Mexico Natural Food Flavors Market Size, Share, Trends and Forecast by Source, Flavor Type, Application, and Region, 2025-2033

Mexico Natural Food Flavors Market Overview:

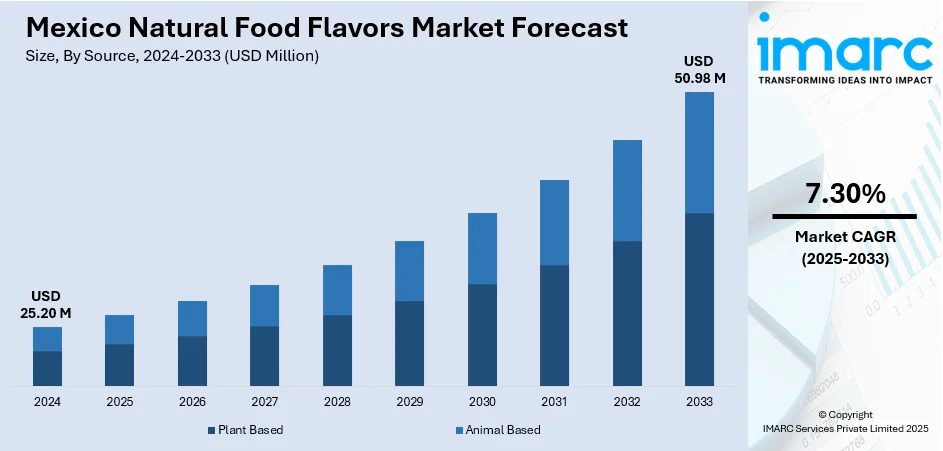

The Mexico natural food flavors market size reached USD 25.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 50.98 Million by 2033, exhibiting a growth rate (CAGR) of 7.30% during 2025-2033. Increasing consumer demand for clean-label products, growing health-consciousness, rising preference for organic ingredients, and expanding awareness of the harmful effects of artificial additives are some of the factors contributing to Mexico natural food flavors market share. Additionally, the demand for plant-based and sustainable food options fuels market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.20 Million |

| Market Forecast in 2033 | USD 50.98 Million |

| Market Growth Rate 2025-2033 | 7.30% |

Mexico Natural Food Flavors Market Trends:

Shift toward Natural Flavors in Food Service Industry

The foodservice industry in Mexico is seeing an increasing demand for authentic and clean-label products. With new offerings like jalapeño garlic, serrano lime, and cilantro lime, there’s a clear movement toward natural, high-quality ingredients. These new flavors, made with hand-scooped Hass avocados and free from artificial colors and flavors, cater to the growing desire for fresh and wholesome ingredients. As consumers prioritize authenticity and transparency in their food choices, brands are responding by expanding their product ranges to include cleaner, more natural options. This shift reflects a larger consumer trend in the Mexican market toward healthier, more transparent food experiences, particularly in the foodservice sector, where flavor quality and ingredient sourcing are becoming increasingly important. These factors are intensifying the Mexico natural food flavors market growth. For example, in September 2024, MegaMex Foods expanded its WHOLLY Guacamole line with three new pre-made flavors for foodservice, i.e., Jalapeño Garlic, Serrano Lime, and Cilantro Lime. These additions, made with hand-scooped Hass avocados and natural ingredients, cater to the growing demand for authentic, clean-label products. The range now includes five flavors, all free from artificial colors or flavors, highlighting the trend toward natural and authentic food flavors in the Mexico market.

To get more information on this market, Request Sample

Rising Demand for Clean-Label and Authentic Food Products

In Mexico's foodservice market, there is a growing consumer preference for clean-label products that emphasize authenticity and natural ingredients. With increasing awareness of food quality, many consumers are turning away from products with artificial additives and seeking out options that are free from synthetic colors and flavors. This shift is driving food brands to innovate with fresh, natural ingredients, such as hand-scooped Hass avocados, to meet the evolving expectations of their customers. The expansion of product lines with unique and bold flavor profiles, like jalapeño garlic, serrano lime, and cilantro lime, reflects the rising demand for more authentic taste experiences. These new offerings cater to the desire for foods that not only taste great but also align with health-conscious choices. As consumers become more discerning, food brands are placing a greater emphasis on ingredient transparency and product integrity, offering choices that feel more aligned with the values of natural, wholesome eating. This trend is reshaping the market, pushing companies to rethink traditional flavor offerings and focus on cleaner, more authentic ingredients.

Mexico Natural Food Flavors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on source, flavor type, and application.

Source Insights:

- Plant Based

- Animal Based

The report has provided a detailed breakup and analysis of the market based on the source. This includes plant based and animal based.

Flavor Type Insights:

- Fruit and Flavor

- Vegetable Flavor

- Herb and Spice Flavor

- Dairy Flavor

- Others

A detailed breakup and analysis of the market based on the flavor type have also been provided in the report. This includes fruit and flavor, vegetable flavor, herb and spice flavor, dairy flavor, and others.

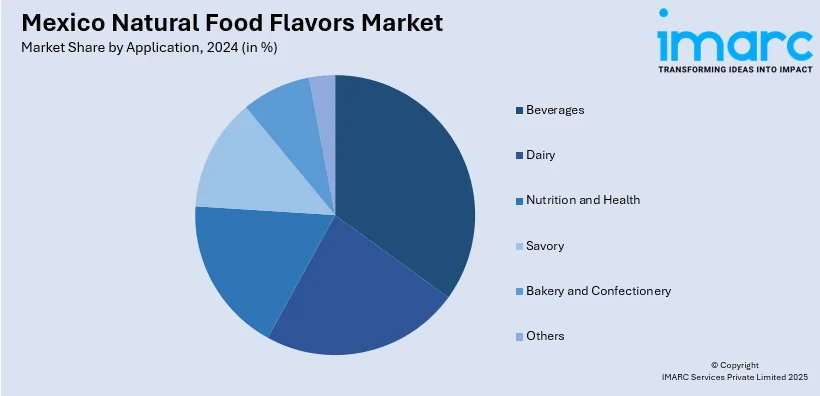

Application Insights:

- Beverages

- Dairy

- Nutrition and Health

- Savory

- Bakery and Confectionery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes beverages, dairy, nutrition and health, savory, bakery and confectionery, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Natural Food Flavors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Plant Based, Animal Based |

| Flavor Types Covered | Fruit and Flavor, Vegetable Flavor, Herb and Spice Flavor, Dairy Flavor, Others |

| Applications Covered | Beverages, Dairy, Nutrition and Health, Savory, Bakery and Confectionery, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico natural food flavors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico natural food flavors market on the basis of source?

- What is the breakup of the Mexico natural food flavors market on the basis of flavor type?

- What is the breakup of the Mexico natural food flavors market on the basis of application?

- What is the breakup of the Mexico natural food flavors market on the basis of region?

- What are the various stages in the value chain of the Mexico natural food flavors market?

- What are the key driving factors and challenges in the Mexico natural food flavors market?

- What is the structure of the Mexico natural food flavors market and who are the key players?

- What is the degree of competition in the Mexico natural food flavors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico natural food flavors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico natural food flavors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico natural food flavors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)