Mexico Plasterboard Market Size, Share, Trends and Forecast by Form, Type, End-Use Sector, and Region, 2025-2033

Mexico Plasterboard Market Overview:

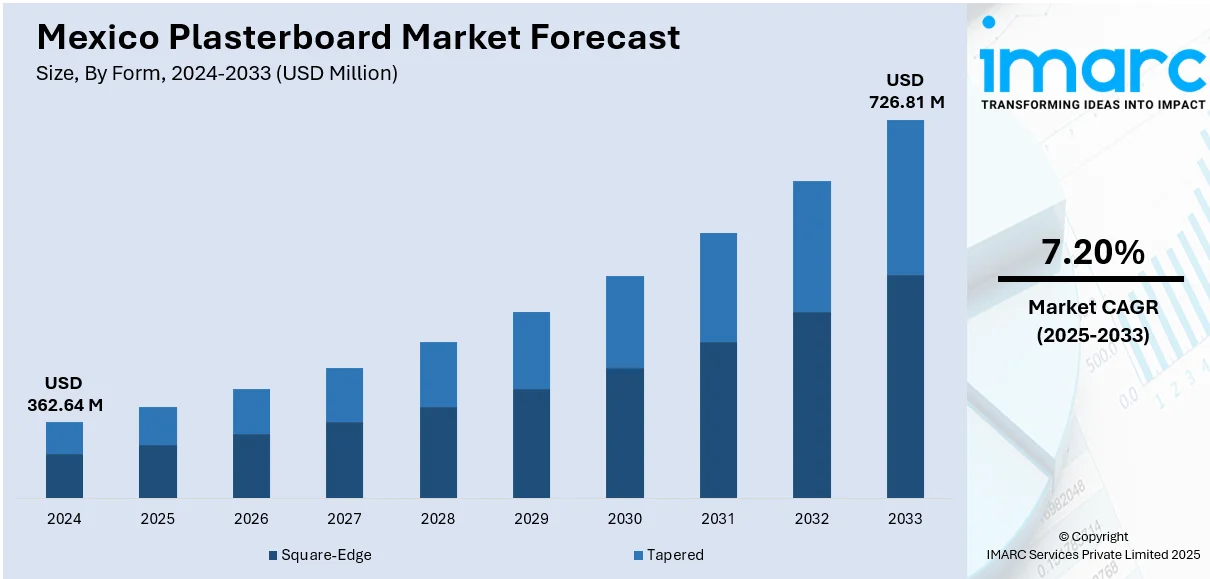

The Mexico plasterboard market size reached USD 362.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 726.81 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. Rising demand for lightweight, quick-install materials in housing and industrial projects is supporting steady growth. Apart from this, growing use in modular interiors and moisture-resistant applications continues to strengthen Mexico plasterboard market share across real estate, manufacturing, and infrastructure development segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 362.64 Million |

| Market Forecast in 2033 | USD 726.81 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Plasterboard Market Trends:

Construction Sector Boosts Demand

The Mexico plasterboard market growth is increasingly tied to expansion in construction activity. Government-backed housing initiatives and rising investments in commercial real estate are playing a direct role in boosting demand. Rapid urbanization in key cities like Monterrey, Guadalajara, and Mexico City has led to a growing demand for cost-effective and efficient building materials. Plasterboard fits well here due to its easy installation, lightweight structure, and thermal insulation properties. Contractors prefer it for both partitioning and ceiling applications. Growing interest in sustainable construction is also helping the material gain traction, especially when paired with recycled content and low-emission adhesives. In the lower half of the market, manufacturers are introducing region-specific product lines to meet localized climate and seismic considerations. A noticeable development is the rising preference for moisture-resistant and fire-rated variants in high-density areas. These adaptations align with stricter building codes and growing awareness about indoor air quality. Additionally, the hotel and tourism sectors, particularly in coastal states, are using plasterboards to meet fast-track renovation schedules. Foreign direct investments in infrastructure and logistics parks have further strengthened the material’s position. These trends suggest that the market is being reshaped not just by volume, but also by product specialization and application diversity.

To get more information on this market, Request Sample

Industrial Projects Fueling Consumption

Industrial expansion is another driver pushing plasterboard consumption upward in Mexico. Automotive assembly plants, logistics hubs, and electronics manufacturing units especially along the northern border have led to increased demand for quick-to-install, durable interior materials. Plasterboard serves as a preferred choice for setting up administrative areas within large industrial facilities. Its cost-effectiveness and compatibility with steel framing systems make it a practical option in high-speed construction settings. In recent quarters, demand has also been driven by energy sector infrastructure, particularly for solar and wind project control buildings. One trend gaining momentum is the increasing use of laminated plasterboard in settings where both acoustic control and aesthetic finish are required. Some local producers are now offering customized board thicknesses and edge profiles, a shift from earlier one-size-fits-all approaches. This product tailoring is being driven by architects working on modern industrial parks aiming to balance functionality and visual appeal. The uptick in warehouse construction post-pandemic has also helped, with developers opting for plasterboard for faster tenant turnover. Trade relationships with the U.S. have indirectly supported this demand through nearshoring, leading to industrial builds in northern states. Collectively, these shifts reflect a broader move toward tailored, time-efficient interior solutions across industrial projects.

