Mexico Overhead Cranes Market Size, Share, Trends and Forecast by Type, Lifting Capacity, End Use, and Region, 2025-2033

Mexico Overhead Cranes Market Overview:

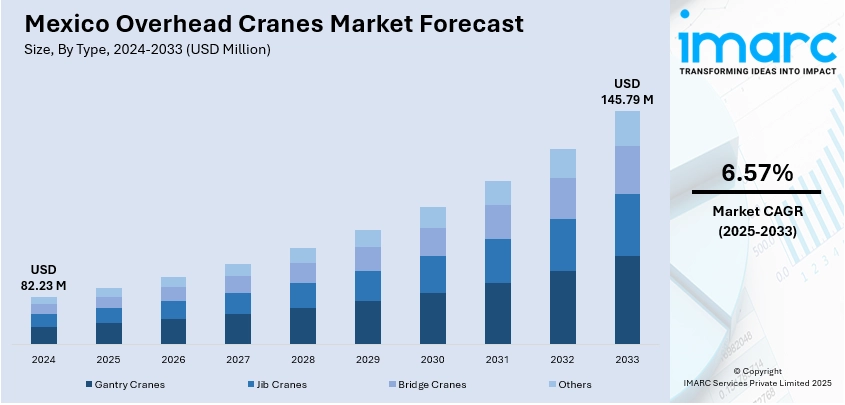

The Mexico overhead cranes market size reached USD 82.23 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 145.79 Million by 2033, exhibiting a growth rate (CAGR) of 6.57% during 2025-2033. Government spending on logistics and industrial modernization, along with warehouse automation and safety standards enforcement, is one of the factors contributing to Mexico overhead cranes market share. Growing construction, infrastructure upgrades, and the automotive and manufacturing sectors are increasing demand for efficient material handling.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.23 Million |

| Market Forecast in 2033 | USD 145.79 Million |

| Market Growth Rate 2025-2033 | 6.57% |

Mexico Overhead Cranes Market Trends:

Increased Focus on Operational Efficiency and Space Optimization

The overhead cranes market in Mexico is aligning more closely with the specific layout and spatial constraints of industrial facilities. Companies are prioritizing equipment that not only meets lifting capacity needs but also integrates smoothly into existing infrastructure. This has led to growing interest in cranes that can be adapted to unique building dimensions without requiring extensive structural changes. Projects increasingly involve collaborative planning between suppliers and clients to ensure equipment is tailored to available space while maintaining safety and performance standards. Additionally, there’s a stronger emphasis on improving overall operational flow. Overhead crane systems are being evaluated not just for load handling, but also for how they support productivity, reduce manual intervention, and optimize floor usage. This focus is especially relevant in sectors where real estate and indoor space are at a premium. Pre-installation support services, like trial lifts, detailed manuals, and visual guides, are becoming expected as part of the delivery process. These added services help clients implement systems faster and with fewer errors, reflecting a market-wide shift toward reliability, ease of use, and faster return on investment from crane installations. These factors are intensifying the Mexico overhead cranes market growth.

To get more information on this market, Request Sample

Shift toward Modular and Precision-Focused Overhead Cranes

Mexico’s overhead crane market is increasingly moving toward solutions that offer both transport efficiency and high performance. Modular designs that simplify disassembly and container transport are gaining ground, especially among manufacturers aiming to reduce shipping and installation costs. Precision technology, including variable frequency drives, is becoming a key requirement as local industries demand tighter control over lifting operations. Clients are also favoring custom setups, such as single-hook configurations, when they result in lower budgets and streamlined operations. These shifts reflect a broader preference for supplier adaptability, practical engineering, and investment in systems that align with both financial and technical goals. As manufacturing operations grow, demand for versatile and tailored crane systems is expected to keep rising. For instance, in September 2023, Kinocranes successfully delivered overhead cranes to a high-end manufacturing client in Mexico, featuring a modular European design for easy container transport and reduced logistics costs. The project included two 10-ton and one 20-ton double-girder cranes. Precision was ensured with variable frequency drives. Kinocranes’ tailored recommendation of a single-hook setup also helped cut the client's budget, demonstrating their deep industry knowledge and customer-first approach.

Mexico Overhead Cranes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, lifting capacity, and end use.

Type Insights:

- Gantry Cranes

- Jib Cranes

- Bridge Cranes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes gantry cranes, jib cranes, bridge cranes, and others.

Lifting Capacity Insights:

- Up to 5 Ton

- 6-10 Ton

- 11-50 Ton

- More Than 50 Ton

A detailed breakup and analysis of the market based on the lifting capacity have also been provided in the report. This includes Up to 5 ton, 6-10 tone, 11-50 ton, and more than 50 ton.

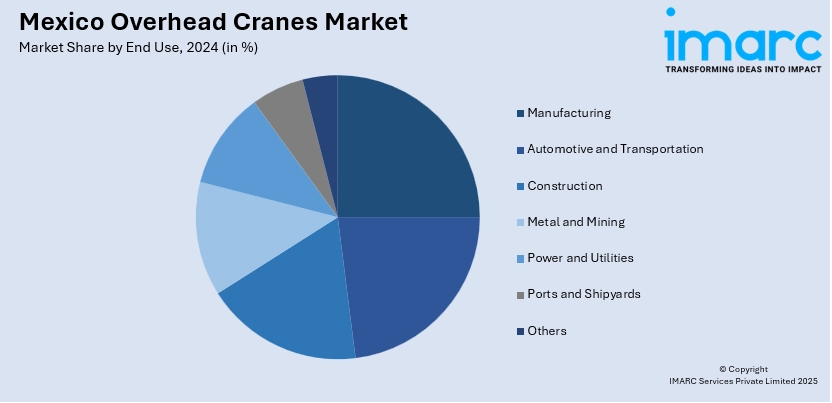

End Use Insights:

- Manufacturing

- Automotive and Transportation

- Construction

- Metal and Mining

- Power and Utilities

- Ports and Shipyards

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, automotive and transportation, construction, metal and mining, power and utilities, ports and shipyards, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Overhead Cranes Market News:

- In February 2025, BW Crane exported over 20 customized overhead cranes to an industrial zone in Mexico, reinforcing its global presence. Each crane was tailored to the client's plant layout, with detailed installation support including manuals, videos, and trial lifting. Known for their stability, the cranes ensure safe and efficient operations. This delivery meets Mexico's industrial demands and reflects BW Crane’s dedication to high-quality international lifting solutions.

Mexico Overhead Cranes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gantry Cranes, Jib Cranes, Bridge Cranes, Others |

| Lifting Capacities Covered | Up to 5 Ton, 6-10 Ton, 11-50 Ton, More Than 50 Ton |

| End Uses Covered | Manufacturing, Automotive and Transportation, Construction, Metal and Mining, Power and Utilities, Ports and Shipyards, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico overhead cranes market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico overhead cranes market on the basis of type?

- What is the breakup of the Mexico overhead cranes market on the basis of lifting capacity?

- What is the breakup of the Mexico overhead cranes market on the basis of end use?

- What is the breakup of the Mexico overhead cranes market on the basis of region?

- What are the various stages in the value chain of the Mexico overhead cranes market?

- What are the key driving factors and challenges in the Mexico overhead cranes market?

- What is the structure of the Mexico overhead cranes market and who are the key players?

- What is the degree of competition in the Mexico overhead cranes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico overhead cranes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico overhead cranes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico overhead cranes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)