Mexico Personal Luxury Goods Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2025-2033

Mexico Personal Luxury Goods Market Overview:

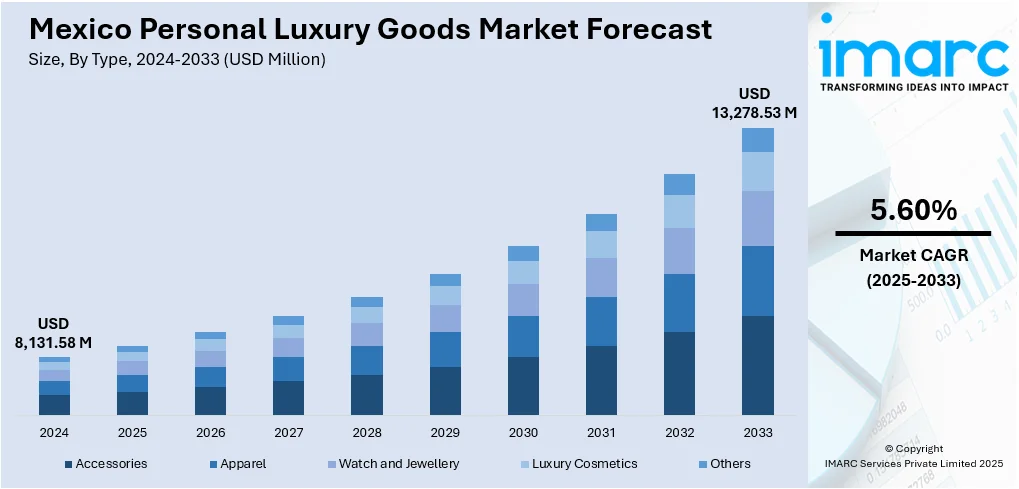

The Mexico personal luxury goods market size reached USD 8,131.58 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13,278.53 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The inflating disposable incomes, an expanding middle class, a growing number of high-net-worth individuals, booming tourism supported by proximity to the U.S., rapid digitalization and e-commerce proliferation, and strong brand marketing targeting younger, social-media-savvy consumers are among the key factors propelling the market forward.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,131.58 Million |

| Market Forecast in 2033 | USD 13,278.53 Million |

| Market Growth Rate 2025-2033 | 5.60% |

Mexico Personal Luxury Goods Market Trends:

Omnichannel & Digital Acceleration Fueling Luxury Engagement

The Mexico personal luxury goods market is undergoing a significant transformation with a strong focus on omnichannel retail and digital innovation, opening up new consumer segments and expanding wallet share. In 2023, online shopping accounted for 15% of all retail sales, a sharp increase from just 1% a decade ago, reflecting a tenfold rise in digital adoption. This growth is fueled by rapid smartphone penetration, the widespread use of digital wallets, and the rise of buy-now-pay-later schemes, allowing both affluent and aspirational shoppers to seamlessly shop across online, mobile, and in-store platforms. Major luxury brands like Chanel, Louis Vuitton, and local e-tailers such as Mercado Libre are investing heavily in mobile-first websites, AI-powered chatbots, and augmented-reality ‘virtual try-ons’ to enhance digital experiences. As Mexican e-commerce is projected to reach USD 176.6 billion by 2033, digital channels will continue to be a key growth driver for luxury brands.

To get more information on this market, Request Sample

Tourism-Driven and Experiential Luxury Consumption

Mexico’s tourism resurgence has significantly fueled high-value, experience-driven luxury spending, positioning the country as a rising hub for premium retail. According to Mexico’s national statistics institute (INEGI), the nation welcomed 45.04 million international tourists in 2024, a 7.4% year-on-year increase, while overall visitor numbers, including day-trippers, surged by 15.5% to 86.41 million. International tourism revenue also rose by 5.9%, reaching USD 30.25 billion. This surge has translated directly into booming sales in duty-free zones and luxury boutiques across hotspots like Cancún, Los Cabos, and Mexico City’s upscale neighborhoods, especially along Polanco’s Presidente Masaryk Avenue. Luxury brands and hoteliers have seized the momentum by integrating high-end boutiques into five-star resorts such as Rosewood and Four Seasons, offering exclusive experiences like VIP services, trunk shows, branded cafés, and pop-up events. Tourists now account for nearly one-third of all luxury purchases, reinforcing Mexico’s dual appeal as both a leisure and luxury shopping destination and driving continued growth in its high-end goods market.

