Mexico Pet Supplement Market Size, Share, Trends and Forecast by Pet Type, Source, Distribution Channel, Application, and Region, 2025-2033

Mexico Pet Supplement Market Overview:

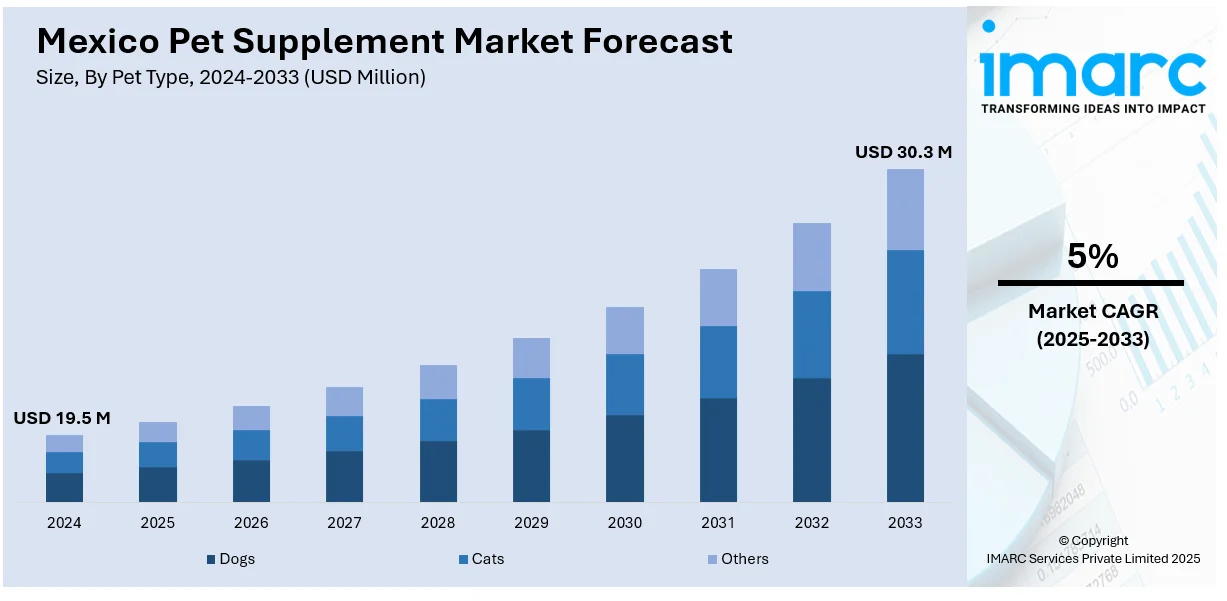

The Mexico pet supplement market size reached USD 19.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 30.3 Million by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. The market is increasing steadily with the support of heightening consumer awareness, changing purchasing habits, and growing distribution networks, coupled with sustained demand through high-quality standards, regulatory compliance, and an established supply chain in both local and foreign markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.5 Million |

| Market Forecast in 2033 | USD 30.3 Million |

| Market Growth Rate 2025-2033 | 5% |

Mexico Pet Supplement Market Trends:

Growing Demand for Natural and Organic Pet Supplements

The Mexico pet supplement market outlook is witnessing a massive transition towards natural and organic supplements as pet owners increasingly become health and nutrition-conscious of their pets. Consumers are now looking for supplements in the form of organic ingredients that are free from additives, preservatives, and synthetic chemicals and are instead seeking natural options to cater to the overall welfare of their pets. For instance, in September 2023, Cargill re-launched its PINGO™ dog food brand in Mexico, launching meat-flavored puppy and adult formulas focusing on affordability, pet health, and sustainability due to changing consumer needs. Moreover, such a trend is especially prevalent among the owners of cats and dogs, who spend money on excellent formulations that promote vitality and longevity. The demand for organic pet supplements is also supported by an increased recognition of the possible health merits of natural nutrients, such as herbs, vitamins, and probiotics. Retailers and internet sites have followed suit, offering plant-based, grain-free, and chemical-free supplements that cater to the increased demand for holistic pet care. As public awareness continues to build, natural and organic pet supplements are predicted to experience sustained Mexico pet supplement market growth.

Increasing Popularity of Functional Pet Supplements

Functional pet supplements are growing in popularity in Mexico as owners seek specific fixes for certain ailments. For example, in September 2023, Purina's Unleashed Accelerator program was enlarged to Brazil and Mexico, with backing for pet care business ventures with tech-based solutions in nutrition, health, and sustainability, providing mentorship, investment, and industry access for expansion. Furthermore, supplements targeted to promote joint health, coat and skin conditions, digestion, and overall immunity are on the rise. This trend illustrates an increased focus on preventative medicine, with owners wanting to keep their pets healthy and avoid common afflictions that are part of aging, breed vulnerability, or nutritional deficit. Functional supplements are especially popular with aging animals, with owners using glucosamine, chondroitin, and omega-3 fatty acids as they focus on mobility and joint function. Furthermore, prebiotics and probiotics are being increasingly added to pet foods to support digestive well-being. As more attention is paid to longevity and health, the functional supplement industry continues to grow, buoyed by innovation in products and greater consumer understanding of the merits of customized pet nutrition.

