Mexico Online Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, Payment Mode, Service Type, and Region, 2025-2033

Mexico Online Car Rental Market Overview:

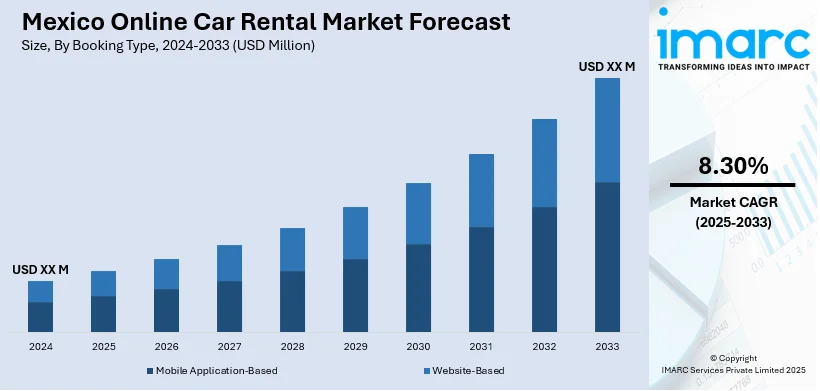

The Mexico online car rental market size is projected to exhibit a growth rate (CAGR) of 8.30% during 2025-2033. At present, foreign travelers are making car bookings online for enhanced mobility and ease of travel to locations like Cancún, Mexico City, and Playa del Carmen. This, along with the swift penetration of smartphones and enhanced internet connectivity, is propelling the market growth. Moreover, the shifting mobility preferences among the masses are expanding the Mexico online car rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 8.30% |

Mexico Online Car Rental Market Trends:

Rising Tourism and Business Travel Demand

The Mexican online car rental sector is experiencing tremendous growth as local and overseas tourism keeps spreading throughout the nation. Foreign travelers are making car bookings online for enhanced mobility and ease of travel to locations like Cancún, Mexico City, and Playa del Carmen. Concurrently, corporate travelers are increasingly relying on car rental services for business transport within cities. Airlines and accommodation platforms are also collaborating with car rental companies, adding smooth online booking features that are driving its usage. Passengers are using mobile apps and websites that provide clear pricing, simple comparison, and real-time inventory, further instilling confidence. With the Mexican government investing heavily in tourist infrastructure and intra-regional connectivity, travel is becoming more affordable, hence catalyzing the need for car rentals. According to official government data, Mexico received 3.8 million international tourists by air in the initial two months of 2025. This number indicates a 2.7% rise compared to the equivalent time in 2024 and an impressive 17.9% increase from the pre-pandemic figures of 2019. This constant growth in tourism and corporate travel is considerably propelling the expansion of the online automobile rental market across Mexico.

To get more information on this market, Request Sample

Penetration of Smartphones and Ease of Internet Access

The swift penetration of smartphones and enhanced internet connectivity are changing people’s behavior in Mexico, particularly the manner through which they arrange transport services. People are increasingly relying on digital platforms and mobile apps to hire cars, sidestepping conventional car rental desks. With telecommunication infrastructure being regularly upgraded and data plans becoming cheaper, more people are getting digitally connected. Web-based car rental sites are taking advantage of this trend by creating easy-to-use applications with global positioning system (GPS) and instant booking and digital payment capabilities. Firms are also providing customer service, digital agreements, and rewards for loyalty through apps, which are improving user satisfaction and retention. Real-time tracking of vehicles and personalized booking capabilities are making the experience easier and more convenient. As mobile technology keeps advancing and digital literacy increases, a large number of Mexicans are opting for the convenience of online rentals. This digital shift is contributing to the Mexico online car rental market growth. The IMARC Group predicts that the Mexico smartphones market is projected to attain 29.95 Million Units by 2033.

Shifting Mobility Preferences

Preferences of city dwellers in Mexico are changing, especially in major cities such as Monterrey, Guadalajara, and Mexico City, where traffic, parking, and increased automobile ownership expenses are driving locals to seek other modes of transport. Individuals are embracing flexibility, shared mobility, and affordable options, which internet-based car rental websites are providing in diversified forms like hourly car rentals, long-term subscriptions, and self-driving schemes. The younger generation, especially, is abandoning vehicle ownership and using technology-based mobility services. City professionals are also opting for rentals for sporadic use, weekend getaways, or for meetings out of town. When ride-sharing becomes saturated or expensive, rental cars provide more privacy and control. Online platforms are responding to these new tastes by providing customized packages, green fleets, and dynamic pricing schemes. This continuous change in urban transportation habits is positively crafting an ideal scenario for the Mexico online car rental business to expand and diversify at a faster pace.

Mexico Online Car Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on booking type, rental length, vehicle type, application, payment mode, and service type.

Booking Type Insights:

- Mobile Application-Based

- Website-Based

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes mobile application-based and website-based.

Rental Length Insights:

- Short Term

- Long Term

The report has provided a detailed breakup and analysis of the market based on the rental length. This includes short term and long term.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes luxury, executive, economy, SUVs, and others.

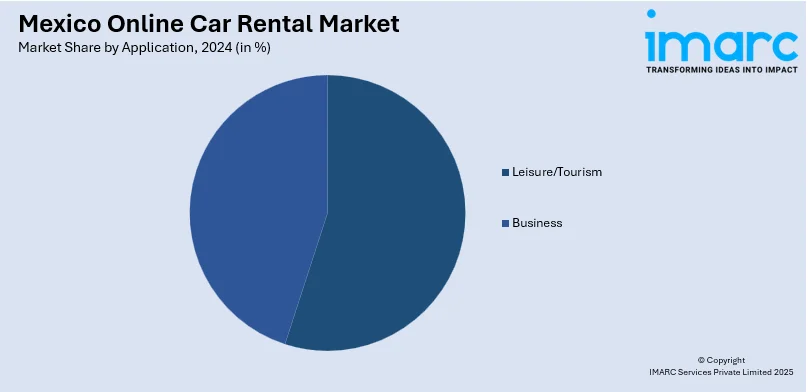

Application Insights:

- Leisure/Tourism

- Business

The report has provided a detailed breakup and analysis of the market based on the application. This includes leisure/tourism and business.

Payment Mode Insights:

- Online Payment

- Cash on Delivery

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes online payment and cash on delivery.

Service Type Insights:

- Self-Driven

- Chauffeur-Driven

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes self-driven and chauffeur-driven.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Online Car Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Mobile Application-Based, Website-Based |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| Payment Modes Covered | Online Payment, Cash on Delivery |

| Service Types Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico online car rental market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico online car rental market on the basis of booking type?

- What is the breakup of the Mexico online car rental market on the basis of rental length?

- What is the breakup of the Mexico online car rental market on the basis of vehicle type?

- What is the breakup of the Mexico online car rental market on the basis of application?

- What is the breakup of the Mexico online car rental market on the basis of payment mode?

- What is the breakup of the Mexico online car rental market on the basis of service type?

- What is the breakup of the Mexico online car rental market on the basis of region?

- What are the various stages in the value chain of the Mexico online car rental market?

- What are the key driving factors and challenges in the Mexico online car rental market?

- What is the structure of the Mexico online car rental market and who are the key players?

- What is the degree of competition in the Mexico online car rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico online car rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico online car rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico online car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)