Mexico Natural Gas Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Mexico Natural Gas Market Overview:

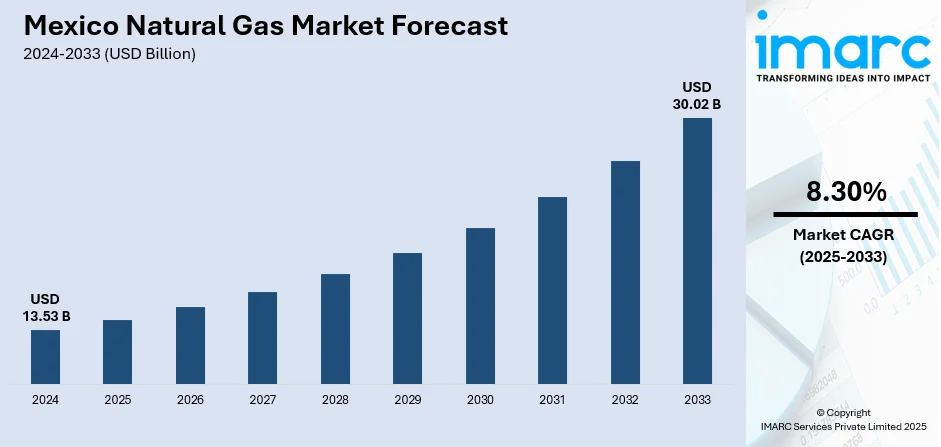

The Mexico natural gas market size reached USD 13.53 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 30.02 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Surging power sector demand, declining domestic production, and increasing reliance on pipeline imports from the US, due to its low cost and proximity, are some of the factors contributing to Mexico natural gas market share. Infrastructure development and nearshoring trends also play a significant role.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.53 Billion |

| Market Forecast in 2033 | USD 30.02 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Mexico Natural Gas Market Trends:

Expanding Domestic Natural Gas Production

A significant shift is underway in Mexico's natural gas production ambitions. The nation is targeting an ambitious output driven by a novel collaborative development framework. This model emphasizes shared participation, initially focusing on key fields for upcoming tenders. A substantial stake is guaranteed for the national oil company, fostering strong interest from local entities, particularly those with existing governmental relationships. This strategic pivot appears to favor domestic firms, potentially influencing the breadth of international technical contributions, especially for more intricate and challenging extraction endeavors. The underlying aim is to bolster internal capacity and achieve greater energy self-sufficiency. These factors are intensifying the Mexico natural gas market growth. For example, according to an article published in May 2025, Mexico aims for 5 Bcf/d gas output by 2030 via a new shared participation model, prioritizing four fields for tenders. Pemex guarantees a 40% share, attracting firms like Grupo Carso with government ties. This strategy favors domestic companies, potentially limiting international expertise in complex projects.

To get more information on this market, Request Sample

Growing Role in the Global LNG Landscape

Mexico's liquefied natural gas sector is poised for considerable expansion, fueled by governmental initiatives aimed at increasing clean energy adoption. This strategic direction anticipates a substantial rise in industrial demand for this cleaner fuel. Opportunities for investment are emerging across various segments, including enhancing storage capabilities, extending transportation networks to currently underserved areas, boosting indigenous production, and solidifying the nation's position as an LNG exporter. This overarching push aims to diversify energy sources and reduce reliance on single suppliers, establishing a more robust and self-sufficient energy profile for the country within the broader international market. For instance, as per an article published in February 2025, Mexico's LNG market is set for significant expansion, driven by government reforms targeting 45% clean energy by 2030 (up from 24.3% in 2024). Industrial demand for LNG is projected to grow substantially, with a 25% increase by 2040 from current levels. Key investment opportunities exist in storage, transportation to underserved regions, boosting domestic production, and establishing Mexico as an LNG exporter, reducing reliance on single suppliers.

Mexico Natural Gas Market Segmentation:

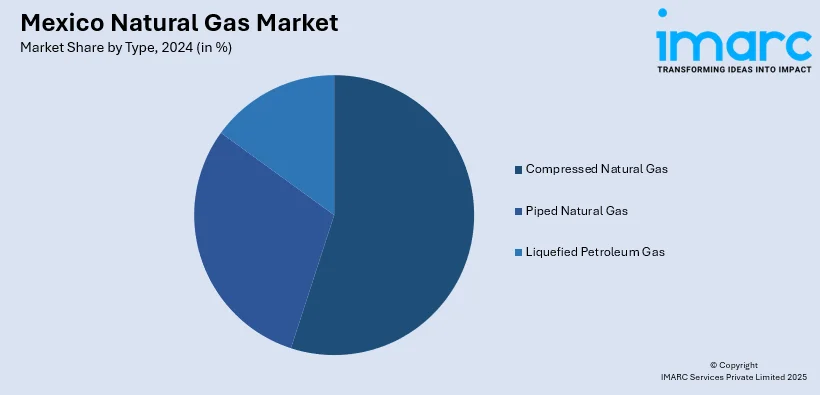

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Compressed Natural Gas

- Piped Natural Gas

- Liquefied Petroleum Gas

The report has provided a detailed breakup and analysis of the market based on the type. This includes compressed natural gas, piped natural gas, and liquefied petroleum gas.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Natural Gas Market News:

- In May 2025, TC Energy Corp. completed its 444-mile Southeast Gateway natural gas pipeline in Mexico, with a 1.3 Bcf/d capacity. This pipeline is contracted until 2055 and is poised to significantly bolster natural gas supply in Mexico's central and southeastern regions, supporting new power plants.

Mexico Natural Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Compressed Natural Gas, Piped Natural Gas, Liquefied Petroleum Gas |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico natural gas market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico natural gas market on the basis of type?

- What is the breakup of the Mexico natural gas market on the basis of region?

- What are the various stages in the value chain of the Mexico natural gas market?

- What are the key driving factors and challenges in the Mexico natural gas market?

- What is the structure of the Mexico natural gas market and who are the key players?

- What is the degree of competition in the Mexico natural gas market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico natural gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico natural gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico natural gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)