Mexico Plastic Furniture Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Plastic Furniture Market Overview:

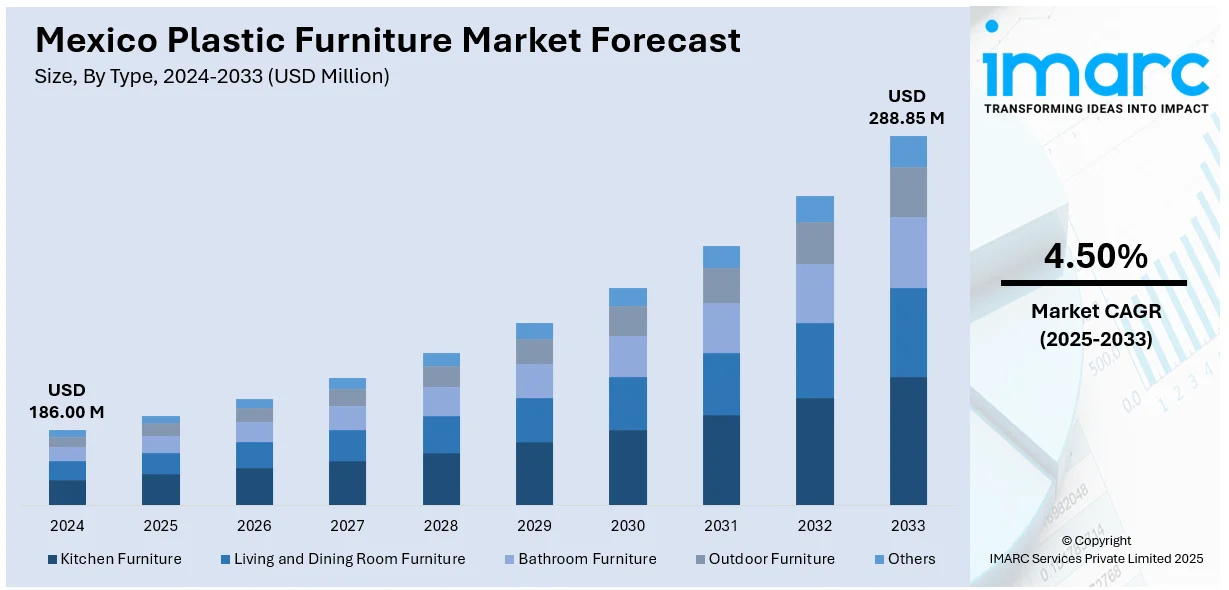

The Mexico plastic furniture market size reached USD 186.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 288.85 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is on the rise due to mounting demand for sustainable, lightweight, and long-lasting designs. Customers now increasingly demand ecofriendly products that can be recycled or biodegradable, particularly outdoor furniture. Heightening adoption of e-commerce is also helping the market grow, as it offers ease and access to a large collection of plastic furniture. All these trends are influencing Mexico plastic furniture market share and outlook in a very positive way.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 186.00 Million |

| Market Forecast in 2033 | USD 288.85 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Mexico Plastic Furniture Market Trends:

Rising Demand for Eco-Friendly Plastic Furniture

With environmental issues on the increase, there has been a d move towards green plastic furniture in Mexico. Customers are becoming intensely aware of the environmental cost of the products they buy, and this has led to an amplifying demand for sustainable products. To meet this demand, manufacturers are turning their attention to making plastic furniture from recycled materials, biodegradable plastics, and other sustainable sources. This is most evident in garden furniture, where there is great demand for environmentally friendly, weather-resistant products. Most companies are also adding eco-friendly manufacturing methods to minimize carbon emissions. As per the reports, in May 2023, Mexico City signed the New Plastics Economy Global Commitment and committed to achieving UN and Ellen MacArthur Foundation targets to end unnecessary plastics use and encourage reuse, recycling, and circular economy operations. Furthermore, the Mexican market for environmentally friendly plastic furniture is on the upswing, and sustainability is playing a significant role in consumer choices. The outlook for Mexico's plastic furniture market is bright, as such eco-friendly innovations keep boosting their popularity and helping the market's overall growth and size.

Movement towards Lightweight and Long-Lasting Designs

Plastic furniture is gaining significant popularity in Mexico due to its lightweight and durable properties, making it an ideal choice for various residential and commercial applications. Compared to traditional materials such as metal or wood, plastic furniture offers greater portability and requires less maintenance. Its resistance to extreme weather conditions makes it highly suitable for use outdoors, e.g., patio furniture. In the years gone by, manufacturers have been innovating to produce plastic furniture that is both practical and visually appealing, combining durability with modern designs. The greater availability of plastic furniture in various styles, colors, and shapes has drawn a wide customer base. This shift has contributed favorably to the plastic furniture market share in Mexico, as there is a hike in demand for durable, convertible, and convenient furniture, thereby ensuring a great future for market growth and sustainability.

