Mexico Organic Snack Foods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Flavor, and Region, 2025-2033

Mexico Organic Snack Foods Market Overview:

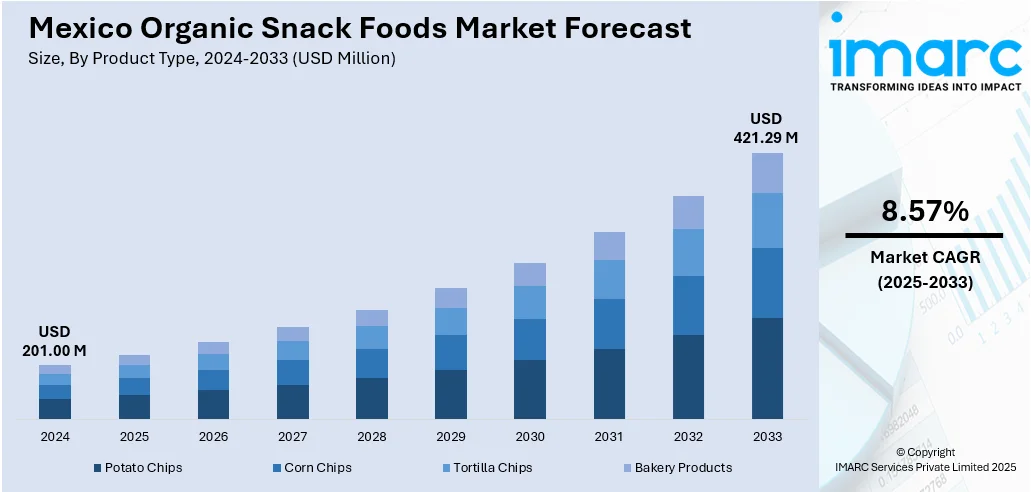

The Mexico organic snack foods market size reached USD 201.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 421.29 Million by 2033, exhibiting a growth rate (CAGR) of 8.57% during 2025-2033. The market is fueled by consumers looking for health-sensitive, clean-label products, increasing demand for native superfoods, such as amaranth and nopal, and expanding access to organic snacks along both offline and online channels. These dynamics indicate a strengthening convergence between local roots and international wellness trends. Improved distribution channels and inclusions of native ingredients are together accelerating product appeal and consumer outreach, which are positively impacting Mexico organic snack foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 201.00 Million |

| Market Forecast in 2033 | USD 421.29 Million |

| Market Growth Rate 2025-2033 | 8.57% |

Mexico Organic Snack Foods Market Trends:

Growth of Clean Label Trends Among Health-Focused Consumers

In Mexico, growing clean label adoption has had a strong impact on consumer behavior in organic snack foods. Consumers are more conscientious about ingredient disclosure, requiring products produced using entire, minimally processed foods that include no artificial additives or preservatives. This trend is influenced by increased concerns for health, nutrition, and the long-term effects of eating chemically altered or genetically modified foods. Natural-tasting snack products that feature wholesome ingredients and minimal ingredient lists, like dried fruit blends, seed bars, and dehydrated vegetable chips are increasingly popular among health-conscious consumers. Broader fitness culture and food awareness, especially among urban millennials and young parents, have driven this trend even more. Organic branding that speaks to authenticity, sustainability, and traceability is increasingly becoming purchase drivers. Consequently, growth in Mexico organic snack foods market is well backed by this clean label movement, opening up new prospects for product innovation that is consistent with health, transparency, and consumer trust. According to the sources, in January 2025, Mexico had 48,874 certified organic producers that controlled 246,899 hectares across the country, second in the world in organic coffee and third in tropical fruit production, solidifying its status as a competitive organic food market (Senasica).

To get more information on this market, Request Sample

Incorporation of Indigenous Ingredients into Organic Snack Formulations

Utilization of indigenous Mexican ingredients into organic snack food innovations is remaking the nation's health-aware food culture. Superfoods like amaranth, chia, cacao, and nopal are being used in organic snacks to provide functional nutrition with rich cultural heritage. Ingredients that were traditionally prized by Mesoamerican cultures for their health benefits are now being utilized in forms such as energy bars, puffed foods, and organic granola to appeal to contemporary shoppers who are interested in both heritage and wellness. By combining heritage agriculture with modern eating patterns, these snacks have distinct taste experiences and nutritional value, including plant proteins and fiber content. This trend also encourages local farmers and conservation of biodiversity through promotion of native crops. The Mexico organic snack food market trends are an integration of innovation and heritage, as companies seek to differentiate their products on the basis of authenticity and cultural significance. This trend supports the market's self-identification as both locally rooted and internationally competitive.

