Mexico Network Automation Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Network Type, End Use Industry, and Region, 2025-2033

Mexico Network Automation Market Overview:

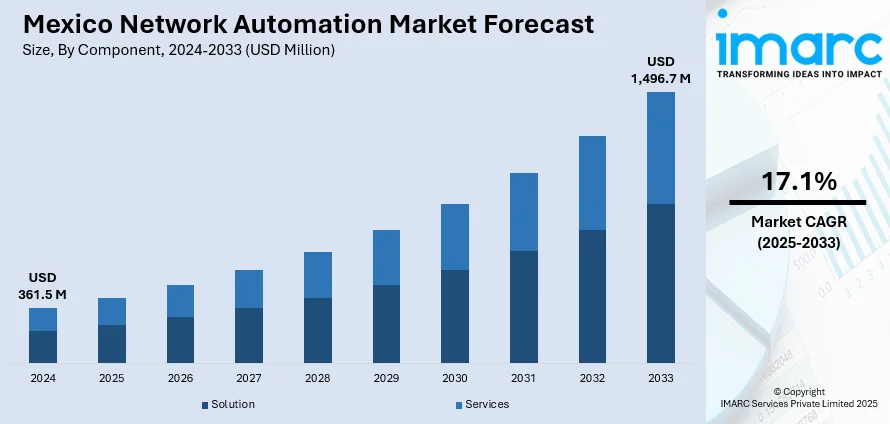

The Mexico network automation market size reached USD 361.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,496.7 Million by 2033, exhibiting a growth rate (CAGR) of 17.1% during 2025-2033. Telecom digitization, enterprise software-defined networks, SDN and NFV adoption, orchestration platform deployment, real-time fault resolution, IoT scalability, smart utility systems, managed service growth, regulatory compliance needs, cybersecurity automation, sector-specific policy enforcement, network segmentation, anomaly response protocols, infrastructure orchestration, public service modernization, autonomous optimization platforms, and workforce decentralization are some of the factors positively impacting the Mexico network automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 361.5 Million |

| Market Forecast in 2033 | USD 1,496.7 Million |

| Market Growth Rate 2025-2033 | 17.1% |

Mexico Network Automation Market Trends:

Digital Transformation in Telecom and Enterprise Networks

Mexico’s ongoing digital transformation is driving the adoption of advanced network automation technologies across telecom operators and enterprise environments. The need for greater agility, operational efficiency, and service reliability has led to a shift from manual, hardware-centric network management toward software-defined and intent-based automation frameworks. Telecom providers are investing in automation to streamline configuration, reduce operational expenditures, and ensure faster time-to-market for digital services. Similarly, enterprises are automating internal network functions to accommodate remote workforces, hybrid cloud strategies, and secure data movement. A major influence in this transformation is the Mexico network automation market forecast, which reflects increased interest in SDN (Software Defined Networking), NFV (Network Functions Virtualization), and AI-driven orchestration tools. These technologies are being deployed to enhance network observability, enable closed-loop automation, and improve service-level performance in both public and private networks.

To get more information of this market, Request Sample

On January 14, 2025, Amazon Web Services (AWS) launched its new Mexico (Central) infrastructure region, backed by a planned USD 5 Billion investment over 15 years and expected to add over USD 10 Billion to Mexico’s GDP while supporting 7,000+ full-time jobs annually. The new region, comprising three Availability Zones, will enhance data residency, reduce latency, and strengthen local access to advanced cloud capabilities including AI, ML, IoT, and network automation tools. This move supports a growing base of Mexican enterprises, governments, and startups seeking to modernize IT operations and accelerate digital transformation through automation. With increasing customer demand for uninterrupted connectivity, automation plays a critical role in real-time fault detection and self-healing protocols. Another contributor is the proliferation of IoT ecosystems across sectors such as logistics, utilities, and manufacturing. As sensor networks expand, automated traffic management and scalable infrastructure provisioning are necessary to ensure system stability and performance. This trend is driving Mexico network automation market growth, particularly in mid-size enterprises and managed service environments looking to optimize their digital operations without increasing administrative overhead.

