Mexico Oleochemicals Market Size, Share, Trends and Forecast by Type, Form, Application, Feedstock, and Region, 2025-2033

Mexico Oleochemicals Market Overview:

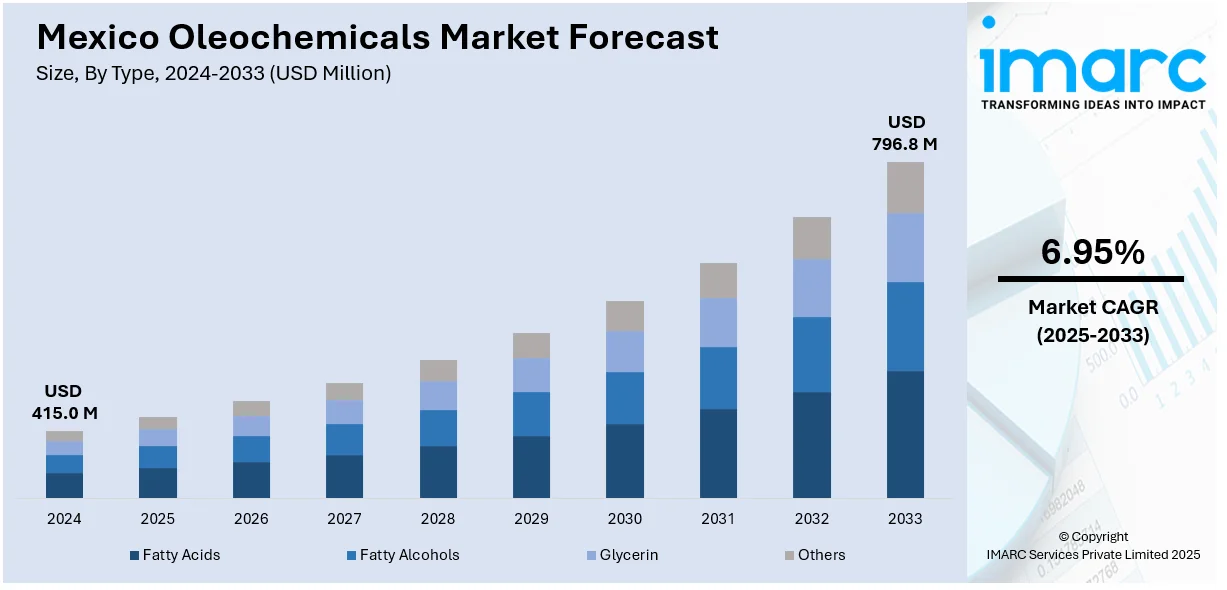

The Mexico oleochemicals market size reached USD 415.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 796.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.95% during 2025-2033. The growing individual inclination toward natural, environmentally sustainable, and non-toxic products in the cosmetics and food and beverage (F&B) industries is catalyzing the demand for oleochemicals in Mexico, as manufacturers are transitioning from synthetic compounds to renewable, bio-based alternatives for aligning with regulatory and market expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 415.0 Million |

| Market Forecast in 2033 | USD 796.8 Million |

| Market Growth Rate 2025-2033 | 6.95% |

Mexico Oleochemicals Market Trends:

Growing Employment in Food and Beverage (F&B) Sector

Oleochemicals are gaining prominence in the food and beverage industry because of their use in packaging, additives, and food processing aids. Fatty acids and glycerol-based compounds are increasingly being used as emulsifiers, stabilizers, and anti-foaming agents, especially as food manufacturers seek ingredients that extend shelf life and meet clean-label standards. This trend corresponds with increasing consumer demand for safe, plant-based ingredients and the wider movement towards transparent sourcing of components. The rise in processed and convenience food consumption is another contributing factor, with food producers aiming to enhance product texture, consistency, and storage stability. Domestic companies are redesigning their products to incorporate oleochemical components that regulatory agencies have certified as food-grade. These components are becoming highly recognized in bakery, dairy, and confectionery sectors. Furthermore, producers are collaborating with chemical suppliers to create formulations customized for local production conditions and user demands. According to United States Department of Agriculture (USDA), Mexico's retail industry achieved $82.2 billion in 2023, featuring 26 supermarket chains that manage more than 3,300 food retail locations nationwide. This extensive distribution network persists in fueling the need for packaged and processed foods, underscoring the importance of oleochemicals in maintaining quality and performance on a large scale. The combined influence of regulatory support, market growth, and evolving dietary preferences is making oleochemicals a key enabler in modern food production strategies across Mexico.

