Mexico PCB Components Market Size, Share, Trends and Forecast by Component Type, PCB Type, End Use Industry, and Region, 2026-2034

Mexico PCB Components Market Summary:

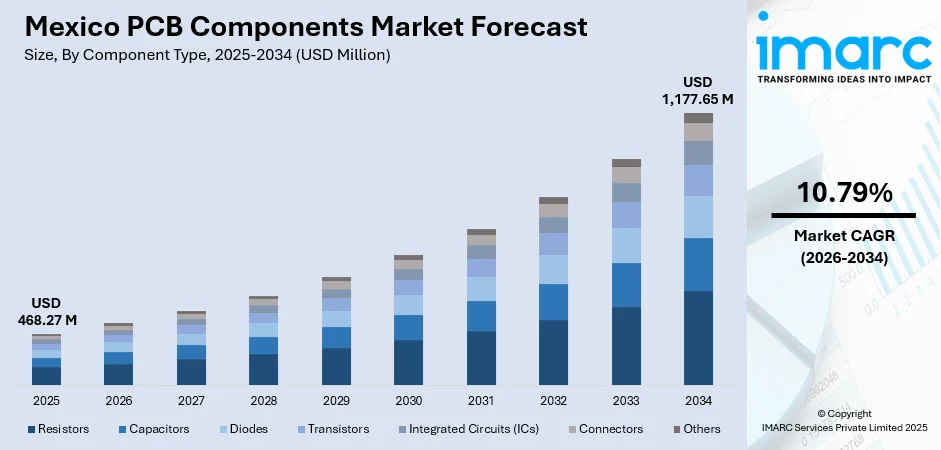

The Mexico PCB components market size was valued at USD 468.27 Million in 2025 and is projected to reach USD 1,177.65 Million by 2034, growing at a compound annual growth rate of 10.79% from 2026-2034.

The Mexico PCB components market is experiencing substantial growth driven by the country's emergence as a strategic electronics manufacturing hub in North America. Nearshoring activities, favorable trade agreements, and geographical proximity to the United States are accelerating demand for advanced PCB components across consumer electronics, automotive, and industrial applications. The expansion of contract manufacturing operations and growing electric vehicle production are creating significant opportunities for market participants.

Key Takeaways and Insights:

-

By Component Type: Integrated Circuits (ICs) dominate the market with a share of 26% in 2025, driven by increasing complexity in electronic devices and growing demand for microcontrollers in automotive and consumer applications.

-

By PCB Type: Rigid PCBs lead the market with a share of 64% in 2025, owing to their widespread application in consumer electronics, automotive systems, and industrial equipment manufacturing.

-

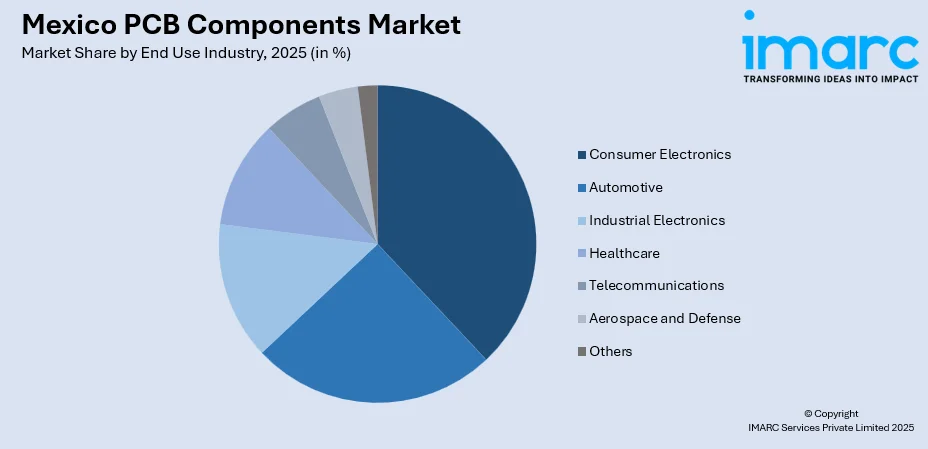

By End Use Industry: Consumer electronics dominate the market with a share of 38% in 2025, fueled by Mexico's position as a leading producer of smartphones, televisions, and computing devices for North American markets.

-

Key Players: The Mexico PCB components market features a competitive landscape comprising international electronics manufacturing services providers and specialized component manufacturers. Market participants are focusing on capacity expansion, advanced manufacturing capabilities, and strategic partnerships to capitalize on nearshoring opportunities and growing demand from automotive and consumer electronics sectors.

