Mexico Pathology Lab Services Market Size, Share, Trends and Forecast by Type, Testing Service, End Use, and Region, 2026-2034

Mexico Pathology Lab Services Market Summary:

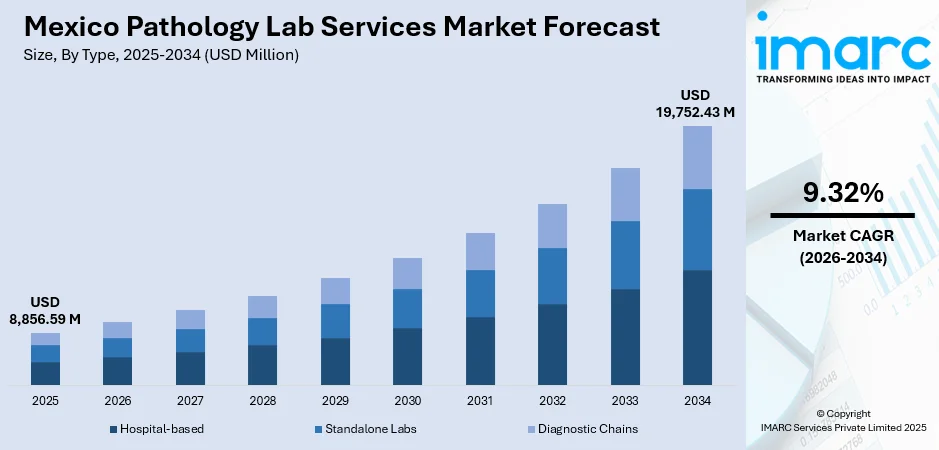

The Mexico pathology lab services market size was valued at USD 8,856.59 Million in 2025 and is projected to reach USD 19,752.43 Million by 2034, growing at a compound annual growth rate of 9.32% from 2026-2034.

The Mexico pathology lab services market is experiencing growth driven by the escalating burden of chronic diseases, particularly diabetes and cardiovascular conditions, which require continuous diagnostic monitoring. Rising healthcare awareness among the population is catalyzing the demand for preventive screening and early disease detection. Government initiatives to expand healthcare infrastructure to underserved regions are creating new opportunities for laboratory service providers. Technological advancements in molecular diagnostics, automation, and artificial intelligence (AI) are enhancing testing accuracy and efficiency. The convergence of aging demographics, improved insurance coverage, and modernized healthcare facilities is contributing to the Mexico pathology lab services market share.

Key Takeaways and Insights:

- By Type: Standalone labs dominate the market with a share of 40% in 2025, driven by their extensive geographic reach, specialized testing capabilities, and established referral networks that provide comprehensive diagnostic services across urban and semi-urban regions throughout Mexico.

- By Testing Service: General physiological and clinical tests lead the market with a share of 55% in 2025, owing to high demand for routine blood chemistry panels, metabolic testing, and preventive health screenings that form the foundation of primary healthcare delivery.

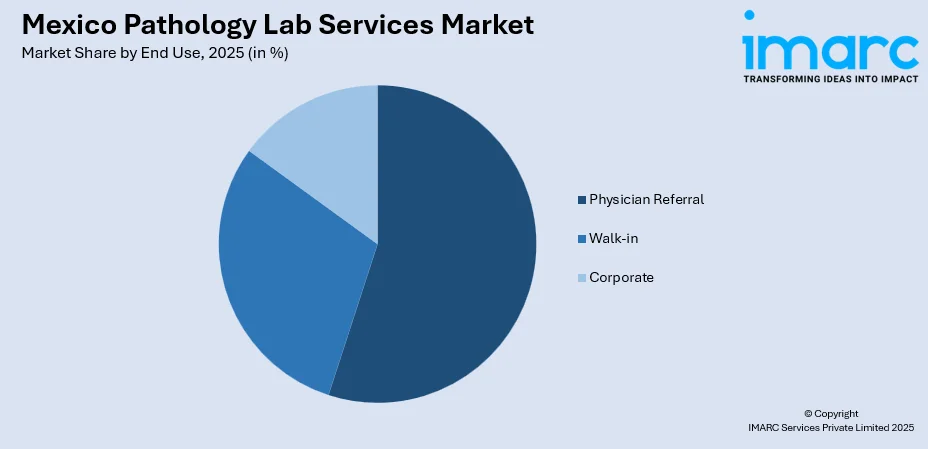

- By End Use: Physician referral represents the largest segment with a market share of 55% in 2025, This dominance is driven by the traditional healthcare pathway where primary care physicians and specialists direct patients to laboratory services for diagnostic confirmation and treatment monitoring.

