Mexico Over-the-Counter Pain Relievers Market Size, Share, Trends and Forecast by Drug Type, Formulation, Distribution Channel, End User, and Region, 2025-2033

Mexico Over-the-Counter Pain Relievers Market Overview:

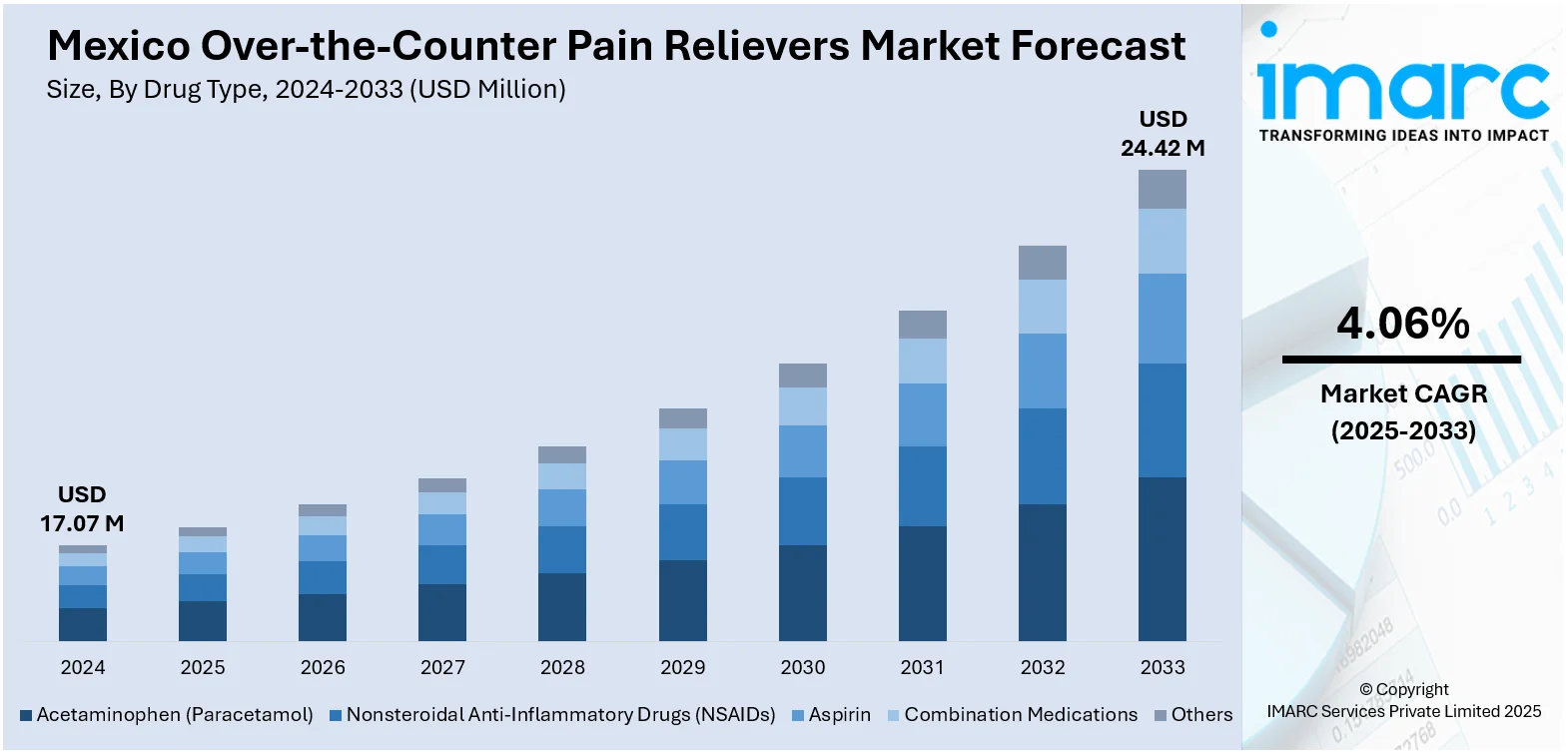

The Mexico over-the-counter pain relievers market size reached USD 17.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 24.42 Million by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033. The expansion of store chains and Mexico's pharmaceutical distribution network are contributing to the market growth. Moreover, people in Mexico are resorting to self-medication as an initial line of action for slight aches, headaches, and muscular discomfort. Apart from this, lifestyle-related illnesses like migraines, backache, and muscle discomfort are fueling the Mexico over-the-counter pain relievers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.07 Million |

| Market Forecast in 2033 | USD 24.42 Million |

| Market Growth Rate 2025-2033 | 4.06% |

Mexico Over-the-Counter Pain Relievers Market Trends:

Rising Self-Medication Trends

People in Mexico are resorting to self-medication as an initial line of action to slight aches, headaches, and muscular discomfort. This is driven by increased access to health information via digital media, which is making it possible for people to make informed decisions without instant reference to medical consultations. In rural and semi-urban areas, poor accessibility of healthcare facilities is further promoting the consumption of over-the-counter (OTC) painkillers as a convenient option. Concurrently, cultural awareness about certain OTC brands and traditional dependence on self-care medications are supporting this trend. Retail stores and pharmacies are also contributing significantly by providing broad product ranges and generating awareness about safe self-medication. With the public becoming health-literate and actively taking the initiative to treat common pain conditions, demand for readily available, affordable, and effective OTC painkillers is continuously increasing across both urban and rural markets. In 2025, Innocan Pharma Corporation, an innovator in the pharmaceutical and biotechnology sectors, revealed that the Mexican patent office has granted a notice of allowance for the Company's patent application regarding its unique topical pain-relief technology.

To get more information on this market, Request Sample

Increasing Retail Infrastructure and E-Commerce Penetration

The expansion of store chains and Mexico's pharmaceutical distribution network are contributing to the Mexico over-the-counter pain relievers market growth. Pharmacies are being upgraded and expanded in the offline space, especially in Tier II and Tier III cities, making products more accessible and visible. At the same time, online channels are revolutionizing the way individuals buy these products through 24/7 convenience, doorstep delivery, and price competitiveness. This change is facilitated by heightened overall digital adoption and logistics infrastructure improvements. Online pharmacies are incorporating educational content and customer feedback, raising buyer trust and driving sales. Digital discount tactics and subscription-based delivery models are also popularizing, particularly with younger, technology-oriented individuals. This retail shift is allowing manufacturers to connect with larger audiences, simplify supply chains, and maximize point-of-sale promotions, all of which are collectively improving the market. The IMARC Group predicts that the Mexico e-commerce market size is projected to attain USD 176.6 Billion by 2033.

Rising Prevalence of Lifestyle-Related Illnesses and Stress

At present, lifestyle-related illnesses like migraines, backache, and muscle discomfort are occurring due to working longer hours, having sedentary lifestyles, and urban stress factors. Since individuals are having more frequent minor illnesses related to daily activities and work-related stress, they are turning more towards quick-acting OTC pain management treatments to ensure productivity and quality of life. Additionally, the changes in work culture and norms of lifestyle, such as increased screen usage and decreased physical activity, are strengthening the market growth. All these are leading to a rise in musculoskeletal pain and associated symptoms. The availability of OTC drugs like ibuprofen, paracetamol, and combination drugs is providing an easy solution, particularly in the context of fast-paced urban lifestyles where time management is of the essence.

Mexico Over-the-Counter Pain Relievers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on drug type, formulation, distribution channel, and end user.

Drug Type Insights:

- Acetaminophen (Paracetamol)

- Nonsteroidal Anti-Inflammatory Drugs (NSAIDs)

- Aspirin

- Combination Medications

- Others

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes acetaminophen (paracetamol), nonsteroidal anti-inflammatory drugs (NSAIDs), aspirin, combination medications, and others.

Formulation Insights:

- Tablets and Capsules

- Gels and Ointments

- Sprays

- Liquids and Syrups

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes tablets and capsules, gels and ointments, sprays, and liquids and syrups.