To get more information on this market Request Sample

The Mexico PCB components market is experiencing growth due to global supply chain shifts, as multinational companies increasingly move electronics manufacturing from Asia to North America. In June 2025, U.S.-based Benchmark opened a 321,000 sq ft manufacturing facility in Guadalajara, expanding its regional presence to support advanced computing, communications, and industrial electronics production. Local electronics manufacturers in major industrial hubs are incorporating advanced PCB components, such as multilayer boards, surface-mount devices, and specialized connectors, into large-scale production. The automotive industry’s shift toward electric and connected vehicles is driving continuous demand for high-performance PCB assemblies that meet rigorous reliability and quality standards. These trends position Mexico as a key hub for sophisticated electronics manufacturing, supporting both domestic production and export-oriented supply chains.

Mexico PCB Components Market Trends:

Nearshoring and Supply Chain Regionalization

The Mexico PCB components market is witnessing accelerated growth driven by nearshoring activities as global manufacturers seek to establish resilient supply chains closer to end markets. Companies are relocating production operations from Asia to Mexico to reduce logistics costs, minimize lead times, and mitigate geopolitical risks. For example, in September 2025 Foxconn announced a $168 million investment via FII AMC México to expand server and advanced electronics production, strengthening its manufacturing footprint in Mexico. This trend is particularly pronounced in the electronics sector, where proximity to the United States enables rapid delivery and enhanced responsiveness to customer requirements.

Automotive Electronics Integration and Electric Vehicle Expansion

The transition toward electric and autonomous vehicles is creating substantial demand for advanced PCB components in Mexico's automotive manufacturing ecosystem. Vehicle electrification requires sophisticated high-voltage PCBs, thermal management components, and battery management systems. For example, in 2025 Airtificial secured multiple Tier-1 automotive contracts to deliver ECU and electric steering inspection lines at its Querétaro facility, highlighting rising local EV electronics production using advanced PCB assemblies. The growing integration of advanced driver assistance systems and infotainment platforms in vehicles is driving demand for multilayer and high-density interconnect boards capable of supporting complex electronic architectures.

Smart Factory and Industrial Automation Adoption

The adoption of Industry 4.0 technologies across Mexican manufacturing facilities is generating increased demand for PCB components used in industrial automation and control systems. Smart factory implementations require sophisticated sensors, controllers, and communication modules that rely on advanced printed circuit board assemblies. For example, in 2023 Bosch Rexroth opened a 42,000 m² factory in Querétaro to locally manufacture factory automation products supporting advanced industrial production across Mexico and North America. The integration of Internet of Things connectivity and machine learning capabilities into production equipment is expanding the application scope for specialized PCB components.

Market Outlook 2026-2034:

The Mexico PCB components market outlook remains highly favorable, supported by continued nearshoring momentum, expanding automotive electronics production, and growing consumer electronics manufacturing activities. Trade policy frameworks including USMCA and strategic investments in semiconductor and electronics infrastructure are strengthening Mexico's position in the North American technology supply chain. The development of advanced manufacturing capabilities and expansion of research and development facilities are expected to enhance the country's competitiveness in high-value PCB component production. The market generated a revenue of USD 468.27 Million in 2025 and is projected to reach a revenue of USD 1,177.65 Million by 2034, growing at a compound annual growth rate of 10.79% from 2026-2034.

Mexico PCB Components Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component Type |

Integrated Circuits (ICs) |

26% |

|

PCB Type |

Rigid PCBs |

64% |

|

End Use Industry |

Consumer Electronics |

38% |

Component Type Insights:

- Resistors

- Capacitors

- Diodes

- Transistors

- Integrated Circuits (ICs)

- Connectors

- Others

The integrated circuits (ICs) dominate with a market share of 26% of the total Mexico PCB components market in 2025.

Integrated circuits represent the most sophisticated and value-added component category within the PCB ecosystem, serving as the computational and control centers for electronic devices. The growing complexity of consumer electronics, automotive systems, and industrial equipment is driving sustained demand for microcontrollers, application-specific integrated circuits, and system-on-chip solutions integrated into Mexican-manufactured products. For example, in late 2024 ASE Technology Holding’s subsidiary ISE Labs acquired land in Tonalá, Jalisco to develop a semiconductor packaging and testing facility supporting integrated circuit production and North American supply chains.

