Mexico Off-Road Vehicles Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Mexico Off-Road Vehicles Market Overview:

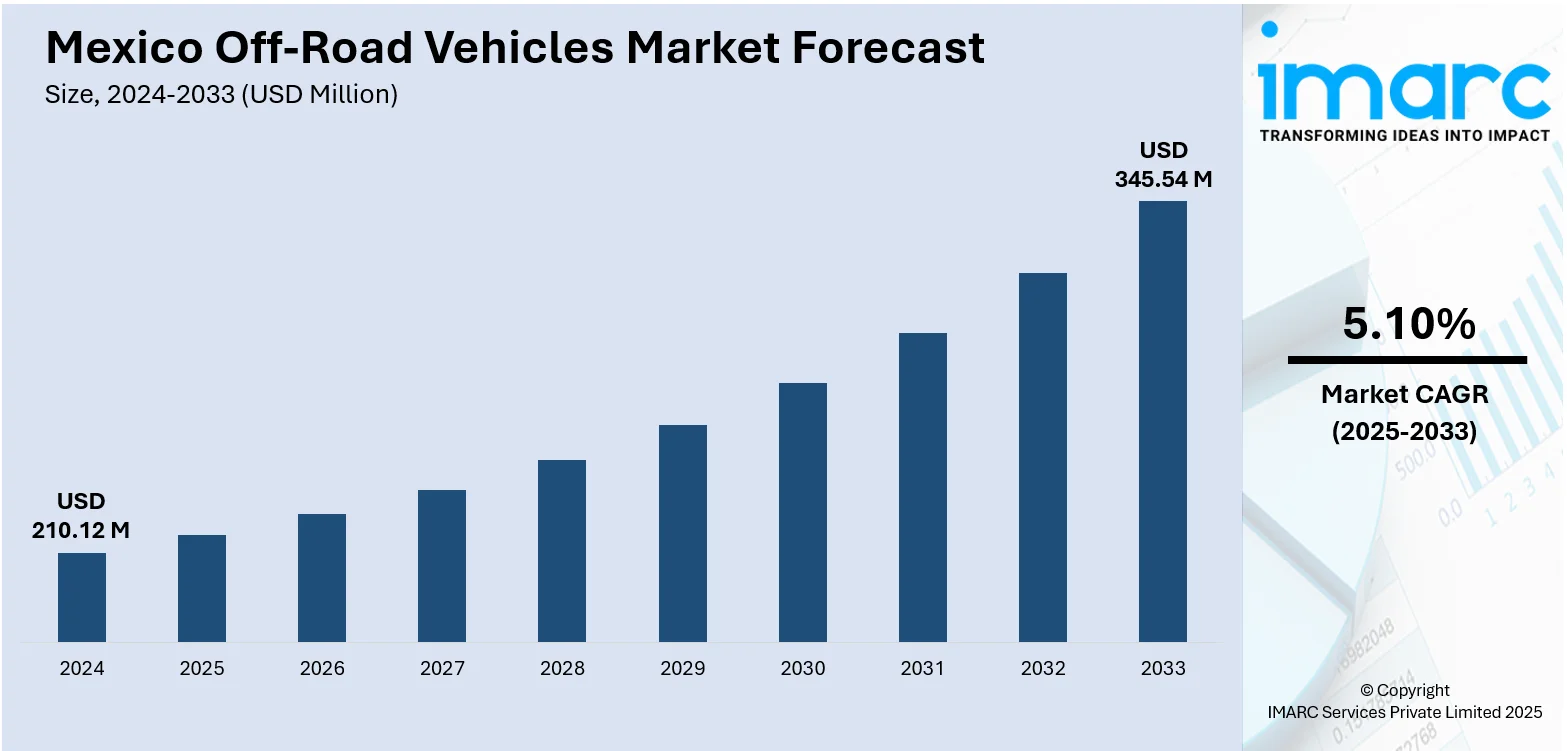

The Mexico off-road vehicles market size reached USD 210.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 345.54 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by the rising adoption of electric off-road vehicles, fueled by environmental regulations, cost efficiency, and expanding charging infrastructure, prompting manufacturers to innovate. Growing adventure tourism is increasing demand for high-performance ATVs and UTVs, supported by rental services and social media promotion. Additionally, technological advancements and increasing consumer interest in rugged recreational activities are further augmenting the Mexico off-road vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 210.12 Million |

| Market Forecast in 2033 | USD 345.54 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Mexico Off-Road Vehicles Market Trends:

Rising Demand for Electric Off-Road Vehicles in Mexico

The market is experiencing a growing shift toward electric models due to increasing environmental awareness and stricter emissions regulations. Consumers and businesses are seeking sustainable alternatives to traditional gasoline-powered off-road vehicles, leading manufacturers to introduce electric ATVs, UTVs, and dirt bikes. These vehicles offer lower operating costs, reduced noise levels, and minimal environmental impact, making them appealing for both recreational and commercial use. Additionally, government incentives for eco-friendly vehicles and expanding charging infrastructure are further accelerating adoption. Mexico's electric vehicle (EV) market is experiencing strong growth, with over 200,000 electrified cars sold in 2024, representing a 70.2% increase from the previous year. The country now has 3,273 public charging points, with plans to further expand to support the adoption of electric vehicles (EVs). With Mexico aiming to phase out fossil fuel vehicles by 2035, this progress in production and infrastructure positions the nation as a significant player in the global shift toward clean electric mobility, both on- and off-road. Key players are investing in R&D to enhance battery efficiency and off-road performance, catering to adventure enthusiasts and industries including agriculture and mining. As technology advances and prices become more competitive, electric off-road vehicles are expected to capture a larger market share in Mexico, aligning with global trends toward electrification.

To get more information on this market, Request Sample

Growth in Recreational Off-Roading and Adventure Tourism

The rise in adventure tourism and recreational off-roading activities is significantly supporting the Mexica off-road vehicles market growth. Popular destinations such as Baja California, Copper Canyon, and the Sonoran Desert are attracting off-road enthusiasts, driving demand for high-performance ATVs, UTVs, and 4x4 vehicles. Tour operators and rental services are expanding their fleets to meet the needs of both domestic and international tourists seeking rugged outdoor experiences. Social media and influencer marketing have also played a significant role in popularizing off-road adventures, encouraging more consumers to invest in personal off-road vehicles. Sixty-six percent of consumers in Mexico have made purchases influenced by recommendations from influencers, while 64% favor posts created by influencers over conventional advertising. Social commerce is on the upswing, with 51% of Mexicans using shopping functionality within social media, particularly among younger generations. These trends underscore the increasing significance of influencers in shaping consumer behavior, presenting new opportunities for the off-road vehicle sector to engage with individuals through social media and partnerships with influencers. Manufacturers are responding by offering customizable, durable models with advanced features such as GPS navigation and enhanced suspension systems. This trend is expected to continue as Mexico’s tourism industry rebounds post-pandemic, creating long-term growth opportunities for the off-road vehicle sector.