Increase in Online Sales and E-Commerce Channels

The fast growth of e-commerce in Mexico has had a huge impact on the plastic furniture market. As more people have internet access and an accelerating number of consumers shop online, demand for plastic furniture through online channels has boosted. Consumers are attracted by the ease of browsing a vast range of furniture products, comparing prices, and having products delivered to their homes. Online stores provide competitive prices and convenient access to a range of plastic furniture for design-conscious as well as price-sensitive buyers. The ease of reading reviews and viewing detailed product details also adds to the ease of purchasing. Most plastic furniture companies are catering to this by developing their online presence, providing customized products, and simplifying the buying process. With e-commerce expansion, this trend is fueling plastic Mexico plastic furniture market growth, adding to its expansion and enhancing the market perspective.

Mexico Plastic Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Kitchen Furniture

- Living and Dining Room Furniture

- Bathroom Furniture

- Outdoor Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes kitchen furniture, living and dining room furniture, bathroom furniture, outdoor furniture, and others.

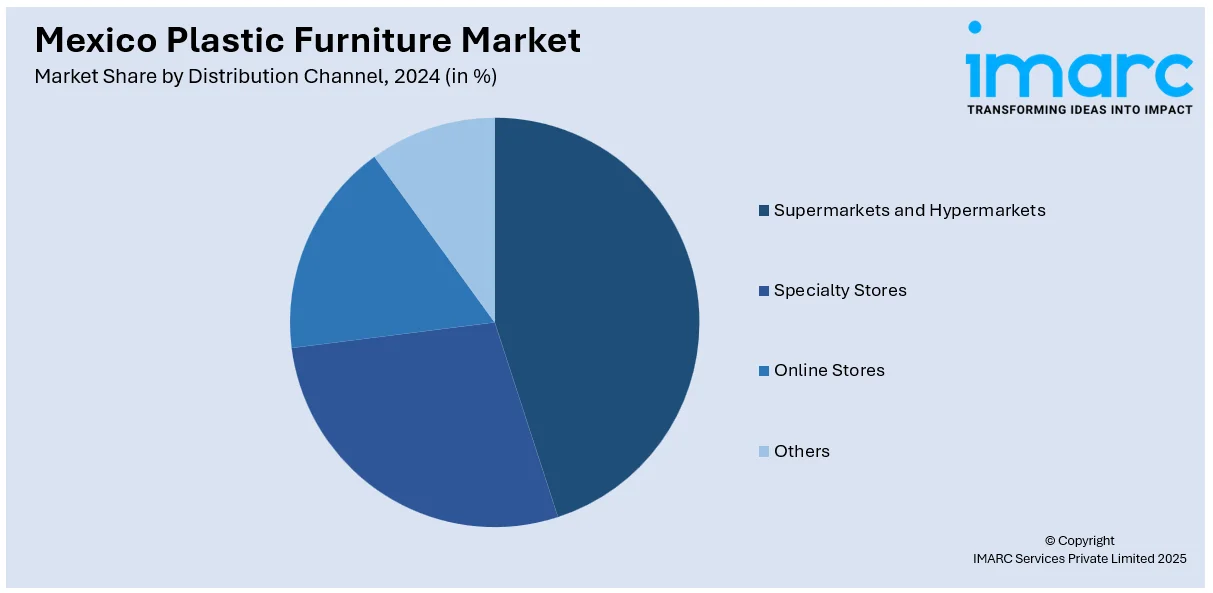

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Plastic Furniture Market News:

- In April 2024, Home Depot revealed committing $172 million to expand in Mexico, to enhance its market share. Its expansion involves opening 12 new stores and expanding furniture, home décor, and pet products offerings. This comes as the market responds to growing consumer demand and the increasing Mexican market for furnishings and home improvement.

Mexico Plastic Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Kitchen Furniture, Living and Dining Room Furniture, Bathroom Furniture, Outdoor Furniture, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico plastic furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico plastic furniture market on the basis of type?

- What is the breakup of the Mexico plastic furniture market on the basis of distribution channel?

- What is the breakup of the Mexico plastic furniture market on the basis of end user?

- What is the breakup of the Mexico plastic furniture market on the basis of region?

- What are the various stages in the value chain of the Mexico plastic furniture market?

- What are the key driving factors and challenges in the Mexico plastic furniture?

- What is the structure of the Mexico plastic furniture market and who are the key players?

- What is the degree of competition in the Mexico plastic furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico plastic furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico plastic furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico plastic furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)