Mexico Pediatric Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Formulation, Age Group, Distribution Channel, and Region, 2025-2033

Mexico Pediatric Nutritional Supplements Market Overview:

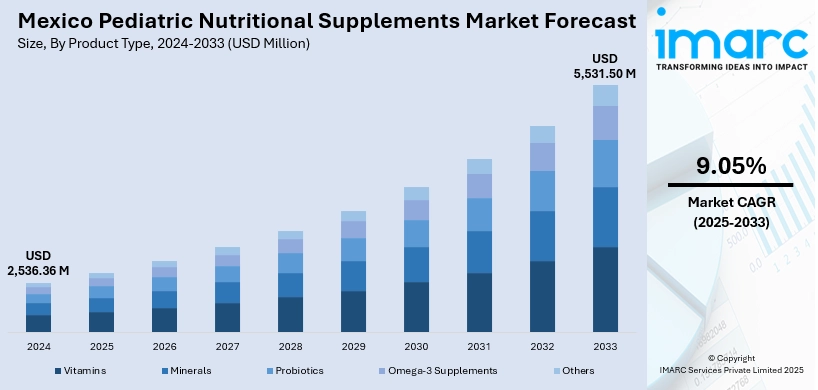

The Mexico pediatric nutritional supplements market size reached USD 2,536.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,531.50 Million by 2033, exhibiting a growth rate (CAGR) of 9.05% during 2025-2033. The market is driven by increasing parental focus on child health, innovations in formulation, digital and retail access, and sustainability awareness, encouraging brands to offer targeted, clean, and high-quality products. Enhanced convenience via online channels and trusted credentials are driving trust and adoption, thus strengthening the Mexico pediatric nutritional supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,536.36 Million |

| Market Forecast in 2033 | USD 5,531.50 Million |

| Market Growth Rate 2025-2033 | 9.05% |

Mexico Pediatric Nutritional Supplements Market Trends:

Dual Burden of Malnutrition and Obesity

Mexico faces a unique nutritional paradox, with some regions experiencing undernutrition while others see rising childhood obesity. This dual burden is shaping the pediatric supplement landscape. Parents are looking for products that either boost nutrition in undernourished children or manage balanced intake in overweight ones. Supplement manufacturers have responded by offering a range of fortified products, including multivitamins, fiber-rich blends, and omega-3s that address both extremes. These offerings are often personalized for specific age groups and conditions. As public awareness of long-term health risks increases, parents are more inclined to adopt supplements as part of routine care. Pediatricians and public health campaigns further reinforce this behavior, promoting tailored supplementation to combat nutrient imbalances and lifestyle-related conditions. This complex health environment fuels diverse, needs-based product demand.

To get more information on this market, Request Sample

Regulatory Support and Health Program Influence

Government-backed programs and health policies in Mexico play a key role in the pediatric nutritional supplements market. Initiatives like Prospera (formerly Oportunidades) promote micronutrient supplementation among vulnerable child populations, establishing a foundation of trust. National health campaigns and school-based nutrition awareness efforts reinforce the importance of preventive care and healthy eating habits. Regulatory oversight ensures product safety, quality, and transparency, boosting consumer confidence in branded supplements. Healthcare providers increasingly recommend supplements tailored to a child’s age and nutritional needs, making them a standard part of pediatric care. The combined influence of public education, pediatric endorsement, and stringent regulation has driven consistent demand. As families seek reliable, well-regulated options, regulatory frameworks continue to shape responsible consumption and help ensure safe Mexico pediatric nutritional supplements market growth.

Expansion of Digital and Retail Access

The widespread availability of pediatric nutritional supplements through e-commerce and retail stores is a major growth driver in Mexico. Digital platforms enable parents to explore ingredient details, pediatric endorsements, and user reviews before purchasing. Online subscription models offer convenience, ensuring regular delivery of age-appropriate supplements. In parallel, pharmacies, supermarkets, and baby care chains are expanding their health and wellness sections, making products more accessible in physical stores. This omnichannel approach caters to tech-savvy, urban parents as well as those in semi-urban areas. Product visibility, promotional offers, and expert advice available online or in-store encourage trial and adoption. The accessibility and ease of purchase are improving consumer confidence, promoting regular usage, and supporting the expansion of the pediatric supplement market across demographic segments.

Mexico Pediatric Nutritional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, formulation, age group, and distribution channel.

Product Type Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamins, minerals, probiotics, omega-3 supplements, and others.

Formulation Insights:

- Tablets

- Capsules

- Powders

- Liquids

- Gummies

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes tablets, capsules, powders, liquids, and gummies.

Age Group Insights:

- Infants (0-2 years)

- Children (3-12 years)

- Adolescents (13-18 years)

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes infants (0-2 years), children (3-12 years), and adolescents (13-18 years).

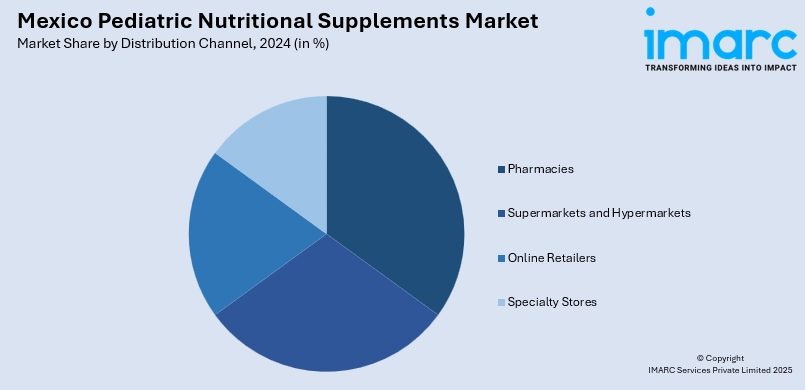

Distribution Channel Insights:

- Pharmacies

- Supermarkets and Hypermarkets

- Online Retailers

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies, supermarkets and hypermarkets, online retailers, and specialty stores.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pediatric Nutritional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamins, Minerals, Probiotics, Omega-3 Supplements, Others |

| Formulations Covered | Tablets, Capsules, Powders, Liquids, Gummies |

| Age Groups Covered | Infants (0-2 years), Children (3-12 years), Adolescents (13-18 years) |

| Distribution Channels Covered | Pharmacies, Supermarkets and Hypermarkets, Online Retailers, Specialty Stores |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pediatric nutritional supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pediatric nutritional supplements market on the basis of product type?

- What is the breakup of the Mexico pediatric nutritional supplements market on the basis of formulation?

- What is the breakup of the Mexico pediatric nutritional supplements market on the basis of age group?

- What is the breakup of the Mexico pediatric nutritional supplements market on the basis of distribution channel?

- What is the breakup of the Mexico pediatric nutritional supplements market on the basis of region?

- What are the various stages in the value chain of the Mexico pediatric nutritional supplements market?

- What are the key driving factors and challenges in the Mexico pediatric nutritional supplements market?

- What is the structure of the Mexico pediatric nutritional supplements market and who are the key players?

- What is the degree of competition in the Mexico pediatric nutritional supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pediatric nutritional supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pediatric nutritional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pediatric nutritional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)