Mexico Paper Cups Market Size, Share, Trends and Forecast by Cup Type, Wall Type, Application, Distribution Channel, End User, and Region, 2025-2033

Mexico Paper Cups Market Overview:

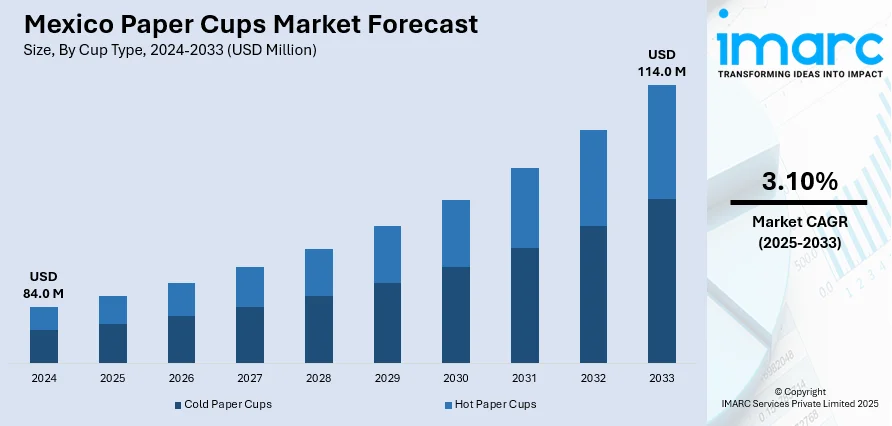

The Mexico paper cups market size reached USD 84.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 114.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The market is experiencing significant growth due to rising demand for sustainable packaging, growing coffee consumption among millennials, and rapid growth of QSRs and delivery services. Furthermore, environmental regulations and regional urbanization also support long-term market development and diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 84.0 Million |

| Market Forecast in 2033 | USD 114.0 Million |

| Market Growth Rate 2025-2033 | 3.10% |

Mexico Paper Cups Market Trends:

Shift Toward Eco-Friendly Alternatives

Environmental concerns are increasingly influencing consumer and business preferences across Mexico, prompting a significant shift from plastic to biodegradable paper cups. Rising awareness around plastic pollution, along with mounting pressure from local and federal regulations banning single-use plastics, has accelerated the demand for sustainable alternatives. Businesses in the foodservice, hospitality, and institutional sectors are actively switching to eco-friendly packaging to meet regulatory standards and align with customer expectations. Manufacturers are responding by developing paper cups with compostable or recyclable linings, often made from plant-based or water-dispersible materials. This green transition is also gaining traction in retail spaces and among event organizers, where sustainability is becoming a core decision-making factor. The shift not only reflects changing environmental values but also supports long-term Mexico paper cups market growth, especially among brands seeking to improve their environmental credentials.

Expansion of Food Delivery and QSR Chains

The rapid growth of food delivery services and quick service restaurant (QSR) chains across urban centers in Mexico is significantly driving the demand for disposable paper cups. With consumers increasingly favoring convenience and speed, particularly in cities like Mexico City, Guadalajara, and Monterrey, on-the-go beverages and takeaway meals have become a part of daily routines. Paper cups are widely used for serving coffee, cold drinks, and desserts in both dine-out and delivery formats. The rise of app-based food delivery platforms has further amplified this trend, leading to increased bulk orders of paper cups by restaurants and beverage chains. Many brands also seek customized, branded paper cups to enhance visibility and customer recall. This growing reliance on disposable packaging, particularly in fast-paced urban areas, is a strong driver shaping the Mexico paper cups market outlook over the coming years.

