Mexico Organic Food and Beverages Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Organic Food and Beverages Market Overview:

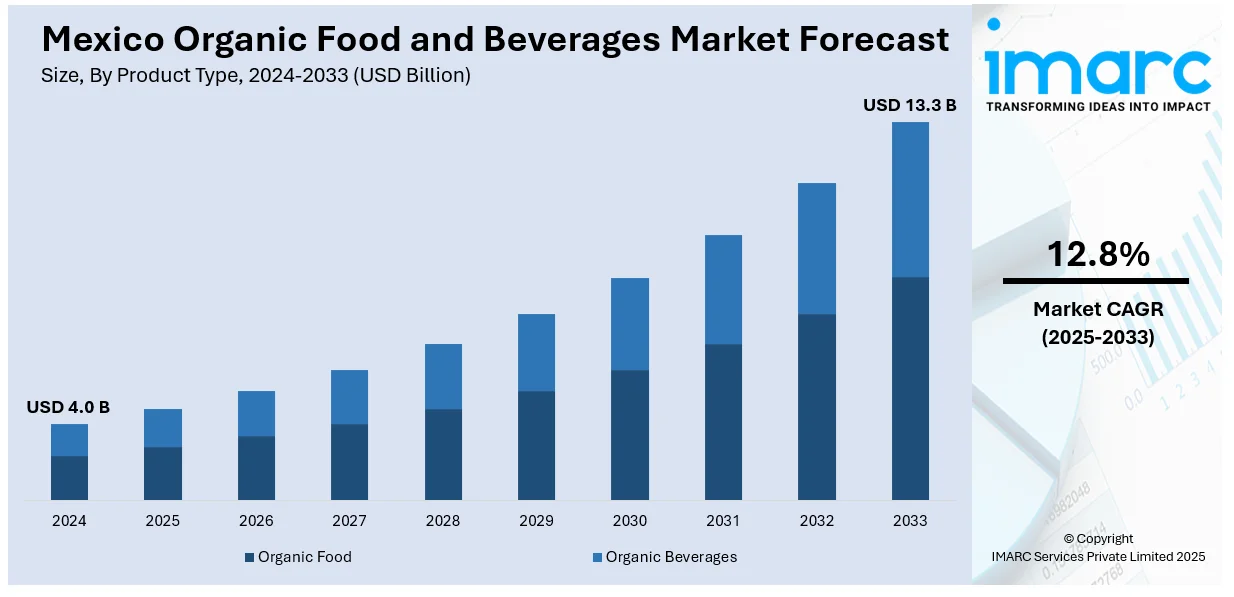

The Mexico organic food and beverages market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.3 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. The market is witnessing substantial growth due to the increasing consumer concern about health and wellness, high biodiversity of the country encouraging climatic conditions to support the growth of various organic crops and implementation of several programs to aid the development of the organic food and drink industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 13.3 Billion |

| Market Growth Rate 2025-2033 | 12.8% |

Mexico Organic Food and Beverages Market Trends:

Increase of Health-Conscious and Ethical Consumption

Mexican consumers are increasingly concerned about health and wellness related to their food and beverage purchases. This is demonstrated by increasing interest in organic food, which is seen as more natural and healthier. According to the IMARC Group, the Mexico health and wellness market size reached USD 52.3 Billion in 2024, and is further expected to reach USD 80.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.58% during 2025-2033. Hence, the preference for naturally derived food and avoidance of synthetic additives reflects a shift toward greater general wellness. Furthermore, the development of front-of-pack (FOP) labeling legislation has raised consumers' concern over sugar, fat, sodium, and levels of calories, also affecting shopping decisions. This new consumer attitude is driving the Mexico organic food and beverages market growth as consumers look for products that conform to their ethical and health-oriented values.

Growth in Organic Beverage Offerings

The organic beverages segment in Mexico is witnessing significant growth, with an increasing variety of products being available for consumers to choose from. Classic drinks such as coffee and cacao are being manufactured organically, demonstrating the rich agricultural history of the country. Newer products such as kombucha and organic juices are also gaining traction, which are helping to meet the demand for functional and health-based beverages. This diversification of organic beverage alternatives is complemented by local manufacturers as well as global brands who delve into the market. The simultaneous presence of these drinks in different retail channels, such as supermarkets and the internet, is extending their availability to a wider consumer base, which is further increasing the Mexico organic food and beverages market share.

