Mexico Optical Transceiver Market Size, Share, Trends and Forecast by Form Factor, Fiber Type, Data Rate, Connector Type, Application, and Region, 2025-2033

Mexico Optical Transceiver Market Overview:

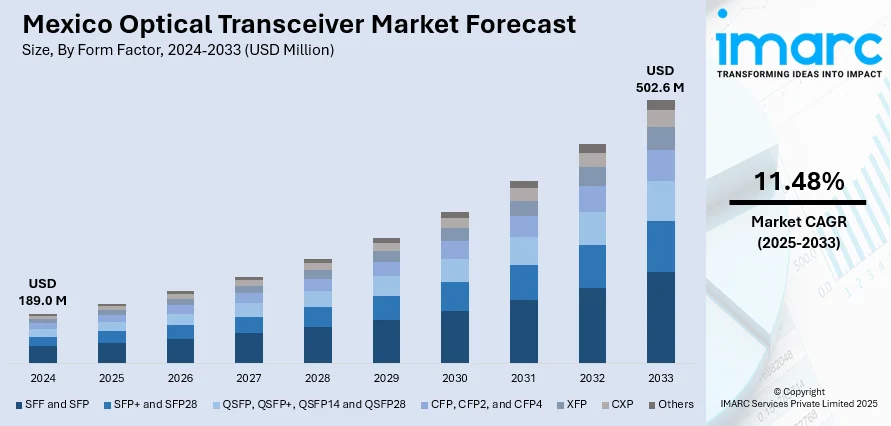

The Mexico optical transceiver market size reached USD 189.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 502.6 Million by 2033, exhibiting a growth rate (CAGR) of 11.48% during 2025-2033. Rising fifth-generation (5G) deployments, expanding data centers, increasing fiber rollout, surging internet usage, digital transformation, cross-border data flows, cloud services adoption, industrial Internet of Things (IoT) expansion, and government support for telecom infrastructure are factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 189.0 Million |

| Market Forecast in 2033 | USD 502.6 Million |

| Market Growth Rate 2025-2033 | 11.48% |

Mexico Optical Transceiver Market Trends:

Rising 5G Deployments

The ongoing deployment of fifth-generation (5G) networks is a critical catalyst for the Mexico optical transceiver market growth. 5G infrastructure demands significantly higher data rates, lower latency, and increased network densification compared to 4G. To meet these technical requirements, telecom operators are investing heavily in fiber-optic backhaul and fronthaul solutions, where optical transceivers play a central role in enabling high-speed transmission between base stations and core networks. In line with this, key service providers are expanding 5G coverage in urban centers such as Mexico City, Monterrey, and Guadalajara, and this expansion is directly translating into increased procurement of optical modules capable of supporting 10G, 25G, and even 100G transmission rates. In 2024, Telcel's 5G network had extended to 125 cities across Mexico, serving over 10 million subscribers. The company emphasized that its 5G infrastructure not only offers high-speed connectivity but also incorporates energy-efficient systems that adjust capacity based on user demand. Additionally, 5G use cases such as smart cities, autonomous vehicles, and ultra-high definition (HD) streaming are accelerating the need for robust, high-capacity network components, which is creating a positive Mexico optical transceiver market outlook.

To get more information of this market, Request Sample

Expanding Data Centers

The growing data center ecosystem is significantly contributing to the rising demand for optical transceivers. As global cloud providers and regional telecom operators continue to expand their infrastructure in the country, the need for high-speed, energy-efficient connectivity solutions has intensified. Cities such as Querétaro are emerging as prime locations for hyperscale data centers due to favorable real estate costs, reliable power supply, and proximity to major urban markets. Within these facilities, optical transceivers are essential for enabling efficient interconnectivity between servers, storage systems, and networking equipment. The shift toward 100G and 400G transceiver modules is becoming more pronounced as operators scale up to support growing volumes of enterprise and consumer data. Moreover, data center interconnect (DCI) solutions require long-range, high-bandwidth optical modules that ensure low-latency and secure transmission across geographically dispersed sites, which is boosting the Mexico optical transceiver market share.

Increased Fiber Rollout

The continued expansion of fiber-optic infrastructure in Mexico is a fundamental driver of the optical transceiver market. As demand for faster and more reliable internet services grows, both public and private stakeholders are investing in large-scale fiber deployment projects. As per the Mexico optical transceiver market forecast, the Federal Telecommunications Institute (IFT) and other regulatory bodies have prioritized broadband accessibility, incentivizing operators to extend fiber coverage to underserved regions. This fiber build-out underpins high-capacity fixed and mobile broadband services, directly increasing the uptake of optical transceivers required at network endpoints and aggregation points. In urban areas, fiber-to-the-home (FTTH) and fiber-to-the-business (FTTB) deployments are gaining momentum, requiring compact and cost-effective transceivers with high data throughput capabilities. In line with this, the growing demand for dedicated fiber links among enterprises to support cloud applications and hybrid work environments is driving the market growth.