Mexico Plasterboard Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, type, and end-use sector.

Form Insights:

- Square-Edge

- Tapered

The report has provided a detailed breakup and analysis of the market based on the form. This includes square-edge and tapered.

Type Insights:

- Standard Plasterboard

- Fire-Resistant Plasterboard

- Thermal Insulated Plasterboard

- Moisture-Resistant Plasterboard

- Sound-Resistant Plasterboard

- Impact-Resistant Plasterboard

The report has provided a detailed breakup and analysis of the market based on the type. This includes standard plasterboard, fire-resistant plasterboard, thermal insulated plasterboard, moisture-resistant plasterboard, sound-resistant plasterboard, and impact-resistant plasterboard.

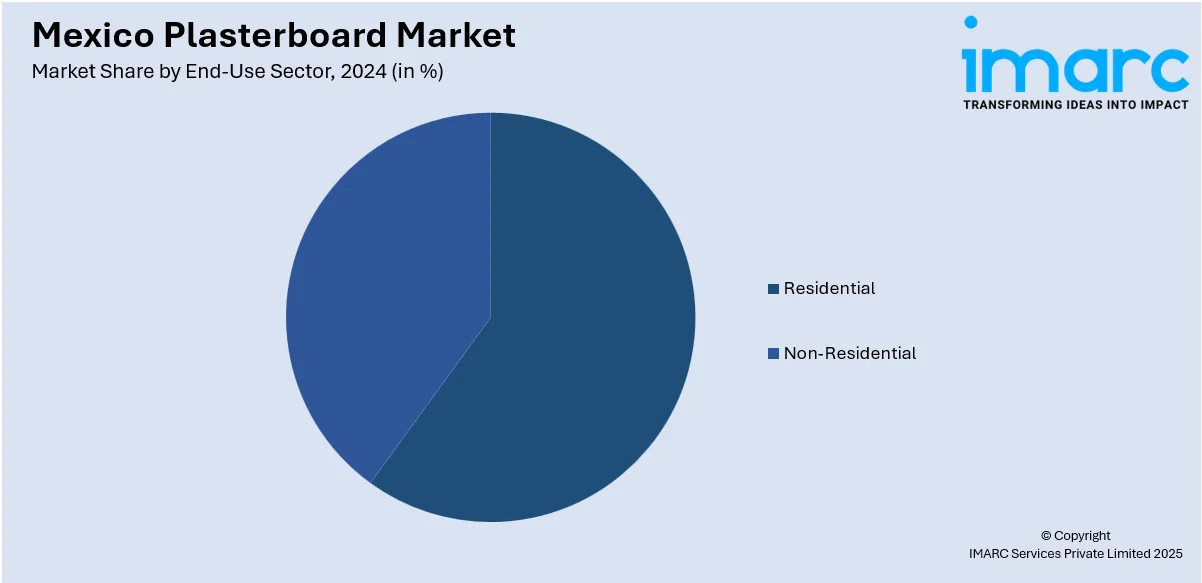

End-Use Sector Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Plasterboard Market News:

- May 2025: SICIT entered a co-control agreement with TPG Rise Climate and Renaissance Partners, announcing a new plaster retardant production plant in Mexico. This move strengthened local supply capabilities, supporting sustainable plasterboard manufacturing and boosting Mexico’s presence the markets.

Mexico Plasterboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Square-Edge, Tapered |

| Types Covered | Standard Plasterboard, Fire-Resistant Plasterboard, Thermal Insulated Plasterboard, Moisture-Resistant Plasterboard, Sound-Resistant Plasterboard, Impact-Resistant Plasterboard |

| End-Use Sectors Covered | Residential, Non-Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico plasterboard market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico plasterboard market on the basis of form?

- What is the breakup of the Mexico plasterboard market on the basis of type?

- What is the breakup of the Mexico plasterboard market on the basis of end-use sector?

- What is the breakup of the Mexico plasterboard market on the basis of region?

- What are the various stages in the value chain of the Mexico plasterboard market?

- What are the key driving factors and challenges in the Mexico plasterboard market?

- What is the structure of the Mexico plasterboard market and who are the key players?

- What is the degree of competition in the Mexico plasterboard market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico plasterboard market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico plasterboard market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico plasterboard industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)