Mexico Personal Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, gender, and distribution channel.

Type Insights:

- Accessories

- Apparel

- Watch and Jewellery

- Luxury Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes accessories, apparel, watch and jewellery, luxury cosmetics, and others.

Gender Insights:

- Female

- Male

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes female and male.

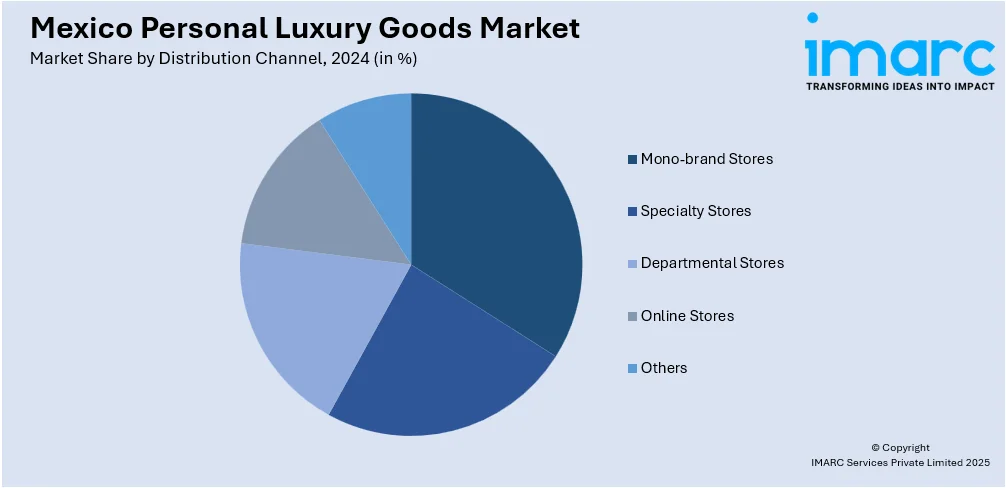

Distribution Channel Insights:

- Mono-brand Stores

- Specialty Stores

- Departmental Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mono-brand stores, specialty stores, departmental stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Personal Luxury Goods Market News:

- May 2025: UK beauty brand Charlotte Tilbury entered Mexico with its launch at Sephora, followed by counters at two El Palacio de Hierro stores and a travel-retail concession at Mexico City airport. This marks a strategic expansion into Latin America’s premium luxury beauty market for the company.

- March 2024: US-based Ulta Beauty, known for its high-end cosmetic products, announced that it would launch in Mexico in 2025. The move marks Ulta’s first major international expansion, leveraging brand awareness and strong border-store performance. Partnering with brand operator Axo, Ulta will compete with Sephora, Liverpool, and Palacio de Hierro.

Mexico Personal Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Accessories, Apparel, Watch and Jewellery, Luxury Cosmetics, Others |

| Genders Covered | Female, Male |

| Distribution Channels Covered | Mono-brand Stores, Specialty Stores, Departmental Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico personal luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico personal luxury goods market on the basis of type?

- What is the breakup of the Mexico personal luxury goods market on the basis of gender?

- What is the breakup of the Mexico personal luxury goods market on the basis of distribution channel?

- What is the breakup of the Mexico personal luxury goods market on the basis of region?

- What are the various stages in the value chain of the Mexico personal luxury goods market?

- What are the key driving factors and challenges in the Mexico personal luxury goods market?

- What is the structure of the Mexico personal luxury goods market and who are the key players?

- What is the degree of competition in the Mexico personal luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico personal luxury goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico personal luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico personal luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)