The automotive sector’s transition toward electric and connected vehicles is driving strong demand for power management integrated circuits, motor controllers, and advanced driver assistance system processors. At the same time, consumer electronics manufacturing requires high-performance processors and memory controllers for smartphones, tablets, and computing devices. Additionally, the expanding adoption of Internet of Things applications across industrial and commercial environments is creating new opportunities for specialized and application-specific integrated circuit solutions.

PCB Type Insights:

- Rigid PCBs

- Flexible PCBs

- Rigid-Flex PCBs

The rigid PCBs lead with a share of 64% of the total Mexico PCB components market in 2025.

Rigid printed circuit boards continue to dominate the market due to their extensive use across various electronic products and well-established manufacturing processes. They provide strong structural support for mounted components and ensure reliable electrical performance under standard operating conditions. Moreover, the mature production infrastructure and cost efficiency of rigid PCB manufacturing make these boards the preferred option for high-volume consumer electronics, industrial equipment, and other applications requiring consistent performance and durability.

The rigid PCB segment benefits from ongoing technological advancements, such as multilayer configurations and high-density interconnect designs, which allow enhanced functionality in compact form factors. Demand is further driven by automotive applications that require durable, thermally stable circuit boards. Additionally, the growth of computing and telecommunications equipment manufacturing in Mexico reinforces the segment’s market position, supporting its continued adoption across both industrial and consumer electronics applications.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Automotive

- Industrial Electronics

- Healthcare

- Telecommunications

- Aerospace and Defense

- Others

The consumer electronics dominate with a market share of 38% of the total Mexico PCB components market in 2025.

Consumer electronics represents the largest end-use segment driven by Mexico's established position as a major manufacturing hub for smartphones, televisions, computers, and audio equipment destined for North American markets. The country hosts numerous contract manufacturing facilities operated by leading global electronics brands, generating sustained demand for PCB components across the production value chain. The Mexico consumer electronics recycling market size reached USD 145.45 Million in 2024, and looking forward, IMARC Group expects it to reach USD 259.64 Million by 2033, exhibiting a growth rate (CAGR) of 6.65% during 20252033.

The segment benefits from continuous product innovation, driving demand for advanced PCB designs with greater functionality and miniaturization. Rising adoption of smart home devices, wearable technology, and gaming equipment is expanding the application scope for sophisticated circuit board assemblies. Additionally, proximity to major consumer markets facilitates rapid product development and responsive manufacturing operations, enabling manufacturers to meet the fast-paced requirements of the consumer electronics industry while supporting shorter time-to-market cycles for new and upgraded products.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico dominates the PCB components market, benefiting from strategic proximity to the United States border and well-established manufacturing infrastructure. States including Baja California, Chihuahua, Nuevo León, and Tamaulipas host major electronics manufacturing clusters with extensive supplier networks. The region's maquiladora operations and advanced logistics capabilities support efficient cross-border trade and rapid delivery to North American customers.

Central Mexico represents a significant market driven by the presence of advanced industrial parks and growing high-technology manufacturing clusters. Jalisco state, particularly Guadalajara, has earned recognition as Mexico's Silicon Valley due to its concentration of semiconductor and electronics companies. Querétaro and surrounding states contribute through automotive electronics production and expanding aerospace manufacturing activities requiring specialized PCB components.

Southern Mexico presents emerging opportunities for PCB component demand as manufacturing activities gradually expand beyond traditional industrial centers. Government initiatives promoting regional development and infrastructure investments are attracting electronics-related projects to states in the southern region. The area offers competitive labor costs and growing technical education programs that support manufacturing workforce development.

Other regions across Mexico contribute to PCB component demand through distributed manufacturing operations and specialized production facilities. These areas benefit from regional development programs encouraging industrial diversification and technology sector growth. Emerging manufacturing clusters in various states are establishing capabilities in electronics assembly and component production to serve domestic and export markets.

Market Dynamics:

Growth Drivers:

Why is the Mexico PCB Components Market Growing?

Strategic Nearshoring and Supply Chain Restructuring

Mexico's emergence as a premier nearshoring destination represents a fundamental driver for PCB component demand. Global manufacturers are relocating production operations from Asia to establish resilient supply chains with proximity to North American end markets. In 2025, Mexico launched a national semiconductor initiative, establishing a public design center and offering incentives for chip and advanced electronics production to boost domestic technology and attract investment. The country offers compelling advantages including reduced logistics costs, shorter lead times, and favorable trade agreements under USMCA. Electronics manufacturing services providers are expanding capacity in key industrial corridors to accommodate growing volumes of cross-border production activities. The strategic location enables same-day ground transportation to major United States distribution centers, providing significant competitive advantages over overseas manufacturing alternatives.