Regulatory Pressure, Cybersecurity, and Cross-Sector Modernization

The Mexico network automation market is further shaped by regulatory directives and increasing pressure to modernize mission-critical infrastructure. With compliance frameworks evolving to address data privacy, service availability, and cybersecurity threats, organizations are adopting automation to enforce consistent policy controls, audit trails, and standardized access protocols across complex network topologies. These automation frameworks not only reduce the margin for human error but also improve transparency and governance across telecom and enterprise environments. Aligned with this shift is the Mexico network automation market outlook, which points to rising investments in automation solutions tailored for regulated industries such as finance, energy, and government. These sectors are leveraging programmable networks and automated compliance tools to meet growing regulatory requirements while maintaining service agility.

Additionally, the rise in ransomware, DDoS attacks, and data breaches is pushing IT and security teams to deploy automated anomaly detection, network segmentation, and breach response workflows. Moreover, the modernization of physical infrastructure, including smart grids, connected transportation, and digital public services, demands low-latency, highly available, and easily managed networks. As intelligent automation reshapes Mexico’s logistics and supply chains, the demand for network-integrated, AI-driven systems is fueling new opportunities for network automation platforms to support real-time data flow, operational resilience, and cross-system coordination. On October 10, 2024, Symbotic Inc. signed a commercial agreement with Walmart de México y Centroamérica (Walmex) to implement its AI-powered warehouse automation systems at two greenfield distribution centers near Mexico City, with the first located in the Bajío region. The Bajío facility will be one of Walmex’s largest distribution centers, and the project marks Symbotic’s largest single-phase deployment to date. To support this expansion, Symbotic established Symbotic Mexico, S. de R.L. de C.V., reinforcing its long-term strategy to scale automation and digital infrastructure across Mexico.

Mexico Network Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, network type, and end use industry.

Component Insights:

- Solution

- Network Automation Tools

- SD-WAN and Network

- Virtualization

- Internet-Based Networking

- Services

- Professional Service

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (network automation tools, SD-WAN and network, virtualization, and internet-based networking) and services (professional service and managed service).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based solutions.

Organization Size Insights:

- Large Enterprises

- Small and Medium-size Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-size enterprises.

Network Type Insights:

- Physical

- Virtual

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the network type. This includes physical, virtual, and hybrid networks.

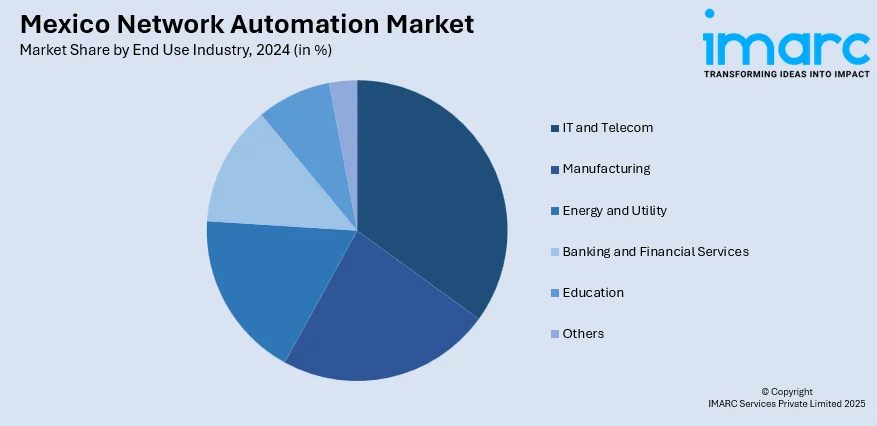

End Use Industry Insights:

- IT and Telecom

- Manufacturing

- Energy and Utility

- Banking and Financial Services

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes IT and telecom, manufacturing, energy and utility, banking and financial services, education, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Network Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-size Enterprises |

| Network Types Covered | Physical, Virtual, Hybrid |

| End Use Industries Covered | IT and Telecom, Manufacturing, Energy and Utility, Banking and Financial Services, Education, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico network automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico network automation market on the basis of component?

- What is the breakup of the Mexico network automation market on the basis of deployment mode?

- What is the breakup of the Mexico network automation market on the basis of organization size?

- What is the breakup of the Mexico network automation market on the basis of network type?

- What is the breakup of the Mexico network automation market on the basis of end use industry?

- What is the breakup of the Mexico network automation market on the basis of region?

- What are the various stages in the value chain of the Mexico network automation market?

- What are the key driving factors and challenges in the Mexico network automation?

- What is the structure of the Mexico network automation market and who are the key players?

- What is the degree of competition in the Mexico network automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico network automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico network automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico network automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)