Mexico Paper Chemicals Market Size, Share, Trends and Forecast by Type, Form, and Region, 2025-2033

Mexico Paper Chemicals Market Overview:

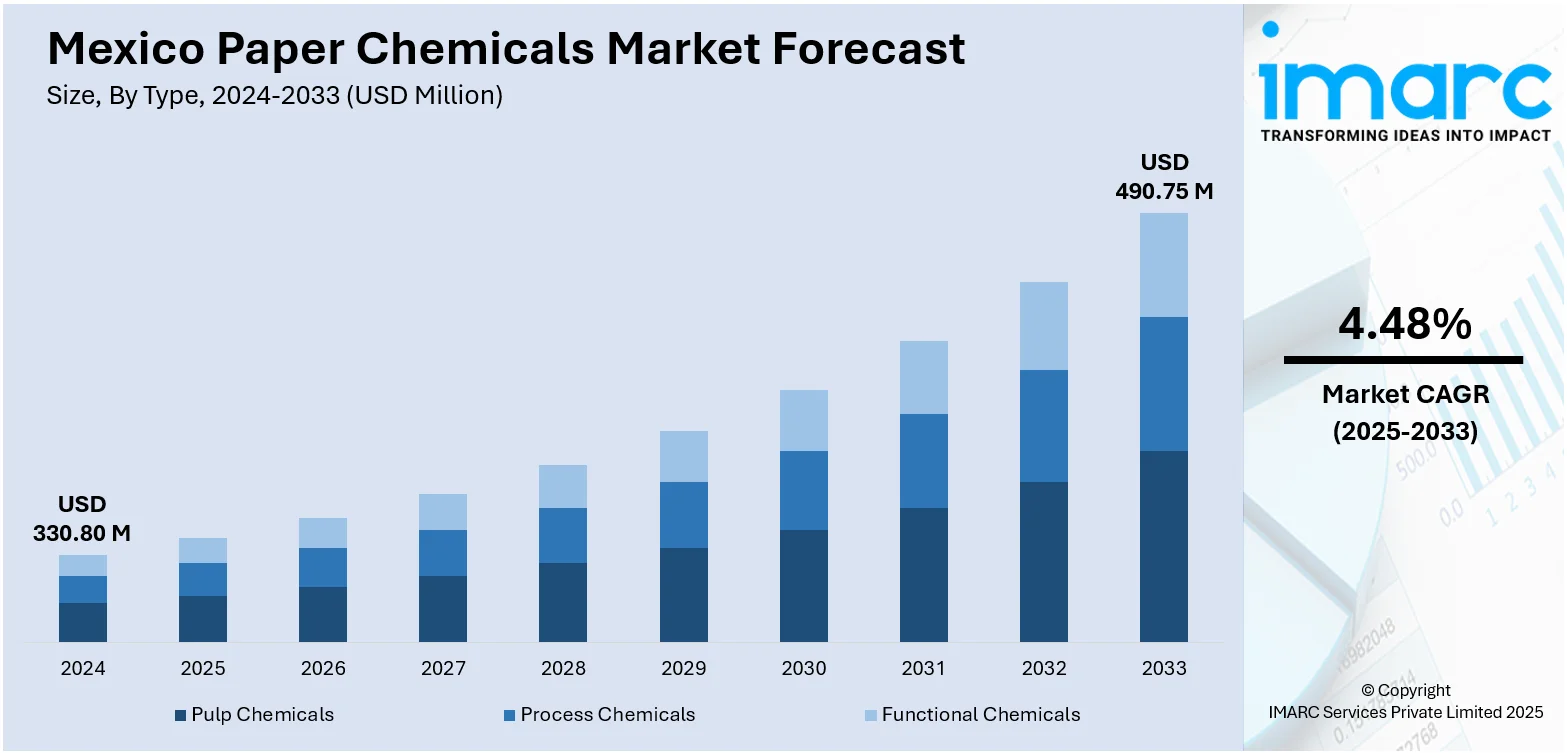

The Mexico paper chemicals market size reached USD 330.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 490.75 Million by 2033, exhibiting a growth rate (CAGR) of 4.48% during 2025-2033. The market is driven by the growing demand for high-quality packaging and printing paper, particularly in the food and beverage and e-commerce sectors. Along with this, increasing industrialization and a shift toward sustainable, biodegradable paper products have prompted the adoption of specialty paper chemicals to enhance product performance. Additionally, supportive government regulations and rising investments in modernizing paper manufacturing facilities are accelerating the use of process and functional chemicals, further augmenting the Mexico paper chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 330.80 Million |