- Key Players: The Mexico pathology lab services market exhibits moderate competitive intensity, with major domestic laboratory chains competing alongside international diagnostic corporations across diverse service segments, price points, and geographic territories.

To get more information on this market Request Sample

The Mexico pathology lab services market is advancing as healthcare providers, government institutions, and private sector participants embrace diagnostic innovation and expanded service accessibility. The market is characterized by the growing adoption of digital pathology solutions that enhance workflow efficiency and enable remote consultation capabilities. Major medical centers in metropolitan areas like Mexico City, Guadalajara, and Monterrey act as focal points for comprehensive testing, while independent laboratories are broadening their networks to secondary cities. A significant example of this technological shift is the November 2024 partnership between Lunit and Salud Digna. This collaboration aims to deploy AI-powered medical imaging solutions across more than 230 clinics in Mexico and Central America, enhancing diagnostic capabilities with tools such as INSIGHT CXR for chest X-ray analysis and INSIGHT MMG for mammography, thereby advancing the market’s growth trajectory.

Mexico Pathology Lab Services Market Trends:

Growing Demand for Diagnostic Services

The rising prevalence of chronic diseases and health conditions in Mexico is driving the demand for pathology lab services. As healthcare awareness improves, individuals are more proactive in seeking timely and accurate diagnoses to better manage their health. According to the National Institute of Statistics and Geography (INEGI), diabetes ranked as the second leading cause of death in Mexico in 2024, highlighting the urgency for regular diagnostic testing. This heightened focus on early detection and preventive care fuels the expansion of pathology services, as both patients and healthcare providers recognize the critical role of accurate diagnostic results in treatment planning.

Private Sector Investment in Healthcare Infrastructure

Growing investments in both public and private healthcare facilities are significantly advancing the capabilities of diagnostic laboratories in Mexico. With enhanced funding, private healthcare providers are equipping their labs with state-of-the-art technology, enabling them to offer a broader range of pathology services and improve overall service delivery. This investment not only raises testing quality but also boosts patient confidence, driving market growth. For example, in 2025, the Mexican government allocated MXN21 billion for new hospitals and clinics under the IMSS Bienestar program, while private sector players like Elixir MD expanded into Mexico, further strengthening healthcare infrastructure.

Advancements in Diagnostic Technologies

Technological advancements in diagnostic equipment and laboratory techniques are enhancing the accuracy, speed, and efficiency of pathology services in Mexico. Innovations in molecular biology, imaging, and automated laboratory systems enable more precise testing and a broader range of diagnostic capabilities. The adoption of advanced technologies, such as next-generation sequencing and artificial intelligence, allows for earlier disease detection, improving patient outcomes and increasing demand for advanced services. A notable example is the installation of the Copan WASPLab® full laboratory automation system at Hospital Angeles Pedregal in 2025, Latin America’s first system of its kind, which enhances workflow efficiency and diagnostic precision. This technological milestone is indicative of the growing role of innovation in the pathology lab services market.

Market Outlook 2026-2034:

The Mexico pathology lab services market demonstrates strong revenue growth potential throughout the forecast period, underpinned by demographic transitions, technological advancement, and healthcare system modernization. The market generated a revenue of USD 8,856.59 Million in 2025 and is projected to reach a revenue of USD 19,752.43 Million by 2034, growing at a compound annual growth rate of 9.32% from 2026-2034. The market is further driven by the increasing chronic disease prevalence, government healthcare investment, rising preventive care awareness, and continued adoption of advanced molecular and digital diagnostic technologies across public and private laboratory networks.

Mexico Pathology Lab Services Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Standalone Labs | 40% |

| Testing Service | General Physiological and Clinical Tests | 55% |

| End Use | Physician Referral | 55% |

Type Insights:

- Hospital-based

- Standalone Labs

- Diagnostic Chains

Standalone labs dominate with a market share of 40% of the total Mexico pathology lab services market in 2025.

Standalone labs dominate the market due to their ability to offer specialized, high-quality services independently. These laboratories are often more agile in adopting new technologies, providing personalized care, and maintaining flexibility in their service offerings compared to larger hospital-based labs. For instance, in 2025, NOUL partnered with Nihon Kohden Mexico to introduce the miLab™ BCM, an AI-powered blood testing automation system, to improve diagnostics across Mexico. The system automates the complete blood count (CBC) and morphology tests, providing results in under 20 minutes.