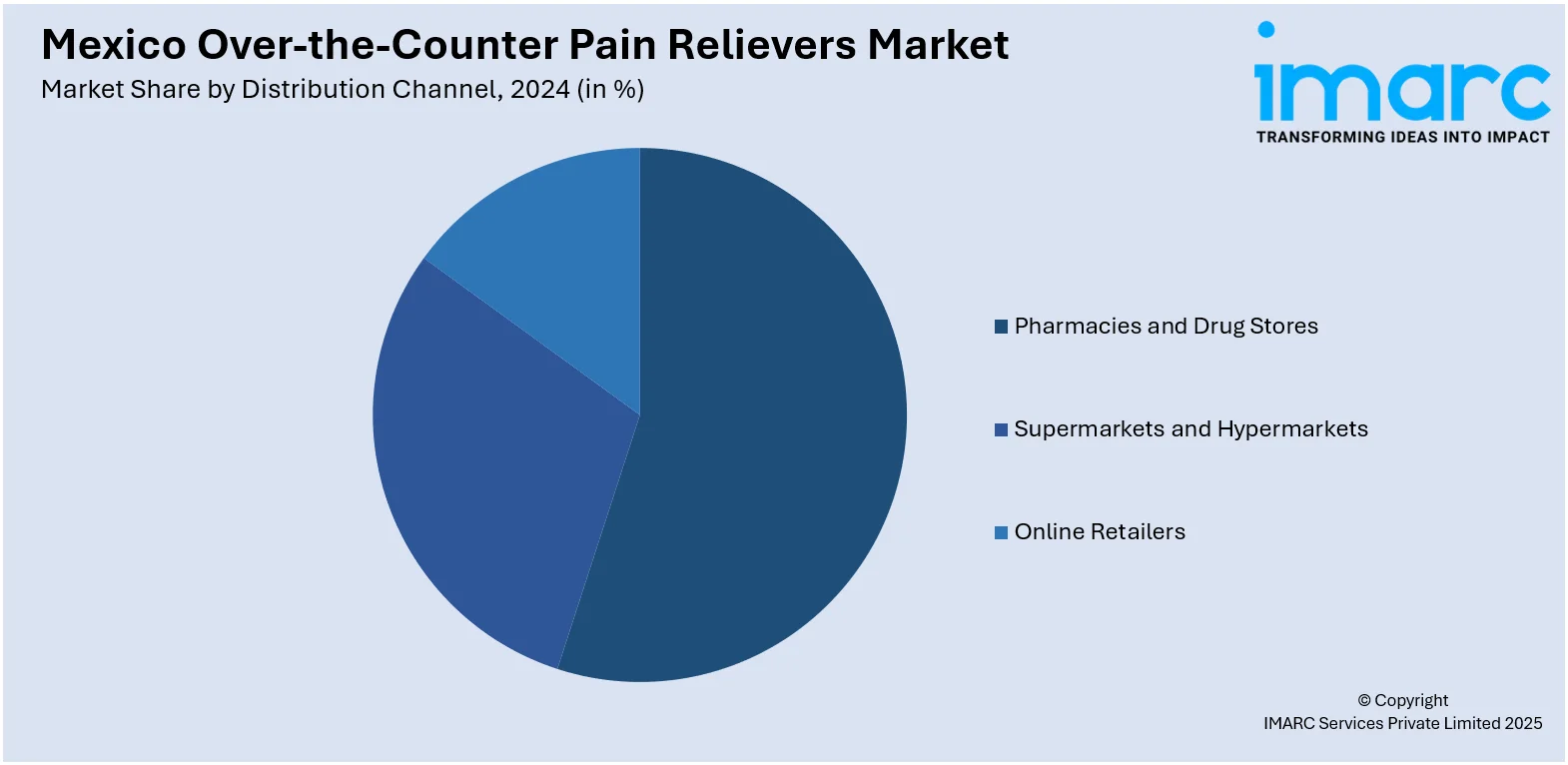

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retailers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes pharmacies and drug stores, supermarkets and hypermarkets, and online retailers.

End User Insights:

- Adults

- Pediatric

- Geriatric

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes adults, pediatric, and geriatric.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Over-the-Counter Pain Relievers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Acetaminophen (Paracetamol), Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Aspirin, Combination Medications, Others |

| Formulations Covered | Tablets and Capsules, Gels and Ointments, Sprays, Liquids and Syrups |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retailers |

| End Users Covered | Adults, Pediatric, Geriatric |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico over-the-counter pain relievers market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico over-the-counter pain relievers market on the basis of drug type?

- What is the breakup of the Mexico over-the-counter pain relievers market on the basis of formulation?

- What is the breakup of the Mexico over-the-counter pain relievers market on the basis of distribution channel?

- What is the breakup of the Mexico over-the-counter pain relievers market on the basis of end user?

- What is the breakup of the Mexico over-the-counter pain relievers market on the basis of region?

- What are the various stages in the value chain of the Mexico over-the-counter pain relievers market?

- What are the key driving factors and challenges in the Mexico over-the-counter pain relievers market?

- What is the structure of the Mexico over-the-counter pain relievers market and who are the key players?

- What is the degree of competition in the Mexico over-the-counter pain relievers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico over-the-counter pain relievers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico over-the-counter pain relievers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico over-the-counter pain relievers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)