Automotive Sector Electrification and Electronics Integration

The automotive industry's transformation toward electric and connected vehicles is generating substantial demand for advanced PCB components across Mexico's established vehicle manufacturing ecosystem. Electric vehicle production requires sophisticated power electronics, battery management systems, and thermal management solutions that rely on specialized circuit board assemblies. The Mexico automotive connectors market size reached USD 211.5 Million in 2024, and IMARC Group expects it to reach USD 336.64 Million by 2033, reflecting sustained growth in automotive electronics and connector demand. The increasing integration of advanced driver assistance systems, infotainment platforms, and connected vehicle technologies is driving demand for multilayer and high-density interconnect PCBs. Major automotive manufacturers are expanding electric vehicle production facilities in Mexico, creating sustained growth opportunities for PCB component suppliers.

Consumer Electronics Manufacturing Expansion

Mexico's position as a leading producer of consumer electronics for North American markets continues to drive PCB component demand. The country maintains substantial manufacturing capacity for smartphones, televisions, computers, and audio equipment through operations of major global brands and contract manufacturers. Growing demand for smart home devices, wearable technology, and gaming equipment is expanding the application scope for advanced circuit board assemblies. The consumer electronics sector benefits from established supplier networks, skilled workforce availability, and efficient logistics infrastructure that support high-volume production operations.

Market Restraints:

What Challenges the Mexico PCB Components Market is Facing?

Limited Domestic Component Manufacturing Capabilities

Mexico's PCB components market faces constraints related to limited domestic manufacturing capacity for advanced semiconductor devices and specialized components. The country relies significantly on imports for critical integrated circuits and electronic components, creating supply chain dependencies that can impact production schedules during global shortage situations.

Infrastructure and Workforce Development Requirements

The expansion of electronics manufacturing in Mexico requires continued investment in infrastructure development and workforce training programs. Ensuring adequate power supply, transportation connectivity, and specialized technical education remains essential for supporting industry growth. Competition for skilled engineers and technicians across expanding manufacturing operations creates workforce availability challenges.

Global Supply Chain Volatility and Cost Pressures

PCB component manufacturers face ongoing challenges related to raw material availability, logistics disruptions, and fluctuating input costs. Global semiconductor supply constraints and component allocation issues can impact production planning and customer fulfillment. Rising energy costs and competitive pressures from other manufacturing destinations require continuous operational efficiency improvements.

Competitive Landscape:

The Mexico PCB components market exhibits a competitive structure characterized by the presence of global electronics manufacturing services providers, international component manufacturers, and specialized regional suppliers. Major contract manufacturers operate extensive production facilities across key industrial regions, offering integrated PCB assembly and component sourcing capabilities. Market participants are investing in capacity expansion, advanced manufacturing technologies, and quality certifications to strengthen their competitive positioning. Strategic partnerships between international technology providers and local manufacturing partners are accelerating capability development and market penetration. Companies are focusing on developing specialized capabilities for automotive, aerospace, and medical device applications that command premium positioning and customer loyalty.

Recent Developments:

-

In August 2025, Federal Electronics Mexico upgraded its Hermosillo facility with a Mycronic A40DX pick‑and‑place system and MYPro i50 3D AOI inspection system to enhance PCB assembly quality and production flexibility, supporting aerospace, medical, defense, and industrial sectors.

Mexico PCB Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Resistors, Capacitors, Diodes, Transistors, Integrated Circuits (ICs), Connectors, Others |

| PCB Types Covered | Rigid PCBs, Flexible PCBs, Rigid-Flex PCBs |

| End Use Industries Covered | Consumer Electronics, Automotive, Industrial Electronics, Healthcare, Telecommunications, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico PCB components market size was valued at USD 468.27 Million in 2025.

The Mexico PCB components market is expected to grow at a compound annual growth rate of 10.79% from 2026-2034 to reach USD 1,177.65 Million by 2034.

Integrated Circuits (ICs) dominated the Mexico PCB components market with a share of 26%, driven by increasing complexity in electronic devices and growing demand for microcontrollers in automotive and consumer applications.

Key factors driving the Mexico PCB components market include strategic nearshoring activities by global manufacturers, automotive sector electrification and electronics integration, expanding consumer electronics production, favorable trade agreements, and proximity to North American end markets.

Major challenges include limited domestic manufacturing capabilities for advanced semiconductor components, infrastructure and workforce development requirements, global supply chain volatility, component allocation constraints, and competition from other manufacturing destinations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)