Mexico Payment Gateways Market Size, Share, Trends and Forecast by Application, Mode of Interaction, and Region, 2025-2033

Mexico Payment Gateways Market Overview:

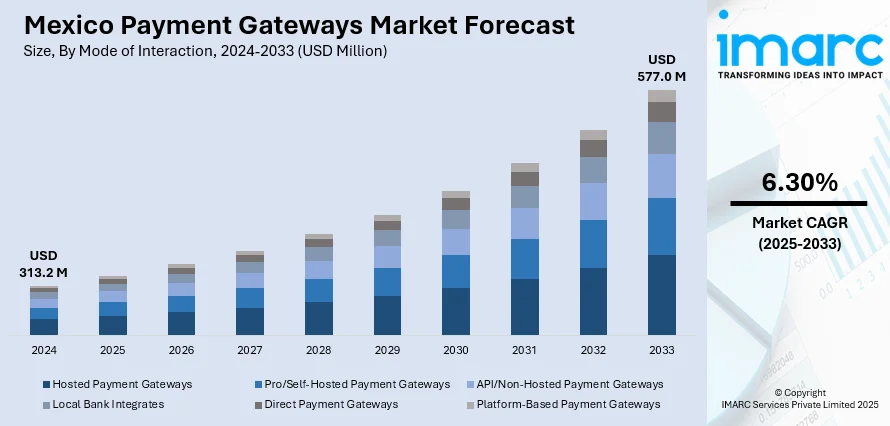

The Mexico payment gateways market size reached USD 313.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 577.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. E-commerce expansion, mobile payment growth, SPEI integration, QR code adoption, fintech innovation under Ley Fintech, CNBV compliance, value-added services, cross-border capabilities, financial inclusion programs, digital wallet penetration, API enhancements, and demand for low-latency, multi-channel, fraud-resistant gateways are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 313.2 Million |

| Market Forecast in 2033 | USD 577.0 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Payment Gateways Market Trends:

Expansion of E-Commerce and Mobile Payment Infrastructure

The accelerated adoption of online retail and mobile commerce in Mexico has significantly increased demand for seamless, secure, and real-time digital payment processing. Consumers across metropolitan and semi-urban regions are transacting more frequently through digital channels, which has placed payment gateways at the center of transaction flows. Businesses, from large retailers to small-scale merchants, are prioritizing integrations with gateways that offer multi-channel compatibility, fraud detection, and localized payment method support. This behavior has expanded the Mexico payment gateways market share, particularly among platforms that support SPEI transfers, QR code payments, and installment billing. Notably, on June 18, 2024, Clip, a leading digital payments platform in Mexico, announced a USD 100 Million investment to expand its operations and technology infrastructure. The funding will support Clip’s efforts to scale its payment ecosystem, enhance merchant services, and broaden financial access for small businesses. Furthermore, domestic fintechs and global players have intensified competition through strategic pricing, faster settlement cycles, and superior API functionality. As online marketplaces, food delivery services, and digital subscriptions scale, demand for payment gateway reliability and compliance with Mexican regulatory standards, including those set by the Comisión Nacional Bancaria y de Valores (CNBV), continues to grow. Merchant acquisition models are increasingly driven by value-added services—such as analytics, recurring billing, and cross-border capabilities—creating opportunities for gateway providers that can tailor offerings to distinct industry verticals. In parallel, integration with mobile wallets and support for real-time data validation is becoming a critical decision factor among enterprise-level merchants.

Financial Inclusion Policies and Growth of Fintech Ecosystem

The expansion of Mexico’s fintech sector, supported by favorable regulation under the Ley Fintech, has led to a wider penetration of digital financial services. Startups, neobanks, and e-wallet platforms are reshaping consumer expectations around payment convenience, prompting traditional banks and retailers to modernize their transaction systems. Payment gateways have benefited directly from this environment, as they serve as critical intermediaries between consumers and merchants across both online and offline channels. Increased smartphone usage, paired with biometric authentication tools, is also reinforcing digital trust. These factors are contributing to steady Mexico payment gateways market growth, particularly in sectors such as ride-hailing, e-learning, and gig economy services. On 25th October 2024, Getnet by Santander launched Getnet SEP, a unified e-commerce payment solution enabling businesses to operate across Brazil, Argentina, Mexico, and Chile through a single integration. The platform supports multi-country settlement, fraud prevention, and local payment method compatibility. This initiative enhances cross-border commerce and simplifies gateway infrastructure for merchants in Mexico, reinforcing the country’s role in regional digital payment connectivity. In line with this, the government’s push for financial inclusion has encouraged various partnerships between fintech firms and public-sector programs aimed at digitizing payments, especially in underbanked regions. Meanwhile, the competition between gateway providers has led to investments in latency reduction, multi-currency support, and fraud analytics. Providers capable of offering adaptive payment solutions across industries are gaining strategic ground. The long-term Mexico payment gateways market outlook remains shaped by regulatory clarity, growing merchant onboarding, and deeper fintech-bank collaboration, particularly in areas requiring custom payment orchestration and KYC automation.

