Mexico Pediatric Healthcare Market Size, Share, Trends and Forecast by Type, Treatment, and Region, 2026-2034

Mexico Pediatric Healthcare Market Summary:

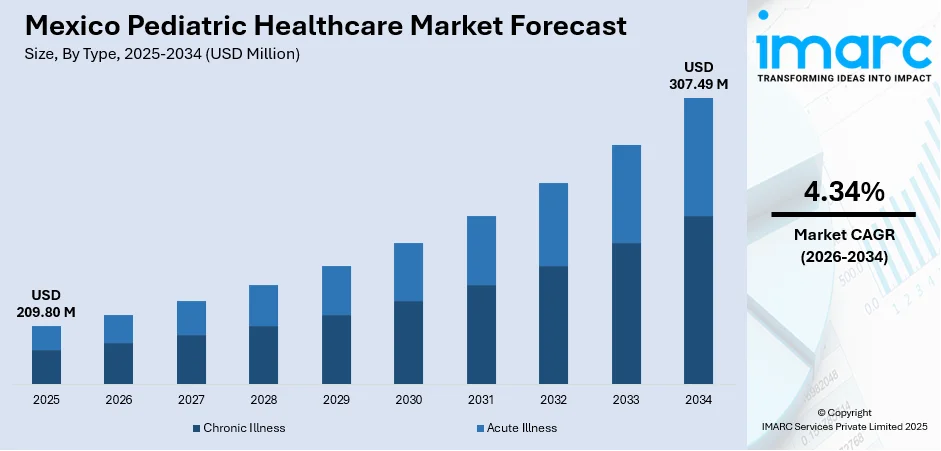

The Mexico pediatric healthcare market size was valued at USD 209.80 Million in 2025 and is projected to reach USD 307.49 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

Mexico's pediatric healthcare market is experiencing steady expansion driven by increasing healthcare awareness among parents, government-led immunization campaigns, and rising investments in child health infrastructure. The growing burden of childhood illnesses has prompted healthcare providers to enhance diagnostic and treatment capabilities. Expanding access to vaccines, specialized pediatric treatments, and preventive care programs continues to strengthen the Mexico pediatric healthcare market share.

Key Takeaways and Insights:

- By Type: Acute Illness dominates the market with a share of 65% in 2025, owing to the high prevalence of respiratory infections, gastrointestinal disorders, and seasonal illnesses among children requiring immediate medical intervention.

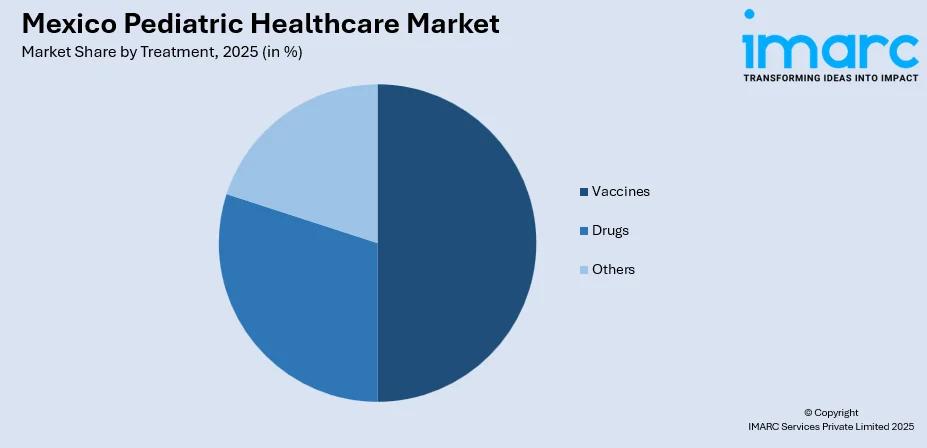

- By Treatment: Vaccines lead the market with a share of 50% in 2025, driven by comprehensive national immunization programs targeting childhood diseases and growing public confidence in preventive healthcare measures.

- Key Players: The Mexico pediatric healthcare market exhibits a moderately competitive landscape with multinational pharmaceutical corporations and domestic healthcare providers competing across various service segments. Market participants are focusing on expanding vaccine portfolios, developing pediatric-specific formulations, and strengthening distribution networks to enhance market penetration.