Rising Coffee Culture Among Millennials

Mexico’s millennial population is fueling a surge in coffee consumption, with a growing preference for premium brews, specialty cafés, and international coffee chains. Urban youth increasingly favor takeaway coffee, creating steady demand for hot paper cups that offer insulation and branding flexibility. The rise of artisanal cafés and boutique roasters catering to this demographic has expanded the need for customized, eco-friendly cups. Many of these outlets prioritize sustainable packaging, aligning with the broader shift toward biodegradable materials. As coffee culture deepens in cities like Mexico City and Monterrey, hot beverage sales are influencing procurement patterns among both independent and chain outlets. This upward trend in daily coffee consumption is expected to remain strong, particularly in metropolitan and college-heavy zones. The resulting increase in demand for hot paper cups is contributing notably to the Mexico paper cups market share.

Mexico Paper Cups Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on cup type, wall type, application, distribution channel, and end user.

Cup Type Insights:

- Cold Paper Cups

- Hot Paper Cups

The report has provided a detailed breakup and analysis of the market based on the cup type. This includes cold paper cups and hot paper cups.

Wall Type Insights:

- Single Wall

- Double Wall

- Triple Wall

A detailed breakup and analysis of the market based on the wall type have also been provided in the report. This includes single wall, double wall, and triple wall.

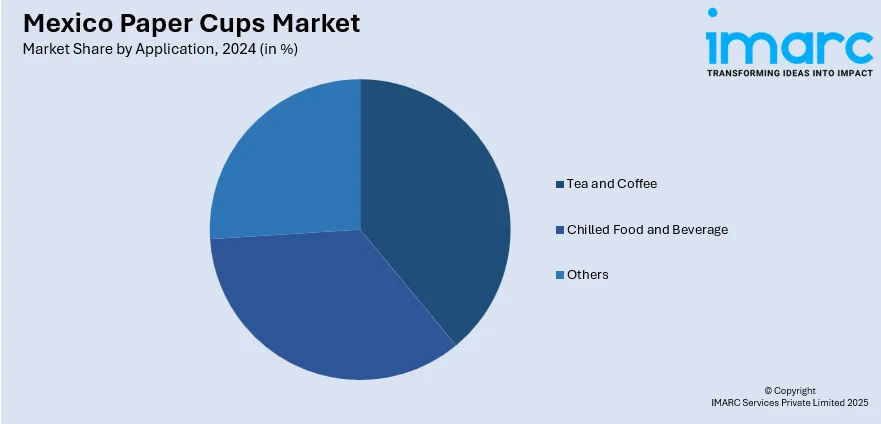

Application Insights:

- Tea and Coffee

- Chilled Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tea and coffee, chilled food and beverage, and others.

Distribution Channel Insights:

- Institutional Sales

- Retail Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes institutional sales and retail sales.

End User Insights:

- Coffee and Tea Shops

- QSR and Other Fast Food Shops

- Offices and Educational Institutions

- Residential Use

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes coffee and tea shops, QSR and other fast food shops, offices and educational institutions, residential use, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Paper Cups Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cup Types Covered | Cold Paper Cups, Hot Paper Cups |

| Wall Types Covered | Single Wall, Double Wall, Triple Wall |

| Applications Covered | Tea and Coffee, Chilled Food and Beverage, Others |

| Distribution Channels Covered | Institutional Sales, Retail Sales |

| End Users Covered | Coffee and Tea Shops, QSR and Other Fast Food Shops, Offices and Educational Institutions, Residential Use, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico paper cups market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico paper cups market on the basis of cup type?

- What is the breakup of the Mexico paper cups market on the basis of wall type?

- What is the breakup of the Mexico paper cups market on the basis of application?

- What is the breakup of the Mexico paper cups market on the basis of distribution channel?

- What is the breakup of the Mexico paper cups market on the basis of end user?

- What is the breakup of the Mexico paper cups market on the basis of region?

- What are the various stages in the value chain of the Mexico paper cups market?

- What are the key driving factors and challenges in the Mexico paper cups market?

- What is the structure of the Mexico paper cups market and who are the key players?

- What is the degree of competition in the Mexico paper cups market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico paper cups market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico paper cups market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico paper cups industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)