Mexico Optical Transceiver Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on form factor, fiber type, data rate, connector type, and application.

Form Factor Insights:

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP14 and QSFP28

- CFP, CFP2, and CFP4

- XFP

- CXP

- Others

The report has provided a detailed breakup and analysis of the market based on the form factor. This includes SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14 and QSFP28, CFP, CFP2, and CFP4, XFP, CXP, and others.

Fiber Type Insights:

- Single Mode Fiber

- Multimode Fiber

A detailed breakup and analysis of the market based on the fiber type have also been provided in the report. This includes single mode fiber and multimode fiber.

Data Rate Insights:

- Less Than 10 Gbps

- 10 Gbps To 40 Gbps

- 40 Gbps To 100 Gbps

- More Than 100 Gbps

A detailed breakup and analysis of the market based on the data rate have also been provided in the report. This includes less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and more than 100 Gbps.

Connector Type Insights:

- LC Connector

- SC Connector

- MPO Connector

- RJ-45

A detailed breakup and analysis of the market based on the connector type have also been provided in the report. This includes LC connector, SC connector, MPO connector, and RJ-45.

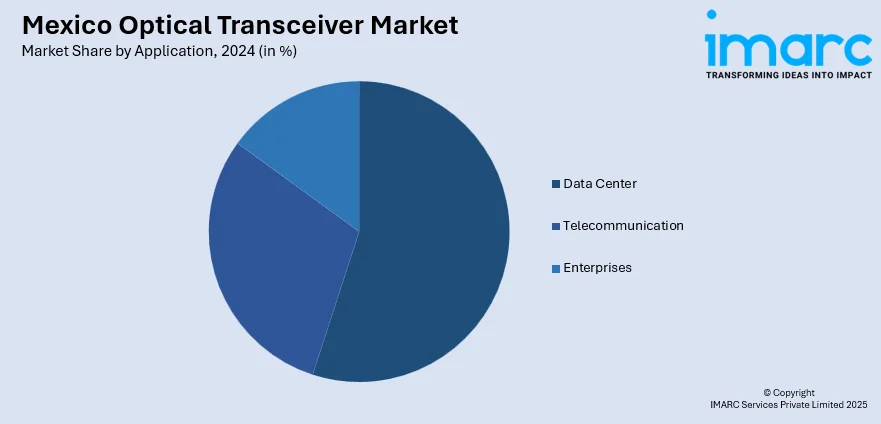

Application Insights:

- Data Center

- Telecommunication

- Enterprises

The report has provided a detailed breakup and analysis of the market based on the application. This includes data center, telecommunication, and enterprises.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Optical Transceiver Market News:

- In 2024, Megacable and Nokia successfully conducted a long-distance optical transmission test, reaching speeds of 1.1 Tbps—the first of its kind in Latin America. This collaboration aims to enhance Megacable’s network capacity, with plans to scale up to 38.4 Tbps in the future.

Mexico Optical Transceiver Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Form Factors Covered | SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14 and QSFP28, CFP, CFP2, and CFP4, XFP, CXP, Others |

| Fiber Types Covered | Single Mode Fiber, Multimode Fiber |

| Data Rates Covered | Less Than 10 Gbps, 10 Gbps To 40 Gbps, 40 Gbps To 100 Gbps, More Than 100 Gbps |

| Connector Types Covered | LC Connector, SC Connector, MPO Connector, RJ-45 |

| Applications Covered | Data Center, Telecommunication, Enterprises |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico optical transceiver market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico optical transceiver market on the basis of form factor?

- What is the breakup of the Mexico optical transceiver market on the basis of fiber type?

- What is the breakup of the Mexico optical transceiver market on the basis of data rate?

- What is the breakup of the Mexico optical transceiver market on the basis of connector type?

- What is the breakup of the Mexico optical transceiver market on the basis of application?

- What is the breakup of the Mexico optical transceiver market on the basis of region?

- What are the various stages in the value chain of the Mexico optical transceiver market?

- What are the key driving factors and challenges in the Mexico optical transceiver market?

- What is the structure of the Mexico optical transceiver market and who are the key players?

- What is the degree of competition in the Mexico optical transceiver market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico optical transceiver market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico optical transceiver market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico optical transceiver industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)