| Market Forecast in 2033 | USD 490.75 Million |

| Market Growth Rate 2025-2033 | 4.48% |

Mexico Paper Chemicals Market Trends:

Growing Demand for High-Quality Packaging and Printing Paper

Mexico's consumer goods, e-commerce, and food and beverage sectors are driving demand for high-quality packaging and printing paper. With increased urbanization and rising disposable incomes, the packaging industry has shifted toward more visually appealing, durable, and sustainable materials. As a result, converters and packaging companies now require specialty chemicals such as sizing agents, wet-strength resins, surface coatings, and optical brighteners that enhance printability, gloss, moisture resistance, and structural integrity. Moreover, companies across retail and FMCG are adopting premium paper substrates with precise color reproduction and consistent surface quality, which is pushing chemical suppliers to develop tailored formulations that improve ink adhesion, prevent feathering, and support high-speed printing. Additionally, there is a shift toward recyclable and biodegradable paper packaging, which requires novel chemical solutions that maintain performance while aligning with environmental regulations. According to industry reports, the Mexico green packaging market is expected to reach USD 5,993.57 Million by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. As this market expands, it creates significant opportunities for chemical suppliers to innovate in biodegradable coatings, adhesives, and barrier technologies that support the paper industry's commitment to sustainability. Besides this, these demands are creating steady growth opportunities for suppliers of functional additives and eco-friendly paper treatment chemicals.

To get more information on this market, Request Sample

Rising Investments in Modernizing Paper Manufacturing Facilities

Paper producers in Mexico are increasingly investing in plant upgrades to improve efficiency, reduce waste, and meet international quality standards. This, in turn, is contributing to Mexico paper chemicals market growth. For instance, on January 27, 2025, Balaji JMC Paper Mill, a subsidiary of JMC Paper Tech, inaugurated its first paper mill in Mexico, located in Ciudad Juárez. The mill, with a 200 TPD Kraft test liner capacity, will produce 100% recycled test liner paper and features advanced automation and an effluent treatment plant for sustainable operations. With a USD 60 Million investment, the mill creates over 200 direct jobs and plans future expansions, aiming to invest USD 200 Million in Mexico in the upcoming five years and spend about USD 500 Million in the next decade. Consequently, there is a growing need for high-performance process chemicals, such as retention aids, deinking agents, and defoamers, that can deliver consistent results across automated, high-speed systems. Local and international suppliers are responding by offering tailored chemical solutions that reduce downtime, optimize dosage, and support predictive maintenance. As mills adopt digital monitoring and process automation, there is a parallel requirement for chemicals that perform reliably under tighter process parameters, ensuring stable production and quality control. This alignment between plant upgrades and chemical demand is reshaping procurement strategies across the industry.

Mexico Paper Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and form.

Type Insights:

- Pulp Chemicals

- Process Chemicals

- Functional Chemicals

The report has provided a detailed breakup and analysis of the market based on the type. This includes pulp chemicals, process chemicals, and functional chemicals.

