Mexico Online Car Buying Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Category, and Region, 2025-2033

Mexico Online Car Buying Market Overview:

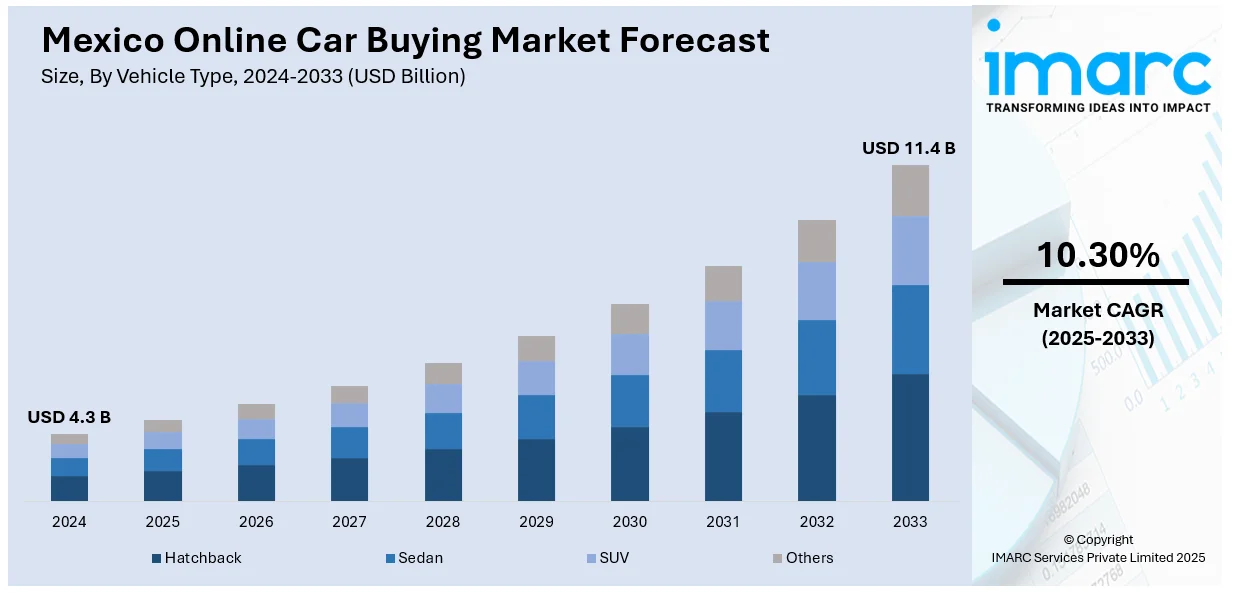

The Mexico online car buying market size reached USD 4.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.4 Billion by 2033, exhibiting a growth rate (CAGR) of 10.30% during 2025-2033. The increasing internet penetration, a shift toward digital platforms, rising consumer demand for used cars, availability of various financing options, the younger tech-savvy demographic, convenient home delivery services, and government support for e-commerce are some of the factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.3 Billion |

| Market Forecast in 2033 | USD 11.4 Billion |

| Market Growth Rate 2025-2033 | 10.30% |

Mexico Online Car Buying Market Trends:

Increasing Adoption of Digital Platforms and Expanding Internet Penetration

Rapid internet penetration and the proliferation of digital platforms are driving the Mexico online car buying market growth. Recently, Mexico's internet penetration rate reached 83.3%, with 110 million users, marking a 1% increase from the previous year. This growth reflects a consistent upward trend from 81.2% in 2023. This digital transformation has prompted a change in consumer behavior, with individuals increasingly using online platforms for shopping. Consumers now increasingly rely on digital sources to research vehicles, compare prices and browse a wider range of options that available through traditional car dealerships. Additionally, the growing access to mobile internet has further reinforced this shift toward digital engagement, enabling users to access car-buying platforms conveniently through smartphones and tablets, thereby contributing further to the market expansion.

Convenience of Home Delivery and Virtual Showrooms

The increasing demand for convenience is another significant factor boosting the Mexico online car buying market share. This trend is further supported by the introduction of home delivery services and virtual showrooms. Remote dealerships, such as Carvana, Vroom, and Shift, are offering home delivery, enabling consumers to skip visiting a dealership entirely. Virtual showrooms have also become an integral strategy for key brands, as they offer high-resolution photos and 360-degree views and undertake virtual test drives, emulating the traditional dealer floor experience. For instance, in 2024, Porsche Cars Australia launched the Virtual Porsche Retail Experience, which mirrors the showrooms of selected official Porsche Centres, permitting visitors to "walk around" a portion of the luxury brand’s retail spaces digitally. This project allows Porsche to transfer its retail formats and brand events to the digital world and reach a larger customer base.