Moreover, standalone labs tend to have lower overhead costs, allowing them to offer competitive pricing. Their ability to cater to local communities and focus on specific diagnostic needs further strengthens their position in the market. This model also allows for quicker turnaround times and improved patient convenience.

Testing Service Insights:

- General Physiological and Clinical Tests

- Imaging and Radiology Tests

- Esoteric Tests

- COVID-19 Tests

General physiological and clinical tests lead with a share of 55% of the total Mexico pathology lab services market in 2025.

General physiological and clinical tests dominate the market owing to their wide applicability and essential role in routine health monitoring. These tests, which include basic blood work and screenings, are frequently requested for preventive care and early disease detection across all demographics.

Additionally, their dominance is driven by the increased demand for preventive healthcare and routine check-ups. The growing focus on routine check-ups and diagnostic tests in preventive healthcare is directly necessitated by the high prevalence of major conditions, as indicated by the National Institute of Statistics and Geography (INEGI), which reported that 192,518 deaths in Mexico in 2024 were attributed to heart diseases, the leading category of cardiovascular deaths.

End Use Insights:

Access the Comprehensive Market Breakdown Request Sample

- Physician Referral

- Walk-in

- Corporate

Physician referral exhibits a clear dominance with a 55% share of the total Mexico pathology lab services market in 2025.

Physician referrals dominate the market due to the critical role physicians play in guiding patients toward necessary diagnostic tests. Referrals ensure that patients receive the appropriate tests based on their medical history and presenting symptoms, improving diagnosis accuracy.

Additionally, physician referrals maintain a high level of trust and reliability in the healthcare system. By directing patients to specific pathology labs, physicians can ensure that quality standards are met and that the diagnostic process aligns with the patient's overall treatment plan, promoting better health outcomes.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico boasts a strong healthcare infrastructure due to its proximity to the US, which facilitates access to advanced diagnostic services. The region's growing demand for pathology lab services is supported by its vibrant industrial and commercial sectors, driving improvements in medical facilities and service accessibility.

Central Mexico, particularly Mexico City, is a healthcare powerhouse with an extensive network of medical centers, hospitals, and pathology labs. The region benefits from well-established infrastructure, a high concentration of healthcare professionals, and strong demand for cutting-edge diagnostic services, contributing to its dominance in the market.

Southern Mexico is seeing increased investment in healthcare infrastructure, improving access to pathology lab services. The region benefits from a growing focus on expanding diagnostic capabilities to underserved areas, with both public and private initiatives working to enhance healthcare access and service delivery for local populations.

Others, including areas like the Yucatán Peninsula, is experiencing significant improvements in healthcare accessibility. Investments in medical facilities and diagnostic services are expanding, enabling more regions to meet the rising demand for pathology services and enhancing the overall healthcare landscape.

Market Dynamics:

Growth Drivers:

Why is the Mexico Pathology Lab Services Market Growing?

Expansion of Laboratory Facilities

The growth of the pathology lab services market is driven by the expansion of new laboratory facilities, which improve the availability and accessibility of diagnostic services. These facilities address the increasing demand for quality healthcare, particularly in underserved regions. By enhancing service delivery, reducing wait times, and offering convenient access to advanced diagnostics, new labs contribute to better patient care and greater market penetration. For instance, the opening of Certolab Lomas de Atizapán in November 2024 in Atizapán de Zaragoza, Mexico, provided a comprehensive range of diagnostic services aimed at improving local healthcare access with high-quality, affordable care and extended hours.

Adoption of Precision Medicine

The shift towards personalized medicine, which tailors treatments based on individual genetic profiles and specific disease characteristics, is driving the need for pathology lab services in Mexico. This approach increases demand for specialized diagnostic testing to enable accurate diagnoses and targeted therapies. Laboratories must adopt advanced techniques, including molecular diagnostics and next-generation sequencing, to meet this need. For example, the opening of the TAM Center in Tijuana, Mexico, in 2025 marked a significant advancement in cancer diagnosis, regenerative medicine, and translational science. The center’s integration of cutting-edge technologies such as AI, stem cell therapy, and next-gen omics is a prime.

Increasing Health Insurance Coverage and Access

As health insurance coverage expands across Mexico, more individuals gain access to a wide range of medical services, including pathology lab testing. The rise of both public and private insurance programs makes diagnostic services more affordable, overcoming previous cost barriers that limited access. This increased coverage is catalyzing the demand for high-quality pathology services, as insured individuals seek routine testing and screenings. Furthermore, the focus on preventive care encourages early diagnoses, enhancing overall healthcare outcomes. A notable example is the launch of “Más Salud México” by Grupo Salinas in February 2025, which provides affordable healthcare service model. This initiative offers accessible medical services, including general consultations and lab tests, using technology and physical clinics to serve underserved areas. The first clinic opened in Coyoacán, Mexico City, with plans for nationwide expansion.