To get more information on this market Request Sample

The pediatric healthcare sector in Mexico is undergoing significant transformation, supported by government initiatives aimed at improving child health outcomes nationwide. For instance, the federal government plans to inaugurate 31 new hospitals and 12 healthcare centers between October 2024 and December 2025, significantly expanding infrastructure under IMSS-Bienestar, ISSSTE and IMSS. The National Immunization Program continues to drive vaccine adoption, with expanded coverage targeting underserved communities. Healthcare infrastructure investments are accelerating, with new pediatric facilities opening across multiple states. The integration of telemedicine services is improving access to specialized pediatric consultations in remote areas, while public-private partnerships are strengthening the overall healthcare delivery system for children. Rising parental awareness regarding preventive care and early intervention is contributing to increased demand for quality pediatric services across the country.

Mexico Pediatric Healthcare Market Trends:

Digital Health Integration in Pediatric Care

Healthcare providers across Mexico are increasingly adopting digital health solutions to enhance pediatric care delivery. For example, in 2025, IMSS, the Mexican Social Security Institute, recently expanded its telemedicine services to include pediatric oncology follow-up and interconsultations, enabling remote diagnosis and treatment coordination for children under oncology care. Telemedicine platforms are enabling remote consultations between pediatric specialists and families in underserved regions. Mobile health applications are facilitating vaccination tracking, symptom monitoring, and appointment scheduling. Hospital information systems are being modernized to improve patient record management and clinical decision-making, particularly in specialized children's hospitals across major metropolitan areas.

Expansion of Preventive Healthcare Programs

National preventive healthcare initiatives are gaining momentum throughout Mexico's pediatric healthcare sector. Government-sponsored programs are emphasizing early disease detection, routine health screenings, and nutrition counseling for children. Schools are partnering with local health authorities to conduct wellness assessments and promote healthy lifestyle habits among students. Under the nationwide Vive Saludable, Vive Feliz strategy, more than 2.76 million students across 17,588 primary‑school institutions had undergone health evaluations by mid‑2025. Community health centers are expanding outreach services to ensure children in rural and underserved areas receive timely preventive care interventions.

Advancement of Pediatric Diagnostic Technologies

Mexican pediatric healthcare facilities are investing in advanced diagnostic equipment to improve disease detection accuracy and treatment outcomes. For instance, in July 2024, Instituto Nacional de Pediatría (INP) in Mexico adopted the United Imaging Healthcare uMI 550 PET/CT system — the first digital PET/CT for pediatric precision medicine in the country. Modern imaging technologies are being deployed at specialized pediatric institutions throughout the country. These technological advancements are supporting earlier intervention, more precise treatment planning, and improved patient outcomes for children requiring complex medical evaluations and specialized care services.

Market Outlook 2026-2034:

The Mexico pediatric healthcare market is positioned for sustained growth through the forecast period, supported by expanding healthcare infrastructure and increasing government investments in child health programs. Rising healthcare awareness, improving vaccination coverage rates, and the proliferation of specialized pediatric facilities are expected to drive market expansion. The integration of digital health technologies and telemedicine services will enhance access to quality pediatric care across diverse geographic regions. The market generated a revenue of USD 209.80 Million in 2025 and is projected to reach a revenue of USD 307.49 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

Mexico Pediatric Healthcare Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Acute Illness | 65% |

| Treatment | Vaccines | 50% |

Type Insights:

- Chronic Illness

- Acute Illness

The acute illness dominates with a market share of 65% of the total Mexico pediatric healthcare market in 2025.

Acute illnesses represent the predominant segment within Mexico's pediatric healthcare market, this dominance is attributed to the high incidence of respiratory tract infections, gastrointestinal disorders, and seasonal viral diseases among children. In 2023, Instituto Mexicano del Seguro Social (IMSS) reported more than 14 million total pediatric consultations nationwide, of which nearly 4 million were handled via hospital emergency‑admission services, underscoring the heavy load of acute pediatric cases requiring urgent evaluation and care. Mexican healthcare facilities experience substantial pediatric admissions for acute conditions requiring immediate medical attention, diagnostic evaluation, and therapeutic intervention. The segment benefits from well-established emergency care protocols and widespread availability of treatment options across urban and rural healthcare settings.