Government Support and Certification Advancements

The government of Mexico has inintroduced various programs to aid the development of the organic food and drink industry. The implementation of the National Law of Organic Products has ensured a regulation mechanism that provides guarantee for integrity of organic label and certification schemes. The law helps to increase the export of organic products outside the country, which further aids in advancing Mexico's competitiveness in organic global trade. Moreover, government-sponsored schemes provide farmers who switch to organic production systems, with financial incentives and technical support for sustainable farming. These initiatives are propelling the growth of the organic sector, while also aligning with the overall objectives of environmental sustainability and economic development. This further influences a permanent shift in the Mexico organic food and beverages market outlook.

Mexico Organic Food and Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Organic Food

- Organic Fruit and Vegetables

- Organic Meat, Fish and Poultry

- Organic Dairy Products

- Organic Frozen and Processed Foods

- Others

- Organic Beverages

- Fruit and Vegetable Juices

- Dairy

- Coffee

- Tea

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic food (organic fruits and vegetables, organic meat, fish and poultry, organic dairy products, organic frozen and processed foods, and others) and organic beverages (fruit and vegetable juices, dairy, coffee, tea, and others).

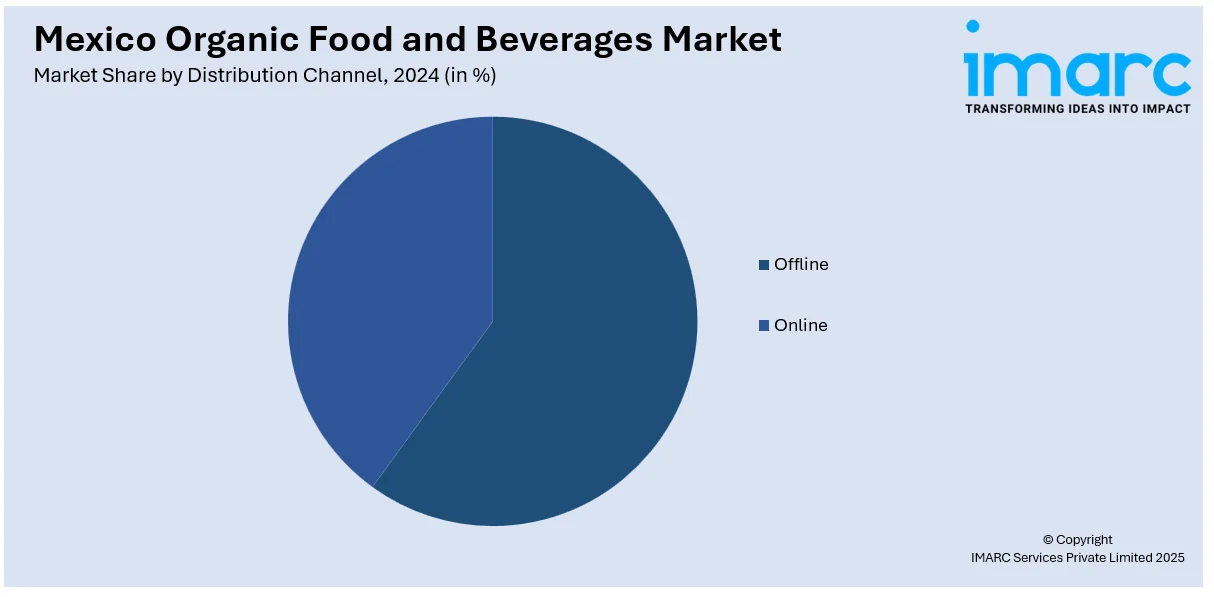

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Organic Food and Beverages Market News:

- In October 2022, Nuherbs, a supplier of Traditional Chinese medicine ingredients, revealed a new collaboration with hibiscus farmers from Mexico aimed at reducing supply chain challenges and carbon emissions.

- In June 2023, Kokomio, LLC. revealed the debut of its coconut juices at Sprouts Farmers Markets. Kokomio, based in Mexico, sources its coconuts locally from Guerrero, Mexico. Mexican coconuts are modestly sweet and have a natural sugar content that is 70% less than other brands. These premium coconuts are carefully selected at their peak, sent directly to Kokomio’s SQF-certified facility in Mexico City, and then bottled and prepared for shipment.

Mexico Organic Food and Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico organic food and beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico organic food and beverages market on the basis of product type?

- What is the breakup of the Mexico organic food and beverages market on the basis of distribution channel?

- What is the breakup of the Mexico organic food and beverages market on the basis of region?

- What are the various stages in the value chain of the Mexico organic food and beverages market?

- What are the key driving factors and challenges in the Mexico organic food and beverages market?

- What is the structure of the Mexico organic food and beverages market and who are the key players?

- What is the degree of competition in the Mexico organic food and beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico organic food and beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico organic food and beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico organic food and beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)