Mexico Pet Care Market Size, Share, Trends and Forecast by Product Type, Pet Type, Distribution Channel, and Region, 2025-2033

Mexico Pet Care Market Overview:

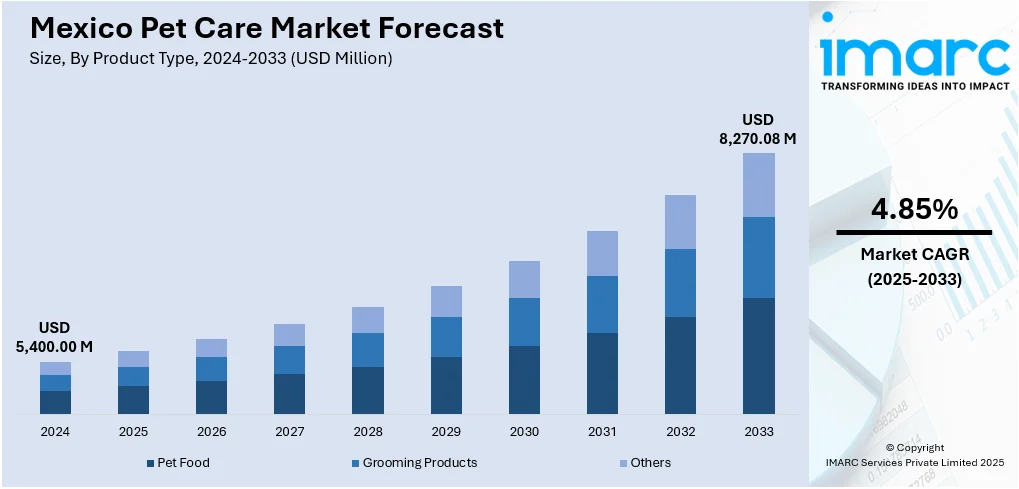

The Mexico pet care market size reached USD 5,400.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,270.08 Million by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. The market is experiencing robust growth, driven by increasing pet ownership, the humanization of pets, rising demand for premium and health-focused products, expanding e-commerce platforms, and a growing middle class prioritizing pet wellness and convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,400.00 Million |

| Market Forecast in 2033 | USD 8,270.08 Million |

| Market Growth Rate 2025-2033 | 4.85% |

Mexico Pet Care Market Trends:

Digital E-commerce Expansion Across Pet Care Channels

The Mexico pet care market is rapidly shifting toward online retail, driven by increasing internet penetration, mobile adoption, and a growing demand for convenience. As of early 2024, 83.2% of Mexicans were online, creating a large digitally connected audience for pet care brands. With over 200 businesses manufacturing or marketing pet food in the country, production is projected to grow by 2.5% annually through 2030. Among online segments, pet supplements are expected to see the fastest growth as owners seek specialized health solutions. Both international giants like Amazon, Chewy, and Petco, as well as local startups, are investing in omnichannel ecosystems that feature AI-driven recommendations, subscription models, and loyalty rewards. Improved logistics now extend beyond major cities, while virtual vet consultations and in-app grooming bookings enhance customer engagement. This digital shift is poised to continue, with further investments in mobile-first experiences and AI-driven personalization driving pet care e-commerce growth.

To get more information on this market, Request Sample

Health & Wellness-Oriented Premiumization Across Product Segments

The Mexican pet care market is undergoing a significant shift toward premiumization, driven by a growing tendency among pet owners to treat their animals as family members and prioritize their health and well-being. As of 2021, nearly 70% of Mexican households owned pets, reflecting the deepening human-animal bonds. Despite this widespread ownership, 45% of pet owners spend less than USD 60 per month on pet care, while only 3% spend over USD 160. However, spending patterns are evolving, with rising demand for pet supplements such as joint support, multivitamins, and digestive aids. Simultaneously, the pet food segment is becoming more sophisticated, with brands introducing grain-free, organic, hypoallergenic, and therapeutic options that mirror human dietary trends. Companies like Nestlé Purina, Mars Petcare, and Diamond Pet Foods are responding by launching products featuring probiotics, hydrolyzed proteins, and superfood extracts. As urban consumers increasingly seek vet-approved, functional nutrition, continued innovation and consumer awareness are set to make premium offerings the cornerstone of market growth.

Mexico Pet Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, pet type, and distribution channel.

Product Type Insights:

- Pet Food

- Dry

- Wet

- Grooming Products

- Shampoos and Conditioners

- Combs and Brushes

- Clippers and Scissors

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pet food (dry and wet), grooming products (shampoos and conditioners, combs and brushes, clippers and scissors, and others), and others.

Pet Type Insights:

- Dog

- Cat

- Others

A detailed breakup and analysis of the market based on the pet type have also been provided in the report. This includes dog, cat, and others.

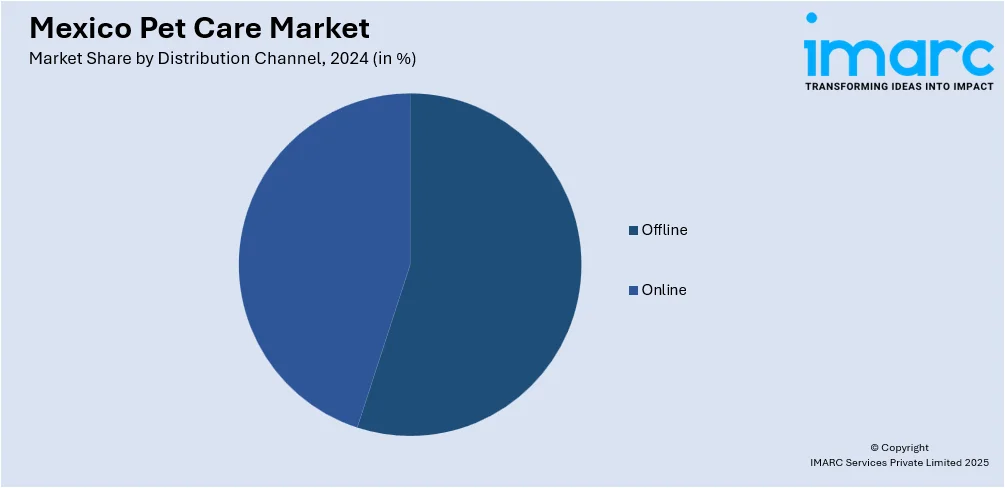

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pet Care Market News:

- March 2025: ADM inaugurated a USD 39 million wet pet food plant in Morelos, Mexico, enhancing its role among the country's top pet food manufacturers. This facility focuses on producing high-quality wet food for dogs and cats under brands like Ganador and Minino, aiming to meet the rising demand for premium pet nutrition.

- May 2024: Nestlé Purina invested USD 220 million to expand its pet food manufacturing facility in Silao, Guanajuato. The expansion includes adding new production lines for both wet and dry pet food, positioning the plant as the largest in Latin America.

Mexico Pet Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Pet Types Covered | Dog, Cat, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pet care market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pet care market on the basis of product type?

- What is the breakup of the Mexico pet care market on the basis of pet type?

- What is the breakup of the Mexico pet care market on the basis of distribution channel?

- What is the breakup of the Mexico pet care market on the basis of region?

- What are the various stages in the value chain of the Mexico pet care market?

- What are the key driving factors and challenges in the Mexico pet care market?

- What is the structure of the Mexico pet care market and who are the key players?

- What is the degree of competition in the Mexico pet care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pet care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pet care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pet care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)