Rising Demand in Cosmetics and Personal Care Industry

The increasing preferences for natural and organic components in the cosmetics and personal care sector is propelling the growth of the oleochemicals market in Mexico. Shoppers are becoming more aware about the components used in their personal care items, progressively choosing those that are sustainable, gentle on the skin, and environment-friendly. This change in user behavior is encouraging manufacturers to replace synthetic chemicals with natural alternatives, with oleochemicals derived from renewable plant and animal sources, such as coconut oil, palm oil, and animal fats, becoming integral components in formulations for skincare, haircare, and cosmetics. Oleochemicals are valued for their mild characteristics, eco-friendliness, and capacity to improve the texture and performance of products. With the rising number of individuals focusing on health-oriented and eco-friendly products, the demand for oleochemicals in Mexico's cosmetics industry is increasing. The cosmetics market in Mexico was valued at USD 7.7 billion in 2024 and expected to attain USD 13.0 billion by 2033, indicating a compound annual growth rate (CAGR) of 5.6% from 2025 to 2033, as per IMARC Group. The growing demand for natural and non-toxic formulations is establishing a solid base for the growth of oleochemicals in personal care items, offering manufacturers and suppliers chances to engage with this expanding market.

Mexico Oleochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, form, application, and feedstock.

Type Insights:

- Fatty Acids

- Fatty Alcohols

- Glycerin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fatty acids, fatty alcohols, glycerin, and others.

Form Insights:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid (flakes, pellets, beads, others).

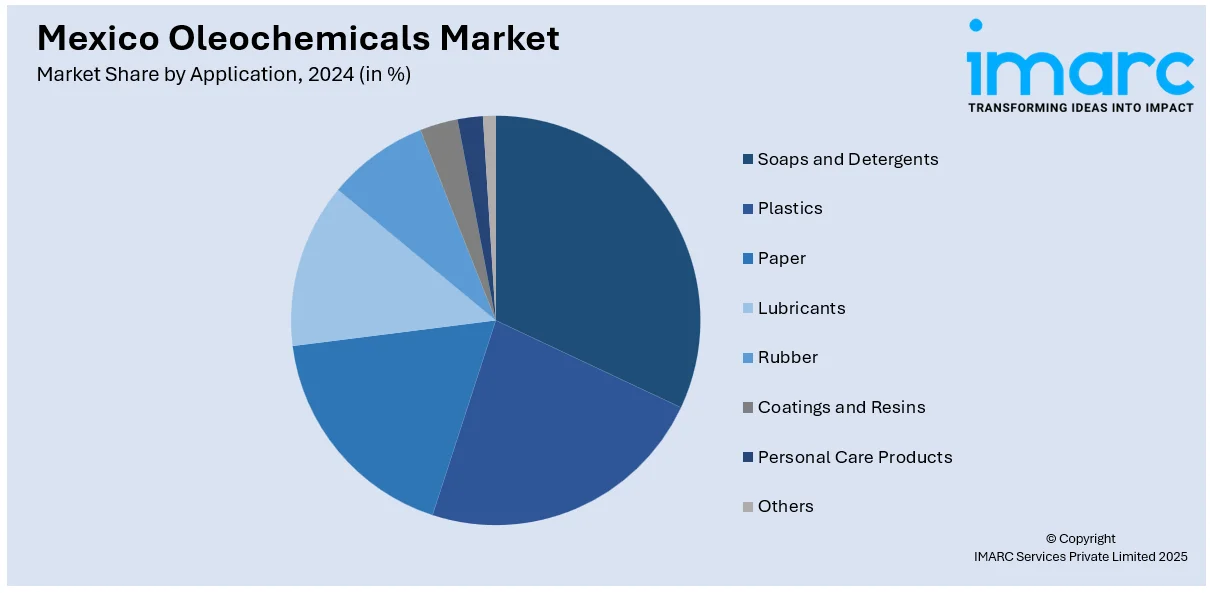

Application Insights:

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes soaps and detergents, plastics, paper, lubricants, rubber, coatings and resins, personal care products, and others.

Feedstock Insights:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

A detailed breakup and analysis of the market based on the feedstock have also been provided in the report. This includes palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Oleochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fatty Acids, Fatty Alcohols, Glycerin, Others |

| Forms Covered |

|

| Applications Covered | Soaps and Detergents, Plastics, Paper, Lubricants, Rubber, Coatings and Resins, Personal Care Products, Others |

| Feedstocks Covered | Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico oleochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico oleochemicals market on the basis of type?

- What is the breakup of the Mexico oleochemicals market on the basis of form?

- What is the breakup of the Mexico oleochemicals market on the basis of application?

- What is the breakup of the Mexico oleochemicals market on the basis of feedstock?

- What is the breakup of the Mexico oleochemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico oleochemicals market?

- What are the key driving factors and challenges in the Mexico oleochemicals market?

- What is the structure of the Mexico oleochemicals market and who are the key players?

- What is the degree of competition in the Mexico oleochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico oleochemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico oleochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico oleochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)