creating substantial replacement demand. Distribution networks maintain extensive inventory availability for this segment, ensuring consistent supply across urban and rural retail channels. This concentrated production output directly influences tire demand patterns, establishing the 12"-15" segment as the market's primary volume driver with consistent replacement cycles throughout the year.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The aftermarket exhibits clear dominance with a 61% share of the Mexico motorcycle tires market in 2025.

Aftermarket channel dominance reflects the substantial installed base of motorcycles requiring periodic tire replacements throughout their operational lifecycle. With Mexico's exceeding motorcycle fleet and intensive commercial usage patterns, tire replacement demand significantly outpaces new vehicle tire requirements. Delivery service motorcycles accumulating high daily mileage experience accelerated tire wear, typically requiring replacements every few months depending on usage intensity. This commercial utilization pattern generates predictable recurring aftermarket revenue streams across the country's expanding tire distribution network.

The aftermarket channel benefits from expanding retail infrastructure including specialized motorcycle tire shops, multi-brand service centers, and e-commerce platforms offering convenient tire purchasing options. Growing consumer awareness of tire safety and performance characteristics drives preference for quality aftermarket replacements over budget alternatives. Service network development in both urban and semi-urban areas extends aftermarket accessibility, while increasing digital engagement and mobile service offerings support sustained channel growth throughout the forecast period.

Location Insights:

- Front

- Rear

The rear tire dominates with a 55% share of the Mexico motorcycle tires market in 2025.

Rear tire market leadership stems from fundamental motorcycle mechanics where rear tires experience significantly higher wear rates than front tires. Power transmission through rear wheels concentrates acceleration forces, while braking forces combined with passenger and cargo weight loading accelerate tread degradation. Commercial delivery motorcycles carrying packages and food orders experience particularly pronounced rear tire wear due to consistent loading conditions. This mechanical reality generates higher rear tire replacement frequency, creating proportionally larger market share relative to front tire demand.

Tire manufacturers design rear-specific compounds and tread patterns optimized for Mexican riding conditions, addressing durability requirements for intensive urban use. Service centers recommend rear tire inspection more frequently than front tire checks, reinforcing replacement awareness among riders. The growing emphasis on motorcycle safety education by industry associations and delivery platforms highlights tire condition importance, encouraging proactive rear tire replacement before reaching critical wear levels. This safety-conscious approach supports sustained rear tire segment growth alongside the expanding motorcycle fleet throughout Mexico.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a strategically important market for motorcycle tires, characterized by proximity to United States border crossings and concentration of industrial manufacturing facilities. The region's automotive and tire manufacturing ecosystem positions Northern Mexico as an emerging production hub serving both domestic and export markets. Industrial workforce transportation needs and cross-border logistics activities drive regional motorcycle usage patterns.

Central Mexico dominates the motorcycle tires market due to its concentration of major metropolitan areas including Mexico City, Guadalajara, and surrounding urban zones. This region hosts the highest motorcycle density nationally, with intensive usage for daily commuting and commercial delivery services in congested environments. Central Mexico's position as the primary manufacturing and distribution center creates substantial tire demand from both OEM and aftermarket channels.

Southern Mexico exhibits growing motorcycle tire demand driven by tourism-related transportation needs and agricultural sector requirements. The region's varied terrain creates opportunities for dual-sport and adventure tire categories serving riders navigating mixed road conditions. Infrastructure development initiatives including highway and port expansions are improving regional accessibility, supporting motorcycle adoption growth. Tourism destinations in the Yucatan Peninsula and coastal areas generate demand for recreational motorcycle rentals requiring regular tire maintenance.

Market Dynamics:

Growth Drivers:

Why is the Mexico Motorcycle Tires Market Growing?

Explosive Growth in Last-Mile Delivery and E-Commerce Logistics

The transformation of Mexico's retail landscape through e-commerce expansion and food delivery platform proliferation has fundamentally altered motorcycle usage patterns, directly accelerating tire demand. Approximately 70% of motorcycle sales now serve delivery and self-employment purposes, creating intensive daily usage that accelerates tire wear beyond typical commuter patterns. Major platforms deploy thousands of motorcycle delivery riders across Mexican cities, each requiring reliable tire performance for safety and efficiency. In March 2025, Yadea announced an $80 million investment to establish a two-wheeler assembly plant in Ocoyoacac, State of Mexico, targeting the growing delivery vehicle segment with capacity for 500,000 units annually by 2026, directly correlating to future tire demand expansion.

Rising Urbanization and Traffic Congestion Driving Motorcycle Adoption

Mexico's accelerating urbanization is intensifying traffic congestion in major metropolitan areas, positioning motorcycles as an increasingly attractive transportation alternative. Urban dwellers seeking efficient navigation through congested streets recognize motorcycles' advantages in journey time savings and reduced fuel consumption compared to automobiles. The country's urban population, with Mexico City, Guadalajara, and Monterrey experiencing chronic traffic saturation during peak hours. This congestion reality drives motorcycle adoption for both personal commuting and commercial applications, expanding the tire-consuming vehicle base. The Mexican Association of Motorcycle Manufacturers and Importers (AMFIM), projects continued growth of 10-15% in 2025, directly translating to proportional tire market expansion.