Expansion of Distribution Channels in Urban and Semi-Urban Markets

Mexico's organic snack category is seeing significant growth in its distribution reach, extending beyond metropolitan areas into regional and semi-urban markets. Previously restricted to specialized health food stores, organic snack food is now distributed through major supermarket chains, convenience stores, specialist retailers, and online marketplaces. This broad access has boosted consumer exposure and convenience, enabling more Mexicans to embrace healthier snacking practices. Online stores have been instrumental, providing subscription services and door-to-door delivery options that respond to hectic lifestyles. Product ranges that are healthy-oriented also now appear in school vending machines, workplace snack boxes, and travel retail outlets, indicating an expansion of consumer touchpoints. For instance, in July 2023, Taylor Farms opened up Mexico's organic snack foods market further by launching new ready-to-consume Snack Packs with fresh vegetables and dips, offering easy, healthful alternatives to meet increasing organic snack demand. Moreover, as distribution becomes diversified and more efficient, chances for stable demand and penetration of categories boost immensely. These geographic and logistical spread serves to play a key role in reinforcing Mexico organic snack foods market growth by providing a wider and more diverse consumer base.

Mexico Organic Snack Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and flavor.

Product Type Insights:

- Potato Chips

- Corn Chips

- Tortilla Chips

- Bakery Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes potato chips, corn chips, tortilla chips, and bakery products.

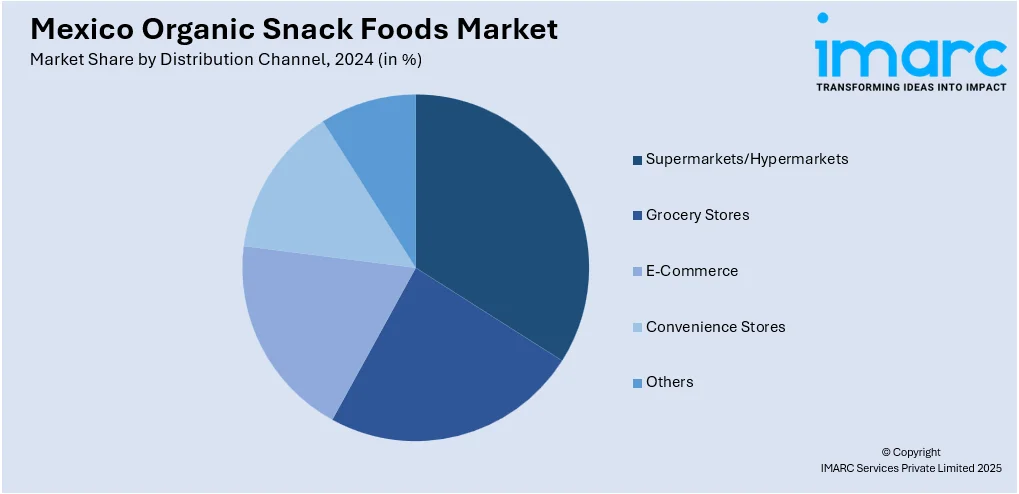

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Grocery Stores

- E-Commerce

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, grocery stores, e-commerce, convenience stores, and others.

Flavor Insights:

- Chocolate

- Vanilla

- Strawberry

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes chocolate, vanilla, strawberry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Organic Snack Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Potato Chips, Corn Chips, Tortilla Chips, Bakery Products |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Grocery Stores, E-Commerce, Convenience Stores, Others |

| Flavors Covered | Chocolate, Vanilla, Strawberry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico organic snack foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico organic snack foods market on the basis of product type?

- What is the breakup of the Mexico organic snack foods market on the basis of distribution channel?

- What is the breakup of the Mexico organic snack foods market on the basis of flavor?

- What is the breakup of the Mexico organic snack foods market on the basis of region?

- What are the various stages in the value chain of the Mexico organic snack foods market?

- What are the key driving factors and challenges in the Mexico organic snack foods?

- What is the structure of the Mexico organic snack foods market and who are the key players?

- What is the degree of competition in the Mexico organic snack foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico organic snack foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico organic snack foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico organic snack foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)