Mexico Personal Grooming Products Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, Form, and Region, 2025-2033

Mexico Personal Grooming Products Market Overview:

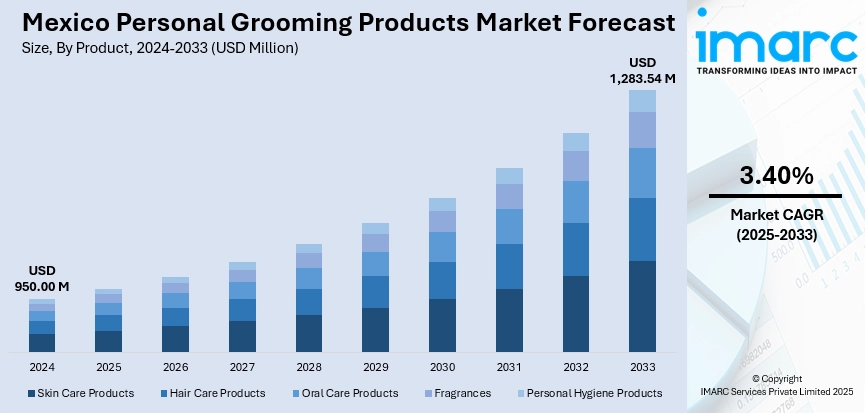

The Mexico personal grooming products market size reached USD 950.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,283.54 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is driven by growing self-care awareness, e-commerce adoption, and rising demand for organic and premium solutions. Consumers are embracing multifunctional, planet-friendly options alongside routines tailored to skincare, haircare, and male grooming. Increasing urban lifestyles and social media influence continue to reshape buying behaviors and brand innovation, enhancing the Mexico personal grooming products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 950.00 Million |

| Market Forecast in 2033 | USD 1,283.54 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Mexico Personal Grooming Products Market Trends:

Rising Disposable Income and Urbanization

Mexico’s growing middle class and rising disposable incomes are fueling demand for personal grooming products. As more households attain higher earning capacity, consumers are feeling affluent enough to invest in quality grooming items beyond necessities, ranging from skincare serums to premium fragrances. Concurrently, rapid urbanization places more people in cities where grooming standards and peer visibility are more pronounced. Urban consumers are increasingly exposed to global beauty trends via retail stores and local salons, leading to greater adoption of advanced hygiene and wellness routines. This blend of economic growth and city-driven lifestyle changes is steadily pushing Mexicans toward comprehensive grooming habits, ultimately supporting sector expansion and heightened Mexico personal grooming products market growth.

To get more information on this market, Request Sample

Demand for Natural, Organic, and Sustainable Solutions

A marked shift toward clean, green beauty is influencing Mexico’s grooming products sector. Consumers are increasingly preferring natural, organic, and eco-friendly items free from harmful chemicals, favoring ingredients like plant extracts and botanicals. Sustainability extends to biodegradable packaging, cruelty-free formulations, and transparent sourcing—features that resonate particularly with younger, environmentally-conscious shoppers. This trend is convincing brands to reformulate classic products and launch specialized “green” lines. The emotional appeal and perceived wellness benefits associated with sustainable grooming are enhancing loyalty and justifying price premiums. This driver continues to steer product innovation, research and development (R&D) investment, and market positioning strategies toward a clean-beauty future.

Cultural Shift and Premium Male Grooming

Male grooming in Mexico is undergoing a cultural transformation—from rudimentary shaving routines to sophisticated self-care regimes. This mindset shift is fueled by evolving norms and increased awareness of skin concerns such as aging, sensitivity, and acne. Urban, younger males are experimenting with beard oils, serums, specialized cleansers, and anti-aging moisturizers, and they are becoming more open to male-targeted grooming products. Premium male grooming brands and upscale barber services are pushing quality and expertise, reflecting a willingness to invest in curated, value-enhancing solutions. Combined with rising disposable income and digital exposure, this cultural pivot is expanding the male segment and adding depth and profitability to the broader grooming market.

Mexico Personal Grooming Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, distribution channel, and form.

Product Insights:

- Skin Care Products

- Hair Care Products

- Oral Care Products

- Fragrances

- Personal Hygiene Products

The report has provided a detailed breakup and analysis of the market based on the product. This includes skin care products, hair care products, oral care products, fragrances, and personal hygiene products.

Gender Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes men, women, and unisex.

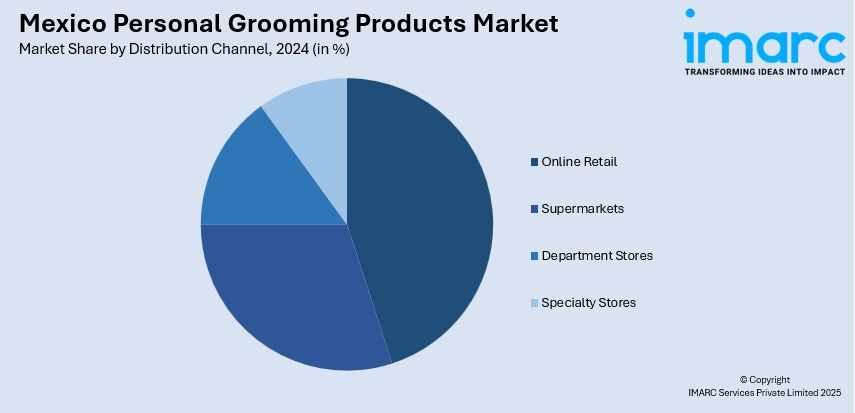

Distribution Channel Insights:

- Online Retail

- Supermarkets

- Department Stores

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail, supermarkets, department stores, and specialty stores.

Form Insights:

- Liquid

- Cream

- Gel

- Spray

- Wipes

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid, cream, gel, spray, and wipes.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Personal Grooming Products Market News:

- In February 2025, Aora México's Buy 1, Remove 9X the Plastic campaign is a partnership with RePurpose Global to support the recovery of plastic pollution. For every Aora product sold, the amount of plastic pollution removed from the environment will increase by nine times. The Mexican beauty brand had been identified as a "plastic-negative" enterprise by RePurpose Global.

Mexico Personal Grooming Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Skin Care Products, Hair Care Products, Oral Care Products, Fragrances, Personal Hygiene Products |

| Gender Covered | Men, Women, Unisex |

| Distribution Channels Covered | Online Retail, Supermarkets, Department Stores, Specialty Stores |

| Forms Covered | Liquid, Cream, Gel, Spray, Wipes |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico personal grooming products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico personal grooming products market on the basis of product?

- What is the breakup of the Mexico personal grooming products market on the basis of gender?

- What is the breakup of the Mexico personal grooming products market on the basis of distribution channel?

- What is the breakup of the Mexico personal grooming products market on the basis of form?

- What is the breakup of the Mexico personal grooming products market on the basis of region?

- What are the various stages in the value chain of the Mexico personal grooming products market?

- What are the key driving factors and challenges in the Mexico personal grooming products market?

- What is the structure of the Mexico personal grooming products market and who are the key players?

- What is the degree of competition in the Mexico personal grooming products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico personal grooming products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico personal grooming products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico personal grooming products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)