Government health programs have prioritized acute illness management through enhanced primary care facilities and emergency response systems. The National Health System continues to strengthen pediatric emergency services, ensuring timely access to medical care for children presenting with acute symptoms. Healthcare providers are investing in rapid diagnostic technologies and evidence-based treatment protocols to improve patient outcomes and reduce hospitalization duration for acute pediatric conditions.

Treatment Insights:

Access the comprehensive market breakdown Request Sample

- Vaccines

- Drugs

- Others

The vaccines lead with a share of 50% of the total Mexico pediatric healthcare market in 2025.

Vaccines constitute the largest treatment segment within Mexico's pediatric healthcare market, commanding the maximum market share. In 2025, the Programa Nacional de Vacunación (National Immunization Program) provides comprehensive vaccine coverage against multiple preventable diseases, including hepatitis B, tuberculosis (via BCG), rotavirus, pneumococcal infections, and the usual pediatric vaccines for measles, mumps, rubella, diphtheria, tetanus, polio, and more. Mexico's vaccination schedule covers children from birth through adolescence, with routine immunizations administered through public health facilities, community clinics, and school-based programs. The introduction of newer vaccines has expanded protection against childhood diseases and strengthened preventive care.

Healthcare authorities continue to prioritize vaccination campaigns, particularly targeting underserved populations in rural and low-income communities. Public awareness initiatives have strengthened parental confidence in immunization programs, contributing to improved vaccine uptake rates. The government's commitment to achieving universal vaccination coverage is driving investments in cold chain infrastructure, healthcare worker training, and community outreach programs to ensure all children receive timely immunizations.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico demonstrates robust pediatric healthcare infrastructure supported by higher economic development and proximity to the United States border. States in this region feature advanced medical facilities with specialized pediatric departments offering comprehensive care services. The region benefits from stronger healthcare investment, higher insurance coverage rates, and greater access to private healthcare services catering to children's health needs.

Central Mexico, anchored by the capital and surrounding states, represents the largest concentration of pediatric healthcare facilities nationwide. The region houses premier institutions offering comprehensive specialized services including pediatric oncology, cardiology, and neurology. Dense population centers drive substantial healthcare demand, supporting extensive networks of public and private pediatric clinics across metropolitan areas.

Southern Mexico presents unique healthcare challenges characterized by significant indigenous populations and rural communities with limited medical access. States in this region experience higher child mortality rates and lower vaccination coverage compared to northern regions. Government initiatives are prioritizing healthcare infrastructure expansion, community health worker programs, and telemedicine services to address pediatric care disparities.

Remaining regions across Mexico demonstrate varied pediatric healthcare landscapes influenced by local economic conditions, population density, and healthcare infrastructure development. Coastal and tourist destinations benefit from medical tourism-oriented facilities, while agricultural regions face challenges in attracting specialized pediatric healthcare providers. Government decentralization efforts are gradually improving healthcare access through community-based clinics and mobile health services.

Market Dynamics:

Growth Drivers:

Why is the Mexico Pediatric Healthcare Market Growing?

Government Investment in Child Health Infrastructure

The Mexican government has significantly increased investments in pediatric healthcare infrastructure, driving market expansion through expanded hospital capacity and improved medical equipment availability. In 2025, authorities committed over MXN 90 billion to modernize Mexico’s public health system, planning to inaugurate 31 hospitals and 12 primary‑care clinics by December, expanding access to general, maternal, and child‑health services nationwide.

Federal health authorities have announced comprehensive plans to inaugurate new hospitals and primary care clinics, including specialized maternal and pediatric care centers across multiple states. The initiative involves facilities operated by major public healthcare systems, with substantial budgetary allocations for hospital construction and healthcare system strengthening. These investments are enhancing access to quality pediatric services nationwide and addressing gaps in underserved regions.