Market Restraints:

What Challenges the Mexico Pathology Lab Services Market is Facing?

Regional Healthcare Infrastructure Disparities

Significant disparities in healthcare infrastructure between urban and rural regions create imbalances in access to quality pathology services. Urban centers typically boast modern diagnostic laboratories with advanced testing equipment, enabling rapid and accurate results. In contrast, rural and remote areas face challenges like outdated facilities, limited diagnostic capabilities, and difficulties in transporting samples, all of which leads to delays and compromised patient care. This gap in infrastructure exacerbates health inequalities and limits the effectiveness of pathology services in underserved areas.

Workforce Shortages and Skilled Personnel Gaps

The shortage of trained pathologists, laboratory technicians, and specialized diagnostic personnel is a critical issue affecting healthcare service delivery. In many regions, particularly those outside urban centers, the concentration of skilled professionals in major cities leaves rural and remote areas with insufficient personnel to meet the growing demand for pathology services. This disparity in workforce distribution not only hampers timely diagnoses but also creates significant delays in the planning of treatments. The shortage of qualified staff is a key barrier to improving healthcare quality, particularly in the laboratory setting.

Regulatory Complexity and Reimbursement Challenges

The regulatory landscape surrounding diagnostic services is often complex and constantly evolving, creating operational hurdles for healthcare providers. Laboratories must navigate changing regulations, which add layers of compliance and administrative work. Additionally, the variability in reimbursement rates across public and private payers further complicates the financial sustainability of diagnostic services. These challenges not only slow down the process of obtaining necessary approvals but also discourage investment in advanced diagnostic technologies, as healthcare providers face uncertainty about reimbursement and financial viability.

Competitive Landscape:

The Mexico pathology lab services market exhibits moderate competitive intensity characterized by the presence of major domestic laboratory chains alongside international diagnostic corporations competing across diverse service segments and geographic territories. Market dynamics reflect strategic positioning ranging from comprehensive testing portfolios emphasizing advanced molecular capabilities to value-oriented services targeting cost-conscious healthcare segments. The competitive landscape is increasingly shaped by technology investments, geographic network expansion, quality accreditation achievements, and strategic partnerships with healthcare providers. Organizations are differentiating through specialized testing capabilities, digital health integration, and patient accessibility initiatives that address the growing demand for convenient diagnostic services across urban and emerging market territories.

Recent Developments:

- In August 2025, KFBIO showcased its digital pathology solutions at the 66th Mexican Pathology Congress, highlighting remote diagnostic capabilities and the use of AI-assisted analysis. Dr. Mario Murguía Pérez demonstrated real-time remote consultations and teaching using KFBIO scanners. The company also hosted workshops on digital pathology implementation at Huawei OpenLab in Mexico.

- In June 2025, ABC Medical Center inaugurated its Precision Medicine Unit and Molecular Pathology Laboratory in Mexico, marking a significant step in personalized healthcare. These facilities will enhance cancer diagnosis and treatment by identifying genetic alterations, enabling more effective and targeted therapies.

Mexico Pathology Lab Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hospital-based, Standalone Labs, Diagnostic Chains |

| Testing Services Covered | General Physiological and Clinical Tests, Imaging and Radiology Tests, Esoteric Tests, COVID-19 Tests |

| End Uses Covered | Physician Referral, Walk-in, Corporate |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico pathology lab services market size was valued at USD 8,856.59 Million in 2025.

The Mexico pathology lab services market is expected to grow at a compound annual growth rate of 9.32% from 2026-2034 to reach USD 19,752.43 Million by 2034.

Standalone labs held the largest revenue share of 40% in 2025, driven by their extensive geographic reach, specialized testing capabilities, and established referral networks that provide comprehensive diagnostic services across urban and semi-urban regions throughout Mexico.

Key factors driving the Mexico pathology lab services market include the rising prevalence of chronic diseases, particularly diabetes, which ranked as the second leading cause of death in Mexico in 2024 (INEGI). Increased healthcare awareness encourages proactive, timely diagnoses, fueling the need for regular testing and early detection

Major challenges include regional healthcare infrastructure disparities limiting access in rural areas, workforce shortages and skilled pathology personnel gaps causing service delays, regulatory complexity and reimbursement challenges impacting investment decisions, and uneven distribution of advanced diagnostic capabilities across geographic territories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)