Mexico Payment Gateways Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application and mode of interaction.

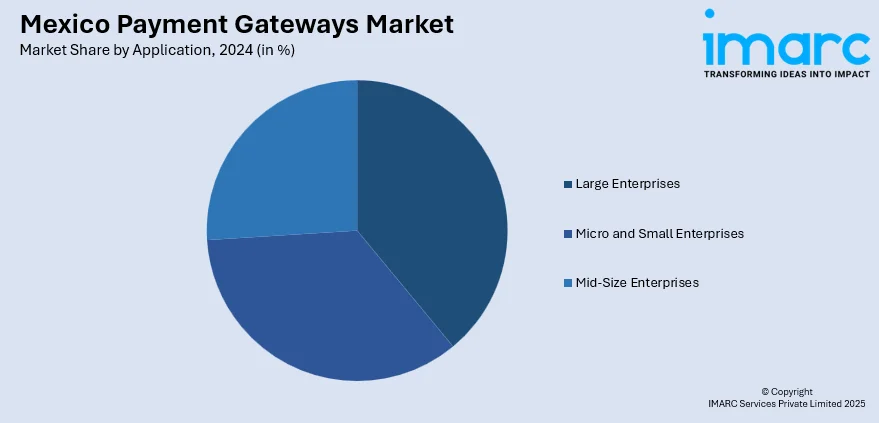

Application Insights:

- Large Enterprises

- Micro and Small Enterprises

- Mid-Size Enterprises

The report has provided a detailed breakup and analysis of the market based on the application. This includes large enterprises, micro and small enterprises, and mid-size enterprises.

Mode of Interaction Insights:

- Hosted Payment Gateways

- Pro/Self-Hosted Payment Gateways

- API/Non-Hosted Payment Gateways

- Local Bank Integrates

- Direct Payment Gateways

- Platform-Based Payment Gateways

The report has provided a detailed breakup and analysis of the market based on the mode of interaction. This includes hosted payment gateways, pro/self-hosted payment gateways, API/non-hosted payment gateways, local bank integrates, direct payment gateways, and platform-based payment gateways.

Mexico Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Payment Gateways Market News:

- On February 8, 2024, EVO Payments announced its agreement to acquire SF Systems, a leading payment gateway provider based in Mexico. This acquisition aims to strengthen EVO’s capabilities in digital payment processing by integrating SF Systems’ proprietary gateway technology and expanding its customer base in Latin America. The move is expected to enhance competition and innovation within the Mexico payment gateways market, particularly in sectors demanding secure, scalable, and locally adapted transaction solutions.

- On March 6, 2024, Mexican fintech Klar announced its acquisition of select assets from Tribal, a B2B payments and financing platform. This transaction enhances Klar’s infrastructure for business payments, enabling it to expand services in credit, payment processing, and cross-border capabilities.

Mexico Payment Gateways Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises |

| Modes of Interaction Covered | Hosted Payment Gateways, Pro/Self-Hosted Payment Gateways, API/Non-Hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, Platform-Based Payment Gateways |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico payment gateways market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico payment gateways market on the basis of application?

- What is the breakup of the Mexico payment gateways market on the basis of mode of interaction?

- What is the breakup of the Mexico payment gateways market on the basis of region?

- What are the various stages in the value chain of the Mexico payment gateways market?

- What are the key driving factors and challenges in the Mexico payment gateways?

- What is the structure of the Mexico payment gateways market and who are the key players?

- What is the degree of competition in the Mexico payment gateways market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico payment gateways market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico payment gateways market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico payment gateways industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)