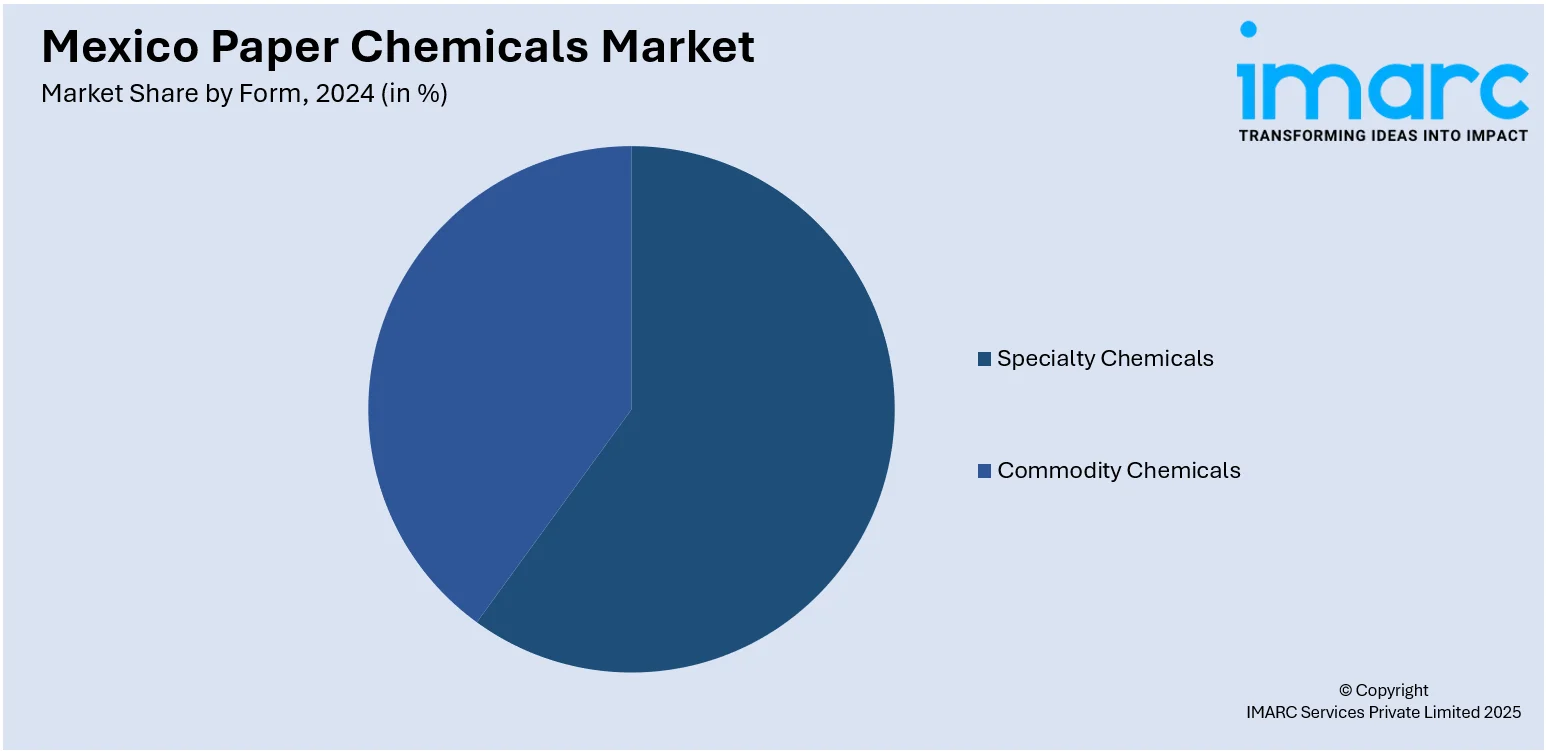

Form Insights:

- Specialty Chemicals

- Commodity Chemicals

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes specialty chemicals and commodity chemicals.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Paper Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pulp Chemicals, Process Chemicals, Functional Chemicals |

| Forms Covered | Specialty Chemicals, Commodity Chemicals |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico paper chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico paper chemicals market on the basis of type?

- What is the breakup of the Mexico paper chemicals market on the basis of form?

- What is the breakup of the Mexico paper chemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico paper chemicals market?

- What are the key driving factors and challenges in the Mexico paper chemicals market?

- What is the structure of the Mexico paper chemicals market and who are the key players?

- What is the degree of competition in the Mexico paper chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico paper chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico paper chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico paper chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)