Growing Preference for Used Cars

The rising demand for used cars is another significantly contributing to a favorable market outlook. Economic constraints and escalating prices of new vehicles have driven consumers to consider pre-owned cars as a more cost-effective alternative. Online platforms specializing in used vehicles provide numerous advantages, including transparent vehicle history report, certification programs, and warranties, which further supports consumer confidence in buying used cars. They also offer easy navigation interface where the customer can filter the options as per their needs, in terms of price, model, and year. Apart from this, the increased accessibility and convenience of purchasing used cars online is a crucial factor in the propelling the Mexico online care buying market outlook, as it meets the needs of cost-sensitive buyers while offering a seamless buying experience.

Mexico Online Car Buying Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, propulsion type, and category.

Vehicle Type Insights:

- Hatchback

- Sedan

- SUV

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, SUV, and others.

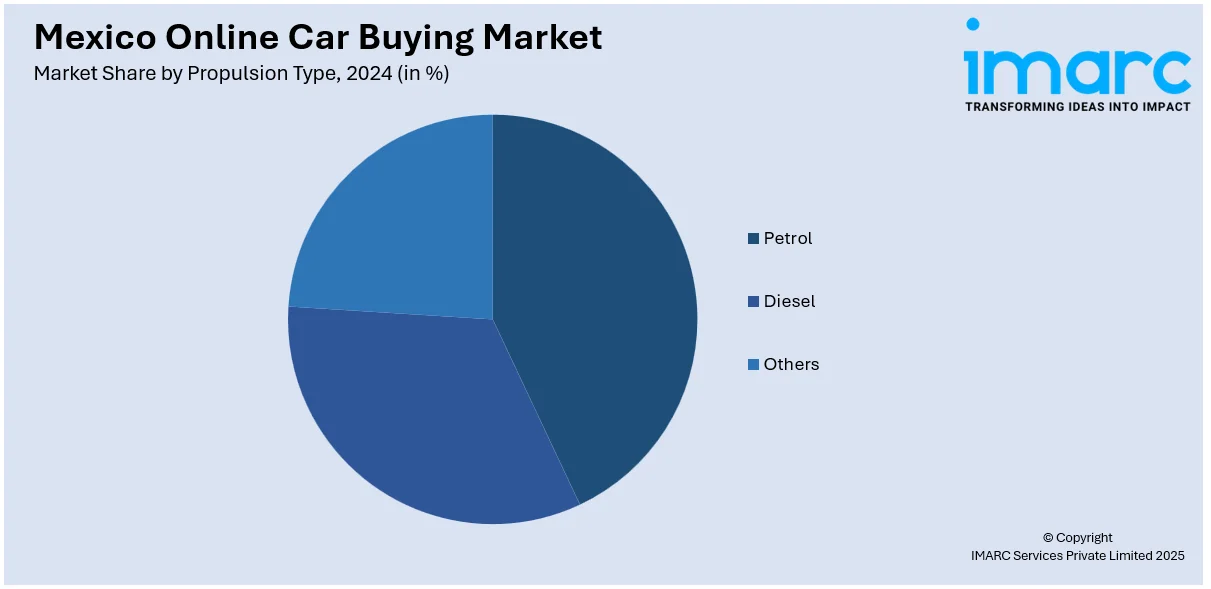

Propulsion Type Insights:

- Petrol

- Diesel

- Others

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes petrol, diesel, and others.

Category Insights:

- Pre-Owned Vehicle

- New Vehicle

The report has provided a detailed breakup and analysis of the market based on the category. This includes pre-owned vehicle and new vehicle.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Online Car Buying Market News:

- In 2024, Kavak, a Mexican startup specializing in the purchase and sale of pre-owned cars, invested over USD 300 million in Brazil. These investments have been directed towards infrastructure, technology, and other areas to establish a strong presence in the Brazilian used car market.

- In 2023, Mercado Libre, a leading e-commerce and classifieds platform, partnered with Creditas, a financial services company, to offer financing solutions for used-car buyers in Mexico. This collaboration aims to democratize car purchasing in Mexico by increasing access to financing options.

Mexico Online Car Buying Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, SUV, Others |

| Propulsion Types Covered | Petrol, Diesel, Others |

| Categories Covered | Pre-Owned Vehicle, New Vehicle |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico online car buying market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico online car buying market on the basis of vehicle type?

- What is the breakup of the Mexico online car buying market on the basis of propulsion type?

- What is the breakup of the Mexico online car buying market on the basis of category?

- What is the breakup of the Mexico online car buying market on the basis of region?

- What are the various stages in the value chain of the Mexico online car buying market?

- What are the key driving factors and challenges in the Mexico online car buying?

- What is the structure of the Mexico online car buying market and who are the key players?

- What is the degree of competition in the Mexico online car buying market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico online car buying market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico online car buying market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico online car buying industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)