Manufacturing Investment Expansion and Local Production Development

Substantial foreign and domestic investment in tire manufacturing facilities positions Mexico as an emerging production hub serving both local and North American export markets. This manufacturing expansion improves tire availability, reduces import dependency, and enhances pricing competitiveness through localized production economics. International tire manufacturers recognize Mexico's strategic advantages including proximity to United States markets, favorable trade agreements under USMCA, competitive labor costs, and established automotive supply chain infrastructure supporting efficient production operations.

Market Restraints:

What Challenges the Mexico Motorcycle Tires Market is Facing?

Price Sensitivity and Competition from Low-Cost Imports

Mexican consumers demonstrate significant price sensitivity in tire purchasing decisions, creating challenges for premium product positioning and brand differentiation efforts. The influx of low-cost imported tires from Asian manufacturers intensifies price competition, compressing margins for established brands. Budget-conscious delivery riders and economy motorcycle owners often prioritize initial cost over long-term durability, favoring inexpensive alternatives despite shorter replacement cycles.

Economic Uncertainty and Currency Fluctuation Impacts

Macroeconomic volatility and currency exchange rate fluctuations create pricing uncertainty for imported tire products and raw materials. Economic headwinds including revised GDP growth forecasts and trade development concerns may constrain consumer purchasing power for discretionary vehicle maintenance. Import-dependent tire supply chains face cost variability affecting retail pricing stability and distributor margin management.

Counterfeit Products and Quality Consistency Concerns

The proliferation of counterfeit and substandard tire products in informal distribution channels poses safety risks and undermines legitimate manufacturer market positions. Quality inconsistency among low-tier suppliers erodes consumer confidence in tire performance claims while creating liability concerns for retailers. Enforcement challenges in identifying and removing counterfeit products from market circulation remain a persistent industry concern.

Competitive Landscape:

The Mexico motorcycle tires market exhibits moderate competitive intensity characterized by the presence of established global tire manufacturers alongside regional distributors and importers. International brands leverage technological innovation, brand recognition, and quality assurance to capture premium market segments, while value-oriented competitors target price-sensitive consumer categories through aggressive pricing strategies. Market participants are increasingly investing in retail network expansion, service center development, and digital marketing initiatives to strengthen distribution reach and customer engagement. The competitive landscape is evolving as manufacturing investments by major players enhance local production capabilities and supply chain efficiency. Premium segment competition intensifies as brands expand dedicated motorcycle tire retail concepts and service offerings targeting enthusiast and performance-oriented consumers.

Recent Developments:

- November 2024: Pirelli launched Ride Passion, its first motorcycle-exclusive store in the State of Mexico located in Echegaray, offering premium tire products including Diablo, Scorpion, and Angel lines along with comprehensive services such as mounting, alignment, balancing, and quick mechanical services. This marked the beginning of Pirelli's planned nationwide expansion of motorcycle-focused retail locations.

- March 2024: Yokohama broke ground on a new $380 Million tire manufacturing facility in Saltillo, Coahuila at the Alianza Industrial Park. The plant is expected to begin production in early 2027 with planned annual output of 5 million tires, positioning Mexico as a strategic production hub for North American market supply.

Mexico Motorcycle Tires Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tire Types Covered | Tube Tire, Tubeless Tire, Others |

| Tire Structures Covered | Radial, Bias, Others |

| Tire Categories Covered | Street Tires, Dual Sports or Adv Tires, Touring Tires, Sports/Performance Tires, Sports Touring Tires, Off-Roads Tires, Racing Tires/Slicks |

| Tire Sizes Covered | Less than 12”, 12”-15”, 15”-17”, More Than 17” |

| Sales Channels Covered | OEM, Aftermarket |

| Locations Covered | Front, Rear |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico motorcycle tires market size was valued at USD 45.19 Million in 2025.

The Mexico motorcycle tires market is expected to grow at a compound annual growth rate of 7.29% from 2026-2034 to reach USD 85.10 Million by 2034.

Tubeless tire dominated the market with a 73% share in 2025, driven by superior puncture resistance, enhanced safety features, better fuel efficiency, and growing consumer preference for low-maintenance tire solutions in urban commuting applications.

Key factors driving the Mexico motorcycle tires market include explosive growth in last-mile delivery and e-commerce logistics, rising urbanization and traffic congestion driving motorcycle adoption, expanding tire manufacturing investments, and increasing consumer preference for premium tubeless and radial tire technologies.

Major challenges include price sensitivity and competition from low-cost Asian tire imports, economic uncertainty and currency fluctuation impacts on pricing stability, counterfeit products undermining quality standards, and infrastructure limitations in semi-urban and rural distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)