Mexico Online Alcohol Delivery Market Size, Share, Trends and Forecast by Type, Delivery Place, and Region, 2025-2033

Mexico Online Alcohol Delivery Market Overview:

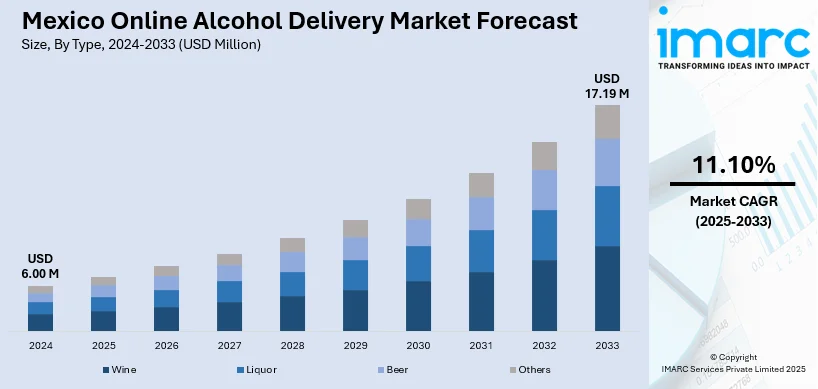

The Mexico online alcohol delivery market size reached USD 6.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 17.19 Million by 2033, exhibiting a growth rate (CAGR) of 11.10% during 2025-2033. The market is driven by growing consumer demand for convenience, allowing easy home ordering through smartphones and apps. Digital transformation enhances this with secure payments, real-time tracking, and personalized recommendations, making purchases seamless. Additionally, changing consumer preferences toward premium, craft, and health-conscious beverages boost market diversity. Social media influence also helps spread awareness and trends, encouraging more online purchases thus strengthening the Mexico online alcohol delivery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.00 Million |

| Market Forecast in 2033 | USD 17.19 Million |

| Market Growth Rate 2025-2033 | 11.10% |

Mexico Online Alcohol Delivery Market Trends:

Convenience and Accessibility

The ease of buying alcohol online is one of the biggest forces in Mexico's expanding delivery economy. Shoppers are increasingly fond of the simplicity of shopping and buying drinks from their smartphones or computers without leaving the physical stores. This is particularly attractive in cities where hectic lifestyles require rapid solutions. Ordering alcohol online to be delivered directly to home spares time and effort and aligns perfectly with new consumer behaviour. Further, convenience features such as pre-scheduled deliveries and simplified reordering augment the customer experience. The convenience theme also appeals to younger cohorts, who are more adept at using digital purchases and demand hassle-free service. As increasingly more citizens turn to e-commerce for everyday essentials, liquor delivery follows naturally on the trend, providing a safer, contactless alternative well-suited to changing consumer expectations, reflecting broader Mexico online alcohol delivery market trends.

To get more information on this market, Request Sample

Changing Consumer Preferences

Changes in consumers' preferences are largely influencing Mexico's online alcohol delivery segment. Based on a 2024 survey conducted by Vital Strategies, 29% of Mexican adults drink tequila and 28% drink wine, reflecting heightened demand for premium and craft products. Consumers are increasingly looking for distinctive, high-quality experiences through specialized items such as craft beers, mezcal, and specialty spirits with unique flavors. Health-mindful trends also contribute, as they increasingly pursue organic, low-calorie, and natural content choices. Online sites respond by providing varied offerings not necessarily available in nearby stores, addressing changing tastes. Social media also aids purchasing decisions by introducing users to fresh brands and trends via online content. This intersection of consumer demand and online interaction stimulates retailers to innovate and widen their products, stimulating dynamic Mexico online alcohol delivery market growth.

Digital Transformation and E-commerce Integration

Advances in technology have greatly contributed to the growth of online alcohol delivery in Mexico. The increased usage of smartphones and better internet connectivity have rendered online shopping convenient for more people. Online shopping platforms offer seamless navigation, secure payments, and recommender systems, making online buying of alcohol easy and enjoyable. Integration with mobile wallets and instant payments makes transactions easier. Also, real-time order tracking and customer service build confidence and satisfaction. Digital marketing, such as social media and influencer collaborations, educates consumers about products and offers, stimulating demand. The use of technology not only simplifies operations but also supports new business models such as subscription services and curated boxes, providing personalized experiences. This digital evolution is essential in capturing tech-savvy buyers and supporting market growth.

Mexico Online Alcohol Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and delivery place.

Type Insights:

- Wine

- Liquor

- Beer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wine, liquor, beer, and others.

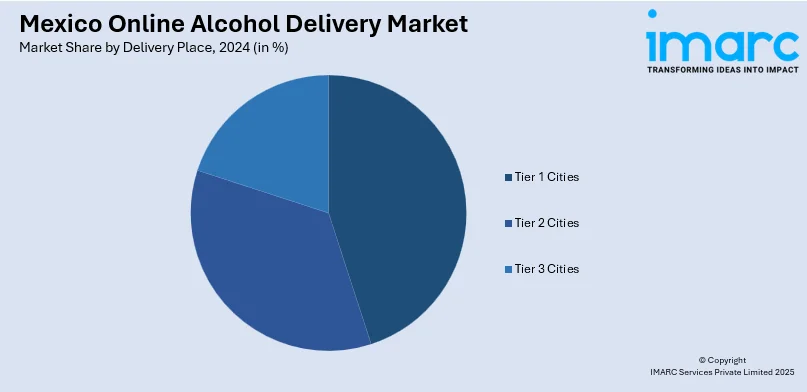

Delivery Place Insights:

- Tier 1 Cities

- Tier 2 Cities

- Tier 3 Cities

A detailed breakup and analysis of the market based on the delivery place have also been provided in the report. This includes tier 1 cities, tier 2 cities, and tier 3 cities.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Online Alcohol Delivery Market News:

- In July 2024, Delivery aggregators like DoorDash, Shipt, and Uber Eats are expanding their alcohol delivery services across multiple U.S. states, driven by growing consumer demand for convenience. Despite regulatory challenges, these companies are partnering with retailers to offer a wider variety of alcoholic beverages for same-day delivery. The trend, accelerated by the pandemic, reflects a broader shift toward digital shopping, with aggregators aiming to capture a larger share of the evolving online alcohol market.

Mexico Online Alcohol Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wine, Liquor, Beer, Others |

| Delivery Places Covered | Tier 1 Cities, Tier 2 Cities, Tier 3 Cities |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico online alcohol delivery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico online alcohol delivery market on the basis of type?

- What is the breakup of the Mexico online alcohol delivery market on the basis of delivery place?

- What is the breakup of the Mexico online alcohol delivery market on the basis of region?

- What are the various stages in the value chain of the Mexico online alcohol delivery market?

- What are the key driving factors and challenges in the Mexico online alcohol delivery market?

- What is the structure of the Mexico online alcohol delivery market and who are the key players?

- What is the degree of competition in the Mexico online alcohol delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico online alcohol delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico online alcohol delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico online alcohol delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)