Mexico Over-the-Counter Pharmaceutical Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Formulation, and Region, 2025-2033

Mexico Over-the-Counter Pharmaceutical Market Overview:

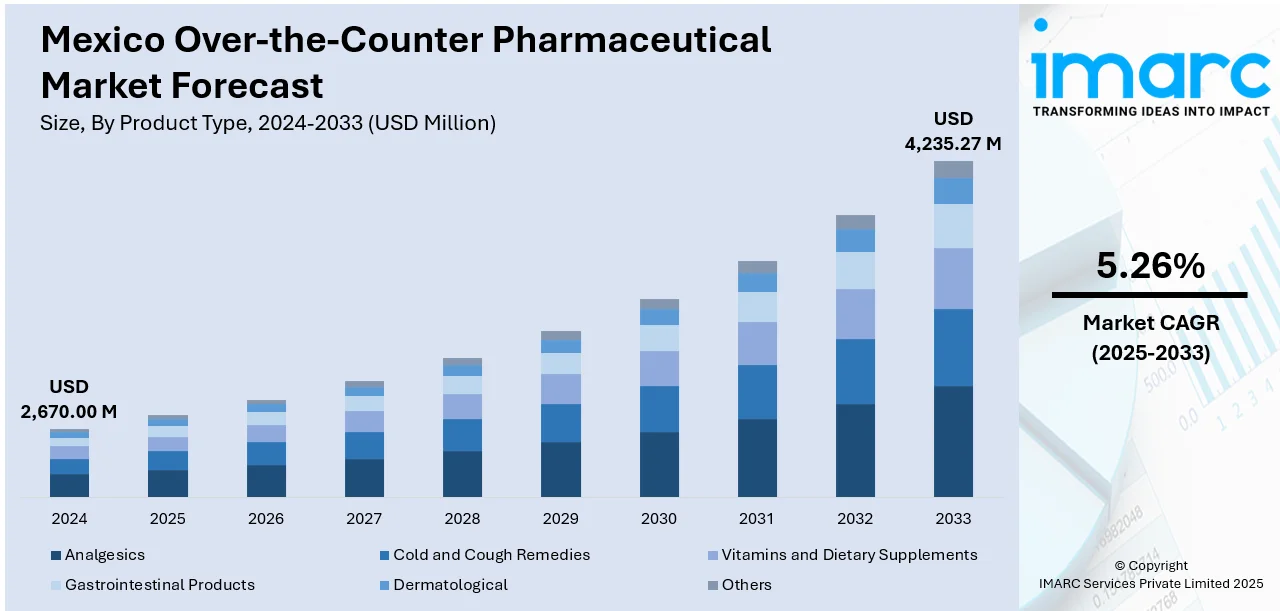

The Mexico over-the-counter pharmaceutical market size reached USD 2,670.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,235.27 Million by 2033, exhibiting a growth rate (CAGR) of 5.26% during 2025-2033. At present, individuals are acknowledging the significance of early intervention and prevention, resulting in an increased shift towards self-treatment with over-the-counter items. Besides this, the broadening of e-commerce portals, which aid in enhancing product availability, is contributing to the expansion of the Mexico over-the-counter pharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,670.00 Million |

| Market Forecast in 2033 | USD 4,235.27 Million |

| Market Growth Rate 2025-2033 | 5.26% |

Mexico Over-the-Counter Pharmaceutical Market Trends:

Growing health awareness

Increasing health awareness is positively influencing the market in Mexico. People are recognizing the importance of early intervention and prevention, leading to a higher preference for self-medication using over-the-counter products. Individuals are seeking remedies for common ailments like headaches, colds, digestive issues, and allergies without consulting a doctor, which is driving the demand for over-the-counter drugs. Health campaigns and educational content are further spreading awareness about maintaining wellness, encouraging people to keep basic medications at home. This transition is motivating individuals to make informed choices and rely more on pharmacy-based purchases. As consciousness about lifestyle-related issues, such as stress, poor diet, and lack of exercise, is growing, people are adopting supplements, vitamins, and pain relievers more readily. Increased health awareness is also catalyzing the demand for herbal and natural over-the-counter remedies, aligning with the ongoing trend of employing safer and chemical-free options. Urban population, in particular, is using over-the-counter medications as part of its regular health routines. Rising disposable incomes are supporting this behavior, allowing people to spend more on non-prescription health products. Overall, the growing health and wellness awareness is shaping user habits and playing a central role in expanding the market. According to the IMARC Group, the Mexico health and wellness market is set to attain USD 80.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.58% during 2025-2033.

To get more information on this market, Request Sample

Expansion of e-commerce portals

The development of e-commerce sites is fueling the Mexico over-the-counter pharmaceutical market growth. According to the PCMI, Mexico ranked as the second-largest e-commerce market in Latin America, with a projected volume of USD 97 Billion in 2024. Online platforms offer a wide assortment of over-the-counter products, allowing people to evaluate prices, check feedback, and make better decisions from the comfort of their residences. This online ease especially benefits those in remote or underserved areas where physical pharmacies may be limited. E-commerce also supports discreet purchasing, which appeals to people seeking privacy for sensitive health needs. Fast delivery options and promotional discounts further encourage online purchases. Pharmacies and retailers are investing in digital infrastructure, mobile apps, and user-friendly websites to tap into the growing online customer base. The rising use of smartphones and digital payment methods is boosting this trend.