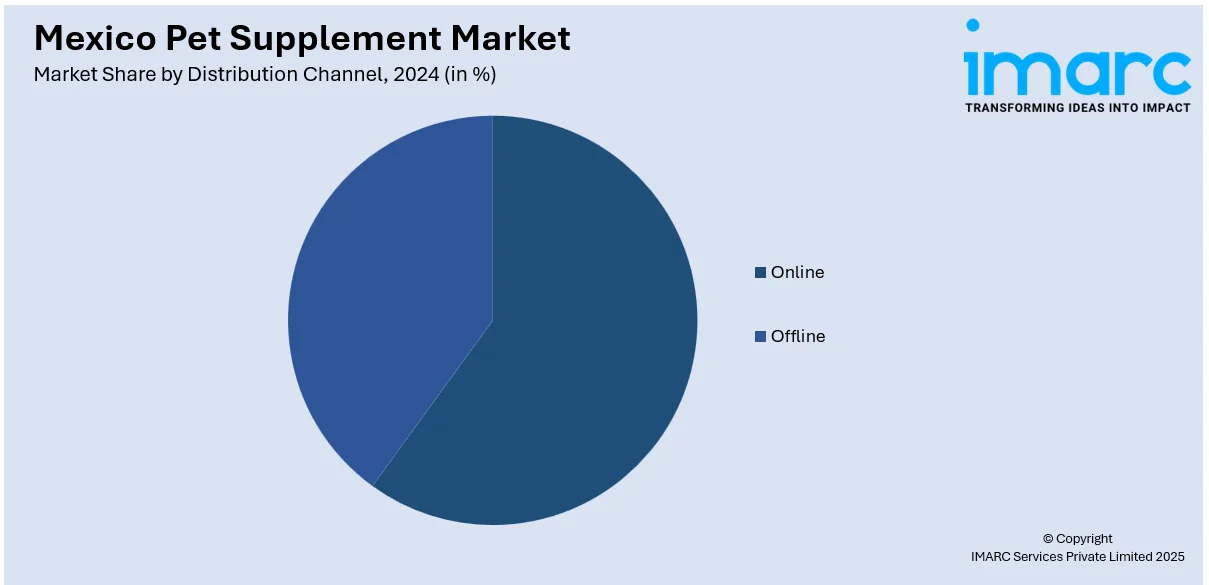

Expansion of Online Pet Supplement Sales

The Mexico pet supplement market share is expanding fast online, supported by higher levels of digital uptake and customer preference for convenience. Online platforms and dedicated pet health websites have made it convenient for pet owners to access various supplements, compare brands, and make informed purchases. Subscription-based plans, with automatic pet supplement replenishment, have also become popular, guaranteeing pets a consistent supply of nutritional support. Online retailers offer extensive product descriptions, ingredient disclosure, and consumer reviews, which further promote informed purchasing behavior. Moreover, improvements in cold-chain logistics and secure packaging have enhanced consumer trust in buying pet supplements online. Promotional discounts, bundled purchases, and doorstep delivery further enhance the attractiveness of online shopping, making it a popular option among many pet owners. With rising internet penetration and the growing popularity of digital payment options, Mexican online sales of pet supplements will continue to grow.

Mexico Pet Supplement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on pet type, source, distribution channel, and application.

Pet Type Insights:

- Dogs

- Cats

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dogs, cats, and others.

Source Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes organic and conventional.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Application Insights:

- Multivitamins

- Skin and Coat

- Hip and Joint

- Prebiotics and Probiotics

- Calming

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes multivitamins, skin and coat, hip and joint, prebiotics and probiotics, calming, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pet Supplement Market News:

- In March 2024, Grupo Nupec introduced eight new pet food lines focused on digestive health, kidney support, and urinary management for cats, as well as specialized dog formulas. The high-end formulas include functional ingredients such as prebiotics and L-carnitine to support digestion and metabolism, reacting to increasing demand for pet health solutions in Mexico.

- In September 2023, Purina extended its Unleashed Accelerator to Mexico to back pet care startups innovating in health and nutrition. As demand for pet supplements continues to grow, the program provides funding and mentorship to companies working on functional ingredients, personalized nutrition, and wellness solutions, supporting Mexico's burgeoning pet supplement market.

Mexico Pet Supplement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dogs, Cats, Others |

| Sources Covered | Organic, Conventional |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Multivitamins, Skin and Coat, Hip and Joint, Prebiotics and Probiotics, Calming, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pet supplement market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pet supplement market on the basis of pet type?

- What is the breakup of the Mexico pet supplement market on the basis of source?

- What is the breakup of the Mexico pet supplement market on the basis of distribution channel?

- What is the breakup of the Mexico pet supplement market on the basis of application?

- What is the breakup of the Mexico pet supplement market on the basis of region?

- What are the various stages in the value chain of the Mexico pet supplement market?

- What are the key driving factors and challenges in the Mexico pet supplement?

- What is the structure of the Mexico pet supplement market and who are the key players?

- What is the degree of competition in the Mexico pet supplement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pet supplement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pet supplement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pet supplement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)