Mexico Paper Napkins Market Size, Share, Trends and Forecast by Product Type, Material Type, Application, Distribution Channel, and Region, 2025-2033

Mexico Paper Napkins Market Overview:

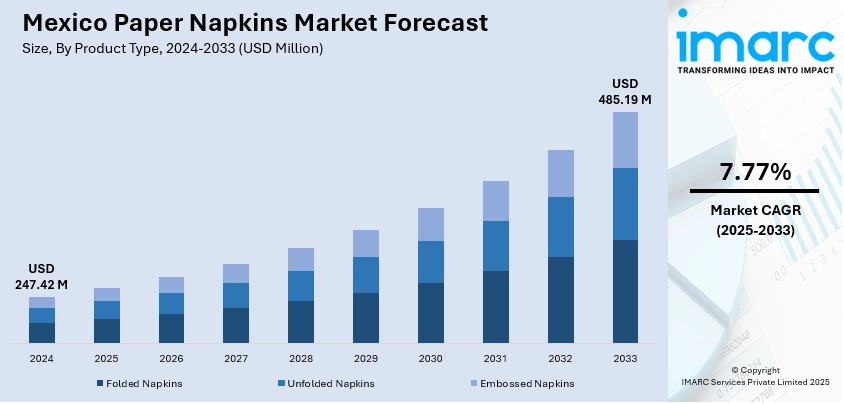

The Mexico paper napkins market size reached USD 247.42 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 485.19 Million by 2033, exhibiting a growth rate (CAGR) of 7.77% during 2025-2033. Rising demand from the foodservice industry, growing urban populations, increased hygiene awareness, and higher disposable incomes are key drivers. Environmental concerns are also pushing demand for eco-friendly alternatives. These factors are collectively supporting expansion in Mexico paper napkins market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 247.42 Million |

| Market Forecast in 2033 | USD 485.19 Million |

| Market Growth Rate 2025-2033 | 7.77% |

Mexico Paper Napkins Market Trends:

Shift Toward Eco-Friendly and Recycled Paper Products

Environmental awareness is influencing purchasing preferences in Mexico, with increasing demand for sustainable and biodegradable paper napkin options. Consumers are showing interest in products made from recycled fibers or certified sustainable pulp sources. This is prompting manufacturers to invest in greener production methods and to promote certifications such as FSC (Forest Stewardship Council). Retailers and food outlets are also aligning with sustainability goals by switching to eco-labeled napkins. Government policies supporting waste reduction and single-use plastic alternatives further reinforce the trend. The shift supports Mexico paper napkins market growth by opening premium product segments that cater to environmentally conscious consumers, while also aligning corporate social responsibility goals with product development. For instance, Valmet is set to deliver its seventh tissue production line to Papel San Francisco in Mexicali, Mexico. The new Advantage DCT 100TS machine, designated as TM 10, is scheduled to start up in Q2 2025. This installation will add 30,000 tons per year to the company's existing production of toilet tissue, kitchen towels, and napkins. The machine features Valmet's advanced technology, including the 100th ViscoNip press, known for its flexibility, uniformity, and energy efficiency.

To get more information on this market, Request Sample

Growth of Organized Retail and Private Label Brands

The expansion of organized retail formats—supermarkets, hypermarkets, and convenience stores—is boosting the availability and visibility of paper napkins in Mexico. Major retailers are increasing shelf space for hygiene products, including napkins, while also launching their own private label offerings to compete on price and quality. These store brands often target value-conscious consumers and introduce bulk packaging options that increase volume sales. Additionally, promotional pricing and bundling with complementary products such as paper towels or disposable cutlery are attracting consumer attention. This distribution shift not only improves accessibility but also drives price competition, supporting Mexico paper napkins market growth across multiple price segments and consumption occasions. For instance, in May 2024, APRIL Group, a major global pulp and paper producer, acquired a controlling stake in India's leading tissue brand, Origami. The deal supports APRIL’s strategy to expand in populous markets like India, following investments in China, Southeast Asia, and Brazil. The partnership aims to boost local production, sustainable innovation, and access to high-quality tissue products.

Mexico Paper Napkins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type material type, application and distribution channel.

Product Type Insights:

- Folded Napkins

- Unfolded Napkins

- Embossed Napkins

The report has provided a detailed breakup and analysis of the market based on the product type. This includes folded, unfolded, and embossed napkins.

Material Type Insights:

- Recycled Paper

- Virgin Paper

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes recycled paper and virgin paper.

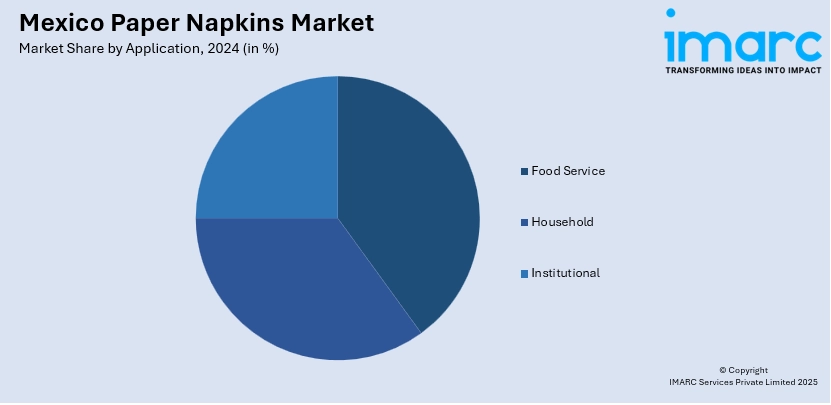

Application Insights:

- Food Service

- Household

- Institutional

The report has provided a detailed breakup and analysis of the market based on the application. This includes food service, household, and institutional.

Distribution Channel Insights:

- Online

- Offline

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline (supermarkets and hypermarkets, convenience stores, and specialty stores).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Paper Napkins Market News:

- In June 2025, Suzano and Kimberly-Clark announced a USD 3.4 Billion joint venture to manufacture and distribute tissue products—such as napkins, toilet paper, and paper towels—across over 70 countries. Suzano will hold 51% and Kimberly-Clark 49%. The venture includes 22 facilities, about 9,000 employees, and will manage over 1 million tonnes of annual tissue production capacity.

- In October 2024, Mexico’s Grupo Corporativo Papelera (GCP) expanded its U.S. operations by installing a new iDEAL 2000s tissue machine at its Texas facility, supplied by A.Celli Paper. The machine will enhance production of private label products like napkins, toilet paper, and kitchen towels. GCP currently sells 85% of output in Mexico.

Mexico Paper Napkins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Folded Napkins, Unfolded Napkins, Embossed Napkins |

| Material Types Covered | Recycled Paper, Virgin Paper |

| Applications Covered | Food Service, Household, Institutional |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico paper napkins market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico paper napkins market on the basis of product type?

- What is the breakup of the Mexico paper napkins market on the basis of material type?

- What is the breakup of the Mexico paper napkins market on the basis of application?

- What is the breakup of the Mexico paper napkins market on the basis of distribution channel?

- What is the breakup of the Mexico paper napkins market on the basis of region?

- What are the various stages in the value chain of the Mexico paper napkins market?

- What are the key driving factors and challenges in the Mexico paper napkins market?

- What is the structure of the Mexico paper napkins market and who are the key players?

- What is the degree of competition in the Mexico paper napkins market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico paper napkins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico paper napkins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico paper napkins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)