Expanding National Immunization Programs

Mexico's comprehensive national immunization program continues driving pediatric healthcare market growth through expanded vaccine coverage and introduction of newer vaccines. The vaccination schedule covers numerous preventable diseases, administered through public health facilities, schools, and community outreach programs. In 2024, as part of the “Campaign for Recovery of Vaccination Coverage,” health authorities committed to administering over 9 million vaccine doses to children and adolescents across all 32 states, highlighting efforts to strengthen nationwide immunization. Healthcare authorities conduct annual national health campaigns promoting vaccination targeting children across all age groups. Ongoing efforts to expand protection against childhood infections through advanced vaccine formulations are strengthening the vaccines segment and improving overall child health outcomes.

Rising Healthcare Awareness Among Parents

Increasing health consciousness among Mexican parents is accelerating demand for pediatric healthcare services across preventive, diagnostic, and therapeutic categories. Urban populations demonstrate heightened awareness regarding childhood nutrition, developmental milestones, and disease prevention strategies. Digital media and social networking platforms are enabling parents to access health information, driving demand for quality pediatric consultations and specialized treatments. Reflecting this trend, the Mexico mother and child healthcare market reached USD 10.85 Billion in 2024 and is projected to grow to USD 32.24 Billion by 2033, exhibiting a CAGR of 11.5% during 2025–2033. Healthcare providers are responding by expanding service offerings, improving patient experience, and establishing pediatric wellness programs that address comprehensive child health needs.

Market Restraints:

What Challenges the Mexico Pediatric Healthcare Market is Facing?

Regional Healthcare Disparities

Significant disparities in healthcare access between northern and southern Mexican states present substantial challenges for equitable pediatric care delivery. Rural and indigenous communities experience limited availability of specialized pediatric services, longer travel distances to medical facilities, and reduced vaccination coverage rates compared to urban populations.

Healthcare Workforce Shortages

Mexico faces persistent shortages of pediatric specialists, particularly in underserved regions where recruitment and retention remain challenging. Limited training capacity for pediatric subspecialties constrains the availability of advanced pediatric care, forcing families to travel significant distances for specialized consultations and treatments.

Healthcare Financing Constraints

Budgetary limitations affecting public healthcare systems create challenges in maintaining consistent service quality and medicine availability. Populations without social security coverage experience reduced per capita healthcare spending, potentially limiting access to comprehensive pediatric services and prescription medications.

Competitive Landscape:

The Mexico pediatric healthcare market demonstrates a diversified competitive structure comprising multinational pharmaceutical corporations, domestic healthcare providers, and specialized pediatric institutions. Leading vaccine manufacturers maintain strong market positions through established distribution networks and government procurement contracts supporting national immunization programs. Private hospital networks are expanding pediatric service offerings, investing in advanced diagnostic technologies, and establishing specialized children's care centers to capture growing demand. Public healthcare institutions continue playing essential roles in pediatric care delivery, particularly for uninsured populations. Market participants are increasingly focusing on strategic partnerships, digital health innovations, and community outreach programs to strengthen competitive positioning.

Recent Developments:

- In May 2025, the Instituto Nacional de Pediatría (INP), in collaboration with the Fight For Life Club Foundation, achieved a national milestone by performing two pediatric living-donor liver transplants within one week, marking a breakthrough in complex pediatric transplant care. The accomplishment highlights how coordinated clinical partnerships are advancing life-saving surgical innovation.

Mexico Pediatric Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chronic Illness, Acute Illness |

| Treatments Covered | Vaccines, Drugs, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico pediatric healthcare market size was valued at USD 209.80 Million in 2025.

The Mexico pediatric healthcare market is expected to grow at a compound annual growth rate of 4.34% from 2026-2034 to reach USD 307.49 Million by 2034.

Acute illness dominated the type segment with 65% market share, driven by high prevalence of respiratory infections, gastrointestinal disorders, and seasonal illnesses requiring immediate medical intervention among children.

Key factors driving the Mexico pediatric healthcare market include expanding government investments in child health infrastructure, comprehensive national immunization programs, rising healthcare awareness among parents, and technological advancements in pediatric diagnostics and treatment.

Major challenges include significant regional healthcare disparities between northern and southern states, persistent shortages of pediatric specialists particularly in underserved areas, healthcare financing constraints affecting public systems, and limited access to specialized services in rural communities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)