Mexico Oral Hygiene Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033

Mexico Oral Hygiene Market Overview:

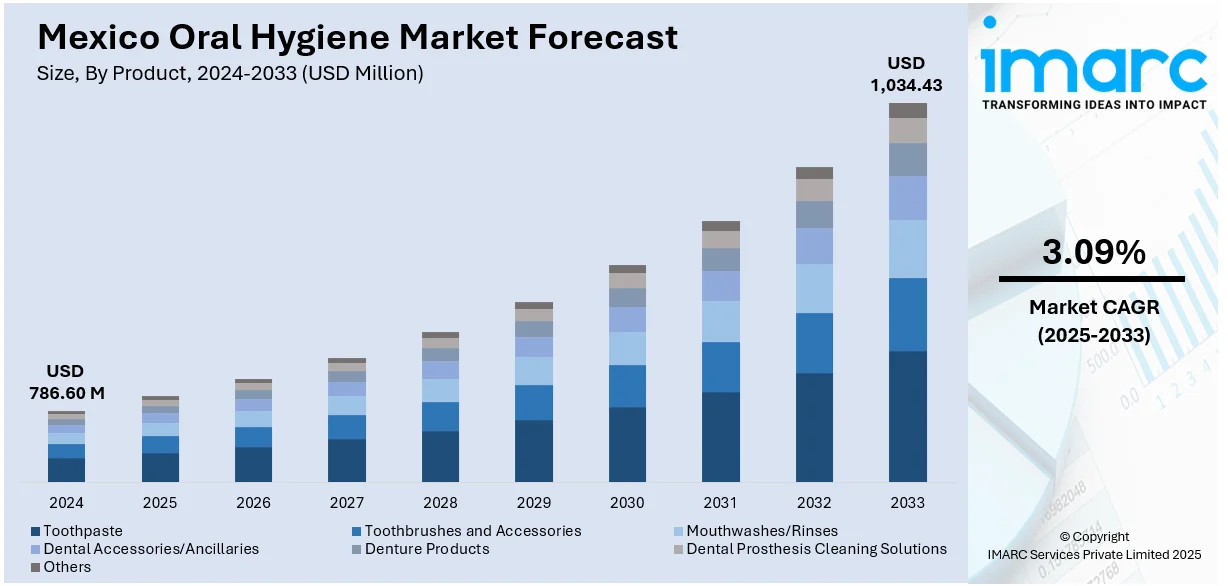

The Mexico oral hygiene market size reached USD 786.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,034.43 Million by 2033, exhibiting a growth rate (CAGR) of 3.09% during 2025-2033. The rising consumer awareness about dental health, growing urbanization, increasing disposable income, the influence of global oral care brands, government-led oral hygiene campaigns, expanding retail channels, higher product availability, and the popularity of herbal and natural formulations are some of the major factors driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 786.60 Million |

| Market Forecast in 2033 | USD 1,034.43 Million |

| Market Growth Rate 2025-2033 | 3.09% |

Mexico Oral Hygiene Market Trends:

Expansion of E-Commerce and Digital Engagement

The growth of e-commerce is significantly reshaping the purchasing landscape for oral hygiene products in Mexico, which is also providing a boost to Mexico oral hygiene market growth. According to industry reports, internet penetration stands at 85.5% among urban residents and 66% in rural areas, indicating strong digital connectivity across both regions. This widespread access is encouraging more consumers to adopt online shopping for oral care needs, driven by the convenience, broader product availability, and the appeal of discounts or subscription-based delivery models. Prominent e-commerce platforms such as Amazon, Mercado Libre, and Walmart are actively expanding their personal care portfolios, making a diverse range of oral hygiene products, including toothbrushes, dental floss, mouthwashes, and specialty toothpaste, easily accessible to consumers in both urban and semi-urban areas. This shift is enabling brands to reach a broader customer base while allowing consumers to compare products, access reviews, and receive home deliveries, thereby reinforcing digital retail as a key distribution channel for oral care in Mexico. Additionally, mobile apps for oral hygiene tracking, virtual dental consultations, and AR-based product demonstrations are being piloted to enhance customer engagement and personalization. As smartphone penetration deepens, digital channels are expected to play an increasingly integral role in consumer purchase decisions.

Increased Adoption of Natural and Herbal Oral Care Products

Consumer preferences in Mexico are gradually shifting toward natural and herbal oral hygiene solutions, which is creating a positive Mexico oral hygiene market outlook. According to industry reports, approximately 90% of Mexicans continue to use botanical remedies, either independently or alongside conventional treatments, with an estimated monthly consumption of 3,500 tons of medicinal plants. This growing inclination is largely driven by heightened awareness of the potential adverse effects associated with synthetic components in conventional oral care formulations. Ingredients such as neem, activated charcoal, clove oil, and aloe vera are gaining popularity among health-conscious consumers seeking safer, plant-based alternatives. Companies are responding by launching herbal variants of toothpaste, mouthwashes, and teeth-whitening products, often promoted as free from parabens, triclosan, or artificial sweeteners. In addition to this, consumers are increasingly evaluating ingredient labels and showing a preference for cruelty-free, vegan, and environmentally responsible brands, which is providing an impetus to the market. Also, Mexican manufacturers and international players are incorporating recyclable packaging and natural extracts to cater to this segment. Marketing strategies highlight botanical ingredients and traditional remedies to reinforce authenticity and trust. Retailers are dedicating more shelf space to these offerings, especially in pharmacies, supermarkets, and online platforms, enabling easier access to consumers nationwide. These factors are collectively augmenting the Mexico oral hygiene market share.