Rising advertising and marketing campaigns

Increasing advertising and marketing campaigns are propelling the market growth. Companies are using various channels like social media, including YouTube and Instagram, print, and digital ads to reach a wide audience and highlight product benefits. As per industry reports, in Mexico, the number of people who used YouTube reached 83.1 Million in 2024. Advertising campaigns build trust and influence user buying decisions by showcasing effectiveness and safety. Marketing efforts also aid in promoting new product launches and seasonal offers, encouraging trial and repeat purchases. Influencer collaborations and health-related content help connect with younger and health-conscious individuals. Strong branding and consistent messaging increase product visibility and loyalty. Overall, advertising and marketing campaigns are driving the demand and sales by engaging people and making them more informed about health options.

Mexico Over-the-Counter Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and formulation.

Product Type Insights:

- Analgesics

- Cold and Cough Remedies

- Vitamins and Dietary Supplements

- Gastrointestinal Products

- Dermatological

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes analgesics, cold and cough remedies, vitamins and dietary supplements, gastrointestinal products, dermatological, and others.

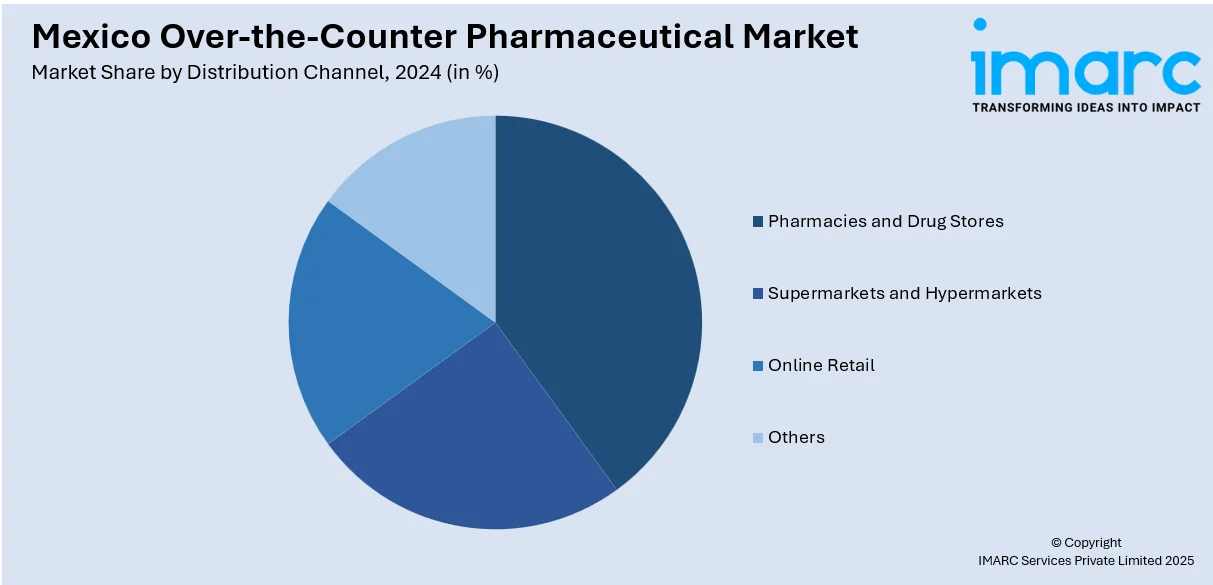

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, supermarkets and hypermarkets, online retail, and others.

Formulation Insights:

- Tablets and Capsules

- Liquids and Syrups

- Topicals

- Creams

- Ointments

- Others

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes tablets and capsules, liquids and syrups, topicals (creams and ointments), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Over-the-Counter Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Analgesics, Cold and Cough Remedies, Vitamins and Dietary Supplements, Gastrointestinal Products, Dermatological, Others |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retail, Others |

| Formulations Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico over-the-counter pharmaceutical market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico over-the-counter pharmaceutical market on the basis of product type?

- What is the breakup of the Mexico over-the-counter pharmaceutical market on the basis of distribution channel?

- What is the breakup of the Mexico over-the-counter pharmaceutical market on the basis of formulation?

- What is the breakup of the Mexico over-the-counter pharmaceutical market on the basis of region?

- What are the various stages in the value chain of the Mexico over-the-counter pharmaceutical market?

- What are the key driving factors and challenges in the Mexico over-the-counter pharmaceutical market?

- What is the structure of the Mexico over-the-counter pharmaceutical market and who are the key players?

- What is the degree of competition in the Mexico over-the-counter pharmaceutical market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico over-the-counter pharmaceutical market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico over-the-counter pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico over-the-counter pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)