Mexico Off-Road Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

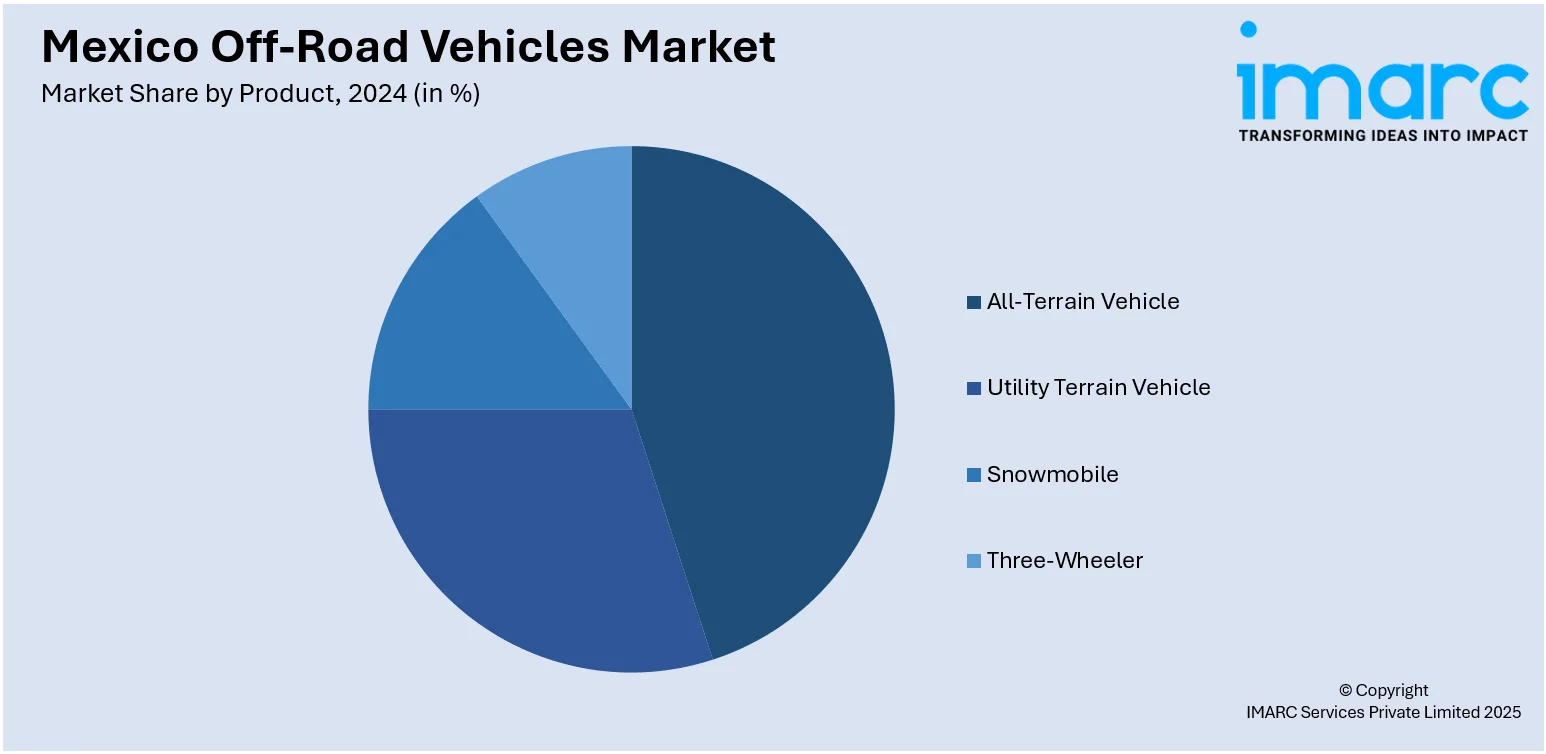

Product Insights:

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

The report has provided a detailed breakup and analysis of the market based on the product. This includes all-terrain vehicle, utility terrain vehicle, snowmobile, and three-wheeler.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Off-Road Vehicles Market News:

- December 11, 2024: INEOS Automotive unveiled the Grenadier 4x4 in Mexico, offering a premium off-road experience with three variants: Trialmaster, Fieldmaster, and Quartermaster. The car features advanced off-road functionalities, including a 5-link suspension, BFGoodrich tires, and improved towing capacity. Priced at USD 2.1 Million, the Grenadier expands INEOS's footprint in North America and plans to bring in the Grenadier Quartermaster pickup by 2025.

Mexico Off-Road Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | All-Terrain Vehicle, Utility Terrain Vehicle, Snowmobile, Three-Wheeler |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico off-road vehicles market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico off-road vehicles market on the basis of product?

- What is the breakup of the Mexico off-road vehicles market on the basis of region?

- What are the various stages in the value chain of the Mexico off-road vehicles market?

- What are the key driving factors and challenges in the Mexico off-road vehicles market?

- What is the structure of the Mexico off-road vehicles market and who are the key players?

- What is the degree of competition in the Mexico off-road vehicles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico off-road vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico off-road vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico off-road vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)