Mexico Oral Hygiene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, distribution channel, and application.

Product Insights:

- Toothpaste

- Toothbrushes and Accessories

- Mouthwashes/Rinses

- Dental Accessories/Ancillaries

- Denture Products

- Dental Prosthesis Cleaning Solutions

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes toothpaste, toothbrushes and accessories, mouthwashes/rinses, dental accessories/ancillaries, denture products, dental prosthesis cleaning solutions, and others.

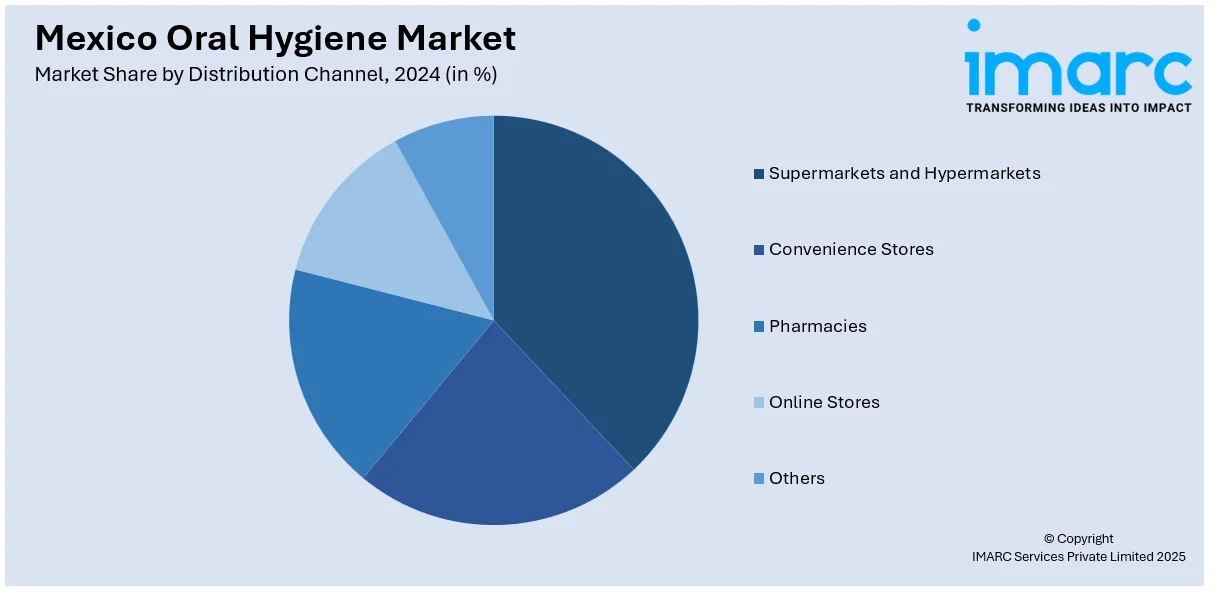

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies, online stores, and others.

Application Insights:

- Adults

- Kids

- Infants

The report has provided a detailed breakup and analysis of the market based on the application. This includes adults, kids, and infants.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Oral Hygiene Market News:

- On March 28, 2025, Smile4EverMexico announced the expansion of its affordable dental care services, offering U.S. patients access to high-quality treatments in Mexico at significantly reduced costs. The clinic provides comprehensive dental procedures, including implants, crowns, and cosmetic dentistry, utilizing advanced technology and experienced professionals to address the rising dental care expenses in the United States. This initiative aims to make dental care more accessible and cost-effective for patients seeking alternatives to high-priced services in their home country.

Mexico Oral Hygiene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toothpaste, Toothbrushes and Accessories, Mouthwashes/Rinses, Dental Accessories/Ancillaries, Denture Products, Dental Prosthesis Cleaning Solutions, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, Others |

| Applications Covered | Adults, Kids, Infants |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico oral hygiene market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico oral hygiene market on the basis of product?

- What is the breakup of the Mexico oral hygiene market on the basis of distribution channel?

- What is the breakup of the Mexico oral hygiene market on the basis of application?

- What is the breakup of the Mexico oral hygiene market on the basis of region?

- What are the various stages in the value chain of the Mexico oral hygiene market?

- What are the key driving factors and challenges in the Mexico oral hygiene market?

- What is the structure of the Mexico oral hygiene market and who are the key players?

- What is the degree of competition in the Mexico oral hygiene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico oral hygiene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico oral hygiene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico oral hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)